House Democrat Introduces Bill to Raise Federal Gasoline Tax by 15 Cents Per Gallon

Federal taxes on highway fuels haven’t been raised in 20 years. Because of inflation and better fuel economy, the Highway Trust Fund, into which those taxes flow and out of which transportation funding is dispersed, faces a shortfall. Standing next to labor, construction and business leaders, Rep. Earl Blumenauer (D-Ore.) announced that he has introduced legislation that would raise the federal tax on gas to 33.4 cents per gallon and on diesel to 42.8 cents.

“Every credible independent report indicates that we are not meeting the demands of our stressed and decaying infrastructure system — roads, bridges and transit,” Blumenauer said. “Congress hasn’t dealt seriously with the funding issue for 20 years,” the congressman continued. “With inflation and increased fuel efficiency, especially for some types of vehicles, there is no longer a good relationship between what road users pay and how much they benefit. The average motorist is paying about half as much per mile as they did in 1993.”

The American Automobile Association supports the proposal. “Though it would be easier to simply kick the can down the road, today’s proposed legislation takes a necessary step forward in fostering debate on an important issue that many policymakers have been reluctant to address,” said Kathleen Bower, vice president of public affairs for AAA. “The country desperately needs additional funding for infrastructure and, for the moment, there is no better means than the fuel tax. The proposed increase is well overdue and in line with what most experts suggest would be appropriate.”

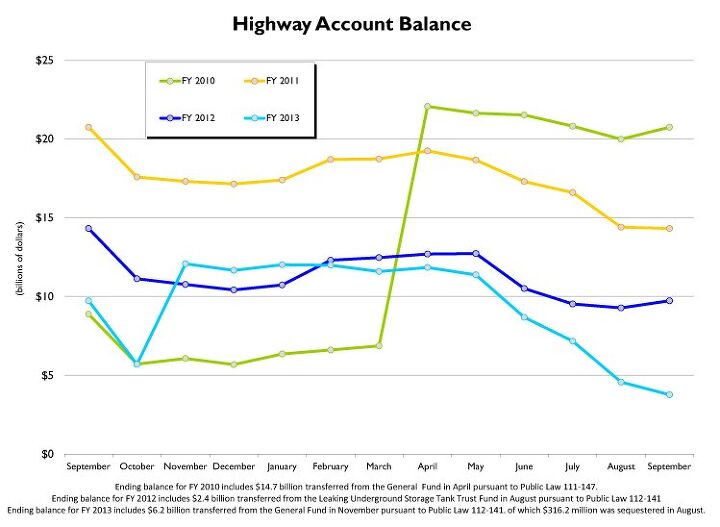

While states levy their own fuel taxes, about half of transportation funding in the U.S. comes from the federal government. The trust fund no longer brings in enough money to cover its obligations so to fund the federal transportation bill currently in effect, which expires in 2014, Congress had to move more than $50 billion in general tax revenue into the fund. Estimates cited by Rep. Blumenauer say that the trust fund will need $15 billion more each year if Congress decides to keep funding at current levels in the next transportation bill. He said that implementing a $0.15/gal tax over three years would raise approximately $170 billion in the next decade.

If the fuel taxes are not increased, Congress will have to choose between cutting transportation funding at the federal level and moving that tax burden to the states, or funding the Highway Trust Fund with general tax revenue.

The American Society of Civil Engineers said last month that the U.S. needs a $2.7 trillion investment in transportation and other infrastructure by 2020 to keep the United States competitive in the global economy. The Federal Highway Administration has estimated that just to keep our current infrastructure safe, highways and bridges will need more than $70.9 billion worth of repairs.

In the Senate, Barbara Boxer (D-Calif.), chairwoman of the Environment and Public Works Committee, has proposed changing the way taxes are levied on fuel, moving the tax to the wholesale level rather than at the pump.

More by TTAC Staff

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Kwik_Shift_Pro4X I fell asleep looking at that image.

- Verbal Rented a Malibu a while back. It was fine, if a bit gutless.I get that Detroit wants to go all-in on high profit margin SUVs and blinged-out MAGA trucks. Everyone has known for decades that they can't compete on price in the affordable sedan space. So now all of Detroit's sedans are gone except for a couple of Cadillac models.But you'd think that just one of the domestic brands could produce a fun, competitive and affordable sedan. Just one? Please? Anyone? Bueller?

- 3-On-The-Tree I wouldn’t even use Ford as a hearse for fear of being late to my party.

- SCE to AUX Norway is in Europe, and Tesla is an American automaker - no problems there.I wouldn't use Ford as the bellwether.https://www.reuters.com/business/autos-transportation/tesla-extends-lead-norway-evs-take-record-82-market-share-2024-01-02/https://elbil.no/english/norwegian-ev-policy/

- Steve Biro If the U.S. government wants to talk about banning all connected cars - or at least the collection and sharing of information from said vehicles - I’m all ears. Otherwise, don’t waste my time.

Comments

Join the conversation

I purposely avoided commenting on this topic until now. I'm not an expert, but I did spend nearly 30 years working for the California Department of Transportation in highway design, both working on the actual blue prints and estimating costs of various projects. Let me just say that there's always a lot of heat on this topic, mostly from people who really don't know how the process works, and there's plenty of evidence of that in some comments. There's also a large number of comments that corrected some of the biggest misperceptions too. Let me also say that labor is a minor cost in road building, so there's no need to get upset about government-mandated pay rates. Government is paying but private contractors are doing the work, and they pay their people the going rate for the skills needed, and that's often more than the mandated amounts. Contractors get penalized in government contracts when they do things wrong and they're willing to pay extra to people who do it right the first time. Secondly, be very wary of any numbers you see, hear or read. Engineers try their best to explain, but politicians are dumb and need simple explanations. Their "staff" knows even less, and gets the engineers' information and explains it to politicians and others, often misrepresenting what they were told. Even the press screws up: The San Francisco Chronicle once ran a n article "What People Earn", and listed state highway maintenance workers' salaries at nearly $65,000. They actually made just a bit over $37,000, with top rate at $3114/month. The Chronicle asked and thought that was $31.14/hour, multiplying by 40 hours/week and 52 weeks to get the annual figure. Third, the building/financing model is broken. It's not just a lack of inflation adjustment, or fuel economy, or the higher-than-inflation rise in construction costs. There's no statewide, much less Federal system to inventory, inspect, maintain and rebuild the nation's road network. Roads and bridges don't last forever, and must be rebuilt top to bottom, not just asphalt re-skin or concrete slab replacement. Our largely concrete interstate has a lifespan of 40-60 years, and the system began in 1959. We need a massive rebuilding program just to keep what's already built. Bridges are at a crisis point already, with many handling more traffic and weight than they were designed for. There have been two major interstate bridge collapses in this century, the Oklahoma I-40 bridge in 2002 and the Minneapolis I-35 bridge in 2007. Six years later there's still no organized effort for enhanced inspection, it's still left to state bridge inspectors making largely visual reviews independent of bridge overload history or stress analysis of components best done with sophisticated instruments. At the bottom of it all is deferrals caused by the annual government budget process, with those deferrals only addressed in a crisis situation. Bottom line: the task of maintaining and rebuilding our existing road network is about to explode, our elected leaders haven't a clue, and the financing for it doesn't exist.

Estimate of needed improvements brought to you by the "American Society of Civil Engineers". In other words, the kind of people that recommend Mobil 1 for everything and buy nothing less than the contractor-grade outlets. I used to work in R&D in a very large corporation. If we adopted all their reccos, we'd be bankrupt. Somehow our business has managed 110 years of paying dividends without going to a 6X safety factor on our product boxes. Is anybody asking these engineers to minimize their recommendations, or are we getting sold on the Gold Package?