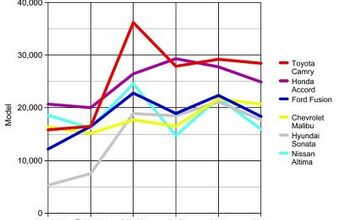

Chart Of The Day: The "Big Six" Midsized Sedans In 2011

A year ago I put together a chart comparing the first-half performance of America’s “big six” most popular midsized sedans. Then, the graph seemed to show promising growth and a tightening segment. Now we seem to be looking at an up-and-down but ultimately more stagnant market… and a segment that is still battling it out in some of the closest competition in recent memory. But this chart alone doesn’t tell the whole story… hit the jump for the same chart, only with sales plotted cumulatively by month.

Plotted in terms of cumulative YTD sales, the Camry is a clear winner… and this less than a year away from its relaunch. Toyota’s demise has clearly been overreported in some circles, but this all-important midsized segment is still tighter than a laser weld tolerance. Even the slightest slip-up could cause fortunes to vary dramatically, and with only 30k units separating King Camry from the upstart Sonata, these six sedans could take this competition right down too the wire…

More by Edward Niedermeyer

Comments

Join the conversation

Everybody's looking for the missing variable that will catapult their favourite to the top. My only question is why we dwell on monthly sales charts when year-over-year tells a much more balanced picture. Monthly sales can be skewed by local incentives, the alignment of Jupiter's moons, or just about any other random variable.

I'm grateful to see how Ford and Chevy are right up there with the imports. Now, I'm waiting to see the reliability data of these six vehicles in a few years. For now, though, congrats to Ford and Chevy for finally offering a mid-size car that's competitive. Of all these, what would I buy? Malibu is first, followed by Fusion, of course. Altima? I drove one. Unimpressed. Sonata? Ditto. Camry? Nope, on general principles, same for Accord. Nothing against any of them, but as long as Chevy (primarily) or Ford makes what I like, that's what I'll buy. When and if that doesn't any longer make sense, next! Chrysler? Still watching and hoping.

I still see a lot of incentives in my market (SWMI) for the Camry, Malibu and Altima. For all of the hype concerning lost sales and shortages due to the tsunami, they're still putting money on the hoods of these cars. If I had to replace the wife's car today, I'd probably look at an Cruze Eco, mostly because I kind of like the idea of 4 cylinder turbo/6 speed manny tranny in a reasonably sized package. A Cruze Eco hatch would really make me consider trading in the Pontiac. For obvious reasons, the Malibu doesn't offer that kind of drivetrain. But, I am interested in seeing the 2013 Malibu and the e-Assist package on that.

I don't have June numbers, but Malibu sales in April were 45% fleet, on total sales of about 25,000 units. I doubt that June's approximately 24,000 units sold looks much different. http://blogs.motortrend.com/gm-leads-strong-sales-month-chevy-cruze-beats-toyota-corolla-15021.html