#MarketShare

OPEC: Oil To Remain Below $100 Per Barrel Through 2020s

Those hoping for a return to $100 per barrel of oil are in for a long wait, as OPEC says oil will remain below the price point through the 2020s.

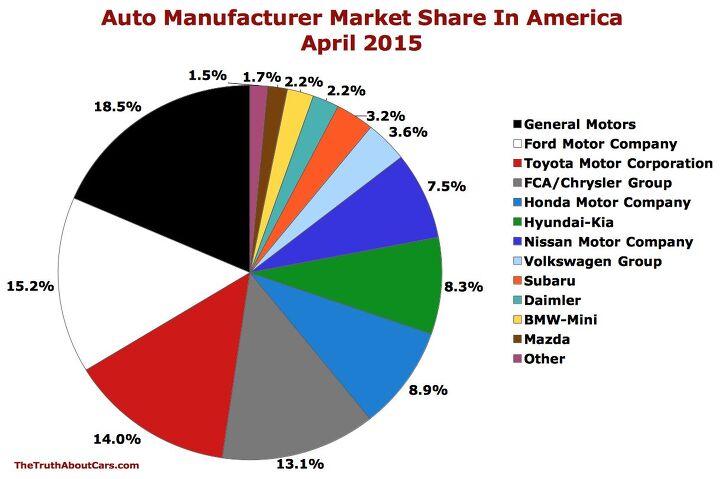

Chart Of The Day: Auto Brand Market Share In America In April 2015

Compared with the prior month, General Motors’ U.S. market share increased by more than two percentage points to 18.5% in April 2015. Toyota’s trio of brands lost slightly more than half a percentage point. American Honda jumped from 8.2% to 8.9%.

Nissan and Infiniti dropped by nearly two percentage points as the automaker suffered its normal, anticipated, severe drop-off in April volume. The auto industry’s size decreased 6% between March and April; Nissan USA’s sales fell 24% during the same period.

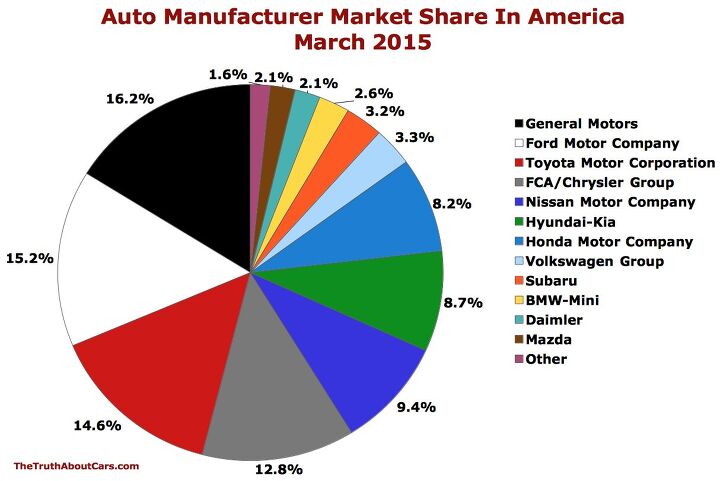

Chart Of The Day: Auto Brand Market Share In America In March 2015

Compact SUVs Gain Popularity At Expense Of Midsize, Compact Cars

While compact SUVs are doing well in the showroom, their success comes at the expense of midsize and compact car sales.

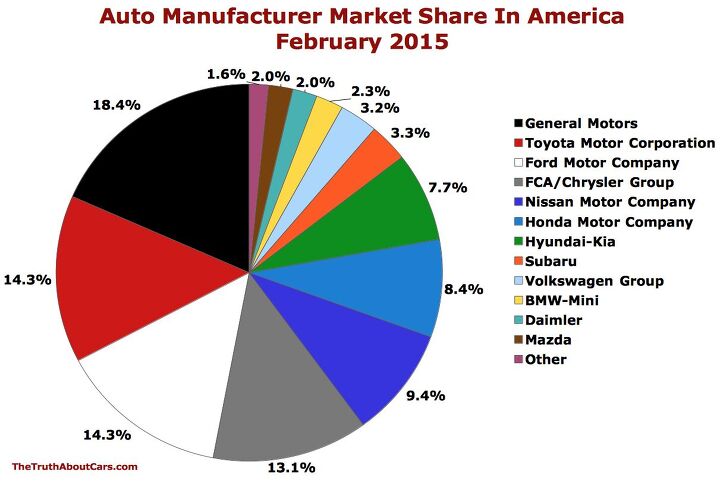

Chart Of The Day: Auto Brand Market Share In America In February 2015

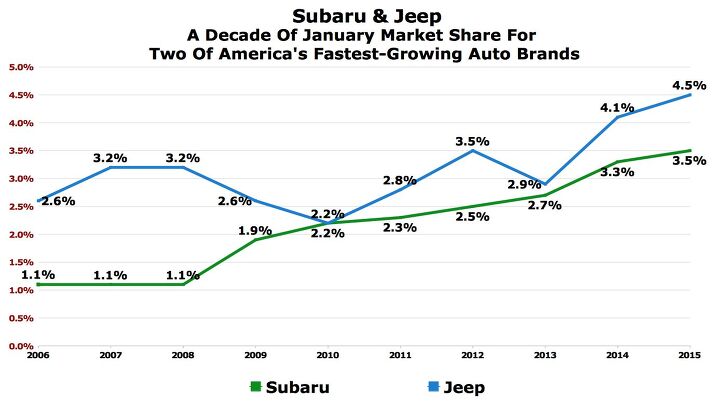

Chart Of The Day: A Decade Of January Market Share Improvement For Winter's Auto Brands

Subaru and Jeep are consistently two of America’s fast-growing auto brands. Aided by expanding portfolios and clearly understood branding, Jeep volume jumped 41% in 2014; Subaru sales shot up 21%.

Are any two auto brands more easily identified with winter than Subaru and Jeep?

Schmidt: Western Europe EV, PHEV Sales Stalling Through Decade

EV and PHEV manufacturers may have fared well in Western Europe last year, but further gains in the market aren’t likely for some time to come.

De Nysschen: Small Cadillac CUV Due In Four Years' Time

Ballers looking for a much smaller Cadillac Escalade may need to wait four years before such a beast arrives, per president Johan de Nysschen.

Carlypso: PHEVs To Reach 1 Percent Market Share In Q1 2015

By the end of Q1 2015, PHEVs are expected to take 1 percent of the overall U.S. domestic market despite fuel prices continuing their downward spiral.

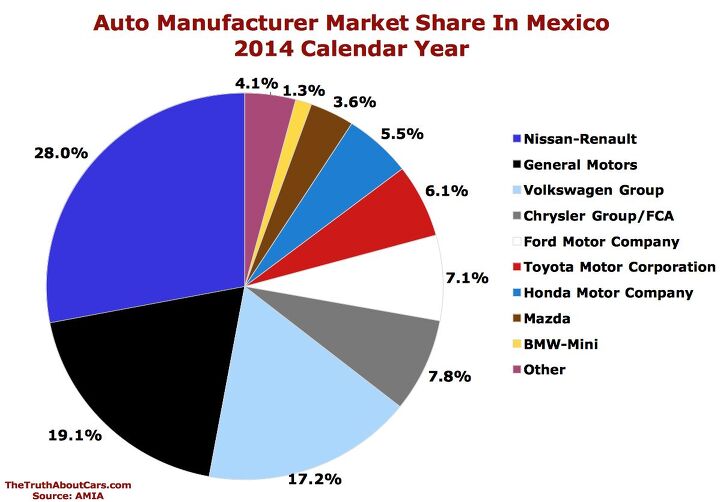

Chart Of The Day: Auto Brand Market Share In Mexico In 2014

The Asociación Mexicana de la Industria Automotriz reported a 7% increase to 1.1 million new vehicle sales in 2014.

Nissan is Mexico’s best-selling auto brand. Sales at the Nissan brand jumped 11% to 291,729 units in 2014. Combined with Infiniti and Renault volume, the Alliance owned 28% of the overall Mexican auto market, up slightly more than a percentage point compared with 2013.

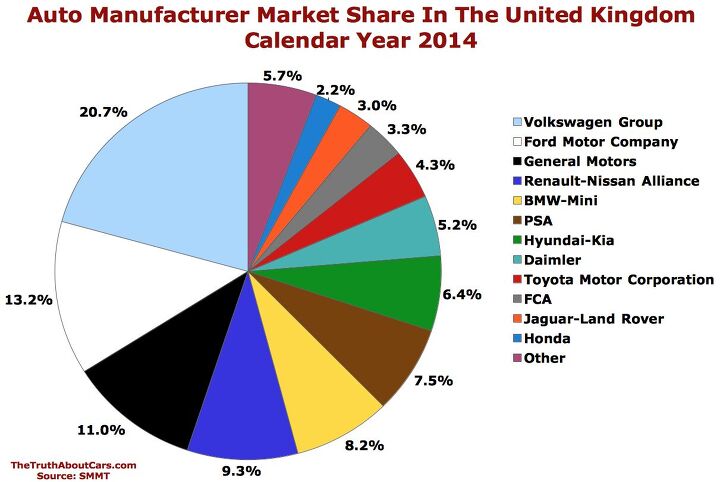

Chart Of The Day: Auto Brand Market Share In The United Kingdom In 2014

We haven’t shied away from discussing the error of Volkswagen USA’s ways here on TTAC nor the results of those ways. Yet while the brand saw its U.S. market share fall from a measly 2.6% in 2013 to 2.2% in 2014 and group-wide market share fell from 3.9% to 3.6%, year-over-year, VW Group market share in the United Kingdom grew by half a percentage point to 20.7% in 2014.

True, the Volkswagen brand itself saw its market share fall despite year-over-year volume growth of 4%. Volkswagen is the UK’s third-best-selling brand behind Ford and GM’s Vauxhall.

The Heavy Lifters: 2014 U.S. Auto Sales Growth Was Mostly Powered By An Elite Few

Subtract the growth achieved by America’s 19 most meaningfully improved vehicles in 2014 and the U.S. auto industry was up just 1.0%, not 5.9%, last year.

The Audi A3; BMW 3-Series/4-Series; Chevrolet Cruze and Silverado; GMC Sierra; Honda Accord and CR-V; Jeep Cherokee; Kia Soul; Nissan Sentra, Rogue, and Versa; Ram P/U; Subaru Forester and Outback; and Toyota’s Camry, Corolla, RAV4, and 4Runner all produced in excess of 20,000 more sales in 2014 than in 2013, combining for 764,885 extra sales in a market which grew by approximately 927,000 units.

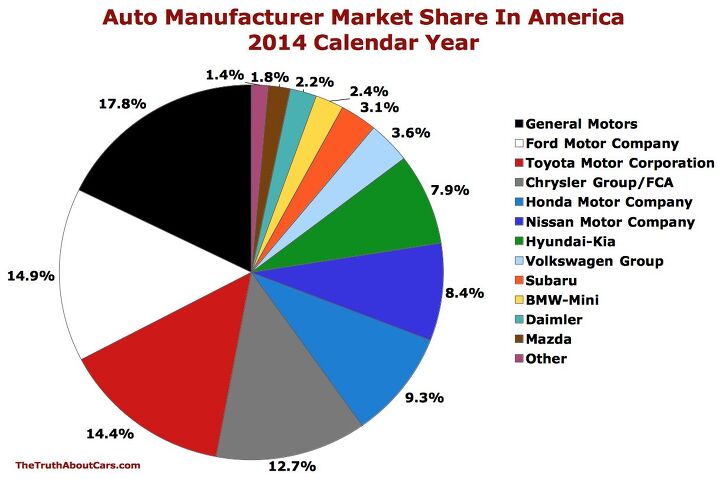

Charts Of The Day: U.S. Auto Market Share In December And 2014

Compared with the prior year, the Ford Motor Company lost one full percentage point of market share in the United States in 2014. While preparing to replace their F-150, Ford/Lincoln market share fell from 15.9% to 14.9% as F-Series sales predictably stalled in an expanding market and as Ford brand car sales slid 4%.

Poised to pickup Ford’s share was Fiat Chrysler Automobiles. The company’s Alfa Romeo, Chrysler, Dodge, Fiat, Jeep, Maserati, and Ram brands boosted FCA’s U.S. market share from 11.6% in 2013 to 12.7% in 2014. Maserati, Jeep, and Ram were America’s fastest-growing auto brands.

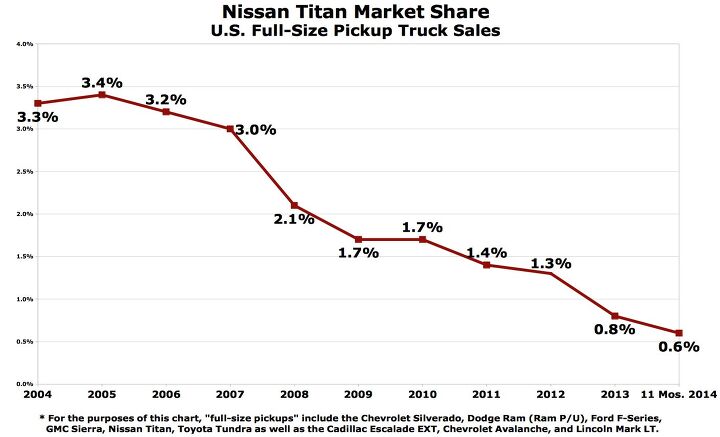

Chart Of The Day: 11 Years Of Nissan Titan Market Share

Nissan USA announced on December 16, 2014, that the next Titan, the second Titan, the first all-new Titan since 2003, will be introduced at 2015’s NAIAS in Detroit on January 12, 2015.

Hardly altered since the production truck arrived for the 2004 model year, the Titan is now somewhat embarrassing. Yet while the truck never had the potential to tackle full-size pickup trucks from Ford, General Motors, and Ram – Toyota can’t either – in the same way Nissan’s Altima can outsell their midsize sedans and Nissan’s Versa their subcompacts, initial U.S. volume was respectable.

Chart Of The Day: U.S. Auto Market Share – November 2014

Compared with the previous month, November 2014 saw smaller automakers pick up market share at the expense of America’s largest automobile manufacturers. General Motors and Ford Motor Company combined to lose nearly a full percentage point in November even as the Volkswagen Group, Subaru, and Daimler AG combined to equal that in terms of gains.

Recent Comments