Canada Sales Recap: February 2014

Automakers chasing a second consecutive record year of total auto sales can’t be too concerned by the slim YOY improvement. Sales in March and April will likely be more than 60% stronger than they were in January and February. And though auto sales only rose 1.5% during the first one-sixth of 2014, a less vicious winter could have allowed more customers to enter new car stores.

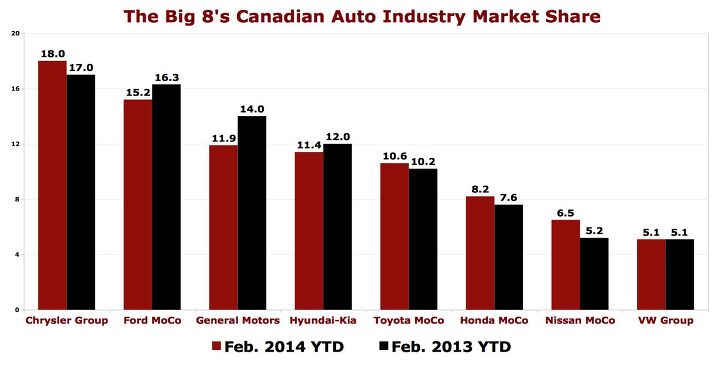

The Chrysler Group’s buyers have not been deterred by harsh weather, at least not on the light truck side of the ledger. In February and on year-to-date terms, Chrysler/Dodge/Jeep/Ram/Fiat sales led all manufacturers, outselling the second-ranked Ford Motor Company by nearly 2300 units in February.

With sales that were 64% stronger than Toyota’s, the Ford brand was by far the highest-volume specific brand. Ford brand car sales are down 21% in 2014.

2668 additional sales from the Jeep Cherokee, Canada’s seventh-best-selling utility vehicle, have been a big help at Chrysler. (Excluding the Cherokee, Chrysler Group volume is down 1%. With the Cherokee, sales are up 7%.) Likewise, Chrysler finds strength in its Ram Pickup, which has seen a market share boost in the truck category to 29% from 27% at this time last year.

Car sales across the Chrysler/Dodge/Fiat range are down 10% in 2014 and fell 22% in February. Only 12% of the vehicles sold by the Chrysler Group in February were passenger cars.

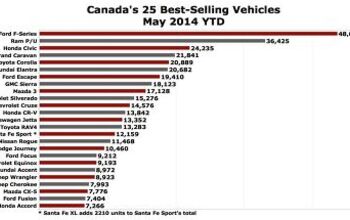

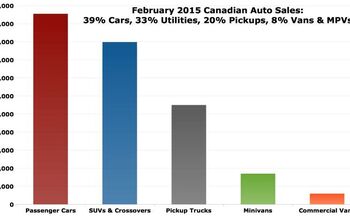

Though it’s exacerbated in Chrysler’s showrooms, Canada’s distaste for cars is becoming more obvious. Automotive News says 39.2% of the new vehicles sold in Canada last month were passenger cars, way down from 43.9% in February 2013 and 44.3% in February 2012. February’s top-selling car, the Hyundai Elantra – which trails the Honda Civic through two months – was down 6%. Sales of the Mazda 3, Volkswagen Jetta, Chevrolet Cruze, Ford Focus, Hyundai Accent, Ford Fusion, and Honda Accord, which ranked fourth through tenth among cars in February, were down YOY.

Meanwhile, massive increases were reported by many of Canada’s top-selling small crossovers. The Ford Escape, Honda CR-V, Nissan Rogue, Chevrolet Equinox, Mazda CX-5, Hyundai Tucson, and Subaru Forester averaged year-over-year gains of 47%.

BMW was the top-selling premium brand in Canada in February, though not year-to-date. Lexus is far from being the Canadian luxury leader, but Toyota’s premium division has outsold Acura in 2014, no mean feat for Lexus. Acura has outsold Lexus by an average of nearly 2300 units annually over the last five years. Typically, Lexus’s car division simply doesn’t pull its fair share of the weight. In fact, at both brands, as is the case among numerous premium automakers, utility vehicles carry the load. 59% of Lexus’s February volume was RX/LX/GX-derived (compared with 40% in the U.S.) while Acura generated 67% of its February Canadian sales with the MDX and RDX.

However, it’s the BMW X5 and not the Lexus RX which currently leads all premium brand crossovers. Indeed, the X5 has led premium utility sales in three of the last four months, a meaningful achievement for a vehicle that’s priced in excess of $63,000 when vehicles like the second-ranked Audi Q5 start just above $40K.

So-called premium automobiles form a burgeoning part of the Canadian market, a part of the market that’s being fuelled as much by high riders as it is by entry-level luxury cars. That should come as no surprise in a country where seven dozen SUV/CUV nameplates have produced 34% of the new vehicle sales in 2014.

On the other hand, maybe Canadian consumers are setting the stage for a return to tradition. Minivan sales jumped 17% to 6671 units in February, equal to 6.3% of the industry’s total volume, almost twice the market share achieved by minivans in the U.S. Or maybe not.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Analoggrotto Does anyone seriously listen to this?

- Thomas Same here....but keep in mind that EVs are already much more efficient than ICE vehicles. They need to catch up in all the other areas you mentioned.

- Analoggrotto It's great to see TTAC kicking up the best for their #1 corporate sponsor. Keep up the good work guys.

- John66ny Title about self driving cars, linked podcast about headlight restoration. Some relationship?

- Jeff JMII--If I did not get my Maverick my next choice was a Santa Cruz. They are different but then they are both compact pickups the only real compact pickups on the market. I am glad to hear that the Santa Cruz will have knobs and buttons on it for 2025 it would be good if they offered a hybrid as well. When I looked at both trucks it was less about brand loyalty and more about price, size, and features. I have owned 2 gm made trucks in the past and liked both but gm does not make a true compact truck and neither does Ram, Toyota, or Nissan. The Maverick was the only Ford product that I wanted. If I wanted a larger truck I would have kept either my 99 S-10 extended cab with a 2.2 I-4 5 speed or my 08 Isuzu I-370 4 x 4 with the 3.7 I-5, tow package, heated leather seats, and other niceties and it road like a luxury vehicle. I believe the demand is there for other manufacturers to make compact pickups. The proposed hybrid Toyota Stout would be a great truck. Subaru has experience making small trucks and they could make a very competitive compact truck and Subaru has a great all wheel drive system. Chevy has a great compact pickup offered in South America called the Montana which gm could make in North America and offered in the US and Canada. Ram has a great little compact truck offered in South America as well. Compact trucks are a great vehicle for those who want an open bed for hauling but what a smaller more affordable efficient practical vehicle.

Comments

Join the conversation

@heavy handle - the lower mainland of BC, Sunshine coast and Vancouver Island tends to get off fairly easy in the winter. With that being said, big tire 4x4's aren't a necessity in most cities let alone the major centres.

So, Canada is the only country in the world where Chrysler is actually the sales leader?