1 View

A Contrarian View Of Subprime Auto Loans

by

Derek Kreindler

(IC: employee)

Published: August 7th, 2014

Share

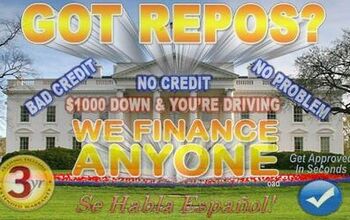

The topic of subprime auto loans has been a hotly contested one at TTAC, with numerous commenters defending both the practice and the stability of recent run-up in subprime lending.

Over at the Autos and Economics blog (operated by contributor Mike Smitka), David Ruggles (better known as “ruggles” around here) provides a well-reasoned defense of subprime lending, and why he thinks we are not headed for a subprime lending bubble. Despite that, other voices seem to think we are heading for one, if not in subprime then in the broader market.

Derek Kreindler

More by Derek Kreindler

Published August 7th, 2014 10:53 AM

Comments

Join the conversation

DK, thanks for pointing us to Ruggles other work.

The bubble is basically a foregone conclusion, but bubbles aren't really the issue. Everyone wants to know how its going to end. Undramatic deflation or cataclysmic pop?

RE: "Depends on the location of the dealer." Actually, it depends more on whether or not the dealer is an inexperienced independent or a franchise new car dealer. RE: "In some places, a dealer has a hard time moving a truck without a lift kit." I wouldn't have any problem moving them because I wouldn't inventory them. RE: "It's all about what the customers demand, caution comes second to profit at most dealers." No, its about what a dealer can reasonably insure and the risk he/she wants to take. Any altered vehicle that a dealer sells is a potential lawsuit if it is in an accident. There are specific paragraphs in dealer's coverage on the issue. Most inexperienced independents aren't aware of it. After all, their area of expertise isn't insurance. They probably never read their policy. In some cases there are limitations on what a lender will finance. After all, the vehicle is collateral. I can't tell you how many times I'd have someone with an altered truck come to me complaining about their tire wear. I'd sell the truck stock and the consumer would replace the wheels and tires and put a lift kit on it, and expect their warranty to still apply. Sorry. It doesn't work that way.

A key statistics from the American of Financial Services Association conference, according to TransUnion and confirmed by many sources. Subprime outstandings are running at about 14% to 15% of total outstandings, about where they've been for a decade. Everyone had a good laugh about the alarmist articles. The people attending are looking for risk to be concerned about. Subprime auto loans aren't a point of concern. Even extended term financing received a good discussion. No one likes it, ESPECIALLY extended term on pre-owned vehicles. But on new vehicles, OEM rebates seem to be the way out for a consumer who wants to bail on a negative equity trade. The problem is, for them to "get out" they need to buy a vehicle with big incentive money which may or may not be what they actually want to buy. But no one said life would be a series of first choices. If you have serious negative equity, you might end up in a particular RAM truck with $9200. in rebates, even though you don't want a truck. OR, your other choice is to come up with cash or pay down your current vehicle by making some more payments. You might be better off to lease your next vehicle, if you have negative equity. That way at the end of the lease term, the negative equity you rolled into the lease is resolved and you're back to sea level again.