Texas Will Tax EV Registrations to Make Up for Lost Gas Taxes

Many states and municipalities are all-in on EVs, but the shift has some wondering how they’ll make up for the tax shortfall from falling gasoline sales. A popular solution that gets tossed around is to add a tax to EV registrations to help recoup the lost revenues, and Texas recently passed a new law to remedy the problem.

Sen. Manchin Proposes Bill to Force Treasury to Finalize EV Tax Credit Guidance

Despite the United States having an entirely new EV tax credit scheme under the so-called Inflation Reduction Act (IRA), there’s nobody adhering to it right now. That’s because the Treasury Department decided to delay issuing specific guidance on battery matters until March, nullifying any restrictions based on content requirements. While this means more automakers have been able to take advantage of government subsidies, it also means they haven’t been required to follow any of the stipulations outlined in the IRA for 2023.

Senator Joe Manchin (D-WV) believes this is unacceptable and has advanced legislation that would effectively force the U.S. Treasury to do its job.

New IRS Guidance Opens the Door to Tax Credits for Leased EVs That Bypass Final Assembly Rules

Tax credits for electric vehicles have never been the easiest to understand, and the changes recently made with the Inflation Reduction Act have caused even more confusion. The legislation rebooted the federal EV tax credit, bringing new requirements on final vehicle assembly and raw materials sourcing. Though at first, it appeared the new rules would exclude EVs from some of the country’s most popular automakers, the IRS released more guidance that seems to leave a small loophole open for hopeful buyers seeking a credit.

White House May Propose Gas Tax Holiday [Updated]

National fuel prices are currently averaging right around $5.00 per gallon in the United States. However, there are plenty of states with stations listing gasoline well above $6.00 per gallon with diesel being driven even higher. This has started to wreak havoc on the trucking industry, which is now seeing companies pausing shipments to renegotiate contracts, and infuriated consumers who remember a gallon of gas being $2.17 during the summer of 2020.

Earlier this year, Congress and the White House suggested suspending the federal fuel tax to alleviate the financial burden. But the notion was walked back, as prices were relatively low at the time (roughly $3.50 per gallon) and criticisms swelled that this simply exchanged one problem for another. Four months later and things are looking rather desperate, with the Biden administration revisiting the premise of pausing fuel tax to help soften the blow of record-breaking prices at the pump.

Gas War: Automakers Continue Begging Government for EV Incentives

On Monday, General Motors, Ford, Stellantis, and Toyota Motor North America reportedly asked the United States Congress to lift the existing cap on the $7,500 federal tax credit for electric vehicles. Though automakers petitioning the government for free money is hardly new business.

Suspending Federal Fuel Tax Pitched By Senate, White House

President Joe Biden and Democratic lawmakers have suggested ending the federal gas tax until 2023 as a way to offset fuel prices that are nearing record levels and possibly appease some on-the-fence voters ahead of midterm elections. Senators Mark Kelly (D-AZ) and Maggie Hassan (D-NH) recently pitched the bill in Congress. While the White House has not made any official endorsements, it’s offered tacit support by saying it didn’t want to limit itself in terms of finding new ways of easing the financial burdens Americans are facing during a period of high inflation.

“Every tool is on the table to reduce prices,” White House assistant press secretary Emilie Simons said in regard to a possible gas tax holiday. “The president already announced an historic release of 50 million barrels from the Strategic Petroleum Reserve, and all options are on the table looking ahead.”

More Western Leaders Call for the End of Private Vehicle Ownership

If there’s anything that’ll get my stomach into a twist, it’s the government talking about the merits of reducing people’s ability to own things. Fortunately, the 36-hour flu I just experienced made me nigh-invulnerable and someone had forwarded me the latest on what U.K. Parliamentary Under-Secretary for the Department for Transport Trudy Harrison had to say about personal vehicle ownership. She’s very keen on public transpiration but not so interested in the plebian masses having access to their own, individual modes of transport.

Earlier this month, she told a virtual audience at shared transport charity CoMoUK that the United Kingdom needed to move away from “20th-century thinking centered around private vehicle ownership and towards greater flexibility, with personal choice and low carbon shared transport.”

GM CEO Says Incentives May Help America Transition to EVs

General Motors CEO Mary Barra has chimed in on the weeklong open discussion about whether or not it’s a good idea for America to embrace the Biden administration’s EV tax credit plan, which just so happens to be deeply intertwined with the Build Back Better Act’s cavalcade of federal initiatives.

As we’ve already covered the topic more than once, we’ll avoid the recap and simply post the relevant links where Tesla CEO Elon Musk recommended pitching the entire bill into the trash and Transportation Secretary Pete Buttigieg went to bat for the White House by suggesting the updated tax scheme was a necessity for electrification to thrive. Barra opted to go with the latter take, stating that it could help accelerate EV adoption.

Buttigieg Issues Rebuttal to Elon Musk Regarding EV Subsidies

U.S. Transportation Secretary Pete Buttigieg has responded to criticisms Elon Musk has made about the Biden administration’s plan for electric vehicle subsidies.

The Tesla CEO believes the Obama-era EV tax credits were more than sufficient, with his own company serving as physical proof, and suggested the entire Build Back Better Act be tossed into the toilet. But Secretary Buttigieg said it was a necessary item if the United States hoped to advance electrification, swiftly transition away from combustion vehicles, and escape the perils of climate change (formerly known as global warming).

Elon Musk Continues Insulting Biden Admin's EV Tax Credit Scheme

Elon Musk has continued bashing the Biden administration’s tax credit legislation designed to spur electric vehicle adoption, this time suggesting that the entire bill be scrapped. Included as part of the Build Back Better Act that’s focused on addressing various social, infrastructure, and climate issues, Musk suggested the entire text simply be done away.

“Honestly, I would just can this whole bill,” he stated at The Wall Street Journal’s CEO Council Summit, appearing remotely from Tesla’s construction site in Austin, Texas.

Elon Musk Continues Selling Tesla Shares

Tesla CEO Elon Musk has sold another 934,091 shares of the company, worth a hefty $1.01 billion, as a way to meet tax obligations related to the exercise of options to buy 2.1 million shares. But it’s just a drop in the bucket, as Mr. Musk’s offloading of Tesla stock has surpassed $10 billion overall. That’s roughly 10.1 million shares since the CEO asked Twitter users at the start of November whether or not he should dump 10 percent of his existing stake in the company following its big move to Texas.

White House Briefly Mentions Fixing Our Horrible Roads

On Thursday, President Joe Biden spent part of his day listening to a group of lawmakers discuss how much the United States might need to spend on fixing its horrible infrastructure. It’s an issue America has neglected through multiple administrations and has frequently been set back by partisan conflict.

Considering the White House is ruminating on how to source trillions of dollars in new infrastructure spending after the U.S. just printed $9 trillion (almost 25 percent all USD currently in circulation) for COVID relief, that’s unlikely to change. Everyone is worried about raising taxes and causing inflation during a period of economic uncertainty, or skeptical that the government will use the new funding responsibly. But our roads (among other infrastructure projects) are reaching a point where they can no longer be ignored, placing the entire country in a particularly sour pickle.

Auto Alliance Pitches Preferred U.S. Strategy: Government Money

The Alliance for Automotive Innovation (AAI) is proposing a national strategy for the United States it claims will help keep the country competitive. However, the AAI represents automakers, parts suppliers, and technology firms around the globe — making this more of a plea to U.S. policymakers and the industry to remain laser-focused on electrification, connectivity, and vehicular automation. It’s pitching its preferred global strategy, not some custom strategy for helping the U.S. achieve dominance because it’s telling the European Union and Asia the exact same story.

Elsewhere, the eight-part plan is being touted as an invaluable tool to help guide America back toward automotive relevance. But here, we remain skeptical.

White House Wants to End EV Subsidies ASAP

White House economic adviser Larry Kudlow announced Monday that the Trump administration is seeking an end to federal subsidies on electric cars. Interestingly, the move appears to be related to General Motors’ plant closings and layoffs. The company’s restructuring plan hasn’t gone over well with policy makers or the American public, with many accusing the automaker of abusing years of tax breaks, only to reduce its workforce as a way of pursuing new technologies, businesses, and further bolstering its profit margins.

However, cutting GM out of the electric vehicle subsidies deal is more likely to impact its rivals than anything else. The company said it’s on the cusp of the EV tax credit ceiling already, with the gradual phase-out of those incentives likely to take place through 2019. Yet Kudlow pointed to the elimination of the credits as one way of punishing GM for eliminating so many jobs, echoing President Donald Trump’s threats from last last week.

“As a matter of our policy, we want to end all of those subsidies,” Kudlow explained. “And by the way, other subsidies that were imposed during the Obama administration, we are ending, whether it’s for renewables and so forth.”

French Motorists Spark 'Yellow Vest' Protests and Riots Over Fuel Taxes and Regulations (UPDATE: New Green Taxes to Be Suspended)

Despite everything you’ve heard about road rage, motorists tend to be pretty meek — at least when it comes to government regulations, and particularly in Europe. They passively accept, and pay for, mandated safety and emissions regulations as well as for taxes on the fuel for their vehicles. Perhaps, though, they aren’t as passive as we think. For the past three weeks, France has erupted in massive protests and riots that are being called the Gilet Jaunes protests, demonstrations that are spreading to Belgium and the Netherlands, and those protests were spearheaded by motorists.

Gilet Jaunes is French for “yellow vests,” which many of the protesters are wearing as a statement against intrusive, expensive, and sometimes petty government regulations and taxes. (For the past decade, French motorists have been required by law to carry bright yellow/green safety vests in their vehicles and wear them in the case of a breakdown.)

U.S., South Korea Reach Trade Deal; No Korean-built Hyundai Pickups in America's Future

The United States and South Korea reached a free trade agreement on Monday that spared the Asian country from punitive steel tariffs, assuming Seoul keeps an eye on just how much steel it sends to American buyers.

A quota on Korean steel exports means the country can only sell 70 percent of its recent average (2015-2017) to the U.S., though it is hardly Korea’s largest export market. The deal, reached “in principle” ahead of both countries’ meetings with North Korean leader Kim Jung UN, will also see South Korea raise the limit for U.S.-made vehicles that needn’t conform to local safety standards from 25,000 to 50,000.

It’s good news for the Trump administration, but not everyone’s thrilled. Hyundai’s union is hopping mad that a steep tariff on Korean-built pickups — which was set to expire in 2021 under the previous agreement — was just renewed for another 20 years.

Japanese Automakers: Trump's Steel Tariff Will Cost You More at the Dealership

Earlier this month, President Trump signed an executive order imposing a 25 percent tariff on foreign steel and a 10 percent tariff on foreign aluminum. Hoping to receive an exception, the Japanese auto lobby warned that the U.S. import tax would definitely inflate the price of models built by the companies it represents. That’s bad news.

However, the White House has already omitted its NAFTA partners from the tariffs, adding that it would consider further exceptions based on countries’ contributions to U.S. national security, military alliances, trading history, and how much they pay into strategic alliances like NATO.

While Japan is a longtime trading partner with the U.S., there currently exists a $69 billion deficit between the two countries. Trump also bemoaned Japan’s unwillingness to accept American imports. Still, the two have shared military alliances throughout the 20th century, with one ugly exception during World War II. They currently operate under the Treaty of Mutual Cooperation and Security and the U.S. currently considers the Japan one of its closest allies, despite it not being a NATO member — placing it in reasonably positive standing for tariff exceptions.

UPDATED: Steel Tariffs Are Coming, Canada and Mexico May See Exemptions

There was quite the backlash against President Trump’s plan to impose sweeping steel and aluminum tariffs on Wednesday. However, the White House pressed onward to formalize the measures on Thursday afternoon with assurances from the Commander-in-chief that they will be imposed “in a very loving way.”

Apparently, Canada and Mexico won’t be subjected to the 25-percent tax on steel imports and a 10-percent tariff on inbound aluminum. But the exception may only be temporary and the overall feeling on the tariff proposals are mixed, to say the least. Considering that the automotive industry accounts for a significant portion of the nation’s steel and aluminum imports, Rust Belt states are worried. Michigan, Ohio, Indiana and Pennsylvania receive around 20 percent of the steel and aluminum sent to the United States. Each of the states went red in the 2015 election after Trump said he would protect manufacturing jobs. But Trump claims that’s exactly what he’s doing.

What's Standing Between You and a Future Citron or Peugeot? Possibly, a Tariff

The threat of new import tariffs has PSA Group worried about its plan to return to the United States. Following President Trump’s proposal to levy a 25-percent tax on steel imports and a 10-percent tariff on inbound aluminum, Europe balked at the suggestion, leading to further threats of a car tariff.

Right now, the U.S. levies a 2.5-percent tax on imported European vehicles, far less than Europe’s 10-percent tariff on vehicle travelling eastward across the Atlantic. There’s a 25-percent U.S. tariff on European vans and trucks, too, which explains why crates of Mercedes-Benz van components sail into the port of Charleston, South Carolina at regular intervals.

According to Trump, any European retaliation against the proposed metal tariffs — which seem all the more likely given yesterday’s resignation of the president’s pro-free trade economic advisor, Gary Cohn — would see the U.S. ratchet up its car tariff. If the scenario comes to pass, your dreams of one day buying a new French car in America could easily be dashed.

Tax the Rich (Person's Car): Luxury Auto Dealers in One Canadian Province Aren't Happy About Their Customers Getting Soaked

After hitting it big with the Fab Four, George Harrison wrote the scathing song Taxman in protest of the British government’s “Super Tax” on high-income earners. At the time, the boys faced a 95 percent tax on their earnings (“There’s one for you, nineteen for me”), and Harrison reportedly did everything he could to offshore his wealth.

Britain’s dismal weather wasn’t the only reason rock musicians fled the country during this period.

In beautiful British Columbia, a mountain- and wine-filled area north of Seattle, the provincial government’s recent budget has some auto dealers steaming mad and worried their customers will hit the road in search of deal. The province’s New Democratic Party government, elected last year, plans to levy a 25 percent tax on the purchase of very high-end vehicles, with lesser models facing a 20-percent markup. However, many dealers wonder where the law of diminishing returns comes into play.

White House At Least Considering Increasing Gas Tax, Needs to Consult Congress

The United States’ 18.4-cent-per-gallon tax on gasoline and 24.4-cent tax on diesel hasn’t changed since 1993. Despite this, the opinion that it should be hiked as a way of funding public works was nowhere near the White House’s official infrastructure strategy. But Donald Trump isn’t averse to the idea. In fact, he proposed a 25-cent increase to senators during a Wednesday meeting as a possible funding solution.

White House officials claim the president says “everything is on the table” in terms of finding a solution for America’s growing infrastructure problems. But how serious the rest of the Trump administration is about raising the fuel tax is debatable.

Nice Prius - Now Pay Up: Maine to Green Car Owners

Here at TTAC, we sometimes tap sister publications when a story arouses our interest. This piece, published by Hybrid Cars, details a battle brewing in the rustic state of Maine — one that pits hybrid and electric car owners against a government that says their cars, while good for the environment, aren’t good for road upkeep. As cars become greener and gas tax revenues dwindle, this won’t be the last battle.

A proposed new fee for hybrids and EVs in Maine could be the highest in the country, reducing clean vehicle adoption.

The Maine Department of Transportation wants to add an annual registration fee for hybrids and electric vehicles. $150 for hybrids, and $250 for electric models. The DOT is looking to impose the fee because it says drivers of the more energy efficient vehicles aren’t paying their fair share toward road maintenance.

“The owners of these types of vehicles are paying far less in the gas tax than other vehicle owners and they are using the highway system just like any others,” MDOT Manager of Legislated Services Megan Russo told the Portland Press-Herald. “There has got to be a way to try and capture revenue from those drivers who are using our road system.”

Here Come the Roads: President 'Big Daddy' Trump Unveils Infrastructure Plan

Few things are sexier than a new road. The scent of fresh tar, smooth pavement that’s still warm to the touch — it’s an absolute feast for the senses. After roughly a year of waiting, President Trump finally seems poised to deliver on a bunch of them. The White House has just offered Congress a 53-page report detailing exactly how to rattle loose $1.5 trillion in investments into the country’s ailing infrastructure.

Maybe “poised” is the wrong word to use; how about we just say that he’s been interested in the idea that somebody should build them.

Expect Democrats to complain that the plan totally fails to create a dedicated funding stream to address the infrastructure issue and Republicans to gripe about how the small federal investment, set at $200 billion, is still far too large. It’s a beautiful system we have here.

Fiat Chrysler to Bring Heavy Duty Pickup Production Back to U.S., Shower Workers With Cash

There’s good news this morning for Fiat Chrysler worker in the United States, and it’s also good news for members of the Trump administration.

The automaker has announced plans to sink another $1 billion into its Warren Truck Assembly plant and bring production of its Ram Heavy Duty models to Michigan from Saltillo, Mexico. At the same time, some 60,000 hourly and salaried workers in the U.S. can expect a $2,000 bonus (paid in the second quarter of 2018) in recognition of “their continued efforts towards the success of the company.” The move also means 2,500 previously unannounced jobs for Michigan.

What’s behind all of this sudden goodwill? Recent changes to the country’s tax landscape, FCA claims.

“It is only proper that our employees share in the savings generated by tax reform and that we openly acknowledge the resulting improvement in the U.S. business environment by investing in our industrial footprint accordingly,” said CEO Sergio Marchionne in a statement.

So, how does this production shuffle play out, and what’s the backstory here?

Union Dos and Don'ts: Volkswagen Chops Salaries and Bonuses for Works Council Amid Investigation

Volkswagen has slashed salaries and suspended the bonuses of 14 members of its works council, including council head Bernd Osterloh, as officials investigate alleged overpayments. In May, it was made public that German prosecutors were looking into current and former executives at VW under suspicions that they paid the labor chief an “excessive” salary.

This was followed by a November raid, after which the council claimed the probe didn’t “target Osterloh.” Members specified that all payments were in line with Germany’s legal guidelines. The offices of VW’s chief financial officer, Frank Witter, and personnel director Karlheinz Blessing were also searched.

Say Goodbye to EV Tax Credits Under New GOP Tax Plan

It’s the last thing Elon Musk wants to hear and it’s likely not something General Motors will be too pleased about. Contained within the tax plan introduced by House Republicans Thursday is the elimination of a huge driver for electric vehicle sales — the $7,500 EV tax credit.

Automakers, and especially the two mentioned above, already stood to lose their credits in the near future (there’s a 200,000-vehicle-per-manufacturer cap), but the new tax bill would see the buyer incentive permanently removed, not renewed, as many had hoped. Such a move could slam the brakes on a still-fledgling segment in the U.S.

Hoping to Turn the Page, Volkswagen Shows Its I.D.

Looking something like an unborn child peering with sightless eyes from inside an amniotic sack, the Volkswagen I.D. concept vehicle has been revealed ahead of the Paris Auto Show.

The description is apt, as Volkswagen sees the I.D. as an embryo, heralding a long-range electric vehicle slated for production within four years.

Volkswagen Eyeing U.S. Van and Truck Market: Report

Move over Chevrolet, Ram and Ford?

It’s hard to say if American van and truck builders have anything to worry about after the head of Volkswagen’s commercial vehicles division publicly mused about jumping into the U.S. market.

General Motors Might Stage Its Own Brexit, Says Report

Britain’s recent vote to leave the European Union could cause General Motors to up and leave the country, industry analysts predict.

Production of Vauxhall and Opel vehicles could shift across the Channel if the EU places import tariffs on vehicles bound from Britain, LMC Automotive said in a report, ending GM’s decades-long presence.

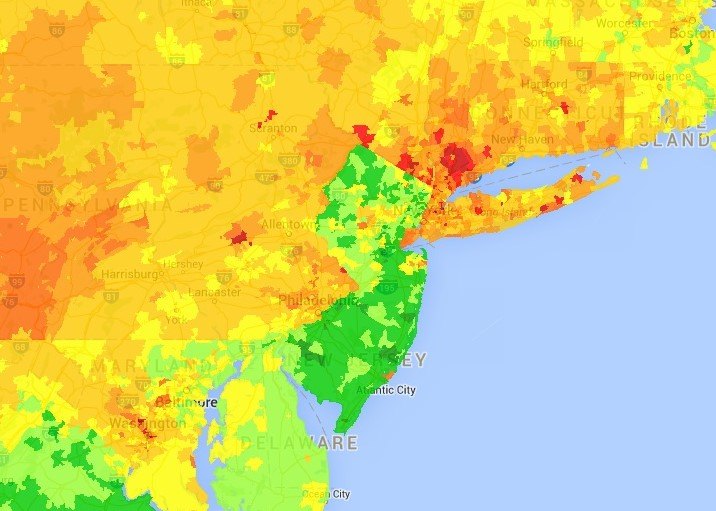

Gas Tax Hike Could Kill New Jersey's Famously Low Pump Prices

A looming bump in New Jersey’s gas tax would mean fewer drivers from neighboring states crossing the Hudson and Delaware Rivers to take advantage of the state’s famously low pump prices.

The state’s transportation fund is almost empty, roads and bridges need repairs, and Democrat lawmakers and select Republicans are putting pressure on Governor Chris Christie to send the gas tax skyward, according to the New York Times.

How much higher? Try 23 cents/gallon more.

Here's One Upside to a European Diesel Downfall

With European regulators taking a closer look at the continent’s wonder fuel — diesel, that is — in the wake of Volkswagen’s emissions scandal, oil burners could hasten their disappearance from European Union streets.

That would be great for police officers in the UK, who seem increasingly confused about what kind of fuel goes in their patrol car’s tank.

Ontario Controversy Adds More Fuel to the EV Incentive Debate

Two sides, two seemingly valid arguments. And in the middle, five $1.1 million cars.

Through the province’s Electric Vehicle Incentive Program, Ontario taxpayers helped lower the price of five Porsche 918 Spyders last year, according to Canada’s national broadcaster, leaving many wondering why their cash helped fund supercars for the ultra wealthy.

The program shaved just over $5,500 off the price of each $1.1 million hybrid Porsche — a limited edition model possessing 887 horsepower, with a top speed of 210 miles per hour.

One of those vehicles has since burned to the ground in a Toronto-area gas pump fire, which, for some, serves as a perfect metaphor for taxpayer-funded EV incentives.

Can the Tesla Model 3 Break Even at $35,000? This Guy Says 'Nope'

Tesla is in the game to make money with its $35,000 Model 3, due out in late 2017, but that claim was recently disputed by an industry insider.

Jon Bereisa, an electric vehicle engineering consultant (and former General Motors systems architect responsible for the Chevrolet Volt), said recently that the Model 3 needs to be much more expensive for Tesla to break even, according to StreetInsider (via Electrek).

'Green Cars Only' Laws: Coming to a Debate Near You

Volkswagen Workers Under Criminal Investigation for Breaking Tax Laws in Germany

German investigators are looking into whether Volkswagen executives or engineers broke laws by lying about carbon dioxide emissions in 800,000 cars sold in Europe, the New York Times reported.

Authorities near the automaker’s headquarters in Wolfsburg say they are focused on five Volkswagen employees, but wouldn’t identify those employees. Investigators are determining if Volkswagen employees knowingly provided false information to authorities about those cars and their emissions to qualify those cars for lower tax rates. In admitting that it lied about its emissions levels this month, Volkswagen said it would repay governments for back tax revenue lost because of the bogus claims.

This month, Volkswagen admitted it underestimated carbon dioxide output from 800,000 cars sold in Europe and said the scandal could cost the company more than $2.1 billion. According to the New York Times report, Volkswagen’s admission included a promise to repay taxes owed on owners’ cars it sold with bogus carbon dioxide numbers.

Incentive Money Gone, Electric Car Sales Have Dried Up In Georgia

Electric car sales in Georgia have halted after that state stopped offering incentives and started charging a $200 annual fee to recoup lost gas tax revenue, the Atlanta Journal-Constitution reported.

New electric vehicle registrations plummeted 89 percent from June to August after the state stopped offering a $5,000 tax break on top of the $7,500 federal incentive. Georgia’s incentive was one of the most generous in the country.

Georgia’s electric purge could portend a future in highly incentivized states, such as California and Colorado, where electric incentives and sales are still relatively strong.

Trans-Pacific Partnership Agreement Reached, Let's All Buy Subaru Sambars

Twelve countries, including the United States, reached an agreement Monday on an historic trade agreement that could economically tie together more than 400 million people in Asian Pacific and American countries. The pact would cover trade for wide ranging products, from rice to pharmaceutical drugs to cars.

The Trans-Pacific Partnership, which negotiators have been working on for eight years, would thaw trade relations among countries included in the regional zone, including Japan and the United States. For automakers in both countries, the tentative deal includes provisions for Japanese automakers to (eventually) bring light-duty trucks to the U.S. For American automakers, part of the proposed agreement included a side deal between America and Japan to allow access for U.S. automakers to traditionally closed Japanese markets.

The agreement faces an uphill battle to get congressional approval; House Republicans and presidential candidates already have roundly dismissed the deal.

Volkswagen Pulled Cheap $51.35 Million Bar Trick in 2009 Based on False Emissions Data

According to the LA Times, Volkswagen’s falsified emissions data made certain 2009 model year vehicles eligible for a $1,300 green car subsidy. That subsidy, applicable to 39,500 Jetta and Jetta Sportwagen units sold, equated to a total of $51.35 million available to buyers from the government.

The LA Times used Internal Revenue Service data and Motor Intelligence, an automotive industry research body, to calculate the numbers.

The $51 million in total tax credits is just another case of automakers leveraging dumb government money to incentivize consumers to buy their vehicles.

Auto Alliance Kills Aggressive California Gas Bill

California’s ambitious climate change bill was stripped Wednesday night of its toughest provision that would have cut the state’s gasoline consumption 50 percent by 2030, Automotive News is reporting.

A pared down version of California’s wide-rangning transportation bill will reach Gov. Jerry Brown’s desk, but won’t include the gas target nor a plan to fix California’s roads.

The controversial bill was met last month by an automotive lobby that flooded the state with advertisements and money to combat the provisions.

“Oil has won the skirmish. But they’ve lost the bigger battle,” Brown said, according to the LA Times. “Because I am more determined than ever.”

At This Point, Nissan Is Just Daring Me Not To Buy A Leaf

Nissan announced Thursday that the 2016 Leaf would run more than 100 miles on a single charge in SV and SL trim, increasing its range by 25 percent over last year. The base S model will keep the 24 kWh battery that manages more than 80 miles on a charge.

For the dozens and dozens of 2015 Leafs wilting on lots around the Denver metro area — where a combination of tax credits and cash back from the manufacturer makes the Leaf the least-expensive new car in America — I can hear them calling. And after Nissan sweetened its own deal this month with no interest for 72 months, it’s getting louder.

Tesla's 'Free' Model X for Referrals Probably Eligible for Federal Tax Credit

Details on Tesla’s “free” Model X for the first 10 referral buyers have been few since the beginning. First it appeared that the program would be limited by time, then it appeared it would be limited by country, now it appears that it’ll be limited by continent.

The first person to refer ten friends in each sales region— North America, Europe, and the Asia-Pacific — will receive a free Founder Series Model X.

But even more unclear is exactly how Tesla will give its winner their new Model X. Depending on how that happens, there are very few scenarios in which the new Model X owner (with 10 friends wealthy enough to buy new Model S cars) wouldn’t qualify for up to $7,500 back from the feds.

Columnist: Consumer Reports 'Prostituted' Itself With Tesla Review

Wall Street Journal columnist Holman W. Jenkins (great name) slammed Consumer Reports for its glowing review and better-than-perfect score for the Tesla Model S P85D, in part, because the $127,000 car still qualifies for a government tax break.

“Prostitute is not too strong a word,” he wrote. “… (Consumer Reports) is shilling not only for the car but the government policies that subsidize it.”

Jenkins takes aim at the state and federal tax incentives still available for the vehicle — which are going away in many places — and at the magazine for hyping its review so heavily, and subsequently giving it away for free on its subscription-based website.

Senate Committee Approves Bill to Help Detroit Make Hybrids

A U.S. Senate committee for transportation passed along a bill Thursday that included provisions to help domestic automakers develop and build cleaner vehicles, the Detroit News is reporting.

The proposal, dubbed the Vehicle Innovation Act, was included in a larger clean energy bill taken up by the committee. The Vehicle Innovation Act would set aside $313.6 million next year for research and development of hybrid technology, battery development and alternative fuels such as natural gas. Funding would increase by 4 percent every year up to 2020.

Nearly all major U.S. automotive lobbies representing manufacturers supported the proposal.

Car Building in Ontario Could Die, and They Probably Can't Save It

Ontario’s debt is swelling and as home to eight manufacturing plants — the largest complex in North America — automakers may have a tough time keeping plants open in Canada’s most-populous province.

According to a story by the Financial Post, Ontario is moving forward with an ambitious plan to revamp roads and mass transit systems despite its debt being downgraded by Standard & Poor’s bond index. The broad public spending plan also extends to other sectors, despite high unemployment numbers and slumping manufacturing jobs.

Automakers such as Fiat Chrysler Automobiles have called on the provincial government to cut back on public programs and reduce costs on utilities in an effort to keep car building in the province profitable. This year, Chevrolet will shift production of its Camaro to Michigan. On the whole, Oshawa GM production has a dark cloud lingering overhead until the company decides what to do with the facility in 2016.

Sales of EVs, Hybrids Slumping After Gas Prices Dip

Sales figures from automakers this week show slumping sales of electric vehicles and hybrids nationwide as gas prices drop and tax incentives dry up.

According to the Detroit News, sales from EV makers such as Nissan and Chevrolet have slowed down significantly — more than 30 percent for the Volt and 12 percent for the Leaf — last month, and both models may end up down significantly for the sales year.

Republican Hopeful Donald Trump Threatens Ford With Tariffs Over Mexico

Republican presidential hopeful and billionaire Donald Trump wants to bring the pain via punitive tariffs to Ford for manufacturing vehicles in Mexico.

Colorado Offers Tax Credits On Used EVs, PHEVs

Shopping for a used PHEV or EV in Colorado? You still may be able to take a tax credit, thanks to the state’s structuring of its EV purchase tax credit.

Biggest Supplier of U.S. Foreign Oil Elects Democratic Socialist Government

Last night, it became official: Alberta, the largest producer of oil in Canada, ended the 40 year reign of the Progressive Conservatives in favor of the New Democratic Party (NDP), a democratic socialist party.

This could mean big changes in the energy sector, from oil patch to gas pump.

Obama Budget Proposes Tax On Corporate Foreign Earnings For Roads

President Barack Obama unveiled his annual budget Monday, which includes a proposition to tax corporate foreign earnings to fund the nation’s roads.

113th US Congress Leaves $8K Hydrogen Credit On The Table

For the few who will be purchasing a Toyota Mirai in 2015, you may be out of luck as far as tax savings are concerned. For now, anyway.

MBUSA Looking South For New Home

With Cadillac getting its inner hipster on in SoHo, and Subaru trekking four miles west to conduct its American hustle in Camden, N.J., Mercedes-Benz USA is feeling the urge to heed the song of the South and go with the wind.

Sen. Reid Calls Upon Congress To Raise EV Tax Incentives

For the past three years, President Barack Obama has called upon Congress to raise tax incentives for electric vehicles from $7,500 to $10,000, with those calls going unanswered.

This year, the top Democrat in the U.S. Senate is taking the charge.

AAA: 51 Percent Surveyed Willing To Pay For Better Roads

As those inside the Beltway debate how best to fund their responsibility for the nation’s transportation infrastructure, a AAA study finds most Americans would pay more taxes for better roads.

Michigan Legislators, Business Groups Debate Proposed Fuel Tax Hike

State senators in Michigan returned to Lansing Monday in a rare session to discuss raising fuel taxes to fund improvements to the state’s road infrastructure.

Federal, State Governments Face Budget Shortfalls Amid Increased Fuel Efficiency

As the funding aquifers for road maintenance continues to fall before the efficiency-fueled gas tax drought, federal and state governments are left to ponder how best to make up for the shortfall.

Analysis: Toyota Could Bring $7.2 Billion To Texas Over Next Decade

Toyota’s big move from California to Texas may also bring a big return for Plano, Texas over the next decade, to the tune of $7.2 billion of economic activity.

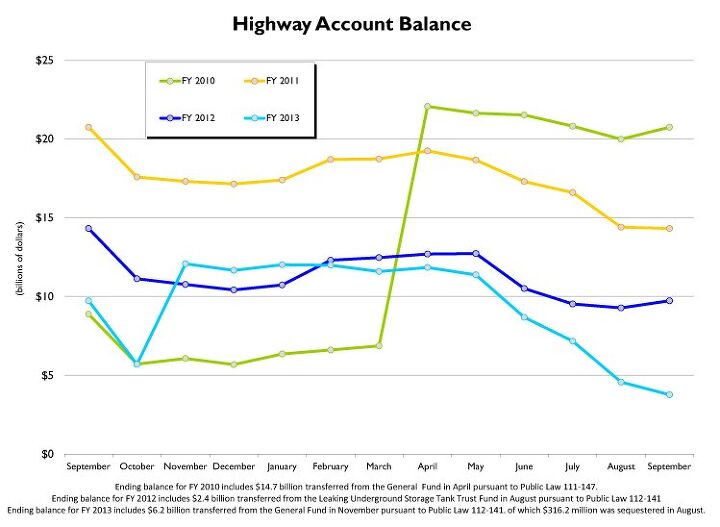

Foxx, Obama Administration Urge Congress To Act On Funding Highway Trust

With 112,000 infrastructure projects and 700,000 jobs at stake, the Obama administration and Secretary of Transportation Anthony Foxx are both urging Congress find a way to provide funding to the United States Highway Trust Fund before the well goes dry as early as August.

Auto Sales In Turkey Fall 8 Percent In January

Vehicle sales in Turkey fell 8 percent in January to 32,670 vehicles from the previous high of 35,523 units in January 2013 according to national industry group Otomotiv Distribütörleri Derneği and Automotive News.

Foreigners May Pay Toll to Storm the Autobahn

If you happen to live outside of Germany, you may soon find yourself paying a toll to do your best Burt Reynolds and Dom DeLuise impressions on the Autobahn.

House Democrat Introduces Bill to Raise Federal Gasoline Tax by 15 Cents Per Gallon

Federal taxes on highway fuels haven’t been raised in 20 years. Because of inflation and better fuel economy, the Highway Trust Fund, into which those taxes flow and out of which transportation funding is dispersed, faces a shortfall. Standing next to labor, construction and business leaders, Rep. Earl Blumenauer (D-Ore.) announced that he has introduced legislation that would raise the federal tax on gas to 33.4 cents per gallon and on diesel to 42.8 cents.

“Every credible independent report indicates that we are not meeting the demands of our stressed and decaying infrastructure system — roads, bridges and transit,” Blumenauer said. “Congress hasn’t dealt seriously with the funding issue for 20 years,” the congressman continued. “With inflation and increased fuel efficiency, especially for some types of vehicles, there is no longer a good relationship between what road users pay and how much they benefit. The average motorist is paying about half as much per mile as they did in 1993.”

![White House May Propose Gas Tax Holiday [Updated]](https://cdn-fastly.thetruthaboutcars.com/media/2022/07/10/8870350/white-house-may-propose-gas-tax-holiday-updated.jpg?size=720x845&nocrop=1)

Recent Comments