Chart Of The Day: Post-Recession Automaker Market Share In America

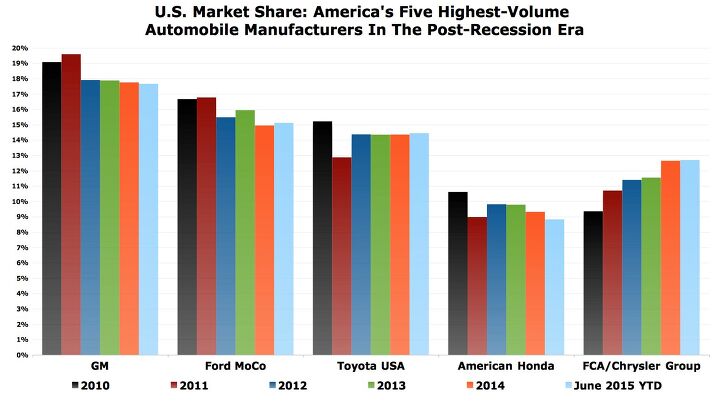

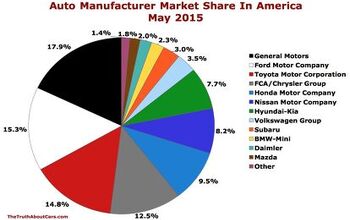

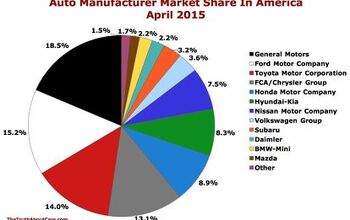

Since 2010 — when America’s auto industry was in tatters but also in recovery — General Motors, Ford Motor Company, Toyota USA, and American Honda have lost 5.5 percentage points of market share.

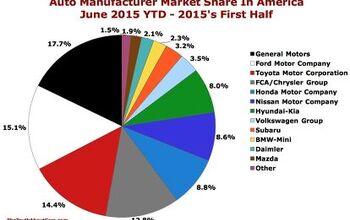

Through the first half of 2015, those four automobile manufacturers produced 56.1 percent of all new vehicle sales in the United States, down from 61.6 percent in calendar year 2010.

Fortunately, over the span of five years, the market has boomed back to 2005-like heights. As a result, GM in 2015 may sell more than 3 million vehicles for the first time since 2007. Total Ford/Lincoln sales will be around 33-percent higher than the Ford MoCo total from 2010; Toyota’s 40-percent higher in comparison; Honda’s 22-percent greater.

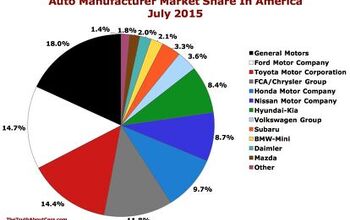

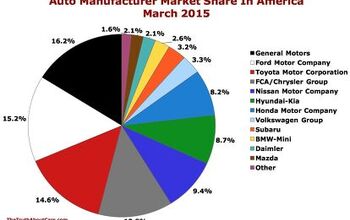

But where did their market share go? The Chrysler Group, now known as Fiat Chrysler Automobiles, is now the country’s fourth-best-selling automaker; having taken over from American Honda in 2011; having not yet looked back. Together with Nissan/Infiniti, Germany’s four premium brands, and Subaru, the market share lost by GM, Ford, Toyota, and Honda is fully accounted for.

Timothy Cain is the founder of GoodCarBadCar.net, which obsesses over the free and frequent publication of U.S. and Canadian auto sales figures. Follow on Twitter @goodcarbadcar and on Facebook.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- THX1136 What happened to the other companies that were going to build charging stations? Maybe I'm not remembering clearly OR maybe the money the government gave them hasn't been applied to building some at this point. Sincere question/no snark.

- VoGhost ChatGPT, Review the following article from Automotive News: and create an 800 word essay summarizing the content. Then re-write the essay from the perspective of an ExxonMobil public relations executive looking to encourage the use of petroleum. Ensure the essay has biases that reinforce the views of my audience of elderly white Trump-loving Americans with minimal education. Then write a headline for the essay that will anger this audience and encourage them to read the article and add their own thoughts in the comments. Then use the publish routine to publish the essay under “news blog” using Matt Posky listing the author to completely subvert the purpose of The Truth About Cars.

- VoGhost Your source is a Posky editorial? Yikes.

- Fed65767768 Nice find. Had one in the early-80s; loved it but rust got to it big time.Still can't wrap my head around $22.5K for this with 106,000 km and sundry issues.Reluctant (but easy) CP.

- El scotto err not be an EV but to own an EV; too much training this week along the likes of what kind of tree would be if you were a tree? Sorry. Bring back the edit function.

Comments

Join the conversation

Fascinating charts. GM marketshare went up in 2011 even with only 4 brands, and has been on a decline since. The supply constraints of the earthquake and tsunami both hurt Toyota and Honda in 2011 - that charts are very clear. What is interesting is they never fully gained their 2010 recessionary level marketshare back even as the economy picked up and annual car sale volumes returned to pre-great recession levels. It appears Ford, GM, and FCA all benefited from the earthquake. This chart really shows how much impact the disruption had (hello, emergency planners in the Pacific Northwest, look at these charts) Really fascinating to see that Toyota's marketshare has essentially flatlined since 2012. Had I not seen a representation this way, I would think that Toyota was still growing. I wouldn't think Honda is losing ground either, but I guess a string of really bad decisions and product mix mistakes are catching up to the brand. With all the "bad" news coming out of FCA about product roadmap and some high profile mistakes like the Dart launch, you would think they would be doing worse - but they aren't. I'd be curious to know how much of that marketshare growth at FCA is Ram and Jeep - I would suspect most of it. Is it really that simple to say that Honda and Toyota have lost share to FCA? Or is some of that share going to Hyundai/Kia? Some of the most interesting charts Mr. Cain has provided. Wish you could drill down into the data!

'Together with Nissan/Infiniti, Germany’s four premium brands, and Subaru, the market share lost by GM, Ford, Toyota, and Honda is fully accounted for.' ?? Hyundai and Kia had no impact ?