GM Sales Top Forecasts; Core Brands Up 13%

GM October sales beat analyst forecasts, with total sales up 4%, and YTD sales up 6%. As GM would have you prefer, it would rather you focus on the four core brands, which are up 13%, and 22% YTD. As the General’s dead brands fall away (Pontiac as of this past Sunday), comparisons to their former volumes do become increasingly irrelevant. A key component of GM’s October success? A higher number of new 2011 models to sell, which also brought down incentives. Details:

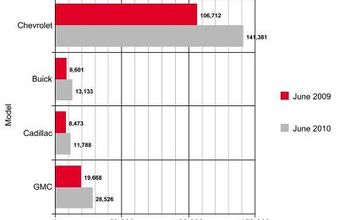

Chevrolet posted a 7% gain (+17% YTD), on the strength of a 54% increase in Equinox sales, as well as a strong start for the just introduced Cruze. Silverado sales eked out a modest 8% gain. The Equinox has a “11 day to turn” ratio, and GM is still struggling to keep up with demand. The Cruze sold a bit over 5k units in its roll-out month.

Buick, “the fastest growing major automotive brand in the US” (GM), saw a 39% increase, with YTD sales up a hot 55%. Buick’s sales are being fueled by the LaCrosse, Enclave and Regal. Buick claims that 42% of its buyers are coming from a non-GM brand.

GMC was up 30%, and is up 28% YTD. Sales momentum leaders are the Terrain (+85%) and Acadia (+65%)

Cadillac, which GM calls the fastest growing luxury brand, was up a more modest 15%, but is up a strong 40% for the year. Sales leaders are the CTS (+45%) and SRX (+27%). Retail sales increases were substantially higher than total increases, reflecting a lower percentage of fleet sales.

Automotive News reports that GM incentives were some $600 lower in October, a reflection of a higher mix of new 2011 models in the sales mix, as 2010 modals have been swept out more quickly than usual due to the substantially improved inventory control and higher sales.

More by Paul Niedermeyer

Comments

Join the conversation

I see. We are to treat old GM and new GM as the same for tax loss carry forwards, but not for sales comparisons. That said, I am happy to see some positive news for Buick and Cadillac. But a big percentage increase in a small number is still a small number. The tepid growth at Chevrolet should be of some concern. This is where they are going to need to start seeing some real growth numbers. Maybe the Cruze will be the source of that retail growth that Chevrolet sorely needs. But what is GM doing about the rest of the line? Is it just coincidence that there are no raw numbers in this piece? I looked elsewhere, and Buick sold about 12k cars altogether. Not a lot. All of GM sold a bit over 180k, roughly double Chrysler's October sales. GM used to sell 3 to 4 times what Chrysler did. My concern is that GM has now picked most of the low-hanging fruit. Future gains will be tougher to get. Chrysler, on the other hand, is going to see a lot of easy sales gains over the next year just because of the poor performance of the old outgoing models. Ford seems to be going from strength to strength. Chevrolet seems to have caught the disease that used to grip Ford: How is it freshening models? The Malibu is not new any more. The Fusion has had one minor restyle 2 years ago, and the Bu is starting to get a bit old. Chrysler's minivans are the same age, and are getting a moderate upgrade this year. I am predicting a long 2011 for GM.

I've read reports where 24% of core brand sales came from Fleets. Ouch.

Oh, gosh, it would be so much simpler if fleet sales were categorized as commerical fleet (government, industrial, etc.) and rental fleet. If company "A" has 24% volume in fleet sales, but it's all to rental agencies, well, that's bad. On the other hand, if company "B" has 24% fleet sales, but most of it is sold to commercial interests and governments, that's good fleet sales. My wife works for a truck dealership, and fleet sales are regarded as the ultimate sale - not only are the initial sales reasonably profitable, but there's guaranteed service once the original factory warranty has expired. Some of the government sales are good for 5 to 7 years of service and parts sales after the warranty period. Commerical fleet sales are good, and if the bulk of GM or Ford fleet sales are commerical, nobody should be calling either company on it.