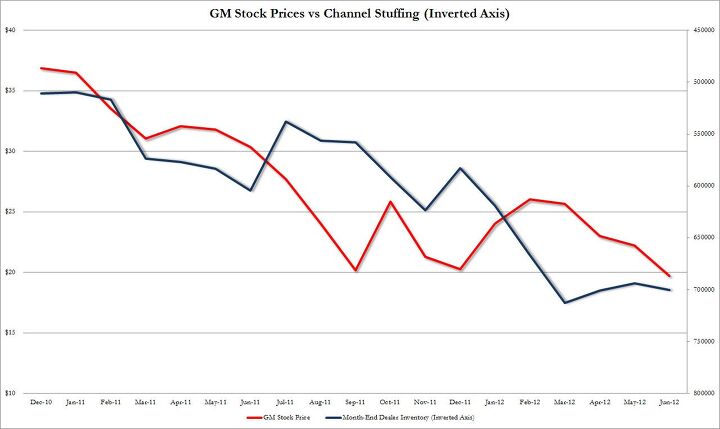

Chart Of The Day: Channel Stuffing Bonanza

Today’s Chart comes from finance blog Zero Hedge, which has taken a periodic interest in General Motors channel stuffing endeavors. While we don’t normally report on stock prices here at TTAC, this one is worth mentioning.

The chart, using an inverted axis, shows the relationship between GM’s month-end inventory levels, and their post-IPO share price. The lower it goes, the more inventory The General seems to have.

Channel stuffing is an addiction that GM is unwilling to get help for, and it’s always the same nasty habit of loading up dealers with big full-size trucks and SUVs (to the tune of 130 day supply levels, or more), even though that’s what got them in to the whole bankruptcy mess in the first place. But that’s ok, because their sales numbers look great, even if their share price is in the toilet.

More by Derek Kreindler

Comments

Join the conversation

what hits 15 first, share price or market share?

Hey...look everyone...Ford did the same thing last time they did a major redesign. And, golly, they didn't go bankrupt. So, maybe the morons at GM are just following a proven strategy to not go bankrupt again. http://www.autoblog.com/2008/03/17/ford-ramps-up-f-150-production-ahead-of-2009-model-changeover/

Wow. This thread is serving as the counterpoint to TTAC. GM could have introduced MY 2013 in May if they were preparing for a short model year. All it would have taken is three new colors and a set of optional BFG A/Ts, which is all Silverado fans are going to get next year. Surely 2013 trucks would have been more valuable in January than 2012s will be. Instead they are recycling the same story they used last year when they added 100,000 vehicles to their baseline inventory that were never shifted. Baseline was 500,000. Then it was 600,000. Now it is 700,000. Supposedly the big shutdown that is going to reduce inventory to manageable levels is coming this fall, just as it was last fall. I'm a big fan of a car company or two that makes some poor decisions. I don't defend the ones that are obviously ridiculous, but then I don't get paid to.

Gentlemen, I am proud of you. All of you. Apparently, it is possible to have even a heated discussion without name calling. Without the name calling the quality of the discussion improves. Isn't "The good news is that if you want to sue your math teachers for gross negligence, you’re going to have a slam dunk case" m,uch better than calling the other guy a moron? Thank you.