GM April Sales Up 6.5 Percent, Core Brands Up 20 Percent

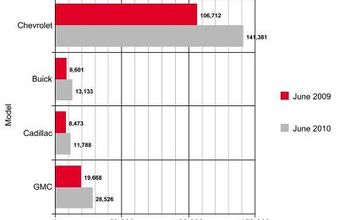

For yet another month, GM’s sales [full April sales report in XLS format here, press release here] managed to be both promising and disappointing, depending on how you cut them. GM’s “core brands” were up 20 percent cumulatively, with Cadillac and Buick leading the way with 35.7 percent and 36.4 percent increases respectively (Chevy up 17.4 percent, GMC up 18.4 percent). And though GM is especially eager to boost sales numbers at its two premium brands, thanks to their low baseline sales, the solid percentage gains resulted in surprisingly small volume improvements. The General’s overall volume was up only 6.5 percent compared to April 2009, a month when the just-canceled Pontiac outsold both Buick and Caddy.

Buick’s big boost came from the LaCrosse, which sold 5,236 units for an increase of 272 percent over last April. Enclave approached the 5k mark, with 4,599 units moved last month, for a more modest gain of 23 percent. Lucerne lost 38 percent of its April 2009 volume, at 2,346 units.

The big news is Cadillac-land is the SRX, which vaulted over last April’s modest sales of the outgoing model, with a 587 percent improvement to 3,904 units. Actually, that’s the big positive news. The really big news is that Cadillac’s bread-and-butter CTS is utterly stagnant with consumers right now, actually sliding 15 percent to 3,278 units. This despite GM recently making the CTS the poster child for “the return of affordable auto leases”. STS and XLR sales fell by 54 and 73 percent respectively, while DTS and the Escalades all added between 20 percent and 30 percent, to keep Cadillac’s overall volume up. Still, with new CTS Sportwagons available, and a Coupe coming soon, Cadillac needs to see its most important sedan pick up the pace if it wants to stay on Ed Whitacre’s good side.

GMC’s Acadia narrowly improved on last April’s sales, up 2.4 percent to 4,877 units. That performance just barely pipped GMC’s Terrain, which sold 4,404 units. Sierra was GMC’s top-selling nameplate again though, up 13 percent to 9,360. Canyon moved only 527 units, Yukon was down 21 percent to 1,942 and Yukon XL added 46 percent to 1,693.

Chevrolet’s Malibu improved 13 percent, making it the most popular car in the Chevy lineup at 16,536 units. Impala fell 8 percent, to 16,144. Cobalt had a strong April, with volume up 29 percent to 13,701. Equinox sold 11,987 units and Traverse added ten percent for a total of 9,020 units. Camaro continued its strong sales streak, moving 9,150 units. Silverado was Chevy’s top-selling nameplate, at 29,618 units, and even the Colorado avoided a Canyon-like dropoff, logging just over 2,000 sales. Tahoe volume fell 23 percent to 6,309, while Suburban added 15 percent to 5,087 units. HHR fell 19 percent to 5,383 units.

According to GM, fleet sales for its four “core” brands totaled 58,000 units, a two percent drop compared to April 2009.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- SCE to AUX All that lift makes for an easy rollover of your $70k truck.

- SCE to AUX My son cross-shopped the RAV4 and Model Y, then bought the Y. To their surprise, they hated the RAV4.

- SCE to AUX I'm already driving the cheap EV (19 Ioniq EV).$30k MSRP in late 2018, $23k after subsidy at lease (no tax hassle)$549/year insurance$40 in electricity to drive 1000 miles/month66k miles, no range lossAffordable 16" tiresVirtually no maintenance expensesHyundai (for example) has dramatically cut prices on their EVs, so you can get a 361-mile Ioniq 6 in the high 30s right now.But ask me if I'd go to the Subaru brand if one was affordable, and the answer is no.

- David Murilee Martin, These Toyota Vans were absolute garbage. As the labor even basic service cost 400% as much as servicing a VW Vanagon or American minivan. A skilled Toyota tech would take about 2.5 hours just to change the air cleaner. Also they also broke often, as they overheated and warped the engine and boiled the automatic transmission...

- Marcr My wife and I mostly work from home (or use public transit), the kid is grown, and we no longer do road trips of more than 150 miles or so. Our one car mostly gets used for local errands and the occasional airport pickup. The first non-Tesla, non-Mini, non-Fiat, non-Kia/Hyundai, non-GM (I do have my biases) small fun-to-drive hatchback EV with 200+ mile range, instrument display behind the wheel where it belongs and actual knobs for oft-used functions for under $35K will get our money. What we really want is a proper 21st century equivalent of the original Honda Civic. The Volvo EX30 is close and may end up being the compromise choice.

Comments

Join the conversation

perfume on a pig.

Yeah, nice. Weird, March they had like 40+% for their core brands. I don't like domestic brands but I'm glad they bail GM out. If WW3 happens we'll be glad that we got em. It'll be similar to the situation back when we loan Chrysler money, they paid us back. Only car I would consider from GM is a drop top Camaro ^_^. Maaaybe a Corvette but I would rather buy GT-R or Jaguar XK. They're doing very very well over in China. Chinese apparently thinks Buick is a luxury brand >_>. Their new Lacross is pretty nice, FWD drive though =(. Their current plans seem to be fuel efficiency with their V6 and eco tech inline 4 turbos which is a pretty good plan. They're also developing the next chassis to replace the Zeta chassis. I dunno about their future products though, haven't seen any yet. I think Volt is going to fail if the price is around 30k or more. They need a good family sedan and some kind of an image to sell. Nissan sells their products as performance oriented rather than Toyota's appliance image.