#AkioToyoda

Toyota Allegedly Stressing Electrification Under New Leadership

With longtime CEO Akio Toyoda stepping down from Toyota Motor Corp, the business is reportedly about to shift targets and place a greater emphasis on battery-electric vehicles. However, there are a few caveats to that claim and the entire issue is mired in controversy, with entities clearly trying to pressure the Japanese automaker against doing things its own way.

Akio Toyoda Stepping Down As Toyota CEO in April

It’s the end of an era at Toyota. CNBC reported that CEO and President Akio Toyoda plans to step down on April 1 and will be replaced by a Lexus official. Toyoda will take on a new role as board chair.

Toyota Still Isn't Sold On An All-Electric Future

Despite helping mainstream electrification with the hybridized Prius, Toyota still isn’t “all-in” on EVs. This is counter to the corporate rhetoric shared by many automakers and governments around the world. But CEO Akio Toyoda doesn’t see customers jumping onto the bandwagon as quickly as Toyota’s industrial rivals originally assumed.

That’s not to suggest the Japanese company is completely snubbing EVs, however. Toyota plans on offering a mix of all-electric, hybrid, and traditional gasoline vehicles for the foreseeable future. It’s even throwing some hydrogen-powered cars into the mix for good measure. But an all-electric lineup seems to have been taken off the table of possibilities.

Toyota Cutting Production By 20 Percent Next Month

Earlier this week, we covered Toyota stressing over the feasibility of its current production plans. Automakers around the world are presently trying to suss out how to maintain solid profitability with diminished output, with Japan’s largest manufacturer suggesting the present state of the world might force it to do likewise.

While we assumed the resulting decisions would take a couple of weeks for Toyota to finalize, as it considered its many options, the company announced on Friday that it would need to cut domestic production by 20 percent for the month of April. The automaker framed this as part of its preexisting “recovery plan” necessary to account for supply chain issues that never seem to end, saying that diminished output would gradually normalize in Japan over the spring.

Toyota Considers New Production Strategy As World Burns

Toyota Motor Corp. is reconsidering its existing production strategy, citing ongoing global issues that are hindering its ability to manufacture vehicles at a normal pace.

Like most other automakers, Toyota has endured COVID restrictions, supply chains bottlenecks, component shortages, at least one cyberattack, and some new obstacles stemming from Russia’s invasion of Ukraine. These issues have already encouraged General Motors to pursue lower output as it focuses on selling on higher-margin vehicles. Though it’s hardly the only automaker signaling diminished production for 2022. Even the National Automobile Dealers Association is assuming 2022 will be another year of extra-tight inventories and wild markups. It’s something the industry was already doing, with Toyota becoming the next company opting to rejigger its targets to account for hard times.

Toyota Announces EV Strategy, Readies $70 Billion for the Cause

On Tuesday, Toyota Motor Corp. announced a commitment of 8 trillion yen ($70 billion USD) toward the goal of achieving carbon neutrality someday. Though the concept of any multinational manufacturing entity totally nullifying their carbon footprint seems kind of laughable, so we’ll be referencing this as another electrification strategy — which is still a big deal considering how EV averse Toyota has been thus far.

Despite being an environmental trendsetter with the Prius Hybrid, Toyota has been hesitant to formally commit itself to transition its lineup toward being reliant on battery power. However, President Akio Toyoda has just proudly confirmed that the Japanese automaker would be earmarking the funds for exactly that purpose, noting that the brand (along with Lexus) would be spending the money through 2030 to make sure its global sales of battery electric vehicles (BEVs) reach 3.5 million vehicles annually. Though the most enjoyable aspect of the release was the direct manner it was presented, with Toyoda-san being impressively honest about modern automotive trends.

Toyota's Akio Toyoda Chosen 2021 World Car Person of the Year

Selected 2021 World Car Awards Person of the Year was Akio Toyoda, Toyota Motor Corporation (TMC) president and CEO.

Toyota Is Becoming a Software Company

Toyota announced the creation of a new holding company that will oversee its software development initiatives this week. While our default response is to gripe about the nebulous concept of “mobility companies” and the industry’s obnoxious emphasis on shifting data, we also understand that it pays to have someone on hand who knows their way around a line of code.

It wasn’t all that long go that Volkswagen was bragging about taking software seriously, only to be publicly shamed by the media when bunk programming screwed up the launch of numerous physical products. The cynical side of the brain knows this could have been avoided by ignoring unnecessary connectivity features and a potentially ill-conceived attempt to digitize the entire cabin.

We’re sympathetic to the nature of competition and the appeal “newness” has on customers. The automotive industry has seen the sea of riches amassed by tech companies harvesting data and knows which way the wind is blowing. No brand wants to be seen as technologically inferior, even if many of the newer features in modern cars aren’t really in service of anything other than marketing. Yet the “software first” mentality that has started presiding over vehicle development seems somewhat counterproductive, and Toyota may have just bought into it hook, line and sinker.

Then again, maybe it’s a great play and we’re just not seeing the big picture. So let’s dive in and see what we find.

Toyota Spending $2 Billion to Develop Electric Cars in Indonesia

Having recently announced plans to “popularize” battery electric vehicles, Toyota now expects half of its global volume to stem from electrified cars by 2025. That’s five years sooner than originally promised.

Toyota may seem perpetually averse to change but it has been making a lot of moves behind the scenes to ensure it’s at the forefront of a shifting market while also trying to future proof itself in the event that electrification winds up being a dead end. The plan is rather complex and, as I don’t want to re-write a 900-word article, I would like to redirect you to the relevant information.

However, as nuanced as Toyota’s overall strategy may be, the company is still going to need to spend truckloads of cash to remain in the game. With that in mind, the Japanese automaker appears to be investing $2 billion to develop electric vehicles in Indonesia over the next four years — with hybrids being first on the docket.

Playing Both Sides: How Toyota Is Rolling With the Trade War Punches

While it’s difficult to muster sympathy for giant corporations, the trade war current raging between the United States and China has left many stuck in an industrial limbo. Automakers want a bigger slice of the global market, but putting your eggs in either country’s basket will result in repercussions from the other.

We’re not saying this to promote some kind of commiseration for multinational companies; rather, it’s simply to remind everyone of how the auto industry has to conduct its business. Frequently, carmakers must play both sides. Toyota, already one of the world’s largest automakers, knows this better than anyone, and new documents shed light on some of the cloak-and-dagger aspects of maintaining its high-volume position.

Toyota's Trying to Remain Non-threatening in the U.S.

While the Trump administration is carefully considering whether or not imported vehicles qualify as a threat to national security, and prepares for trade negotiations with Japan, Toyota is being very careful about how it comes across in America. Last week, the automaker announced plans to add about 600 jobs across the Southern United States — raising its proposed American expansion by another $749 million. In total, the company is expected to expend $13 billion inside the U.S. by 2022.

“In a time when others are scaling back, we believe in the strength of America and we’re excited about the future of mobility in America,” Jim Lentz, CEO of Toyota Motor North America, said of the decision.

Throwing some casual shade at other automakers who are cutting down their domestic workforce is a sound PR strategy but, according to Toyota, its increased investment has nothing to do with global or industrial politics.

And Then There Were Two: Toyota Builds Second Century GRMN

Built for current Toyota patriarch Akio Toyoda, the Century GRMN celebrates both the man and his desire to create a more emotive and performance-driven automaker. With the V12 gone, the standard Toyota Century is powered by a direct-injected, 5.0-liter V8 with a two-stage electric motor and nickel-metal hydride battery. The powertrain is good for a claimed for 375 hp and 376 lb-ft of torque, delivered silky smooth.

Painted white (below the break), the GRMN prototype nixes some chrome trim and adds black ground effects, subtle red stripes, and applicable badging. But Toyota never bothered to tell us what Gazoo Racing actually did to improve the car. Presumably, suspension and engine upgrades abound. But, as the car was meant as a one-off gift for Toyota’s president, we never heard about them.

Then, at the Tokyo Auto Salon, a second one appeared — casting doubts that this car doesn’t have aspirations for a super-lux market that’s currently thriving.

Sorry, Gazoo Racing Models Aren't Coming to the United States

Toyota has been exceptionally vocal about its desire to spice up the brand and, for the most part, it has delivered. Expressive, sometimes polarizing, designs have begun populating its lineup as company president Akio Toyoda endlessly talks up the merit of sporting vehicles. While other chief executives focus solely on promoting mobility, he’s discussing the importance of building fun-to-drive cars.

The company’s motorsports group, Gazoo Racing (GR), has even started cranking out tuned versions of the brand’s road cars. However, none of them have made it to North America — nor will they. Despite all of Toyoda’s seemingly earnest talk of performance models, the United States hasn’t seen it manifest into anything tangible.

Considering Toyota also decided not to offer GR models in the U.S., and with cost-cutting measures making the 86 coupe a potential candidate for discontinuation, Akio’s grand vision doesn’t look particularly robust in the West.

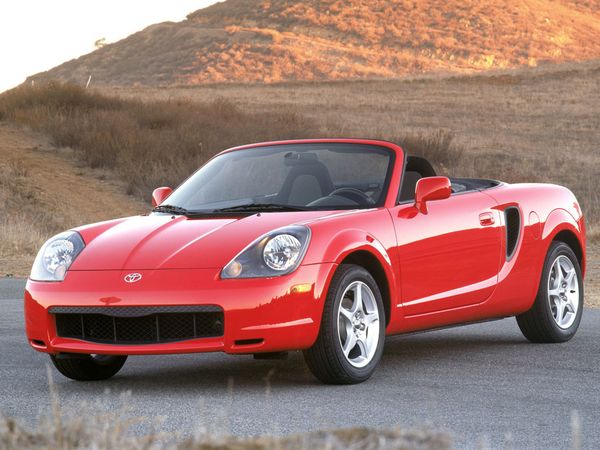

Toyota Mulling a Return of the MR2

Starting with the introduction of the 86 (Scion FR-S in North America) in 2012, Toyota began spicing up a brand viewed as being more synonymous with bulletproof reliability than fun. While this manifested itself primarily through more expressive exterior design choices, the brand also introduced performance-tuned GRMN variants in Europe and Japan. It’s also bringing back the Supra, arguably the brand’s most iconic sports car.

Still, a subset of the population looks back at Toyota’s history with a particular fondness for the mid-engined micro machine known as the MR2. Discontinued in 2007, the model was as endearing as it was fun to drive — especially those earlier incarnations, when it looked like a pint-sized Lotus Esprit. And, as luck would have it, Toyota’s European vice president of sales and marketing Matt Harrison says its return isn’t beyond the realms of possibility.

Trade War Watch: Japan Gets Vocal Over U.S. Tariff Threats

While the Japanese government has walked on eggshells when discussing trade issues that are transforming the globe into an angry beehive, the nation’s automakers have been more forthright. However, they’re both getting increasingly vocal as the situation escalates.

As the United States and Japan head into trade discussions scheduled for July, it’s beginning to look like everyone will come out swinging — especially when it comes to the automotive industry. Last month, the White House launched a national security investigation into car and truck imports that could lead to new tariffs on some of Japan’s biggest U.S.-bound exports.

Japanese Finance Minister Taro Aso was uncharacteristically negative toward the current U.S. trade policy during a Group of Seven finance leaders’ gathering held last week. “It’s deeply deplorable,” Aso said. “Inward-looking policies involving one-sided, protectionist measures benefit no country.”

Recent Comments