GM Core Brand Sales Up 32 Percent

With rumors of another GM executive shakeup flying thick and fast, we expected a downright miserable sales performance from The General in February. By the year-over-year numbers [ full release here, sales numbers in PDF format here], there’s no such flow of red tape, as GM’s four “core brands” gained 32 percent and total sales (including Hummer, Pontiac, Saab and Saturn) were up 11.5 percent. But that’s in comparison to February of 2009, when GM’s sales were down 53 percent from the year earlier. In short, GM appears to have hit bottom in terms of volume, but it still has yet to recover to anything close to 2008 volume.

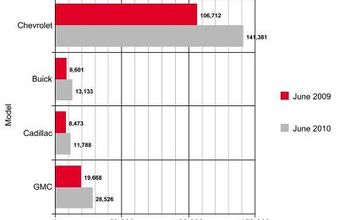

One thing is for certain: the departure of Cadillac’s Bryan Nesbitt was not a coincidence. Cadillac’s SRX sold 3,542 units, not only obliterating its predecessor but also outselling the rest of the brand’s models. And that’s where the good news ends. CTS volume fell to 2,690 units, a 17.5 percent drop. DTS fell to 611 units, while Escalades held fairly steady at around 2,000 units (across the three body styles). Overall, Cadillac’s volume fell below 10,000 units, which may well have been a cut-off point for Nesbitt’s tenure as head of the brand.

Buick also remains under the 10k volume mark, despite a 163 percent increase in LaCrosse volume driving a 47.2 percent overall increase.

Chevrolet sales were up 32.4 percent on strong showings from Equinox (+132.8%, 8,061 units), Cobalt (+69.5 %, 14,101 units), Impala (+50%, 11,740 units), Malibu (31.6%, 15,150 units) and Camaro (6,482 units). Pickups and full-size SUVs were stagnant at best, with even the Lambda-based Traverse declining.

GMC sales improved 26 percent, largely on the back of 3,789 Terrain sales and a 36 percent bump in Acadia sales. Sierra and Yukon were largely stagnant.

Chevrolet was by far the bright point in GM’s sales results this month, and cars generally showed more improvement than trucks. But GM is still comparing its monthly sales with results from the depths of its bailout-and-bankruptcy era, which inflates the perceived improvement. Looking at volume alone, GM clearly has a long ways to go, especially for its non-Chevrolet brands. Cadillac in particular can’t seem to keep its CTS sales up, and is surviving on SRX sales without a killer new product on the immediate horizon. Buick will have to keep flogging LaCrosses, and will need strong sales from the forthcoming Regal to bring the brand out of its sub-10k volume trough. But most troubling to GM’s bottom line are the weak truck and SUV sales. GM is currently spending money on a major update to its full-sized offerings, and unless it turns consumer perception around, GM will be missing out on a lot of high-profit business.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Alan My view is there are good vehicles from most manufacturers that are worth looking at second hand.I can tell you I don't recommend anything from the Chrysler/Jeep/Fiat/etc gene pool. Toyotas are overly expensive second hand for what they offer, but they seem to be reliable enough.I have a friend who swears by secondhand Subarus and so far he seems to not have had too many issue.As Lou stated many utes, pickups and real SUVs (4x4) seem quite good.

- 28-Cars-Later So is there some kind of undiagnosed disease where every rando thinks their POS is actually valuable?83K miles Ok.new valve cover gasket.Eh, it happens with age. spark plugsOkay, we probably had to be kewl and put in aftermarket iridium plugs, because EVO.new catalytic converterUh, yeah that's bad at 80Kish. Auto tranny failing. From the ad: the SST fails in one of the following ways:Clutch slip has turned into; multiple codes being thrown, shifting a gear or 2 in manual mode (2-3 or 2-4), and limp mode.Codes include: P2733 P2809 P183D P1871Ok that's really bad. So between this and the cat it suggests to me someone jacked up the car real good hooning it, because EVO, and since its not a Toyota it doesn't respond well to hard abuse over time.$20,000, what? Pesos? Zimbabwe Dollars?Try $2,000 USD pal. You're fracked dude, park it in da hood and leave the keys in it.BONUS: Comment in the ad: GLWS but I highly doubt you get any action on this car what so ever at that price with the SST on its way out. That trans can be $10k + to repair.

- 28-Cars-Later Actually Honda seems to have a brilliant mid to long term strategy which I can sum up in one word: tariffs.-BEV sales wane in the US, however they will sell in Europe (and sales will probably increase in Canada depending on how their government proceeds). -The EU Politburo and Canada concluded a trade treaty in 2017, and as of 2024 99% of all tariffs have been eliminated.-Trump in 2018 threatened a 25% tariff on European imported cars in the US and such rhetoric would likely come again should there be an actual election. -By building in Canada, product can still be sold in the US tariff free though USMCA/NAFTA II but it should allow Honda tariff free access to European markets.-However if the product were built in Marysville it could end up subject to tit-for-tat tariff depending on which junta is running the US in 2025. -Profitability on BEV has already been a variable to put it mildly, but to take on a 25% tariff to all of your product effectively shuts you out of that market.

- Lou_BC Actuality a very reasonable question.

- Lou_BC Peak rocket esthetic in those taillights (last photo)

Comments

Join the conversation

GM fleets increased 114% over January and are expected to climb all the way into the summer. Fleet sales are keeping the doors open while Government Motors survives during Barracks term in office. Once he is gone and a Republican steps in (not enough UAW emplyees to buy another term for Obama) funding for this dinosaur will end and GM will finally sink for good.

By the way, that Deville in the pic? Couldn't of happened to a nicer Livery vehicle. Glad the driver wasn't hurt.