Canada Sales Recap, February 2014

Forgotten in the industry’s excitement over a record year for Canadian auto sales was the challenging start to 2013.

Sales in 2012 had risen to a ten-year-high, and in each of the 2013’s first three months, sales were down, year-over-year. The predicted record sales level eventually materialized, but not in the first quarter.

January 2014’s results, therefore, appear to formulate a better start for automakers competing in the Canadian auto market. In fact, compared with January 2012’s figures, sales were down 2% last month, but the year-over-year tally produced a 0.4% increase.

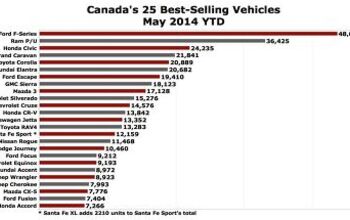

In recent months, improved auto industry sales figures in North America have been motivated in large part by pickup trucks. Not so in January, not in the United States; not in Canada. Canadian truck sales slid 4.5%. Total GM pickup sales dropped 16.8%, an 888-unit decline. Ford F-Series volume was off January 2013’s pace by 5.6%. The three remaining nameplates in the small/midsize truck segment combined for just 985 sales, only 5.3% of the overall truck category.

Ram sales rose slightly. Toyota, Nissan, and Honda all produced increased truck sales. But with trucks – responsible for fuelling so much more of the Canadian industry’s volume than they do in the U.S. – falling by 885 units, it became clear that January was not a month for extreme auto sales growth.

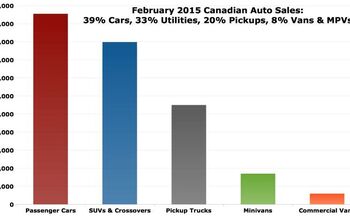

Minivan sales in January were down 10.9% despite a 9.3% increase in sales of the Dodge Grand Caravan, Canada’s fourth-best-selling vehicle overall. With its twin, the Chrysler Town & Country, losing two-thirds of its volume, total Chrysler minivan sales were down 4.3%. More than 5% of the new vehicles sold in Canada in January 2014 were minivans. Excluding the Mazda 5, Chevrolet Orlando, and Kia Rondo, the category still owned 4.6% of the industry’s total sales. “Full-size” minivans accounted for just 3.1% of the U.S. market last month.

Canada’s perennial car leader, the Honda Civic, was up 32.4% in January 2014 after Civic sales plunged 49.3% a year ago. According to the Automotive News Data Center (subscription required), passenger car sales in Canada were down 6.3% in January 2014 as Acura, Audi, Bentley, BMW, Buick, Cadillac, Chevrolet, Chrysler, Ford, Hyundai, Kia, Mini, Porsche, Scion, Toyota, and Volkswagen all reported decreased car sales.

GM car sales were down 35.2%. Even with a big (percentage-wise) Lincoln car increase, total Ford Canada car sales were down 23.3%. The ANDC says total Toyota Canada car sales were down 15.1%. All too often, the passenger car sales improvements reported by 15 other brands (Dodge, Fiat, Honda, Infiniti, Jaguar, Lexus, Lincoln, Maserati, Mazda, Mercedes-Benz, Mitsubishi, Nissan, Smart, and Subaru) were not as significant as the decreases reported by brands in the first group.

With great frequency, however, an automaker’s car losses were cancelled out by SUV/crossover gains. BMW’s four X models generated a 36% year-over-year increase, enough for the BMW brand to post a 5% increase even as car sales slid 26.9%. Despite a 15.9% car sales drop, Toyota brand sales were up 11.8% in large part due to the 118% increase in SUV/crossover sales, led by the RAV4’s 221% jump.

From 29.8% in January 2013, the market share afforded to SUVs and crossovers shot up to 34.5% in January 2014 as seven dozen nameplates combined for a 16.3% increase.

Nevertheless, the follow-up to last year’s first quarter decline proves just how lacking in relevance January auto sales figures are in the Great White North, especially when the January in question was a particularly cold and white one. Last year, Canadians registered nearly twice as many new vehicles in May as they did in January.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Lou_BC I read an interesting post by a master engine builder. He's having a hard time finding quality parts anywhere. The other issue is most young men don't want to learn the engine building trade. He's got so much work that he will now only work on engines his shop is restoring.

- Tim Myers Can you tell me why in the world Mazda uses the ugliest colors on the MX5? I have a 2017 in Red and besides Black or White, the other colors are horrible for a sports car. I constantly hear this complaint. I wish someone would tell whoever makes theses decisions that they need a more sports car colors available. They’d probably sell a lot more of them. Just saying.

- Dartman EBFlex will soon be able to buy his preferred brand!

- Mebgardner I owned 4 different Z cars beginning with a 1970 model. I could already row'em before buying the first one. They were light, fast, well powered, RWD, good suspenders, and I loved working on them myself when needed. Affordable and great styling, too. On the flip side, parts were expensive and mostly only available in a dealers parts dept. I could live with those same attributes today, but those days are gone long gone. Safety Regulations and Import Regulations, while good things, will not allow for these car attributes at the price point I bought them at.I think I will go shop a GT-R.

- Lou_BC Honda plans on investing 15 billion CAD. It appears that the Ontario government and Federal government will provide tax breaks and infrastructure upgrades to the tune of 5 billion CAD. This will cover all manufacturing including a battery plant. Honda feels they'll save 20% on production costs having it all localized and in house.As @ Analoggrotto pointed out, another brilliant TTAC press release.

Comments

Join the conversation

The Ram is a fine "looking" truck. Great for the guy that wants a fine looking truck. Ask the farmer, or the landscaper. or the construction fleet buyer, how he feels about a "fine looking truck"

A chart would have made reading this article much easier.