Industry: Optimism Is Back, But Only A Little At A Time

Optimism sure ain’t what it used to be. Introducing its latest survey of auto industry executives [ PDF], Booz & Co. proclaims that “optimism is skyrocketing,” and that “a new wave of optimism is overtaking the U.S. auto industry.” They’re not wrong, but for those used to the pre-bailout days of unabashed optimism dressed up as analysis, the “new optimism” is remarkably guarded. And it’s all relative to the pessimism that was beginning to set in when the industry began to realize that the “old optimism” was wildly at odds with the slow-motion market recovery.

So, just how optimistic is the “new optimism”? Which companies have the most reason for optimism? What do industry executives worry about most? When do they expect a Chinese invasion? The answers to these questions and more after the jump.

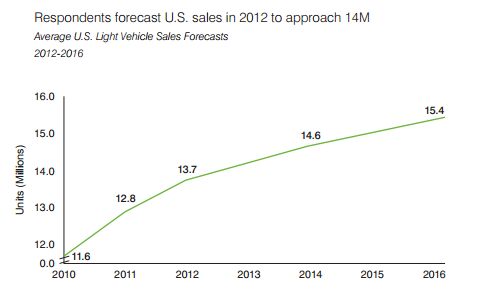

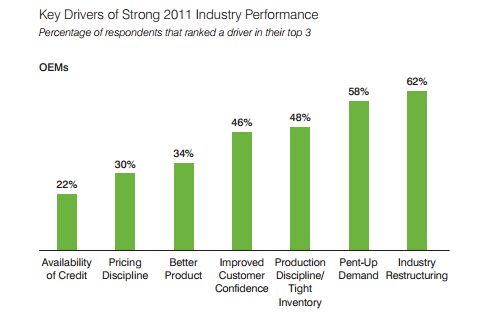

The “somewhat better” scenario that industry execs tell Booz is defining their business planning looks something like this graph. Overall, 86% of suppliers and OEMs expect auto sales growth to be consistent with GDP growth. This steady market growth outlook puts a premium on market share growth, and the execs polled certainly seem to have strong opinions on that front:

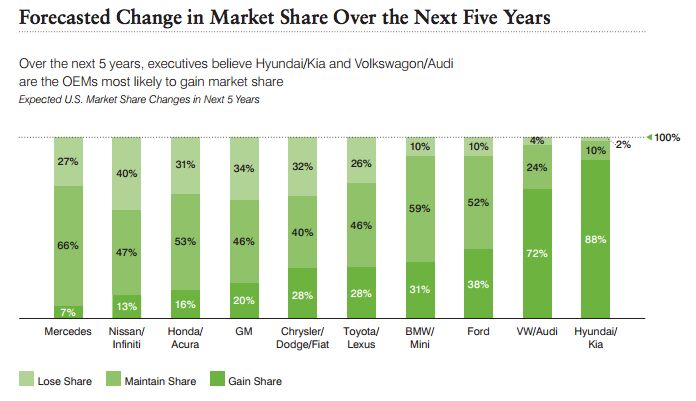

This chart is amazing to me. Clearly the US industry is terrified of two automakers: VW/Audi and Hyundai/Kia. More executives think VW will gain share than think Nissan, Honda, GM or Chrysler will gain or maintain their market share, and the optimism around Hyundai/Kia is straight-up out of control. It’s almost as if auto execs are haunted in their sleep every night by hipster hamsters and the disembodied voice of Jeff Bridges repeating the words “forty miles per gallon” over and over in a congenially bemused voice.

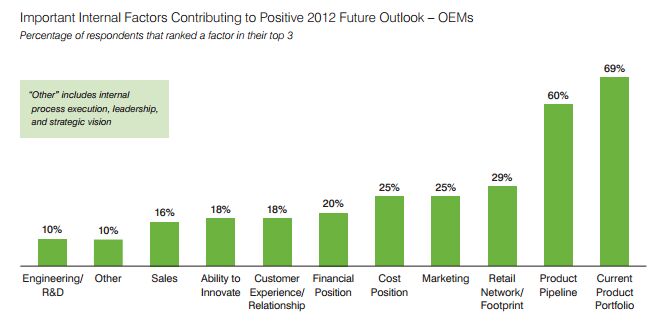

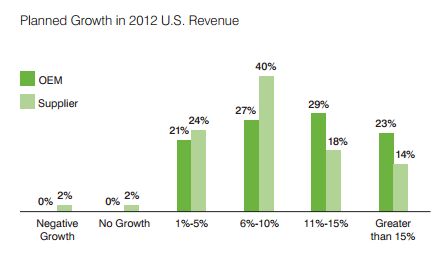

And where do executives think success comes from? Product, product, product. After all, market growth may be slow, but companies expect their revenue to rise. Cost, inventory and pricing discipline can deliver improved profit in a low sales growth environment, but only if the product sells itself.

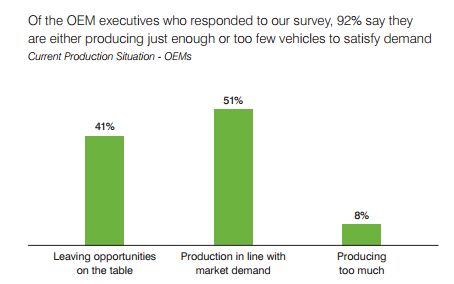

Meanwhile, 55% of the OEM executives polled say their companies are “capacity constrained” and 36% say they are comfortable with current capacity. As sales rise slowly, higher capacity utilization will help drive the revenue improvements the industry sees. Once again, as long as the product is good and discipline can be maintained.

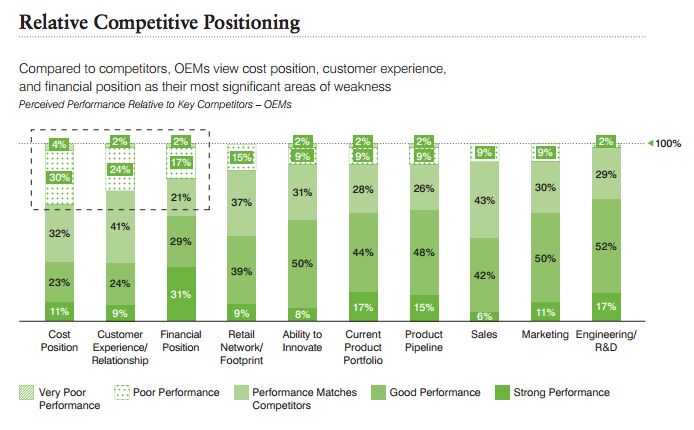

And though 69% identified current product portfolio as a top-three driver of growth in 2012, only 17% expect their current portfolio to turn in a “strong performance” vis-a-vis the competition, with 44% expecting a “good performance.” Cost position and financial position are two factors that could always be better from an executive’s position, but the fact that 26% of execs say customer experience and relationship performance could be “poor” or “very poor” is worrying.

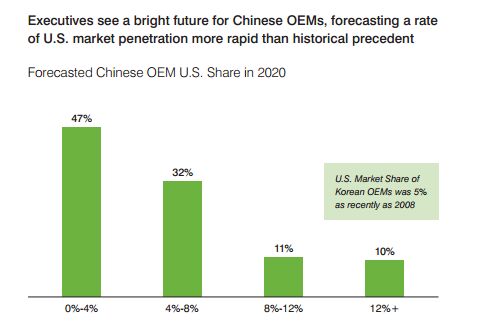

Meanwhile, all the talk of price and capacity discipline and improving profit rather than buying market share will only last as long as there’s no major effort to break into the US market. But by 2020, 32% of auto execs expect Chinese manufacturers to have broken into between four and eight percent of the market. By attacking the low end of the market and aggressively trying to buy a foothold in the US market, Chinese firms hold the potential to wreck the disciplined, realistic “new optimism” by putting severe pressure on pricing discipline.

For now, though, the automakers in the US market seems to be settling into a quiet phase of profit-taking rather than adventurous market share grabs. Clearly there’s a sense of having learned tough lessons from the auto bailout, and from the ongoing capacity issues in Europe. But rather than focusing on bailout-era lessons as they did last year, Booz’s 2012-specific questions now center on dealing with “black swan” events like last year’s tsunami and Thai floods. All of which adds to the overall perception that automakers are playing defense, concentrating on profits and hedging against uncertainty.

According to Booz & Co.: Two hundred and eight automotive executives from more than 75 automotive vehicle manufacturers and suppliers participated in the online survey. Thirty-two percent of the respondents were employees of OEMs, and 68 percent work for auto parts suppliers. Three-quarters of the executives were from U.S.-based firms. More than 50 percent of respondents were VP level or above.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Tassos No, because I am not one of these idiot fanatics who buy a new model in its first year of production, bugs and all (not to mention they usually are charged a stiff premium over MSRP from their greedy Dealer-Stealer)

- HotPotato The Ariya's trim levels are so confusing that they should also hire a navigator to walk the customer through how to get the car they want. Or an online configurator where you check off the things you want and it leads you to whichever obscure version offers them (if GM can do it, why can't Nissan?). God help you if you have a simple request like "I just want the tan cloth interior and Bose, which model offers that?" The website can't help you and neither can the dealer; they're as confounded by the whole Ariya array as you are.

- Tassos So Tim believes that if you steal an item (here, CONDOMINIUM ASSOCIATION ELECTRICITY) priced less than a certain amount, you should be allowed to do so with no consequences. He is lucky some litigious Condo Board member did not SUE HIM. I bet they wanted to, but knowing he is destitute, their lawyer discouraged them from doing so.

- HotPotato Yup. I bought a 2013 Ford C-Max new. It was quiet, quick for a hybrid, economical, had a cavernous and well-finished interior with fold-flat seats for dogs, and rode and handled with the sophistication of a fine European sedan. Never mind that it was new to the US, it had been on sale for years in Europe so surely they had it right by now, no? No. There was the twice-annual dead battery (took them three years worth of TSBs to figure that out), the multiple safety and functionality recalls, the dysfunctional infotainment, the MPG scandal (twice), the front suspension that bottomed out on the gentlest dips, the transmission that failed due to a known defect, and by 30k miles the car had the torsional rigidity of a wet dishrag. This, I later learned, may have had to do with failed A-pillar welds, something they didn't bother informing owners about. All this probably had something to do with it losing 80% of its value by the time I traded it in a few years later...a value so low even the used-car lowball specialist went back to double-check it. I loved the car despite its many flaws but gawd, never again a first-year Ford.

- Bd2 Ultimately, it comes down to price/whether it makes financial sense for buyers (right now, BEVs just aren't there, even with the tax credit). HEVs are finally seeing their place in the sun, decades after being a niche market; this is due to premium for HEVs having narrowed significantly with pure ICE, whereby buyers can recoup that after 2-3 years of ownership.

Comments

Join the conversation

"For now, though, the automakers in the US market seems to be settling into a quiet phase of profit-taking rather than adventurous market share grabs." I would say that depends upon the automaker. VAG and Hyundai are both playing for share -- they are adding models and variety to their US lineups and they can use foreign operations to pay for it. If anything, Hyundai's problem appears to be one of having too little capacity. Likewise, Chrysler is also pushing for share. (They have no choice, as they risk not having sufficient to go the distance.) Nissan seems to be content with competing on price, leaving the top of the segments to the stronger competitors. Ford, TMC and Honda do seem to be more focused on margins. That's been a recipe for TMC's and Honda's success in the US, and Ford wants to play the same game. GM may be somewhere in the middle.

I think Hyundai is both pushing for share and focused on margins. During the the past 2 years or so they've added significant market share and and are among the lowest in incentives paid per unit. They've actually taken a page out of the Honda playbook—aggressively focusing on leasing.