#SalesCharts

How Far and How Fast Has U.S. Passenger Car Market Share Fallen? So Far, and so Fast

– Bob Carter, Executive Vice President, Toyota North America

37 percent of the new vehicles sold in the United States in the first seven months of 2017 were passenger cars. That’s correct. 63 percent of the new vehicles now sold in America are pickup trucks, SUVs, crossovers, and vans.

But how did we get to this 37-percent basement? When did we get here? How long did it take to get here? And is it really the basement?

What Happened To Ford's U.S. Market Share During The Mark Fields Era?

Prior to this morning’s announcement that outgoing Ford Motor Company CEO Mark Fields is “retiring,” Fields was in charge at the Blue Oval for nearly three years. Just a little more than ten quarters, to be more precise.

In eight of those quarters, Ford Motor Company U.S. market share declined, year-over-year.

Ford was not without excuse, of course. There was always market share to be taken if Ford wanted it. But an attempt to limit reliance on daily rental fleet sales, particularly with Ford’s passenger car division, did the automaker’s market share no favors. Ford’s transition from old F-150 to the new aluminum-bodied model was a major switch, too, and sales growth during the transition phase wasn’t easy to come by.

Nevertheless, Ford’s U.S. market share didn’t nosedive during the Mark Fields era. The burden on incoming CEO Jim Hackett’s shoulders won’t be the elevation of Ford Motor Company market share in the automaker’s home market.

No, it’s the price of a Ford share that matters right now.

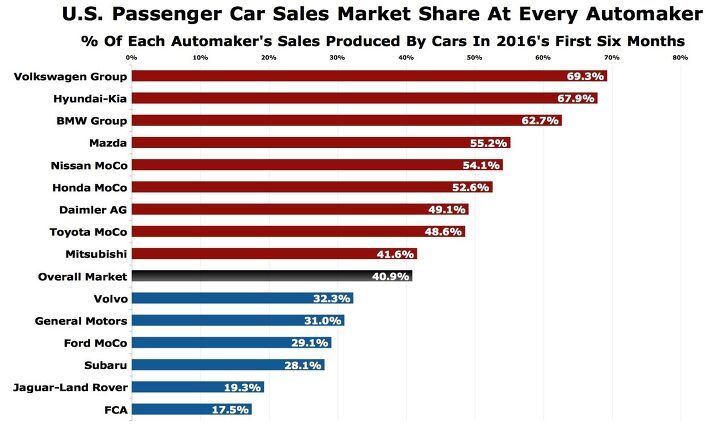

As SUVs And Pickup Trucks Surge, Which Automakers Sell An Inordinate Number Of Cars?

Barely four out of every ten new vehicles sold in the United States in the first-half of 2016 were traditional passenger cars. Toyota Camrys, Honda Civics, Ford Mustangs, Mercedes-Benz C-Classes, and dozens of alternatives remain numerous — more than 3.5 million were sold in 2016’s first six months.

But together, these cars make up a smaller chunk of the market now than they did a year ago, and a far smaller slice of the market than just five years ago. Cars were at parity with light trucks (pickups, SUVs, crossovers, vans) in 2011 and earned 52 percent of the market the year prior.

Jeep Carries FCA Again, Renegade Near Top Of Subcompact Crossover Heap

In October 2015, not the first time, Jeep was FCA’s meal ticket in the United States.

Little more than one month ago, we discussed the fact that non-Jeep sales at Fiat Chrysler Automobiles’ U.S. division were unhealthy at best, particularly given the boom experienced by the industry as a whole.

Fortunately for FCA, October was different. Combined sales at Alfa Romeo, Chrysler, Dodge, Fiat, and Ram were up six percent last month. (The five lower-volume brands are down one percent, year-to-date.) Yet across the FCA lineup, as year-over-year sales improved by 25,065 units, Jeep accounted for 18,363 of those extra sales on its own, or 73 percent of the increased volume.

GM Sold 124,000 More Pickup Trucks Than Ford In The First Three Quarters Of 2015

Not since 2009 has General Motors ended a calendar year with more total pickup truck sales than Ford. Moreover, not since 2009 have General Motors’ full-size pickup trucks, combined, outsold the Ford F-Series.

As GM’s current generation of pickup trucks overcame their slow start and GM added midsize pickup trucks to their fleet – and as Ford entered a transition phase between old F-150 and new aluminum-bodied F-150s – 2014’s results were close. Yet even in those circumstances, Ford Motor Company sold 1,000 more pickup trucks than General Motors in the United States last year.

2015 is very, very different. As Ford gradually ramped up F-150 availability for much of the year and as the clear-out of remaining last-gen models ended, total F-Series sales slid 2.4 percent through the first half of this year. Meanwhile, GM’s full-size twins are stealing market share, not just from the F-Series, but from the Ram P/U range, as well.

Scion Second-Fastest Growing Brand In September; New IA And IM Lead

The FR-S did not turn out to be Scion’s savior. Doubts regarding the ability of a conventional hatchback and a subcompact sedan — the brand’s first sedan — to rescue a brand that was built on unconventional cars have been expressed in many corners.

Yet with the arrival of those two cars, the iA and iM, Scion was the fastest-growing car brand in America in September 2015 and the second-fastest-growing brand overall.

Chart Of The Day: Subaru Sets Monthly U.S. WRX/STI Sales Record In July 2015

After two consecutive years of growth, including record-setting U.S. sales achievements in 2014, what does the Subaru WRX do for an encore performance?

An all-time monthly record of 3,716 WRX/STI sales in July 2015 starts the second-half off strongly after a first-half in which sales of Subaru’s rally-inspired nameplate jumped ahead of last year’s sales pace by 14 percent.

When setting a brand-wide sales record in 2014, Subaru’s WRX/STI-specific record of 25,492 units accounted for 5 percent of the brand’s total U.S. sales volume.

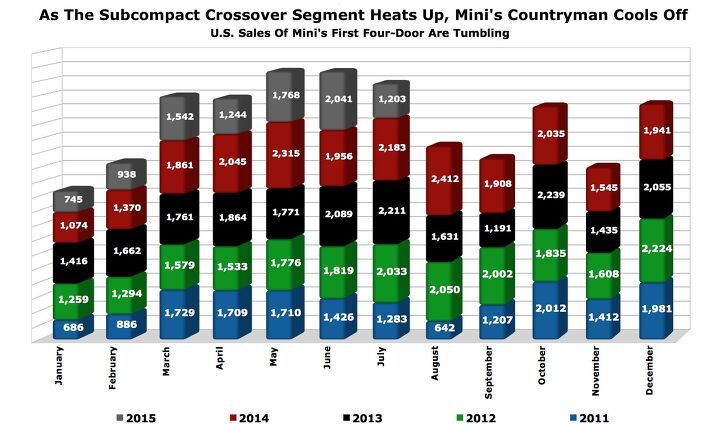

Chart Of The Day: Mini Countryman Sales Are Crumbling In The United States

A rising tide lifts all boats?

Not in the Mini Countryman’s case.

One of the oldest models on the block, the Countryman, is suffering from a sharp decline in U.S. sales even as consumers develop greater interest in subcompact crossovers.

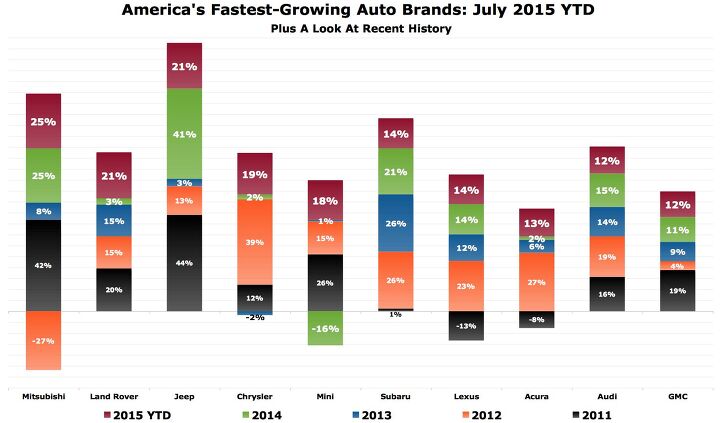

Chart Of The Day: Mitsubishi Is America's Fastest Growing Auto Brand, Sort Of

Relative to their own achievements during the first seven months of 2014, no auto brand in America is growing faster through the first seven months of 2015 than Mitsubishi.

Mitsubishi?

Yes, Mitsubishi.

Chart Of The Day: Volvo XC90 Sales Are Way Up, Now Double It

We’re finally beginning to see the impact a new SUV can have in Volvo showrooms.

The second-generation XC90 posted a 209% year-over-year increase to 1,176 U.S. sales in July 2015. That equalled 796 more sales this July than last and the highest monthly total for the XC90 since December 2010.

So is Volvo back? Well, not quite. Not yet.

Because the auto market is so seasonal, year-over-year change is a valid figure to consider, but it’s less useful when the previous year in the year-over-year comparison was the 13th year in the model’s lifespan. XC90 sales in July 2014, for instance, were 88% lower than in July 2004.

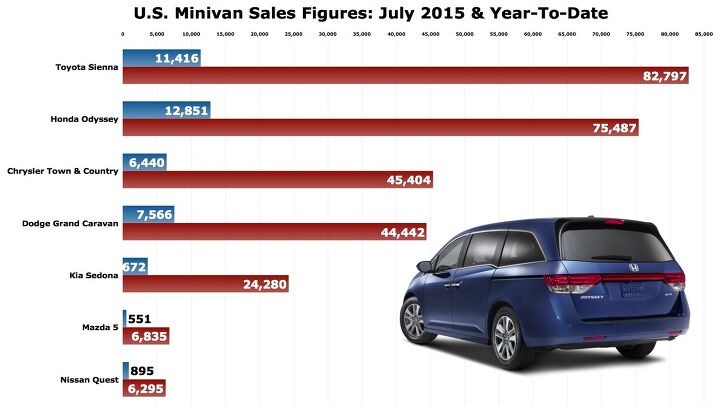

Chart Of The Day: Honda Odyssey Puts An End To Toyota Sienna's Best Seller Streak

Not since January of last year had the Honda Odyssey finished a month as America’s top-selling minivan. Indeed, not since October of last year had the Toyota Sienna not been America’s best-selling minivan.

But in July 2015, Odyssey sales jumped 18 percent, year-over-year, enough to overtake the Sienna on a monthly basis.

Chart Of The Day: U.S. SUV/Crossover Market Share Surges In July 2015

U.S. sales of SUVs and crossovers jumped 14 percent in July 2015, a year-over-year improvement equal to more than 67,000 extra sales compared with July 2014.

As a result, just under 36 percent of the U.S. auto industry’s volume was produced by utility vehicles in July 2015, a three-percentage-point increase over the same period one year ago.

Passenger car volume, meanwhile, slid 3 percent last month, a drop of around 18,000 sales as the overall market grew by more than 5 percent, or 75,000 units.

Chart Of The Day: 2014's U.S. Full-Size SUV Sales Pace Wasn't Sustainable

There were six new full-size SUVs from General Motors. Ford refreshed the Expedition. Lincoln did the same with their upmarket Expedition, the Navigator.

The year was 2014, and U.S. sales of Detroit’s biggest, baddest, full-size SUVs were booming, relative to the recent past.

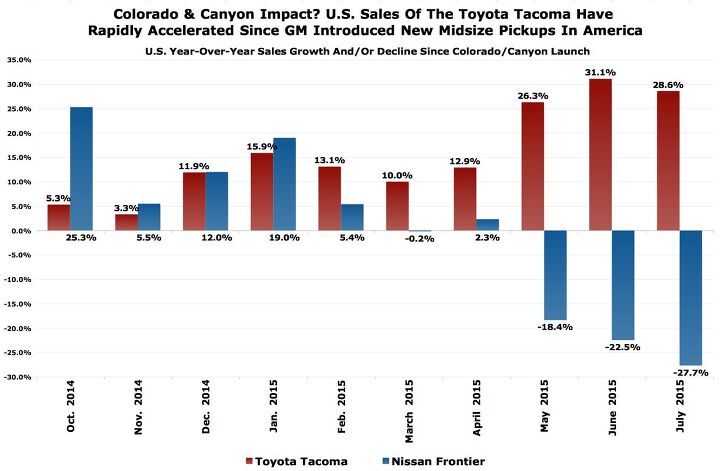

Chart Of The Day: Toyota Tacoma U.S. Sales Growth Is A Thing To Behold

In each of the last 28 months, the Toyota Tacoma has been America’s fifth-best-selling pickup truck nameplate.

One might imagine, however, that its ability to succeed in its own sub-category of small/midsize trucks would have weakened over the last ten months. With the introduction of new midsize pickup trucks from General Motors, the best-selling manufacturer of pickup trucks in America, the number of Tacoma competitors increased from one, the Nissan Frontier, to three.

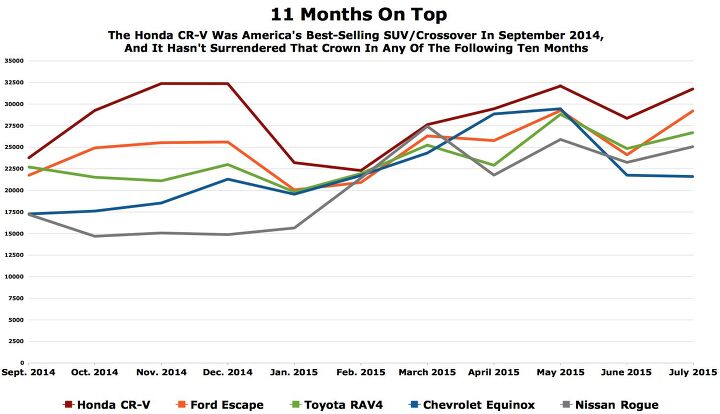

Chart Of The Day: July Marks 11 Months On Top For The Honda CR-V

Beginning in September 2014, the Honda CR-V began a streak as America’s best-selling SUV/crossover, a streak which has now extended through July 2015. Eleven consecutive months is no mean feat — the Toyota Camry’s current streak as America’s best-selling car is only six months long.

The CR-V is strengthening, however. In July, year-over-year volume jumped 11 percent to 31,785 units, 2,532 units more than the second-ranked Ford Escape managed. During this increasingly lengthy period of dominance, no one challenger has really stood up to take the fight to the CR-V.

Recent Comments