GM Reports $1b Q1 Profit, Still Seeking "Competitive Levels Of Profitability"

Once upon a time, GM’s North American operations spewed red ink across the firm’s balance sheet, with the whole mess kept afloat by relatively strong overseas operations. Now GM makes most of its money at home while its international divisions limp along. No, really: in its just-released Q1 financial report, GM reveals that some $1.7b of its $2.2b global EBIT came from its once-troubled home markets. What a difference a bailout makes!

GM CEO Dan Akerson sums up the situation with refreshing candor, noting

New products are starting to make a difference in South America, but Europe remains a work in progress. We’ll continue to work on both revenue and cost opportunities until we have brought GM to competitive levels of profitability. [emphasis added]

That GM is not yet experiencing the kind of hot streak one might expect from a global titan that’s been stripped of debt and loaded with government cash is self-evident. Like its share price, GM’s performance in the last quarter has been merely adequate. A billion dollars in profit is always a good thing, but around the world GM is still underperforming the market. In fact, The General lost .3% global market share. in Q1 2012, the third straight quarter of such declines, and GM’s share of the world market is now a full point lower than it was in Q2 of last year.

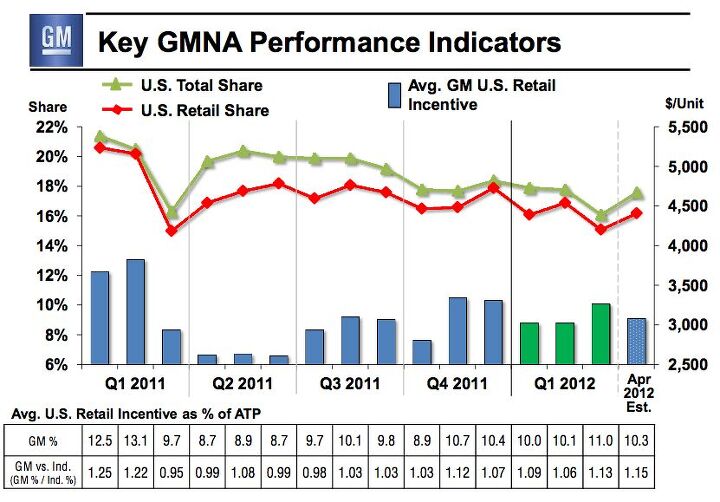

Even in the US market that now provides the lion’s share of its profit, GM is losing ground to the competition. North American market share has also fallen for the last three quarters, now standing at 16.4%, some 2.4% lower than Q2 2011. US dealer inventories jumped dramatically in the quarter as well, from 583,000 to 713,000. All this in the face of above-average incentives (as a % of average transaction price) and subprime financing (8.2% compared to an industry average of 6%). In light of these developments, GM’s ability to earn the majority of its profits in North America speaks to its bailout-streamlined cost structure. Still, there’s no denying that things are not headed in the right direction.

GM Europe continues to be the source of the most serious bad news, although its $300m loss is half of the Q4 2011 number. Still, restructuring and plant shutdowns will cost GM a pretty penny at some point in the not-to-distant future, and until that bitter medicine is administered, GME can only try to control its losses. GM South America turned the corner into profitability, yielding a $100m gain on its lowest production volume in over a year (albeit with steady market share).

But GM’s opaque “International Operations,” which include Korea, Australia and the crown jewel of China show some of the most troubling signs of malaise. With costs rising faster than volume and pricing gains could make up for, GMIO’s EBIT declined by $100m compared to Q1 2011. With the Chinese market cooling off, GMIO is also losing market share at a steady .1% per quarter for the last three quarters. Given how crucial China is to GM’s global future, this is not a promising development.

This is not a return to “Deathwatch” territory by a long shot, as GM still has $31.5b of government cash and equivalents on hand, and $37.3b of available liquidity. But the premise that GM simply needed a bailout in order to soar to global dominance is certainly wearing thin. And with the government waiting for an uptick in GM’s stock price to sell its stock at a politically-palatable price, mediocre results like this will allow the stigma of government ownership to linger.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Ajla Goldman Sachs 🥂

- Rna65689660 DVR and watch all that are aired. Has been this way for 40 years.

- Kwik_Shift_Pro4X The only car racing I'll watch is rally car.

- Offbeat Oddity The price is definitely too high, but this generation of Accord has still been very reliable- not far off from the Camry. I believe the CVTs in these have held up very well, so while not ideal, it wouldn't deter me- the mileage is just way too high.

- VoGhost "compliance EVs" - so typically Posky. Come on, Matt, come clean about what Big Oil is paying you already.

Comments

Join the conversation

At the time, the so-called "bailout" was viewed as the least-harmful option. Was it the right decision? You can Monday-morning-quarterback all you want, but the "bailout" was and is an undeniable fact, so get over it, because personal opinion doesn't mean squat, especially when nobody asked me at the time for my input! Time will tell if GM makes it, and if the "bailout" was right or wrong. Personally, I'd rather see the government spend money on an automaker rather than wasting it on other - ummm - "ventures". Right now, I see some good, but lots of bad and I worry about their future, especially now that I like much of what they build, and will have to replace at least one of our cars in the next two years, most likely, and no, I don't want a Honda or Toyota if I can help it.

As always, I appreciate the perspectives of TTAC's B&B here... but there's just one issue that several don't seem clear on, namely the role of the bailout in all this. The bailout plays two basic roles in my analysis: 1) The bailout raised expectations for GM. Yes, GM is doing much better now than when it was at death's door, but it also was absolved of debt, shuttered plants and was handed tens of billions in liquidity. That GM isn't making as much of those profound advantages as it could be is evidenced in its share price. 2) The fact that taxpayers own so much of those shares should make these results of greater interest to Americans than, say, BMW's results. GM has made it clear that it wants the government out, but it seems the government doesn't want to count its losses until they reach some politically palatable level. GM can't "put the bailout behind them" until it starts turning in performances that exceed expectations, which raise the stock price and allows the government to divest at an acceptable loss. This is not about "punishing GM because it was bailed out," it's about putting these results into context. The problem isn't that GM isn't meeting my expectations, it's that it isn't meeting Wall Street's expectations.