Canada Joins Mexico in Trade Dispute Against United States

Mexican and Canadian officials have been dropping hints that they’re not all that enthusiastic about the United States-Mexico-Canada Agreement (USMCA) since before Enrique Peña Nieto, Donald Trump, and Justin Trudeau all sat down to sign it in 2018. But just getting to that point required months of formal negotiations that rarely looked to be all that productive.

Sadly, things don’t seem to have changed now that the USMCA is in full effect. Last week, Mexico requested a dispute settlement panel under the terms of the trade pact to help resolve disagreements about the surprisingly contentious automotive content stipulations that determine whether or not vehicles and parts will be slapped with tariffs. Under the previous North American Free Trade Agreement (NAFTA), 62.5 percent of the vehicle’s components had to be sourced from member nations to be considered tax-exempt. In an effort to spur localized production, USMCA increased that number to 75 and not everyone is thrilled with the updated content requirements with Mexico claiming it’s not even sure how to apply them. Canada now intends to formally sign onto Mexico’s complaint against the U.S. over their divergent interpretation of rules.

Rubber Shortages Become Latest Problem for Auto Industry

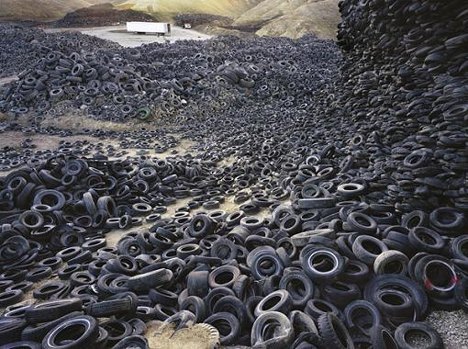

Those of you tracking the semiconductor shortage can probably take it easy for a while, as practically every industry group on the planet has tentatively agreed we’ll be seeing a chip deficit for a few years. Meanwhile, market analysts are trying to predict the next material we won’t have enough of and rubber is looking like an ideal candidate.

Rubber supplies are drying up and price increases are reportedly beginning to climb at an untenable pace. Despite several years of relatively stable availability and low prices, supply chain disruptions created by lockdowns have left latex harvesters in a bad position. Low prices encouraged many to over harvest their existing crop, rather than invest in farmland. But with shortages looking probable as countries began responding to the pandemic, China went on a buying spree to maintain a robust national stockpile in 2020. The United States was late to the party and now finds itself in a position where scarcity is driving rubber prices through the roof just when it needs to buy more.

White House Presses Taiwan On Semiconductor Shortage

Automakers around the globe have been issuing warnings for weeks that the semiconductor shortage will eventually result in fewer cars and leaner profitability reports. But the absent chips are affecting just about every industry producing modern connected devices, creating fears that electronic prices could skyrocket as availability dwindles. Lockdowns effectively crippled semiconductor supply lines right as demand peaked and everyone is starting to get a little worried about how it’s going to impact production in other industries.

The White House is reportedly taking steps to mitigate the issue by tasking Brian Deese (Director of the National Economic Council) and Jake Sullivan (National Security Adviser) with coming up with a solution. It’s also asking embassies to assist chip suppliers around the world however possible and hopefully suss out a way to stop the global shortage. Meanwhile, Deese and Sullivan will be focusing the brunt of their efforts on Taiwan.

Tires Made in Southeast Asia Will Be More Expensive

Tires from South Korea, Taiwan, Thailand and Vietnam are about to get more pricey, as the U.S. Department of Commerce (DOC) announced yesterday preliminary duties in the antidumping duty (AD) investigations of passenger vehicle and light truck tires from those countries.

Trade War Watch: Report Claims White House Wants to Dictate Where Cars Are Manufactured

The Trump administration has reportedly expressed an interest in deciding where and how automotive manufacturers do their business if they want to secure duty-free deals under the United States–Mexico–Canada Agreement (USMCA) that’s positioned to replace NAFTA. According to Bloomberg, there’s currently a discussion taking place between administration officials, congressional staff, and domestic and foreign automakers regarding the context of the legislation that lawmakers will ultimately have to vote on. The White House is said to want highly specific language that would allow it to select production rules unilaterally.

Considering how messy things have gotten with China, it could be useful to have extremely clear trade language and some direct oversight of businesses with global interests. But critics are worried the strategy could bring U.S. trade policy closer to the rigid policies already in place in the People’s Republic — a country America has attempted to distance itself from due to its ludicrous levels of government intervention.

The real fear is that the government could use this to give one manufacturer better treatment than another — cutting it a sweet deal for building in a politically advantageous area, for example. While plausible, we can’t confirm something that’s largely speculative.

Trade War Watch: Automotive Tariffs and the European Union

It’s been nearly a year since President Donald Trump and European Commission President Jean-Claude Juncker kissed and negotiated a temporary truce aimed at buying the United States and the EU time to renegotiate their positions without fear of new tariffs.

Unfortunately, it seems everyone had better things to do following the smooch.

Trump to EU: Expect Auto Tariffs Without Trade Deal

Earlier this week, the European Union warned that if the United States imposes any new tariffs on European-built vehicles, it can expect similar levies on American products. However, armed with the Commerce Department’s confidential report on automotive imports, President Donald Trump doesn’t appear remotely interested in backing down.

While Trump previously agreed not to impose additional duties on European cars, the arrangement hinged upon the two coming together on trade. Unfortunately, while both sides seem eager to work out a deal, they can’t quite manage to keep the constant threats down to a dull roar.

Trade War Watch: Congress Tries a New Tactic to Block Auto Tariffs

With the United States’ government shutdown now over, lawmakers have an opportunity to work together as promised. Interestingly, one of the first pieces of bipartisan legislation to emerge after the federal bureaucracy resumed operations involves a plan to severely limit presidential authority to impose tariffs for national security reasons.

The Bicameral Congressional Trade Authority Act, introduced by Senators Patrick Toomey (R-PA) and Mark Warner (D-VA), along with House Representatives Mike Gallagher (R-WI) and Ron Kind (D-WI), would require the president to get approval from Congress before taking any trade actions based on national security threats. If passed into law, the bill would let the Legislative Branch effectively block the tariffs being proposed by the Trump administration on automobiles and automotive parts.

Trade War Watch: China to Temporarily Suspend U.S. Auto Tariffs

China announced Friday its intent to reduce tariffs on imports of American-made cars as it tries to negotiate a trade deal with the United States. As you’ll recall, the People’s Republic imposed additional punitive tariffs on U.S. cars and auto parts earlier this year after promising it would lower the trade barriers on a global scale.

Things look to be different this time around. China has already taken steps to scale back the trade war and appears ready to continue down that path. Earlier this month, President Donald Trump and Chinese President Xi Jinping agreed to a truce in the trade war at their meeting in Argentina. This was followed by an announcement, via Trump’s Twitter account, claiming China had agreed to scale back auto tariffs against the United States.

Trade War Watch: Trump Says China Will Remove Car Tariffs, China Claims Nothing

Last night President Donald Trump tweeted that China had agreed to reduce tariffs. While The People’s Republic already lowered tariffs over the summer, it chose to cut the United States out of that deal as trade relations worsened. In fact, America found itself subject to an increased, 40-percent fine on imported autos while the rest of the world saw their tariffs (partially) eased. But the president seems optimistic.

“My meeting in Argentina with President Xi of China was an extraordinary one,” Trump explained in a follow-up post. “Relations with China have taken a BIG leap forward! Very good things will happen. We are dealing from great strength, but China likewise has much to gain if and when a deal is completed. Level the field!”

Meanwhile, China remains silent on the matter.

Europe Will Punch Back Against Any U.S. Car Tariff: EU Trade Commissioner

It’s been a trade-heavy week. Earlier, the White House decided to postpone any major tariff decisions following a discussion with the Commerce Department over a draft report on the impact of auto imports, giving trade representatives from the United States and European Union room to talk.

Unfortunately, things don’t appear to have gone swimmingly. European Trade Commissioner Cecilia Malmström left her Wednesday meeting with U.S. Trade Representative Robert Lighthizer promising that the EU would have retaliatory tariffs at the ready if America pulls the trigger on auto import duties. However, she also said some progress was made during her talk with Lighthizer, but had nothing conclusive to announce

Negotiating with the EU has grown difficult and, frankly, the automotive aspects have become less important of late. The European Union is now discussing the possibility of creating its own army, leaving president Trump to tweet angrily about historical precedents.

Trade War Watch: Trump Reportedly Delaying Auto Tariffs, Clock Still Ticking

The Trump administration was supposed to make an announcement Tuesday as to whether or not imported automobiles pose a national security risk, following discussions with trade representatives. While it wasn’t presumed that the White House would say anything truly definitive or hold a formal press conference on the issue, it was assumed that the president would take a stronger public stance either for or against an earlier proposal to raise foreign auto import tariffs to 25 percent. And it has, in a way.

According to those familiar with the matter, the White House decided to postpone any major decisions after discussing a draft Commerce Department report on the impact of auto imports with trade reps. However, the administration doesn’t have forever to make up its mind. Nor does its trading partners, which could be the point.

Trade War Watch: Were the Auto Tariffs Ever Supposed to Be More Than a Threat?

The U.S. Commerce Department has submitted draft recommendations to the White House on its investigation into whether it’s prudent to impose tariffs of up to 25 percent on imported automobiles and parts, based on the premise that they’re a threat to national security. The possibility has the industry in a tizzy, with both foreign and domestic brands lobbying against it.

Truth be told, we half assumed the entire concept was a ruse to bring other nations to the bargaining table with something to lose — a scenario where the United States could be viewed as a favorable alternative to tariff-crazy China. However, China has begun opening its market to foreign automakers while also placing a massive 40 percent duty on American autos, leaving the U.S. at a disadvantage. Now it looks as if the Trump administration may go through with everything.

Trade War Watch: Ford Blames Trump for Sky-high Steel Prices

Ford Motor Co. is blaming Donald Trump’s commodity tariffs for elevating U.S. steel prices higher than any other market on the planet. Regardless of your opinion on the president’s policies (the economy is reportedly booming), it’s a little hard to rebuff Ford’s criticisms on this one. The automaker’s now going straight to the source in an attempt to remedy the situation.

Trump hasn’t gone easy on Ford. He spent a large portion of his presidential campaign coming down on the automaker over its plan to move small-car production to Mexico. However, the company’s about-face proved a short-lived victory — it ultimately decided to stop selling cars altogether. This was followed by Ford’s cull of the upcoming Focus Active in North America after Trump’s 25 percent levy on Chinese-built vehicle made the introduction impossible (and unprofitable).

Trade War Watch: Canada Says It'll Take Its Time Reaching a Deal; Japan's Up for Talks

Canadian Prime Minister Justin Trudeau ignored mounting pressure from the United States to quickly agree to a new NAFTA deal on Wednesday. Trudeau indicated it was possible for the three nations to maintain a trilateral agreement, but noted his priorities would always align with what’s best for Canada. The nation now seems fine with ditching the agreement altogether.

Meanwhile, U.S. President Donald Trump announced that an agreement reached with Japanese Prime Minister Shinzo Abe allows the two countries to begin trade negotiations. The focus of these talks will likely be automotive in nature. Trump has remained oddly fixated with convincing Japan to sell more American-made models ever since taking office, and the Land of the Rising Sun doesn’t want itself saddled with import tariffs.

Trade War Watch: NAFTA Window Almost Closed, Canada Still Isn't Interested

The United States is getting extremely close to having to move forward on its NAFTA deal with Mexico without Canada, according to White House economic adviser Kevin Hassett.

“I’m a little surprised that the Canadians haven’t signed up yet,” Hassett said in an interview with Fox News. “I worry that politics in Canada is trumping common sense because there’s a very good deal that was designed by Mexico and the U.S. to appeal to Canada. And they’re not signing up and it’s got everybody over here a little bit puzzled.”

On Thursday, Canadian Foreign Minister Chrystia Freeland and U.S. Trade Representative Robert Lighthizer met in Washington to discuss terms. However, no agreement was reached.

Trade War Watch: Trump Rejects Auto Tariff Deal With Europe

Earlier this year, President Donald Trump took a renewed interest in European tariffs after deciding he didn’t like what he saw. He argued it was time for the United States to consider a fresh tax on vehicles manufactured in the European Union to level the playing field. “If the EU wants to further increase their already massive tariffs and barriers on U.S. companies doing business there, we will simply apply a tax on their cars which freely pour into the U.S.,” he wrote in March.

A few months later, America floated the ridiculous-sounding proposal of abolishing all automotive tariffs between the U.S. and EU. Surprisingly, Europe was highly receptive. German Chancellor Angela Merkel even directly addressed the issue by saying she would support lowering EU tariffs on U.S. car imports. The European Union now seems willing to pursue a zero-tariff solution on automobiles.

However, Trump has since changed his tune. The new rhetoric coming from the White House is that the deal, which was originally pitched by the U.S., is no longer good enough.

Trade War Watch: American-Made Mercedes-Benz SUVs Held Up at Chinese Ports Over 'Safety Risk'

Mercedes-Benz sport-utility vehicles assembled in Tuscaloosa, Alabama, are being checked for potential problems by Chinese customs authorities in Shanghai, according to the nation’s media. The situation was later confirmed by Daimler AG on Thursday.

Officially, custom agents discovered the imported GLE and GLS models possess “insufficient” rear brakes and pose a safety risk. However, this isn’t China’s first time holding up product from the Tuscaloosa factory. Daimler confirmed that its American-made SUVs, along with vehicles from Ford, were held up for several weeks in late April.

Trade War Watch: Trump's Not Letting Up on Europe's 10 Percent Solution

The past week has seen a flurry of trade trade announcements — none of them particularly promising for the United States. After a brief moment where President Donald Trump’s tariff threats seemed to have a positive impact on the European Union, Germany threw new support behind China as the People’s Republic issued a stunningly large 40-percent retaliatory tax on vehicles imported from America.

While Europe and the U.S. still might work out a zero tariff deal on automobiles, the recent activity has led Trump to respond with another warning. He now claims if the region cannot engage in fair trading practices with the United States, he’ll further restrict imported cars.

Trade War Watch: Germany and China Now Best Friends

China and Germany signed a collection of commercial accords valued at $23.5 billion this week. Meanwhile, the nations’ leaders publicly affirmed their commitment to a multilateral global trade order, while the United States adopts a more protectionist policy.

“We both want to sustain the system of World Trade Organization rules,” German Chancellor Angela Merkel said during a press conference. Chinese Premier Li Keqiang, also present, agreed and stated protectionism must be prevented for the good of the global economy.

Chinese President Xi Jinping has already pleaded for governments to maintain an open trading policy. “We reject selfish, shortsighted, closed, narrow policies, [we] uphold World Trade Organisation rules, support a multi-lateral trade system, and building an open world economy,” Xi said in an incredibly hypocritical speech from last month.

Trade War Watch: Mazda Joins Toyota in Condemning U.S. Tariff Proposals

Automakers are not thrilled with the White House’s current interest in automotive tariffs. With factories scattered across the globe, no major manufacturer would go untouched by the proposed increases in import duties or the retaliatory tariffs foreign governments may issue in response.

There’s a lot to lose from a financial perspective. According to a recent analysis from Evercore ISI, Fiat Chrysler would take an annual hit of $866 million if the United States placed a 25-percent import tariff on cars. Considering that other automakers stand to lose at least that much, it’s unsurprising they’ve begun raising their corporate voices over the matter.

Granted, the FCA example is a worst-case scenario for that particular brand, but even a lesser tariff would see a profit loss of hundreds of millions. For an automaker like Mazda, the loss would be far worse.

Ailing Motorcycle Industry Could Be Canary in Coal Mine for Automakers - Part Two

Last week, we discussed how the motorcycle industry’s total failure to entice new riders for over a decade has come back to bite it in the ass. Two-wheeled ownership declined drastically in the United States after the Great Recession and never really bounced back. Blame a disinterested population of youngsters with less discretionary funds and few entry-level options to consider.

I speculated that automakers could be on a similar path, despite the passenger car segment being more of a necessity for average commuters and less apt to collapse outright. But that isn’t to presume they might not be subject to similar pitfalls, and we’ve a new one to consider. Harley-Davidson, which serves as the poster child for the motorcycle industry’s current crisis, recently announced it will end all U.S. production of motorcycles sold in Europe.

Those bikes will now be manufactured overseas. The company said in a regulatory filing with the U.S. Securities and Exchange Commission that retaliatory tariffs levied by the European Union on motorcycles exported from the U.S. jumped from 6 percent to 31 percent. Harley-Davidson’s already expensive products come at an additional premium in Europe, and the the company estimates the new fines will add another $2,200 per motorcycle, on average.

Trade War Watch: U.S. Preparing to Limit Chinese Investment

The Trump administration is planning to impose incredibly restrictive investment limits against China. While the barriers could be argued as fair, considering China has some pretty serious restrictions of its own, the timing isn’t great. Treasury Secretary Steven Mnuchin pursued a less confrontational approach toward China after the nation showed some lenience in earlier promises to open its automotive and tech sectors through reduced tariffs, eventually eliminating state-mandated joint partnerships.

This move will no doubt make his job a lot more complicated.

It seems that the limits would restrict certain Chinese companies from investing in U.S. technology firms and block additional tech-related exports to Beijing. Among the industries most affect are robotics, aerospace, and automobiles — which have been labelled by the administration as a threat to economic and national security.

Trade War Watch: Volvo Worried About New U.S. Factory, Germans Want Tariffs Killed Entirely

The ground beneath the factory Volvo Cars opened Wednesday in South Carolina grew shakier after company executives warned that the U.S.-China trade dispute could undo plans to create up to 4,000 auto jobs in the state.

As you probably know, Volvo is currently owned by Chinese automaker Geely — which has a lot to lose if trade relations break down. Geely intends to export Volvo’s American-built cars to markets outside the United States. The situation’s a problematic one, as Volvo also imports the bulk of its U.S. market vehicles and any economic hurdles would surely gum up the works.

Looks Like NAFTA Renegotiations Aren't Happening This Year

Governance is one hell of a slippery fish. While you want your elected officials to assist in helping the nation evolve with an ever-changing society, you don’t want a deluge of contradictory and ill-planned laws mucking things up. That’s why the best progress is carefully measured and negotiated. But something has to happen eventually or you begin wondering what we (and the various lobbies) are paying these dingbats the big bucks for.

For example, the North American Free Trade Agreement looks like it’s about to be abandoned until sometime after 2019. After negotiations missed numerous self-imposed deadlines, U.S. House Speaker Paul Ryan said Congress needed a notice of intent to sign by roughly May 17th if anything was to be finalized for 2018. That date came and went. Now, everyone appears to have thrown their hands up, with practically every country on the planet currently considering retaliatory tariffs against the United States.

French President Convinced Trump Wants to Kill German Cars; Steel Tariffs Strike U.S. Allies

There’s been quite a bit of the old “he said, she said” as the global trade war between developed nations coalesces. Germany has not covered U.S. President Donald Trump’s trade policy favorably, not that it has much reason to. His new tariffs on imported steel and aluminum has tested relationships with numerous countries and, while it isn’t the biggest exporter of metal to the United States, Germany has something to lose. Likewise, proposed duties on passenger vehicles have sincerely rubbed Deutschland the wrong way.

However, the issue was further complicated this week after a gossipy report surfaced claiming Trump told French President Emmanuel Macron in April that he would continue hampering the European auto manufacturers until there are no Mercedes-Benz vehicles driving in America.

Trade War Watch: U.S. Public to Have a Say on Auto Import Threat

There was a mighty blowback against the Trump administration’s suggestion to elevate tariffs to as much as 25 percent on all foreign-built passenger vehicles.

Already reeling from fresh import fees on aluminum and steel, Europe expressed its collective distaste on new taxes while Japan vowed to plead a strong case for itself. Meanwhile, prominent politicians and two of the largest automotive trade groups in the country came forward to condemn the plan, stating it was “confident that vehicle imports do not pose a national security risk” to the United States.

While the administration has already launched its investigation to determine whether vehicle and auto part importers threaten the industry’s health and ability to develop advanced technologies, the government noted that a second opinion wouldn’t hurt. Announced on Tuesday in the Federal Register, the the Commerce Department will allot two days in July for public comments on the matter.

Trade War Watch: Automakers Respond to U.S. Import Investigation, Japan Keeps the Faith

President Trump announced a security investigation into auto imports last week, tasking Commerce Secretary Wilbur Ross with the job. His goal will be to determine what effects imported vehicles have on the national security of the United States under Section 232 of the Trade Expansion Act of 1962 — which sounds like a monumental and rather complex task.

Basically, Ross will examine whether or not the U.S. can get away with escalating automotive tariffs. That’s a touchy subject, considering how contentious global trade has become in recent months. Worse yet, the 80-year-old commerce secretary will have to continue promoting American businesses and industries outside its borders while deciding on an issue few trade partners will be happy with.

Automakers aren’t thrilled either. After Trump announced the investigation, the Association of Global Automakers and Alliance of Automobile Manufacturers both said they didn’t believe vehicle imports posed a national security risk. “To our knowledge, no one is asking for this protection. If these tariffs are imposed, consumers are going to take a big hit,” said John Bozella, President of Global Automakers, in a statement. “This course of action will undermine the health and competitiveness of the U.S. auto industry.”

Trade War Watch: China to Reduce Import Tariffs for Cars and Components

China has announced plans to slash import fees on automobiles to 15 percent starting this July. While the tariff currently rides high at 25 percent, the country’s Ministry of Finance said reducing it was part of an intentional effort to open up China’s markets and spur development within the local automotive sector.

It may also have been part of a peace offering. President Donald Trump has been pretty clear on China’s trade policies with the United States, frequently referring to them as unfair. The U.S. imposes a svelte 2.5 percent fee on imported vehicles — unless we’re talking about trucks. “Does that sound like free or fair trade?” Trump tweeted last month. “No, it sounds like STUPID TRADE — going on for years!”

Here's How Trade Negotiations Are Looking for the Month of May; Steel Tariffs Stalled Through June

May kicked off with a bundle of trade deals going into hibernation mode. After some legitimate — albeit quaint — progress, NAFTA decided to take a break this week. Currently, U.S. Trade Representative Robert Lighthizer is in China to circumvent that brewing trade war and is unable to commit himself to the North American Free Trade Agreement’s renegotiation.

That’s probably fine, because Mexico’s auto reps need time to cool off.

The United States’ most recent proposal for increasing NAFTA’s regional automotive content includes a four-year evolvement to meet a 75-percent regional value threshold. It also suggests new labor rules requiring “substantial work” to be set at wages of $16 an hour or more. The move is intended to help the U.S. and Canada bolster production and force Mexico to raise its own wages.

A significant portion of Mexican trade officials aren’t keen on either aspect, resulting in a mixed response overall.

Team Trump Eases Demands on NAFTA's Regional Auto Content

The United States is softening the contentious automotive content requirement mandates pushed by the Trump administration as part of NAFTA renegotiation talks. While the demand is only one of many asks coming from the U.S., both Canada and Mexico said forcing 85 percent of a vehicle’s overall content to be sourced from the three countries (in order to side-step tariffs) was a nonstarter. Over the past year, the issue became a major sticking point in the trade talks — hindering progress and possibly dooming them to failure.

While Trump’s intent was to bolster domestic employment by incentivizing North American parts suppliers, automakers expressed concerns and noted it was often difficult to reach the current threshold of 62.5 percent.

The United States has now proposed applying the new content requirement only to major components (like a vehicle’s powertrain) while leaving fasteners (nuts, bolts, etc.) alone. As an automobile is made up of tens of thousands of individual parts, deciding what should and should not be counted will make a big difference. Still, some manufacturers are likely to have difficulty meeting the proposed content requirement on critical engine components.

Trump is Talking Tariffs Again, Takes Aim at European Cars

President Donald Trump amplified his earlier threat of a global trade war this weekend by suggesting he would impose a tax on European cars if the EU countered his proposed steel and aluminum tariffs. On Thursday, Trump called for a 25 precent import tariff for steel and a 10 percent fee on aluminum in the hopes it would bolster those industries domestically. Europe responded by threatening a tax on imported bourbon, blue jeans, and American motorcycles. Apple pie and baseball were not mentioned, but you get the idea.

European Union officials clearly wanted to send a message to the president to back down. Instead, he came back even harder in a tweet from Saturday. “If the E.U. wants to further increase their already massive tariffs and barriers on U.S. companies doing business there, we will simply apply a Tax on their Cars which freely pour into the U.S.,” he wrote. “They make it impossible for our cars (and more) to sell there. Big trade imbalance!”

Ending NAFTA Could Cost U.S. 50,000 Auto Jobs: Study

Automotive trade groups have issued warnings about the scrapping of the North American Free Trade Agreement all year. In January, the Center for Automotive Research claimed killing NAFTA could result in the elimination of at least 31,000 auto jobs within the United States. This week, a new study sponsored by the Motor Equipment Manufacturers Association upped that estimation to around 50,000.

With early negotiations not going particularly well at the moment, the new tally serves as a potential warning. If NAFTA is abandoned, North American countries would all likely revert to rules dictated by the World Trade Organization, resulting in higher tariffs from all sides.

While 50,000 fewer jobs is the upper echelon of what could be expected, a few things have to go wrong for it to reach that point. First, Mexico and Canada would have to revert to pre-NAFTA tariff levels — which were comparably higher than the United States. If so, manufacturers would almost assuredly begin sourcing more parts from the same countries where the vehicles are assembled, and gradually move production to lower-cost regions like China.

Japan Says There's Nothing Closed About Its Barrier-filled Automotive Market

Japan has, once again, scoffed at U.S. demands for better access to its car market on Friday, setting the tone for next month’s unproductive talks on bilateral trade and economic relations between the two countries. U.S. Vice President Mike Pence and Japanese Deputy Prime Minister Taro Aso are supposed to hash things out in April but, before they’ve even managed to exchange pleasantries, the table is being set for failure.

If you’re wondering who is to blame, there are plenty of places to point the finger. The U.S. government complained to the World Trade Organization on Wednesday, claiming there are “a variety of non-tariff barriers [that] impede access to Japan’s automotive market.”

Today, Japan’s Chief Cabinet Secretary, Yoshihide Suga, offered his rebuttal to reporters. “We do not impose import tariffs on cars, and we do not impose any non-tariff barriers,” he said.

Weakened By Obama's Union Coddling, Cooper Tires Is Sold To The Indians

Cooper tires is becoming another victim of President Obama’s much too cozy relationship with the union machine. Cooper Tires was bought by an Indian company.

Zetsche Not Scared Of Chinese Trade War

In a bout of severe wishful thinking, Daimler CEO Dieter Zetsche told Reuters that “Daimler does not expect the current spat between the European Union and China will escalate to include cars,”

Trade War Watch 23: EU, Deaf To Obama's Tire Defeat, About To Lose Car Exports In Trade War With China

Nice car you’ve got here

After newly elected President Barack Obama slapped a punitive tariff on made-in-China tires, China looked for a good tit-for-tat and quickly found one: The US imported $1.8b worth of Chinese tires in 2009, while China imported $1.1b worth of US-built cars in 2008. A retaliatory tariff was slapped on Escalades et al. Now, the same is about to happen to BMWs and Benzes coming from Europe.

“China is considering imposing import duties on high-end European cars following complaints over subsidies that enable EU carmakers to sell in China at a loss,” Reuters reports. That, of course, is only half of the story. The EU slapped a punitive tariff on made-in-China solar modules, despite opposition from a majority of EU countries, most notably Germany. Not surprisingly, China fights back.

Protectionism Kills Jobs. As Demonstrated In Chattanooga

There is a shiny new car factory in Chattanooga, Tennessee. People enjoy working at this Volkswagen factory. The factory is airy, there is a lot of space inside and outside the factory for expansion. However, it will be a while until it will make more than the Passat. The people in Tennessee had hopes for Audi moving in here. Instead, Audi decided on going to Mexico. When the new Golf MkVII comes to America, it will be made in Mexico. There is no other car in sight for Chattanooga. Why is the factory, one of the best specimens in Volkswagen’s vast global collection, losing out on new jobs? The Chattanooga Times Free Press thinks it knows the reason: Lack of free trade agreements.

Trade War Watch 22: Obama Wags The Dog, Drags China In Front Of WTO Again In Ohio - Again

President Barack Obama will carry a familiar gift to election rallies in Ohio today.

“The Obama administration will announce a trade complaint against China today as President Barack Obama campaigns in Ohio, alleging impermissible subsidies of auto- and auto-parts exports that encourage outsourcing to China from the U.S.” an administration official told Bloomberg.

Trade War Watch 21: America Drags China In Front Of WTO As Obama Campaigns In Ohio

The United States will report China to the WTO tomorrow, Reuters says. The contention: China’s decision to impose extra duties on more than $3 billion worth of cars imported from the U.S. According to Reuters, “the complaint comes as President Barack Obama campaigns in Ohio, where auto plants have been affected by the duties.” The Prez goes on a “Betting on America” bus tour.

Trade War Watch 20: China Slaps Tariffs On American-Built Large Cars And SUVs

When we last checked in on t he low-level trade war between China and the US, which was sparked by President Obama’s 35% tariff on Chinese tires, the Chinese government had ruled that American large cars and SUVs were being “dumped” on the Chinese market, but wasn’t doing anything about it. Now, Reuters reports that China is doing something about it, namely saying that it plans to impose tariffs of up to 22% on imports of American-built large cars and SUVs. And the “up to” is key: GM and Chrysler are being hit hardest ( unsurprisingly), while American-made BMW, Mercedes and Acuras are receiving considerably lower tariffs.

Still, China only imports $1.1b worth of vehicles in this category, whereas the US imported some $1.8b worth of Chinese tires prior to the Obama tariffs. Like most of the news around Chinese-American relations, this is more saber-rattling than substance. But with economic conditions still shaky in the US, and a Presidential election getting into full swing, small spats can escalate into larger confrontations. And with China surpassing the US as the largest market for cars in the world, it’s probably no coincidence that this simmering conflict largely involves cars and car-related products.

Trade War Watch 19: Brazil Hits The Brakes Of Imports

As you’ve read here many times, the drums against imports have been beating in Brasília for a long time. Now, the government is acting. It has opened up its little tragic bag of dirty tricks and is pulling the first, as it were, rabbit out. It also promises to dip into that bag again if this first rodent fails to bite. Moneyed (and not so moneyed Brazilian import buyers of Chinese cars) Brazilian consumers should run to the dealerships to get ’em while they can. They should also put some money aside as the measure will also affect parts makers and consequently prices.

Trade War Watch 17: China Rules U.S. Dumping Subsidized Cars On Chinese Market, Does Nothing

Beijing closed the book on the tit-for-tat saga that had started with the U.S. slapping punitive tariffs on Chinese tires. China’s Ministry of Commerce (MOC) issued a final ruling today, declaring that the United States has dumped subsidized sedans and sport utility vehicles with engine displacement of 2.5 liters or bigger on the Chinese market, writes China’s state-owned new agency Xinhua. According top the MOC, this has harmed China’s domestic auto manufacturing industries. Then, China did nothing.

Trade War Watch 16: US Doesn't Understand China's EV Policy, Rattles Saber Anyway

George Orwell’s warning, that “the first victim of war is the truth,” apparently applies equally to trade wars. On Friday, Senators Carl Levin and Debbie Stabenow (both D-MI) wrote the United States Trade Representative to express their concern over “reported draft regulations” of China’s New Energy Vehicle plan, noting

We are concerned that these draft regulations continue China’s long history of breaking international trade rules.

Given that the ongoing low-level trade war between the US and China, this was a predictable bit of saber-rattling. But if Levin and Stabenow’s political motivations are easy to understand, the logic that leads them to believe China’s New Energy Vehicle plan is a violation of international trade rules is not. Meanwhile, neither the Senators nor the USTR appear not to have heard about another, more serious possible trade issue arising from China’s headlong dash towards electric vehicles. Sounds like a job for The Truth About Cars…

Trade Peace Watch: US-Korean Trade Pact: Korea (And U.S. Customers) In Deep Kimchi

It looks like North Korea’s artillery barrage on a small South Korean island had one of those famous unintended consequences: South Korea, faced by a belligerent enemy, decided to let bygones be bygones. A shell-shocked South Korea and a proud America “completed a free-trade agreement that will eliminate most tariffs on exports and solidify one of the nation’s most significant alliances in Asia,” as the New York Times praises the deal. South Korea stared down the barrels of North Korean guns, and America won the war that never was.

Don’t run down to your Hyundai dealer just yet and expect dramatic price reductions. The deal has major hurdles to pass. And at closer inspection, it looks like an oinking pig in a poke.

Trade War Watch 15: Thai Tires Trump Chinese

After President Obama paid his outstanding union dues and slapped a 35 percent punitive tariff on Chinese car and light truck tires exported to the USA, we predicted two outcomes:

1.) It will start a trade war, and China will drag the U.S.A. in front of the WTO. Sure did. The WTO accepted China’s complaint, and the t rade war turned into a major conflagration.

2.) We said that not a single new job will be created in the U.S.A., and “what the boneheaded decision does is simply shift tire production from China to other low cost producing countries.” Sure does.

Trade War Watch 14: Hot Wheels

Now that the Conservatives (with the help of the Liberal Democrats) have come to power in the UK, the Conservatives are going to push forward their plans for a reduction in the UK deficit (i.e savage cuts). Now, while I agree in the long term, this will be good for the UK, in the short term, it will cause higher unemployment and severe “belt tightening”. The UK isn’t the only country with this frame of thinking. Only today, the Spanish government has announced deep budget cuts in order to reduce their deficit and to prevent markets from thinking of them as the next “Greece”. So, with the UK and Spain making these budget cuts, the Euro looking unsteady and Greece still not convincing markets, what else could make Europe stare at another recession? That’s right, a possible trade war.

Trade War Watch 13: Pedal Politics

Yesterday, a strange love-fest between U.S. Ambassador to Japan John Roos and Japan’s transport minister Seiji Maehara ensued. After their meeting in Tokyo, as reported by the Nikkei, the ambassador and the minister said that everything is hunky-dory, and that Toyota’s recent recalls won’t undermine relations between the U.S.A. and Japan. Which is odd in itself: Since when does a $15 gas pedal get a leading role on the world stage of international politics?

Ambassador Roos effusively told reporters that the recall issue ”in no way has any kind of direct or indirect impact on the strength of the bilateral relationship between the United States and Japan.” Who said it would?

Trade War Watch 12: "Nationalist assault on a foreign corporation, an economic war"

Recently, there have been voices that mentioned that the attacks on Toyota could be politically motivated. Let’s face it: Toyota has problems. So have other auto makers. There are marked differences in reaction to and treatment of these problems.

One of the tenets of warfare is that you never attack the innocent. You wait until your opponent bumbles. Tricking an “enemy” into doing something really stupid, and exploiting this to declare a “righteous” war, is as old as Julius Caesar. Being the “defender” makes you a winner in the war of public opinion. You need the public on your side to win a war.

Using an outside scapegoat to deflect criticism is the oldest trick in the book. Time and again, people fall for it.

The Japanese were docile, polite, and cautious when in came to Toyota’s troubles. The more surprising is today’s piece in the Nikkei [sub]. Usually, we don’t copy and republish whole pieces. But in the name of authenticity, and because the Nikkei is only available on-line as paid subscription, we make the whole piece available.

Trade War Watch 11: Tire Tax Costs U.S. Jobs

Representatives Kevin Brady (R-Texas) and Dan Boren (D- Oklahoma) are tired of Obama’s punitive tariff on Chinese tires. They called for a government report on the economy-wide effects of the measure, Reuters reports.

“I am concerned that the administration’s tire tax will cost us jobs in the United States and raise prices for tires for hardworking Americans,” Brady said.

Trade War Watch 10: WTO Accepts Chinese Tire Complaint, Trade War Escalates

In September 2009, incoming President Barak Obama slapped a 35 percent punitive tariff on Chinese car and light truck tires exported to the USA. That, in addition to an existing 4 percent duty. No American tire manufacturer had requested the boneheaded move. It was a thank-you to the steelworkers union. Cooper tires openly opposed the action. Ironically, US tire companies were hardest hit by the measure, because they had moved most if not all of their budget segment tire production to low labor cost overseas sites. No job was created in the US. Many were lost. Low cost tire manufacturing simply moved to other overseas countries, which were the only beneficiaries of the useless war.

TTAC warned of a trade war, predicted that China will drag the USA in front of the WTO, and that China would take tit-for-tat measures. All of it became true.

Trade War Watch 9: SECSTATE Disses Japanese C4C

The nerve, the nerve: U.S. Secretary of State Hillary Clinton told Japanese Foreign Minister Katsuya Okada when they met – halfway in Hawaii, so that both had to travel – on Tuesday “that concerns are rising in the U.S. Congress” about Japan’s cash for clunkers incentive scheme, Reuters reports.

As if there aren’t other pressing problems. Such as the economy, global warming, saving the whales, or saving the Marines on Okinawa. (Well, they discussed the Marines. Inconclusively.)

Under the belated Japanese C4C scheme, consumers get up to $2,800 if they trade in their 13 year or older car for new vehicle that meets the 2010 fuel economy standard of 35.5 mpg. So far, so good.

Editorial: Trade War Watch 2: A Game of Chicken

Here we go. Just two days after Obama signed the edict to slap a 35 percent punitive tariff on Chinese car and light truck tires exported to the USA, the Chinese government “has reacted by launching an anti-dumping and anti-subsidies investigation” into American goods exported to China, writes China Daily. In China’s cross-hairs: American cars exported to China. Next in line (who would have thunk it): American chickens exported to China.

Welcome to Trade War Watch. We fear, a regular feature of Thetruthaboutcars.com.

Recent Comments