The Truth About Post-Bailout Pay Restrictions: They Are A Lie

What’s 10 million these days – give the man a raise!

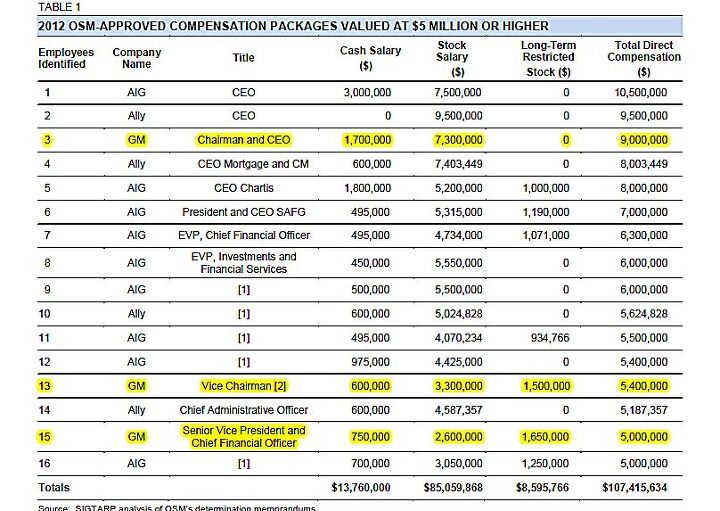

Up until the mid-1800s, debtor’s prison did await those who could not pay their debts. To this day, more than a third of U.S. states allow debtors to be jailed for non-payment. If you run a company called GM, Ally, or AIG, not only do you keep your freedom, you will be bailed out by the government, and given a $10 million salary. Waitaminute, you say, aren’t executive salaries of bailed-out companies limited to a still very generous $500,000? This is exactly the question the special inspector general for the Troubled Assets Relief Program asked. The answer, provided in a report to Treasury Tim Geithner, and the public, is scathing: The Treasury Department ignored its own rules and approved “excessive pay packages” for the leaders of bailed-out companies.

The report lambasts the government which “continues to award excessive pay packages.” It also flogs executives who “continue to lack an appreciation for their extraordinary situations and fail to view themselves through the lenses of companies substantially owned by the U.S. Government.” Special mention for an inordinate amount of chutzpah received “GM CEO Dan Akerson [who] even asked Treasury Secretary Geithner to relieve GM from OSM’s pay restrictions, which was denied.” Akerson took home $9 million in cash and stock in 2012, apparently, he thought that was not enough.

This is your money on drugs

A total of 69 executives of bailed-out companies are under supposed salary restrictions. 23 were found earning more than the $500,000 limit. Another 25 made exactly $500,000. 65 of 69 made more than $450,000. Says the report:

“In stark contrast, the 2011 median household income of U.S. taxpayers who fund these companies was approximately $50,000.”

The report did not specifically reveal by name how much the executives of bailed-out companies make. It also did very little to hide the names.

According to GM’s website, a Daniel F. Akerson serves as GM Chairman and Chief Executive Officer, a Stephen J. Girsky is GM Vice Chairman, Daniel Ammann is GM Senior Vice President & Chief Financial Officer.

The Washington Post calls the report “stinging allegations of lax oversight and supervision.” The Detroit Free Press on the other hand complains that “Akerson’s pay package, which included $1.7 million in cash salary and stock valued at $7.3 million, did not increase from 2011 to 2012,” and that Alan Mulally and Sergio Marchionne make much more.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- MaintenanceCosts Poorly packaged, oddly proportioned small CUV with an unrefined hybrid powertrain and a luxury-market price? Who wouldn't want it?

- MaintenanceCosts Who knows whether it rides or handles acceptably or whether it chews up a set of tires in 5000 miles, but we definitely know it has a "mature stance."Sounds like JUST the kind of previous owner you'd want…

- 28-Cars-Later Nissan will be very fortunate to not be in the Japanese equivalent of Chapter 11 reorganization over the next 36 months, "getting rolling" is a luxury (also, I see what you did there).

- MaintenanceCosts RAM! RAM! RAM! ...... the child in the crosswalk that you can't see over the hood of this factory-lifted beast.

- 3-On-The-Tree Yes all the Older Land Cruiser’s and samurai’s have gone up here as well. I’ve taken both vehicle ps on some pretty rough roads exploring old mine shafts etc. I bought mine right before I deployed back in 08 and got it for $4000 and also bought another that is non running for parts, got a complete engine, drive train. The mice love it unfortunately.

Comments

Join the conversation

Not to debate if the bailout was a smart idea or not (I don't think it was, but understand the fear of not doing anything), limiting financial compensation was probably the dumbest aspect of TARP. Since this is a car site, lets take GM as the example. What do the CEO's of Ford, Toyota, Honda, and Nissan make? How does 500k per year sound? By the way, it was 500k salary plus long term stock incentives. I don't see many people just itching to take the job when they can go other places make orders of magnitude more. When reading the SIGTARP report, it talks of risk to the tax payer with TARP money. SIGTARP fails to account for is a total loss for unqualified talent taking the wheel because that is who the companies are forced to employee given the restrictions.

So, first it was management that was incompetent to decide what the CEO (who was part of management) got paid. Then it was the Executive Compensation Committee of the Board of Directors who was incompetent. So we got the TARP Special Master and now they are incompetent. SIGTARP has all the answers. Where does this madness stop. Can't we all just admit we are extremely jealous that some are paid so much more than us. This is America. The market pays what the market demands.