Toyota Ramps Up Electrification Timeline, Outlines Nuanced Strategy

Following announcements that Toyota would be working on a shared electric vehicle platform with Subaru, as well as a jointly developed crossover, the brand conducted a press conference on Friday regarding its decision to “popularize BEVs.” While the announcement didn’t deal with the specifics of cutting-edge tech, auxiliary business opportunities, or even a total shift toward battery electric vehicles, it did represent a major commitment from a manufacturer that’s notoriously cautious in its decision making.

Opening the conference, Executive Vice President Shigeki Terashi focused largely on the challenges of electrification. Terashi said Toyota’s intent has always been to support “social progress” and curb CO2 emissions while acknowledging that it had only made formal commitments to electrification within the last couple of years. However, he showed that the automaker has been busy within that time, and had several initiatives in the works aimed at repositioning Toyota as a mobility brand, by outlining the company’s extremely complex EV strategy.

Buckle up, because there is a lot to this — including some new cars.

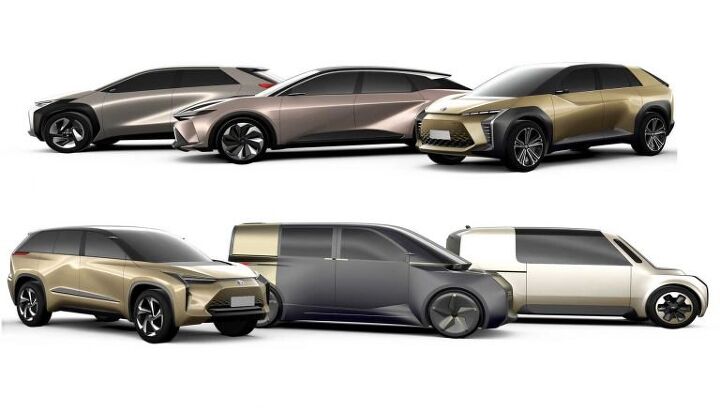

Starting with the Chinese launch of the Toyota C-HR/IZOA BEV in 2020, Toyota says it wants to deliver a batch of electrified models using its new e-TNGA platform. All told, the brand hopes to launch 10 BEV models worldwide, including six global vehicles, using the architecture. China will remain the focus, with additional markets receiving most products only after the People’s Republic has been served up each of the new-energy vehicles. Though it was said that some models could be designated specifically for North America, likely through Lexus.

Toyota also said that it would be bringing in Subaru and Suzuki in on e-TNGA. As previously reported, Subaru will be co-developing a mid-sized crossover while Suzuki (and Daihatsu) have a compact car in the works. The remaining introductory BEVs include a midsize sedan, a minivan, one large crossover, and another middleweight utility. The company eventually hopes to boast fleet-wide electrification by 2025 — meaning all models would at least offer a hybrid variant. Mazda is presumed to be getting some electrified love from Toyota as well, but neither company has confirmed anything officially.

Similar to Volkswagen’s MEB platform, e-TNGA will allow for vehicles that vary largely in form and function. Front, rear, or dual motor all-wheel drive vehicles will be available. Toyota suggested that wheelbases, overhangs, battery capacity, and motor size will all be scalable — allowing the platform to cover a lot of ground in terms of product offerings. But that’s where the similarities with VW end.

What e-TNGA cannot furnish, Toyota said it would build from scratch. In addition to normal-sized cars, the company also plans to deliver a bundle of mobility vehicles concerned with short-range transportation. Among those is a small 2-seater ( based on the i-Ride concept), an enclosed trike (i-Road), a motorized scooter (i-Walk), and a wheelchair. Most of these contraptions are unlikely to make it out of the Japan.

Ultimately, Toyota claims the new strategy should result in the sale of 5.5 million electric and electrified vehicles by 2025 — which is 5 years sooner than it previously suggested. However, it believes only about 1 million of those will be BEVs or hydrogen-powered cars. In order to ensure an adequate supply of batteries — something it claimed would become the biggest source of stress for EV manufacturers — the company has partnered with four additional suppliers: Japan’s GS Yuasa and Toshiba, as well as China’s BYD and CATL.

That’s in addition to existing agreements with Primearth EV and Panasonic, the latter of which is working with Toyota to develop solid-state batteries. While Friday’s press conference did not confirm any major breakthroughs regarding the technology, Toyota executives hinted that a huge announcement could be made next year. The manufacturer also wants to work with these firms in finding new ways to minimize battery degradation and explore recycling solutions.

Terashi said Toyota’s new interest in battery sales was partially due to there being better visibility of the market, improved energy storage, and lowered technological costs. While it still doesn’t seem to believe BEVs will replace internal-combustion vehicles any time soon, it now feels that there is a sufficient market case to be made for OEMs to get more serious about them.

Despite its continued cautiousness and an additional warning about the perceived profitability risks of zero-emission automobiles, Toyota is still making sizable moves in the electric realm. In March, Toyota Tsusho announced it had purchased a stake in Fukuta Electric & Machinery Co. The company has since been discussing evolving into one of the world’s largest suppliers of electric vehicle components and systems. It’s also at the forefront of Automotive Grade Linux, which is collaborative effort between automakers that hopes to establish a new industry standard for the operating systems of connected cars. While often downplayed, these are probably some of the most important aspects of Toyota’s overall plan but you have to pull back a bit to fully appreciate it.

Toyota is taking a realistic and varied approach to electrification without pulling too many punches. If BEVs take off, it’ll be in a good position as both a supplier and brand. If they don’t, it could still make a mint selling its proprietary tech to companies more willing to take risks in an uncertain market. Regardless, Toyota is making important commitments while simultaneously hedging its bets and telling the world that it still isn’t convinced that electric vehicles are viable business model. However, if they are, Toyota should be sitting pretty — possibly with a seat at the head of the table.

[Images: Toyota]

A staunch consumer advocate tracking industry trends and regulation. Before joining TTAC, Matt spent a decade working for marketing and research firms based in NYC. Clients included several of the world’s largest automakers, global tire brands, and aftermarket part suppliers. Dissatisfied with the corporate world and resentful of having to wear suits everyday, he pivoted to writing about cars. Since then, that man has become an ardent supporter of the right-to-repair movement, been interviewed on the auto industry by national radio broadcasts, driven more rental cars than anyone ever should, participated in amateur rallying events, and received the requisite minimum training as sanctioned by the SCCA. Handy with a wrench, Matt grew up surrounded by Detroit auto workers and managed to get a pizza delivery job before he was legally eligible. He later found himself driving box trucks through Manhattan, guaranteeing future sympathy for actual truckers. He continues to conduct research pertaining to the automotive sector as an independent contractor and has since moved back to his native Michigan, closer to where the cars are born. A contrarian, Matt claims to prefer understeer — stating that front and all-wheel drive vehicles cater best to his driving style.

More by Matt Posky

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Daniel J Cx-5 lol. It's why we have one. I love hybrids but the engine in the RAV4 is just loud and obnoxious when it fires up.

- Oberkanone CX-5 diesel.

- Oberkanone Autonomous cars are afraid of us.

- Theflyersfan I always thought this gen XC90 could be compared to Mercedes' first-gen M-class. Everyone in every suburban family in every moderate-upper-class neighborhood got one and they were both a dumpster fire of quality. It's looking like Volvo finally worked out the quality issues, but that was a bad launch. And now I shall sound like every car site commenter over the last 25 years and say that Volvo all but killed their excellent line of wagons and replaced them with unreliable, overweight wagons on stilts just so some "I'll be famous on TikTok someday" mom won't be seen in a wagon or minivan dropping the rug rats off at school.

- Theflyersfan For the stop-and-go slog when sitting on something like The 405 or The Capital Beltway, sure. It's slow and there's time to react if something goes wrong. 85 mph in Texas with lane restriping and construction coming up? Not a chance. Radar cruise control is already glitchy enough with uneven distances, lane keeping assist is so hyperactive that it's turned off, and auto-braking's sole purpose is to launch loose objects in the car forward. Put them together and what could go wrong???

Comments

Join the conversation

Announcements and patent filings are one thing, but I'd wait until we see a product's specs, price, and availability before getting too excited.

The more, the merrier. Even from Toyota.