New Colorado And Canyon Are Now Worthwhile Parts Of GM's U.S. Lineup

Although General Motors’ full-size truck twins failed to outsell the Ford F-Serie s in January 2015, GM still came out on top as the best-selling truck manufacturer in America last month.

In the previous five months, the Chevrolet Silverado and GMC Sierra had accomplished this feat on their own, outselling the F-Series by 939 units in August 2014, 7076 in September, 2120 in October, 6294 in November, and 6918 units in December 2014. (The F-Series outsold the Silverado/Sierra by 12,263 units in calendar year 2014 and the total GM pickup truck family by 1045 units.)

• Colorado/Canyon sales steadily rising

• 14 of GM pickup sales generated by midsize trucks

• Still not approaching historic levels

Fast forward to January, when pickup truck volume jumped 22% year-over-year and the F-Series’ core F-150 line became more available in new aluminum-intensive form, and GM’s bigger set of twins fell 5643 sales short of overtaking the F-Series for a sixth consecutive month. But viewed as a full-line pickup truck manufacturer, GM’s 42% YOY improvement to nearly 57,000 sales was more than enough to fend off Ranger-less Ford.

That oranges-to-clementines comparison is hardly the point, however. Rather, the significant story is that GM’s midsize trucks – their big small trucks – made a significant difference to GM’s total monthly sales output last month. Including the Colorado and Canyon, GM sales jumped 18.3% to 202,786. Without them, GM sales were up 13.5% to 194,639, slightly behind the growth rate of the overall industry.

In their previous best month, December, the new versions of the Colorado and Canyon accounted for just 2% of GM’s U.S. volume. That figure doubled to 4% in January, of far greater value (on volume terms) than the Chevrolet Sonic and Spark (3.3%), Cadillac’s cars (2.7%), commercial vans (2.8%), or the Aussie-import SS and Caprice (0.1%).

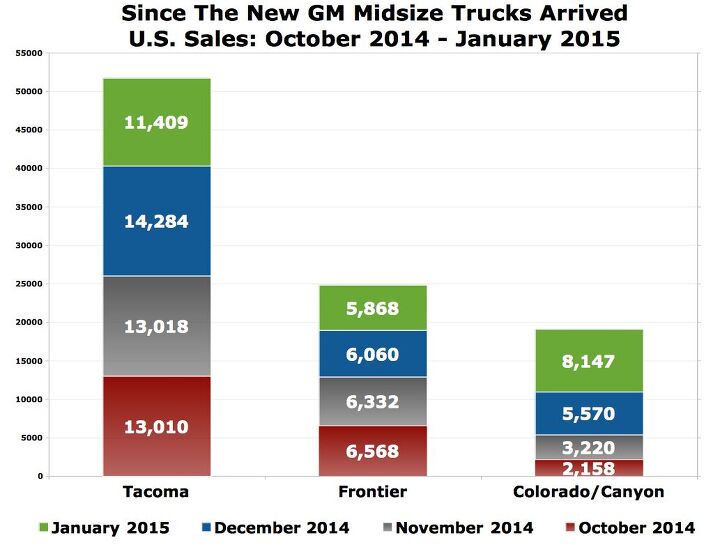

We previously established that the trucks earned 31.8% of the small/midsize truck segment, a category dominated by the Toyota Tacoma. That compares unfavourably with the 34.6% market share GM earned in the full-size truck segment last month. But the smaller twins are still making headway, with the new Chevrolet Colorado overtaking the Nissan Frontier for the first time in January and the new GMC Canyon topping the 2K mark for the first time.

Back to their impact at General Motors specifically, the Colorado and Canyon generated 14.3% of the company’s pickup truck sales in January; 5.9% of GM’s overall light truck volume. Those are huge increases from the 6.4% pickup truck share and 2.9% light truck share that GM’s new midsize trucks earned in the GM U.S. realm in December and the 4.7% and 2.2% figures the pickups put up in November.

Therefore, we’ve likely not seen the full range of their capability when it comes to attracting U.S. pickup truck buyers. But what kind of tidal change is required for these trucks to return to the levels achieved a decade ago? Chevrolet sold 128,359 Colorados in the United States in 2005, or approximately 10,700 per month. Canyon volume was running at nearly 3000 monthly sales in 2005.

The difficulty? Matching those sales in a market that has long since shifted to full-size pickups.

The possibilities? GM’s trucks aren’t competing with the Ranger, Dakota, Raider, Equator, B-Series, or Isuzu i-Series trucks, pickups which produced 7.2% of the total pickup truck category’s volume in 2005 and fully one-third of small/midsize truck sales that year.

Timothy Cain is the founder of GoodCarBadCar.net, which obsesses over the free and frequent publication of U.S. and Canadian auto sales figures.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- 28-Cars-Later "Despite nobody really digging the moniker, Honda has told Autocar that it only plans on changing the name of the model in China (as part of a more comprehensive facelift) because that’s where they’re having the most trouble and anticipated the largest sales volumes.""Customers in China just can’t pronounce it,” explained the source."So the Chinese are class A customers but frack the rest of y'all we don't care what you think or can understand?

- ToolGuy Is a Tesla store the same as a Tesla gallery? 16955 Chesterfield Airport Road is a gallery. 5711 S Lindbergh Blvd is a store. I wonder if anyone knows how far away those two locations are from each other. I wonder if Tesla's website shows vehicles in inventory. I wonder if there is a distance dropdown. So many questions.

- 28-Cars-Later Zerohedge reported something similar in Belgium with the reasoning being the Chinese are flooding Europe with EVs in the early innings of a trade war. For Tesla any guess is a good one but my money is on BEV saturation has been reached.

- MacTassos Bagpipes. And loud ones at that.Bagpipes for back up warning sounds.Bagpipes for horns.Bagpipes for yellow light warning alert and louder bagpipes for red light warnings.Bagpipes for drowsy driver alerts.Bagpipes for using your phone while driving.Bagpipes for following too close.Bagpipes for drifting out of your lane.Bagpipes for turning without signaling.Bagpipes for warning your lights are off when driving at night.Bagpipes for not coming to a complete stop at a stop sign.Bagpipes for seat belts not buckled.Bagpipes for leaving the iron on when going on vacation. I’ll ne’er make that mistake agin’.

- TheEndlessEnigma I would mandate the elimination of all autonomous driving tech in automobiles. And specifically for GM....sorry....gm....I would mandate On Star be offered as an option only.Not quite the question you asked but.....you asked.

Comments

Join the conversation

"GM’s trucks aren’t competing with the Ranger, Dakota, Raider, Equator, B-Series, or Isuzu i-Series trucks, pickups which produced 7.2% of the total pickup truck category’s volume in 2005 and fully one-third of small/midsize truck sales that year." Exactly. This is why GM jumped back into the segment, because it saw everybody else leave. Who knows how well they will ultimately do. I think the mid-size segment will stagnate, and with the new Honda Ridgeline, and a possible new entry from Ram (Fiat really) it could get even more crowded.

I have seen 5 Colorado/Canyon trucks and all of them were seen on the dealer lot. I do see a large number of Toyota Tacoma Double Cab 4x4's. Most are SR5 or TRD level trim trucks. Most are newer models. Most are driven by younger people in their 20-30's. I do think that pent up demand is driving some sales and so far it appears that these new GM offerings aren't poaching Tacoma customers. Anyone on this board from California? That state is supposed to be the small truck kingdom.