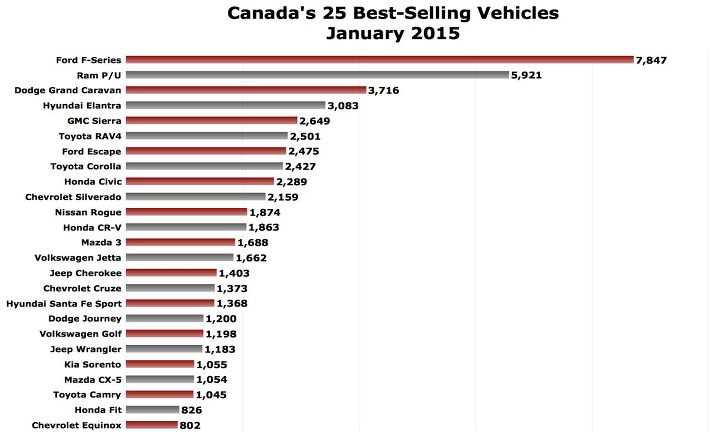

January 2015 Canada Auto Sales Recap – Pickups Earn 21% Market Share

Canadian auto sales increased 3% to the third-highest January in the country’s total in 2015 despite downgraded passenger car volume and limited SUV/crossover growth.

The Ford brand began 2015 where it left off in 2014: as Canada’s best-selling auto brand. Blue Oval car sales plunged 26%, an extreme example of an overarching trend in the Canadian market, but a rising F-Series lifts all boats.

F-Series volume jumped 15%. Overall, Ford sales were up 1%. Total Lincoln-included Ford Motor Company volume was up only slightly, rising 0.4%, as Lincoln sales plummeted 27%.

• Elantra tops list of best-selling cars

• RAV4 outsold all SUVs and crossovers

• Pickup trucks generated 20.6% of auto industry volume

FCA, the automaker formerly known as the Chrysler Group, began 2015 where it began 2014: as Canada’s best-selling manufacturer overall. Outselling FoMoCo by nearly 3500 units and General Motors by nearly 6500 units, FCA generated 86% of their January volume via minivans, SUVs/crossovers, and the Ram P/U.

The Lexus, Chrysler, Audi, Porsche, and Cadillac brands were Canada’s fastest-growing marques in January. Among high-volume players – those first five brands ranked 19th, 18th, 17th, 30th, and 24th, respectively in new vehicle sales rankings last month – Nissan (up 15%), Jeep (up 14.1%), and Subaru (up 13.5%) posted the most notable improvements. 20 different brands recorded increased volume compared with January 2014, and industry-wide volume jumped 3.4%.

Honda, Kia, Dodge, and Mazda were the key volume brands with decreased sales.

In Honda’s case, as the Civic goes, so goes the brand. Total Honda volume slid 3.9% as the Civic, down 31% to 2289 units, ended January as Canada’s third-best-selling car. The Hyundai Elantra, with its best January ever, shot up to the top spot with a 15% year-over-year improvement, 656 sales ahead of the second-ranked Toyota Corolla; 794 ahead of the Civic.

At Kia, brand-wide sales slid 4.6% even as the Sedona and the brand’s best-selling Sorento combined for a 53% increase. Kia car volume slid 19%, and none of the brand’s car nameplates ranked among Canada’s top 20 in January.

Dodge’s 12% decline can be blamed in part on the nearly disappeared Avenger, but the Charger fell 14%, Dart volume was chopped in half, and Journey sales slid 38.5% to 1200 units, a 750 unit drop which cancelled out the Grand Caravan’s 686-unit increase. (The Grand Caravan led a minivan category which posted a 27% YOY increase.)

Mazda, meanwhile, saw sales of its 3 fall 26% to 1688 units. The 3 still generated 53% of all Mazda Canada sales, but that was down from 61% a year ago.

The Toyota RAV4 led Canada’s SUV/crossover category in January 2015, the first such month since March 2013 that the RAV4 topped the leaderboard. Ford’s Escape is the perennial leader, but Escape volume slid 4.7% to 2475 units, a mere 26 units shy of the RAV4. Honda’s CR-V, up 29.6%, ranked fourth among SUVs and crossovers after leading the group in November and December. After utility vehicle volume jumped 15% in calendar year 2014, year-over-year expansion in January measured just 2.3%, slower than the industry’s 3.4% growth rate.

Minivans grew at a faster rate than SUVs and crossovers in January (and added more volume) and commercial van volume was up 36%. Pickup trucks were the true engines of the Canadian auto industry in the first month of 2014, producing more than two out of every ten new vehicle sales, a collective 10% improvement compared with January 2014, and 1845 extra sales in an industry which advanced by around 3300 units.

Don’t be too quick to credit new additions to the small/midsize fold. Although the Chevrolet Colorado and GMC Canyon posted their best months since returning in the fall of last year, the five-truck small/midsize category’s 18.6% increase translated to only 183 units. The Toyota Tacoma, Nissan Frontier, Honda Ridgeline, and the GM twins accounted for less than 6% of all new pickup truck sales.

No, Canada’s truck market expanded because of full-size Detroit trucks. (Combined Tundra/Titan sales slid 18.7%.) F-Series sales rose to the highest January level ever, a strong follow-up to a record-setting 2014. Ram volume was up 7% to 5921 units. The GMC Sierra and Chevrolet Silverado, though roundly outsold by both the F-Series and Ram, posted a 9.4% YOY increase.

Of course, if January results lack meaning in the United States, they’re hardly consequential in Canada. Last year, in what was the Canadian auto industry’s best ever year, January generated only 5% of the year-end sales tally.

Timothy Cain is the founder of GoodCarBadCar.net, which obsesses over the free and frequent publication of U.S. and Canadian auto sales figures.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Formula m How many Hyundai and Kia’s do not have the original engine block it left the factory with 10yrs prior?

- 1995 SC I will say that year 29 has been a little spendy on my car (Motor Mounts, Injectors and a Supercharger Service since it had to come off for the injectors, ABS Pump and the tool to cycle the valves to bleed the system, Front Calipers, rear pinion seal, transmission service with a new pan that has a drain, a gaggle of capacitors to fix the ride control module and a replacement amplifier for the stereo. Still needs an exhaust manifold gasket. The front end got serviced in year 28. On the plus side blank cassettes are increasingly easy to find so I have a solid collection of 90 minute playlists.

- MaintenanceCosts My own experiences with, well, maintenance costs:Chevy Bolt, ownership from new to 4.5 years, ~$400*Toyota Highlander Hybrid, ownership from 3.5 to 8 years, ~$2400BMW 335i Convertible, ownership from 11.5 to 13 years, ~$1200Acura Legend, ownership from 20 to 29 years, ~$11,500***Includes a new 12V battery and a set of wiper blades. In fairness, bigger bills for coolant and tire replacement are coming in year 5.**Includes replacement of all rubber parts, rebuild of entire suspension and steering system, and conversion of car to OEM 16" wheel set, among other things

- Jeff Tesla should not be allowed to call its system Full Self-Driving. Very dangerous and misleading.

- Slavuta America, the evil totalitarian police state

Comments

Join the conversation

Agree with Lou_BC, there would not be a Ford, GM, and Chrysler without truck sales. Truck sales are the most profitable sales and the profits are used to support less profitable but highly competitive vehicles such as compact and midsize cars. By truck sales it is not just pickups but CUVs and SUVs.

Weird to see a sales list without the Camry and Accord in the top 10. And what is it with the GMC pickup outselling the Chevy? O, Canada...sometimes we forget how different it is from America!