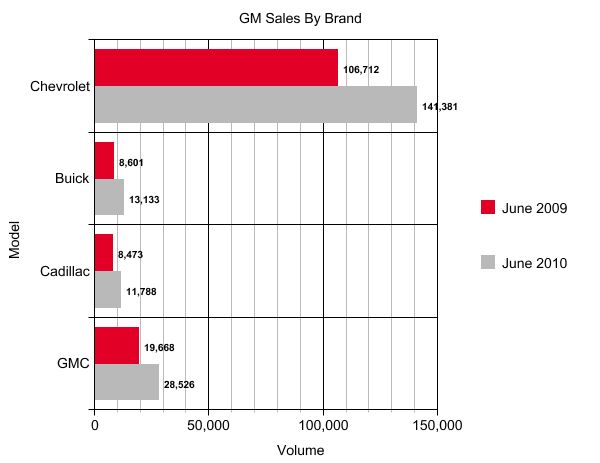

GM "Core Brand" Sales Up 36 Percent In June On Strong Fleet Sales

Sales of GM’s four “core brands” were up 36 percent last month [release here], however that number is compared to June 2009 sales, when GM was in bankruptcy. Even against this backdrop, however, GM’s sales show some signs of continued weakness. Though Chevrolet gained 32 percent in overall, its retail sales improved a mere 11 percent, meaning a huge number of Chevy’s sales went to fleets. Out of Buick’s 53 percent volume gain, retail sales increased only 28 percent. Cadillac had much less of a fleet problem than Buick and Chevy, increasing sales 339 percent and retail sales 35 percent. GMC did not release retail numbers for GMC, but noted that GM’s overall fleet sales were 59,571 for the month. That means nearly one in three vehicles sold by GM last month went to a fleet, a percentage that accounts for the lion’s share of GM’s sales growth. Once again, Detroit seems addicted to fleet sales…

Of course, GM’s new products helped with the 11 percent retail sales gain. LaCrosse stayed over 5k units last month, for a 173 percent increase over last June. SRX saw a 461 percent increase to 3,804 units, while its Equinox cousin added another 180 percent to 11,490 units. GMC’s Terrain also sold 4,603 units. Traverse added 56 percent to 11,371 units.

But, as is always the case, new products eventually lose their luster, and several of GM’s once hot-selling products are slackening off. Camaro is down nearly 20 percent from its high last June, moving 7,540 units. Enclave and Acadia eased up on their sales growth, adding only 20 and 26 percent respectively over last June’s weak numbers. Sierra saw a similarly stagnant June, improving just 27 percent to 11,441 units. The aging Impala and HHR both suffered 3 percent sales drops, despite likely sending a fair number of units to GM’s booming fleet business.

GM’s hot products continue to drive growth, with heartening signs coming from Buick (staying strong with the LaCrosse) and Cadillac (which benefitted from improved CTS (+31%) and strong SRX sales). Chevy, meanwhile, is likely seeing strong retail growth for its Equinox and Traverse, but it’s dead in the water on the sedan front, with only the Malibu likely making retail progress. With the launch of the Cruze looming, GM had better hope the response is strong, otherwise GM seems destined to grow only as a supplier to fleets. And as The General (and Detroit a large) has already learned, that short term growth always comes at the expense of long-term resale and brand equity.

The numbers are up, but there’s still much work to be done.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Lou_BC I read an interesting post by a master engine builder. He's having a hard time finding quality parts anywhere. The other issue is most young men don't want to learn the engine building trade. He's got so much work that he will now only work on engines his shop is restoring.

- Tim Myers Can you tell me why in the world Mazda uses the ugliest colors on the MX5? I have a 2017 in Red and besides Black or White, the other colors are horrible for a sports car. I constantly hear this complaint. I wish someone would tell whoever makes theses decisions that they need a more sports car colors available. They’d probably sell a lot more of them. Just saying.

- Dartman EBFlex will soon be able to buy his preferred brand!

- Mebgardner I owned 4 different Z cars beginning with a 1970 model. I could already row'em before buying the first one. They were light, fast, well powered, RWD, good suspenders, and I loved working on them myself when needed. Affordable and great styling, too. On the flip side, parts were expensive and mostly only available in a dealers parts dept. I could live with those same attributes today, but those days are gone long gone. Safety Regulations and Import Regulations, while good things, will not allow for these car attributes at the price point I bought them at.I think I will go shop a GT-R.

- Lou_BC Honda plans on investing 15 billion CAD. It appears that the Ontario government and Federal government will provide tax breaks and infrastructure upgrades to the tune of 5 billion CAD. This will cover all manufacturing including a battery plant. Honda feels they'll save 20% on production costs having it all localized and in house.As @ Analoggrotto pointed out, another brilliant TTAC press release.

Comments

Join the conversation

Perhaps GM/Ford/Chrylser could produce fleet only models badged as the Hertz Supreme, Thrifty Runabout, etc. in the same way name brand food companies make store brands for grocery stores. They could obscure the similarity to the retail version by altering panels, color schemes and tail lights. If they do this on the cheap, it may be a cost effective way to protect their main retail brands. Other posters here on TTAC have described the interesting ways that US models were uniquely altered for the Canadian market (for retail sales). Eventually, Chinese made cars will probably become the main suppliers for the rental car business. Those agencies will probably want to conceal that fact by using house brands that sound either really anglo or Italian . While car enthusiasts will know the true origin, most consumers will have limited awareness.

I just got home to Nashville from a business trip to Tulsa. This morning I walked through the rental lots at Tulsa airport and the predominate cars were Impalas and Chargers with a whole lot of Camrys too. That is where a lot of sales are going these days.