Canada Sales Recap: August 2014

Canadians continued to buy new vehicles at a record-setting pace in August 2014 as the market expanded in all corners, SUVs and crossovers; pickup trucks; commercial vans; minivans; and even passenger cars.

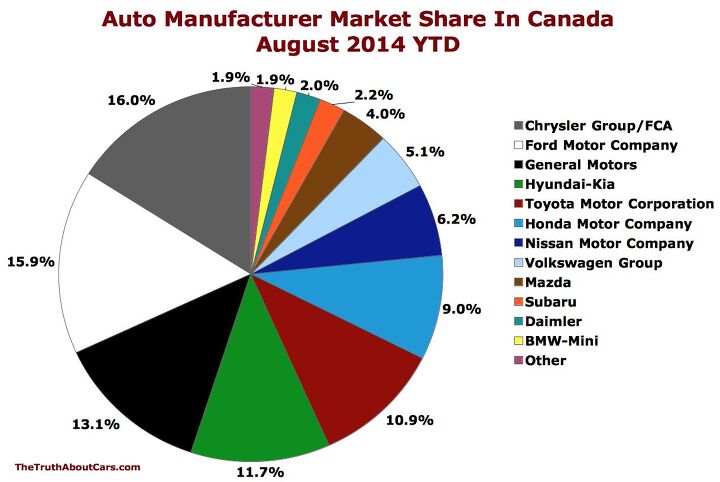

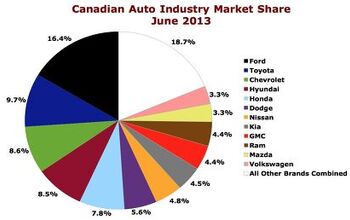

The industry’s 8% year-over-year improvement equalled more than 12,000 extra sales in the Canadian market for automakers of virtually all stripes, from Ford and General Motors to the Volkswagen Group and Toyota.

Chrysler Canada volume jumped 22%. Despite being outsold by Ford/Lincoln in each of the last five months, Chrysler’s five-brand conglomerate leads the manufacturer sales results on year-to-date terms, albeit marginally. Nissan Canada, meanwhile, posted 32% YOY improvement even as Infiniti struggled to maintain momentum, falling 4%.

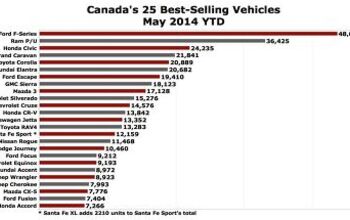

Through the first half of 2012, pickup trucks were anchors on the industry’s plans for another year of record sales, sliding 1%. But July and August told different stories – August sales, specifically, were up 3% – and trucks are now helping to push the market forward. 93% of all pickup trucks sold in Canada in August were Fords, Rams, or GM products; only 4% were small/midsize pickups.

Similarly, the move away from midsize cars, while continuing to be a general theme, was not applicable over the course of the summer. Granted, intermediate sedans are not growing as rapidly as the overall market of late, rising 3% in August as the market shot up 8%, but they weren’t pulling the industry downward. In each of the last two months, the Hyundai Sonata has been Canada’s top-selling midsize car. The Ford Fusion leads a segment in which, through eight months, sales are down 16%.

While Fusion sales have tumbled 14% this year and Ford’s car division has fallen 12%, the Escape has almost completely made up for those losses. (Ford brand car sales are down by 6045 units; Escape sales are up by 5862 units.) Escape volume has topped 5000 units in four consecutive months. No other SUV or crossover topped the 3660-unit mark during that period (the RAV4, in August) and the Escape itself hadn’t climbed above 5000 units in Canada since June 2011. 9% of the utility vehicles sold in Canada last month were Escapes.

The Escape-related MKC was Lincoln’s top seller last month, generating just under half of all Lincoln volume and about half the total sales of Audi’s Q5, the top-selling premium brand utility vehicle. Incidentally, the Macan was also Porsche’s best-selling model in August, the first such month for that occurrence, as well.

Another top-selling vehicle in Canada has also outperformed its norm in recent months. Dodge’s Grand Caravan has topped the 5000-unit mark in three of the last four months, rising 29% to 5178 units in August. Minivans, including the Kia Rondo and Chevrolet Orlando which lack sliding doors, accounted for 5.6% of all new vehicle sales in Canada last month, compared with 3.3% in the United States. The Grand Caravan owns 61% of Canada’s “full-size” minivan segment, excluding the trio of mini-minivans.

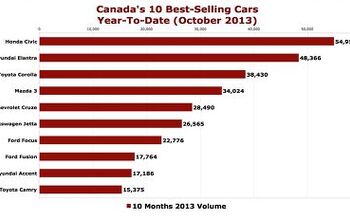

Honda continues to be the maker of Canada’s best-selling car. Civic volume in August was 1.6 times stronger than the sales of the next-best-selling car, Toyota’s Corolla. The Civic has been Canada’s in sixteen consecutive years. 2014 will undoubtedly be the seventeenth.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- MaintenanceCosts I hope they make it. The R1 series are a genuinely innovative, appealing product, and the smaller ones look that way too from the early information.

- MaintenanceCosts Me commenting on this topic would be exactly as well-informed as many of our overcaffeinated BEV comments, so I'll just sit here and watch.

- SCE to AUX This year is indeed key for them, but it's worth mentioning that Rivian is actually meeting its sales and production forecasts.

- Kjhkjlhkjhkljh kljhjkhjklhkjh a consideration should be tread gap and depth. had wildpeaks on 17 inch rims .. but they only had 14 mm depth and tread gap measured on truck was not enough to put my pinky into. they would gum up unless you spun the libing F$$k out of them. My new Miky's have 19mm depth and i can put my entire index finger in the tread gap and the cut outs are stupid huge. so far the Miky baja boss ATs are handing sand and mud snow here in oregon on trails way better than the WPs and dont require me to redline it to keep moving forward and have never gummed up yet

- Kjhkjlhkjhkljh kljhjkhjklhkjh Market saturation .. nothing more

Comments

Join the conversation

So do you think that the sales of the MKC will dwindle down in six months or so due to folks being used too it? I know that markets are different there than here and I cant see the MKC making up half of Lincolns sales in the USA. However I do see that plus a new MKX making up half together. What do you think?