Chart Of The Day: Toyota Tacoma U.S. Sales Growth Is A Thing To Behold

In each of the last 28 months, the Toyota Tacoma has been America’s fifth-best-selling pickup truck nameplate.

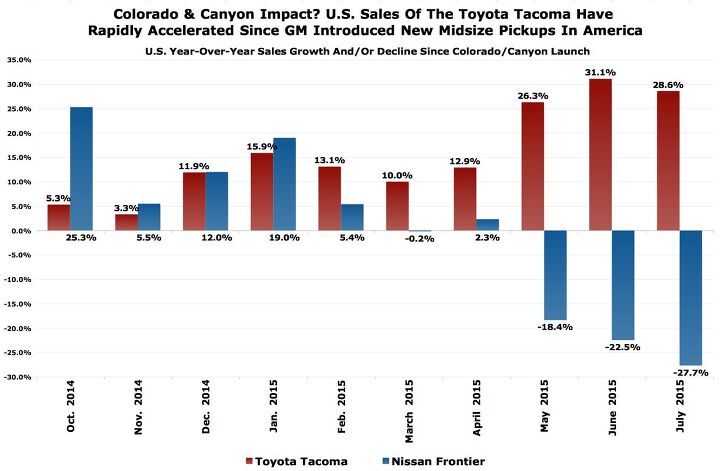

One might imagine, however, that its ability to succeed in its own sub-category of small/midsize trucks would have weakened over the last ten months. With the introduction of new midsize pickup trucks from General Motors, the best-selling manufacturer of pickup trucks in America, the number of Tacoma competitors increased from one, the Nissan Frontier, to three.

Yet since the Colorado and Canyon arrived on the market, Tacoma sales have steadily increased on a year-over-year basis. Indeed, the rate of improvement has actually increased of late, as well.

Over the last three months, Tacoma sales jumped 29 percent compared with the same period one year ago. Toyota USA has twice sold more than 17,000 Tacomas in the last three months.

True, the overall pickup truck market is booming and Toyota is benefiting from added attention because of a refresh for the 2016 model year.

Meanwhile, Toyota may also be benefiting from increased attention in the category as a whole. The arrival of the Canyon and Colorado last autumn struck a chord with many potential truck buyers. Even as the two GM nameplates combine for approximately 9,400 U.S. sales per month, which didn’t exist for GM in the recent past, Toyota has added an additional 2,500 Tacoma sales per month through the first seven months of 2015.

Timothy Cain is the founder of GoodCarBadCar.net, which obsesses over the free and frequent publication of U.S. and Canadian auto sales figures. Follow on Twitter @goodcarbadcar and on Facebook.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Bd2 If I were going to spend $ on a ticking time bomb, it wouldn't be for an LR4 (the least interesting of Land Rovers).

- Spectator Wild to me the US sent like $100B overseas for other peoples wars while we clammer over .1% of that money being used to promote EVs in our country.

- Spectator got a pic of that 27 inch screen? That sounds massive!

- MaintenanceCosts "And with ANY car, always budget for maintenance."The question is whether you have to budget a thousand bucks (or euro) a year, or a quarter of your income.

- FreedMike The NASCAR race was a dandy. That finish…

Comments

Join the conversation

Saw a thing to behold at the local dealer this weekend. The least expensive four door Tacoma on the lot was over $28,000 - not through the addition of many desirable options, rather it was a base model with Southeast Toyota fees on top of dest/del fees. The amazing thing was it had a 2.7L four cylinder (I popped the hood to verify) and claiming ALMOST 160 horses, with a FOUR(!) speed auto. It also had A/C, power windows, a radio, and... I think that was about it. This was a brand new 2015 model. Stepping up two cylinders and one trans gear jumped to well over $30,000 even before adding four-wheel drive or an SR5 option package. It appears the 2016 redesign should address the powertrain but with 100% or more of domestic full size pricing, I just don't see the appeal.

The most logical explanation for the Taco sales bump has not yet been mentioned: There was pent-up demand for mid-sized trucks pending the Colorado/Canyon debut. Once potential buyers had a look at the GM twins there was no compelling reason not to buy a Taco, ergo sales bump.