#TruckSales

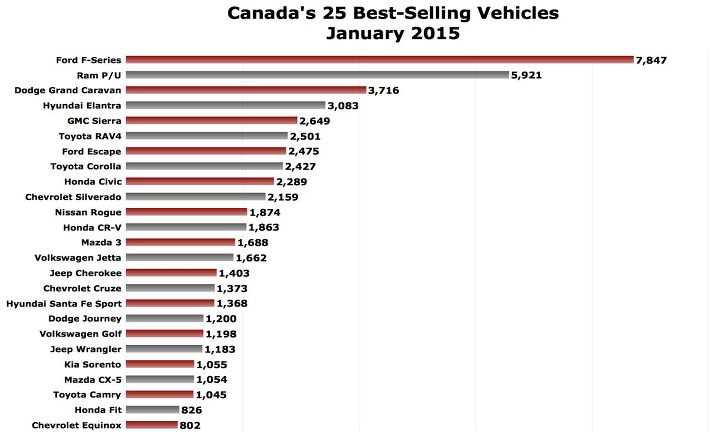

January 2015 Canada Auto Sales Recap – Pickups Earn 21% Market Share

Canadian auto sales increased 3% to the third-highest January in the country’s total in 2015 despite downgraded passenger car volume and limited SUV/crossover growth.

The Ford brand began 2015 where it left off in 2014: as Canada’s best-selling auto brand. Blue Oval car sales plunged 26%, an extreme example of an overarching trend in the Canadian market, but a rising F-Series lifts all boats.

New Colorado And Canyon Are Now Worthwhile Parts Of GM's U.S. Lineup

Although General Motors’ full-size truck twins failed to outsell the Ford F-Serie s in January 2015, GM still came out on top as the best-selling truck manufacturer in America last month.

In the previous five months, the Chevrolet Silverado and GMC Sierra had accomplished this feat on their own, outselling the F-Series by 939 units in August 2014, 7076 in September, 2120 in October, 6294 in November, and 6918 units in December 2014. (The F-Series outsold the Silverado/Sierra by 12,263 units in calendar year 2014 and the total GM pickup truck family by 1045 units.)

• Colorado/Canyon sales steadily rising

• 14 of GM pickup sales generated by midsize trucks

• Still not approaching historic levels

Fast forward to January, when pickup truck volume jumped 22% year-over-year and the F-Series’ core F-150 line became more available in new aluminum-intensive form, and GM’s bigger set of twins fell 5643 sales short of overtaking the F-Series for a sixth consecutive month. But viewed as a full-line pickup truck manufacturer, GM’s 42% YOY improvement to nearly 57,000 sales was more than enough to fend off Ranger-less Ford.

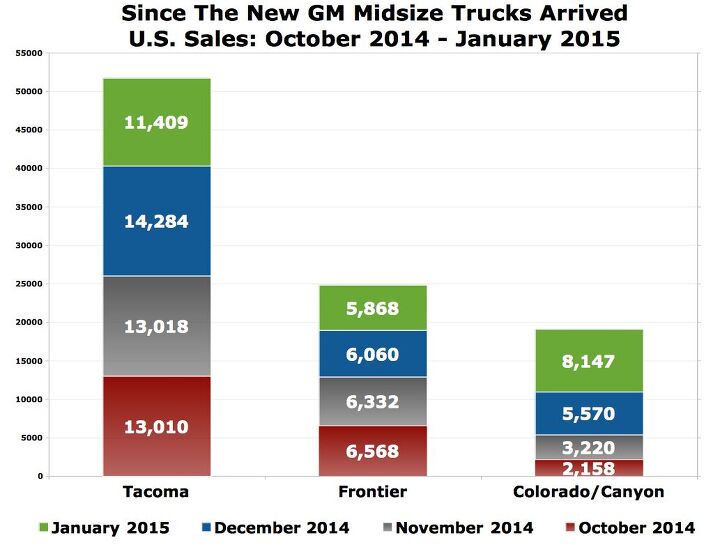

Small/Midsize Trucks Grab 15% Of January 2015's U.S. Pickup Market, Tacoma Still Rules The Roost

The Chevrolet Colorado and GMC Canyon combined to own 31.8% of the small/midsize U.S. pickup truck market in January 2015, up from near nonexistence one year ago.

This meant the class-leading Toyota Tacoma saw its market share plunge by more than 17 percentage points.

Yet Tacoma sales increased in January, rising 1567 units, or 16%, to 11,409 units, 3262 more than the Colorado and Canyon managed.

Since the new GM trucks became readily available in November, and in the lead-up to the debut of a refreshed 2016 Tacoma, sales of Toyota’s sub-Tundra truck have jumped 10%.

January 2015 Full-Size Pickup Truck Sales Up 17% – F-Series Outsells GM Twins

January 2015 was the first month since July of last year in which the Ford F-Series outsold GM’s full-size twins, the Chevrolet Silverado and GMC Sierra.

Between August and December, F-Series sales slid 3%, not unpredictably. As Ford became more firmly entrenched in the F-150 transition phase, sales perked up in January 2015. Rising just as quickly as the fast-growing overall full-size truck market, F-Series sales increased to the highest level since January 2004. (F-Series volume in January 2015 was nearly double what it was in January 2010.)

• Ford outsells GM twins for the first time since July

• GM increases market share, Ram loses market share

• Full-size trucks lose a small amount of market share to small/midsize trucks

Though outsold by the F-Series, it certainly wasn’t a bad month for the big GM trucks. Their market share improved by more than a full percentage point as the Silverado posted a 25% improvement to 36,106 units.

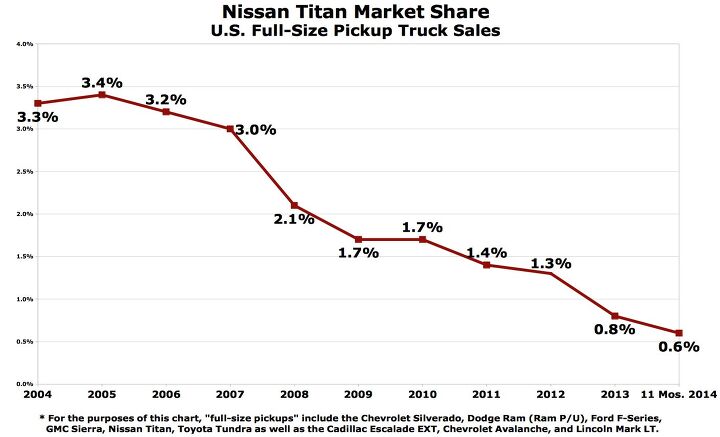

Question Of The Day: Can Nissan Sell 100,000 Titans Annually?

In the nameplate’s best-ever year, Nissan sold 86,945 Titans in the United States.

Nissan USA wants to sell 100,000 Titans annually when the new model, with its more extensive lineup, arrives for the 2016 model year.

• Titan sales declined 20% in 2014

• Titan volume peaked at 87K in 2005

• F-Series, GM, Ram combined for 1.9M full-size truck sales in 2014

A 15% uptick from that record-setting year – the Titan’s second full year in the U.S., 2005 – doesn’t sound like an insurmountable leap forward. But an increase to 100,000 units would represent a six-fold improvement over the Titan’s U.S. sales average from the last three years.

According to Automotive News, Nissan North America’s chairman, Jose Munoz, told a crowd at the J.D. Power Automotive Summit that their aspirations are “modest,” and that when it comes to the automaker’s expectations for the Titan, “We’re very bullish.”

But is it reasonable to expect that the Titan could penetrate the market with Toyota Tundra-like force?

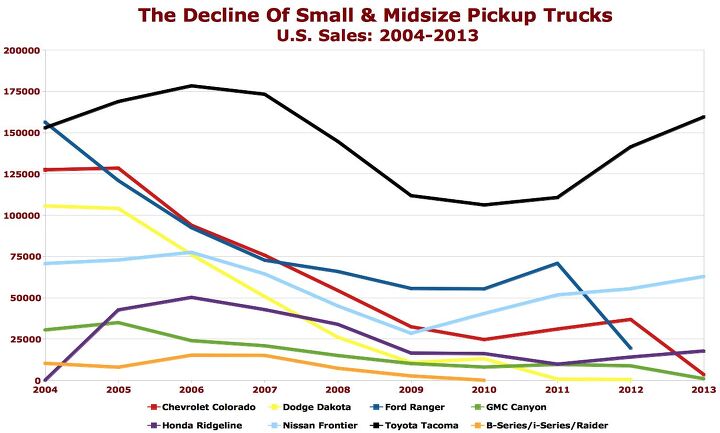

Cain's Segments: Small/Midsize Truck Sales In December And 2014

General Motors’ U.S. market share in the small/midsize truck category grew in December 2014 to 21.1% from 13.9% in November. According to inventory statistics from Automotive News, GM dealers had approximately 9400 Chevrolet Colorados and GMC Canyons in stock at the beginning of December.

• Tacoma and Frontier rising

• GM earning market share

• Small/midsize trucks account for 1/10 pickup sales

Yet a booming auto industry and a surging pickup market meant that even with this new level of competition from the GM midsize pickups, widely regarded as the modern members of the class, the Toyota Tacoma and Nissan Frontier each posted 12% year-over-year improvements in December.

Cain's Segments: Full-Size Trucks In The Year 2014

Pickup trucks soared to their highest total of 2014 during the month of December, climbing 18% to 237,635, equal to 14% of the overall auto industry’s new vehicle volume. Truck sales jumped 6% to 2.3 million in 2014.

• GM twins outsold F-Series in December

• F-Series outsold GM twins in 2014

• Ram makes biggest market share gains

Full-size trucks generated 88.9% of all pickup sales activity in December, down from 90.1% a year ago as General Motors contributed more than 5500 Colorado/Canyon sales to the mix, strengthening the small corner of the market held by small/midsize pickups.

Led by big GM improvements, the full-size sector grew by 30,522 units last month. The Chevrolet Silverado and GMC Sierra combined to outsell the Ford F-Series, as it transition to a 2015 F-150, by 6918 units. Joining GM’s surge, Ram P/U sales shot up 32% to 44,222 units, making December the third month in 2014 that Ram sales shot beyond the 40K mark.

Chart Of The Day: 11 Years Of Nissan Titan Market Share

Nissan USA announced on December 16, 2014, that the next Titan, the second Titan, the first all-new Titan since 2003, will be introduced at 2015’s NAIAS in Detroit on January 12, 2015.

Hardly altered since the production truck arrived for the 2004 model year, the Titan is now somewhat embarrassing. Yet while the truck never had the potential to tackle full-size pickup trucks from Ford, General Motors, and Ram – Toyota can’t either – in the same way Nissan’s Altima can outsell their midsize sedans and Nissan’s Versa their subcompacts, initial U.S. volume was respectable.

Cain's Segments: Full-Size Trucks In November 2014 – GM Twins Outsell F-Series Again

Full-size pickup trucks generated 13.1% of all U.S. new vehicle sales in November 2014, up from 12.5% in November 2013 thanks to a 10% volume gain.

That 10% segment-wide increase occurred despite a 10% decrease from America’s best-selling vehicle line, the Ford F-Series. New F-150s are arriving at dealers now, but overall F-Series volume will be volatile for a few months as the aluminum F-150 takes over from the outgoing model.

The F-Series’ share of the full-size category slid from 42.2% in November 2013 to 34.6% last month.

Small/Midsize Truck Sales Up 19% In October 2014

U.S. sales of small/midsize/non-full-size pickup trucks jumped 19.4% in October 2014, a gain of 3672 units compared with October 2013.

Sales of the Toyota Tacoma were up 5%. Nissan Frontier sales shot up 25%. Not surprisingly, the slowly disappearing Honda Ridgeline was down 35%. GM’s new pickup trucks contributed an extra 2158 sales. Even without those additional Colorados and Canyons, the category would have risen 8% despite the Ridgeline’s sharp but relatively inconsequential decline.

Chart Of The Day: The Pickup Truck Portion

Pickup truck sales increased 10% in the United States in October, an 18,590-unit jump in a market which grew 6%. Besides drawing attention to the, “The people buy trucks because the fuel is cheap,” argument, which is not at all completely false nor entirely true, the 10% increase drew our attention to the massive figures generated by the biggest nameplates and their expansive product ranges.

We’ve covered truck sales already this month, so rather than taking another deep dive into October’s specifics, consider instead the percentage of America’s growing auto market that belonged to the pickup truck category last month: 15.8%.

That’s not a small number. Indeed, it’s a significantly larger number than the one achieved by the category through the first ten months of 2014: 13.8%. For perspective, however, think back one decade. In 2004, 19% of the new vehicles sold in America were pickup trucks.

Cain's Segments: Full-Size Pickup Trucks – October 2014 YTD

Overall pickup truck sales jumped 10.1% in the United States in October 2014 as six full-size nameplates collectively grew 9.5%. Growth in the overall truck world was aided by 2158 Chevrolet Colorado and GMC Canyon sales (up from 34 a year ago), a 1326-unit improvement from the Nissan Frontier, and the Toyota Tacoma’s 5% increase.

September 2014 Sales: Outgoing F-Series Not Responsible For Ford Decline

The Ford Motor Company’s namesake Ford brand suffered a September 2014 sales decline of 3% as the industry reported gains in excess of 9%.

First thought?

The F-Series, not just Ford’s best-selling model line but the country’s most popular vehicle range, was revealed in new, high-tech form months ago, and we’re rapidly approaching the replacement phase. Some members of the media have even been driving the new truck.

In other words, with factories being overhauled and buyers interested in waiting for a more efficient F-150 with a better power-to-weight ratio, sales of the current model would naturally decline, bringing down a brand that relied on the F-Series for more than three out of every ten sales last year.

Indeed, F-Series sales did decline in September. But only slightly.

Cain's Segments: Trucks - September 2014

As is the norm, Ford’s F-Series topped September 2014’s sales charts, but if a true winner was to be crowned after a quick glance at the results tables, Chevrolet’s Silverado must surely take the cake.

Not only did Silverado sales rise more rapidly than any other pickup truck – faster than the Ram’s 30% jump; better than the Nissan Frontier’s 47% rise – but the Silverado also powered General Motors to a second consecutive F-Series-besting month.

Recent Comments