What Happened To Ford's U.S. Market Share During The Mark Fields Era?

Prior to this morning’s announcement that outgoing Ford Motor Company CEO Mark Fields is “retiring,” Fields was in charge at the Blue Oval for nearly three years. Just a little more than ten quarters, to be more precise.

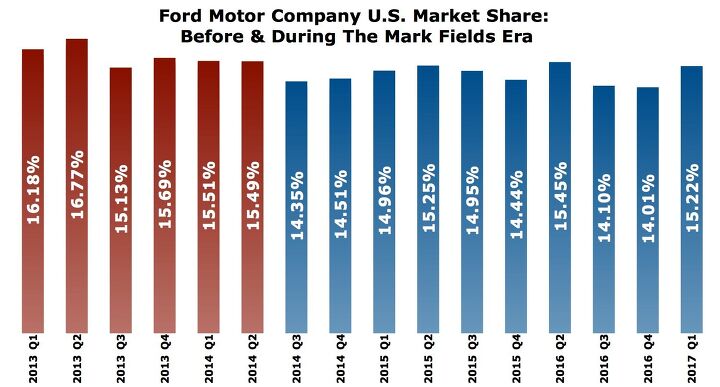

In eight of those quarters, Ford Motor Company U.S. market share declined, year-over-year.

Ford was not without excuse, of course. There was always market share to be taken if Ford wanted it. But an attempt to limit reliance on daily rental fleet sales, particularly with Ford’s passenger car division, did the automaker’s market share no favors. Ford’s transition from old F-150 to the new aluminum-bodied model was a major switch, too, and sales growth during the transition phase wasn’t easy to come by.

Nevertheless, Ford’s U.S. market share didn’t nosedive during the Mark Fields era. The burden on incoming CEO Jim Hackett’s shoulders won’t be the elevation of Ford Motor Company market share in the automaker’s home market.

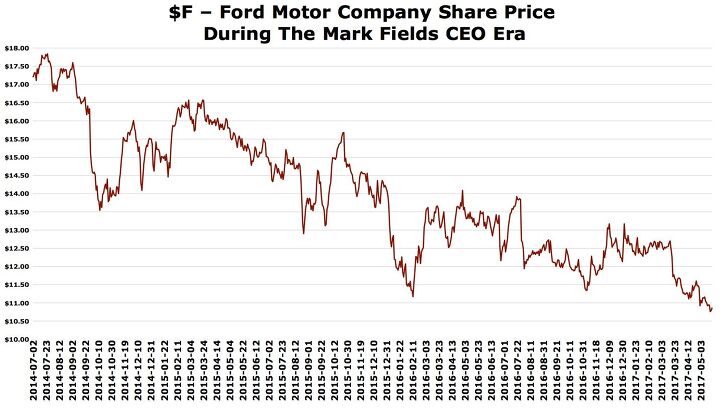

No, it’s the price of a Ford share that matters right now.

Three weeks into Mark Fields’ tenure as CEO at Ford Motor Company, Ford shares were trading at $17.84.

Never again would Fields’ Ford be valued so highly. A year into his reign, Ford shares had fallen 17 percent. Compared with July 2015, Ford’s stock price in July 2016 was down a further 8 percent.

Prior to Fields’ ousting today, Ford shares were 39-percent lower than when Fields took higher office in Dearborn.

General Motors CEO Mary Barra took over at GM six months before Fields became CEO of Ford Motor Company. During Barra’s term, GM shares ebbed and flowed, never rising as high as the $41.04 price GM enjoyed just before Barra arrived; never falling more than one-third lower than that December 2013 mark; steadying now at roughly $33/share. That’s down about 14 percent since March.

In early trading this morning, Ford shares were up slightly more than 1 percent.

Back at Ford’s sales desk, Ford Motor Company only once earned more than a 16 percent share of the U.S. auto industry while Mark Fields was in charge. That was in February 2016.

In the 18 months prior to Fields taking over from Alan Mulally, the Ford Motor Company earned greater than 16 percent market share on six occasions, albeit not once in the final nine months of Mulally’s administration.

Timothy Cain is the founder of GoodCarBadCar.net and a contributing analyst at The Truth About Cars and Autofocus.ca. Follow on Twitter @timcaincars.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Lou_BC “We are always listening to the customer. "You sayin' the baller/gangsta types don't want Escalades on 24's that don't make vroom vroom rumbly sounds?

- AZFelix I shall fully endorse the use of autonomous cars on public roads once they have successfully completed my proposed Turing test for self driving vehicles. This test requires the successful completion of an at fault incident and accident free 24/7 driving session in Buffalo and upstate New York from October 1st until March 31st, and throughout the city of Jakarta, Indonesia for one consecutive year. Only Level 1 and Level 5 vehicles are permissible.

- Lou_BC I'd go Rav4. No Mazda dealer in my town and from what I've seen, Mazda's tend to rust.

- Steve Jacobs I've got a bright Red Kia EV6. Easy to find in a parking lot.

- MKizzy Gently used EV6's under $30K aren't hard to find and have the range and style to almost intrigue me into taking the EV plunge. However, I'll wait for a mid-sized non-luxury EV sedan or wagon which is not a tablet housing a car (Model 3) or sacrifices too much usable space for the sake of style (Ioniq 6) before I go electric. I'm not holding my breath.

Comments

Join the conversation

Too much untested junk sold to the consumer. There was the 2011, 2012, 2013 egoboast F150 piles that kept stalling or dying until a user on the F150 forum figures out drilling a hole in the CAC fixed the problem. Then the Focus auto trans are junk. Of course there is the 1.6L motor drinking coolant & Ford wants to dodge responsibility. Then the 2016 Fusion & others 2.5L throttle body failures that killed engines on roadways, and got several owners/renters/users in accidents. Ford is too busy making future customers for Toyota & Honda. Attention Ford: most of the time those customers never come back to Ford. Signed, a Ford owner & stockholder. Those were some negatives. On the plus side investing in China is brilliant.

Ford is like John Deere, selling only to people that automatically associate a car/tractor to a brand name and assume it's the best. Anyone with experience with either brand knows that they will never get their mess together. Ford can mismanage for the next 60 years selling lawnmower sized engines and people will still buy the product because they heard about Henry Fords famous assembly line in 5th grade and want to own a car made by the first(sic) automaker. Just gotta be a part of that. As an engineer mess like this has taught me that marketing is more important than the product. As long as you satisfy a persons beliefs, whether those beliefs are based in reality or not, they will be happy.