Quote Of The Day: Price Wars Edition

Is the auto industry headed for a price war? Hyundai Motor USA CEO John Krafcik seems to think so, telling Reuters

I think we can officially say that a price war broke out in the industry. There is apparently a lot of pressure to deliver sales results. I would call this a step backward for the industry. This is short-term thinking in a long-term process that hurts manufacturers and consumers.

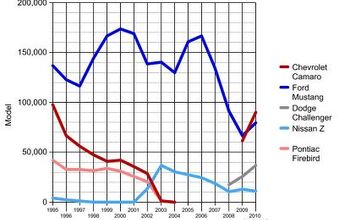

Krafcik says GM kicked off the rush for increased volume by cutting prices in January, and that Toyota (which has increased its incentives by 37.5% since last January, according to TrueCar) “quickly” responded by matching The General’s price cuts. Honda, Nissan and Chrysler have also kept their incentives high, and Chrysler has told Automotive News [sub] that it plans on increasing sales by 45% this year. Says Krafcik

We’ll see if others decide to follow. It’s certainly not in our plan right now.

Krafcik has a point: though sales have recovered over the last year as the economy has come back from the depths of recession, industry-wide incentive spending is up 1.3% in the last 12 months. Rather than taking advantage of the economic recovery to bring incentives down and transaction prices up, automakers appear to be focused entirely on volume. That’s certainly the message GM has sent by announcing that it would no longer release its incentive data. And, as Krafcik points out, the industry has already suffered mightily from such short-term, unsustainable thinking… but not everyone shares his concern.

GM’s response: sales incentives are “targeted.”

Rick Scheidt, vice president of GM’s Chevrolet, argued that Chevrolet has become more strategic, offering few incentives on hot-selling models such as the Equinox and Cruze and higher ones on its Silverado pickup to match competitors.

“If you don’t participate, you aren’t going to be a big player,” said Scheidt. “Things are much more targeted now. I don’t think you can read that much into just one month.”

That critique was echoed by Edmunds’ head analyst Jessica Caldwell, who tells Reuters

GM was very aggressive in January, but I wouldn’t call it a price war. Toyota’s incentives were not extremely different from what it had been doing. In February, other brands may be more aggressive as a reaction (to GM).

What’s left out in this analysis is that Toyota was long a counterweight to the Detroit automakers’ incentive binges, maintaining strong price discipline without losing volume. That changed this time last year when, under attack from all sides during its recall scandal, the Japanese automaker began to boost incentives… and it has yet to take its foot off the accelerator. Toyota maintains that it “isn’t leading the industry,” but by relaxing its incentive discipline, it’s helping accelerate an incentive war.

It’s easy to forget how much overcapacity clean-up the industry went through in the last few years, but it’s foolishness to think overcapacity can’t come back. If manufacturers start cranking up production volumes and use incentives to clear unsold inventory, the industry could pull itself back out of its recovery. We hear reports from the NADA convention about the level of ego involved in sales teams of several large manufacturers… by one account, “it’s getting personal.” As good as low prices might be for consumers, let’s hope that sales bosses take their eye off volume long enough to make sure the entire industry doesn’t cut its own throat trying to outsell the next guy. The last thing America’s auto brands need now is to starve themselves of profit.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Alan As the established auto manufacturers become better at producing EVs I think Tesla will lay off more workers.In 2019 Tesla held 81% of the US EV market. 2023 it has dwindled to 54% of the US market. If this trend continues Tesla will definitely downsize more.There is one thing that the established auto manufacturers do better than Tesla. That is generate new models. Tesla seems unable to refresh its lineup quick enough against competition. Sort of like why did Sears go broke? Sears was the mail order king, one would think it would of been easier to transition to online sales. Sears couldn't adapt to on line shopping competitively, so Amazon killed it.

- Alan I wonder if China has Great Wall condos?

- Alan This is one Toyota that I thought was attractive and stylish since I was a teenager. I don't like how the muffler is positioned.

- ToolGuy The only way this makes sense to me (still looking) is if it is tied to the realization that they have a capital issue (cash crunch) which is getting in the way of their plans.

- Jeff I do think this is a good thing. Teaching salespeople how to interact with the customer and teaching them some of the features and technical stuff of the vehicles is important.

Comments

Join the conversation

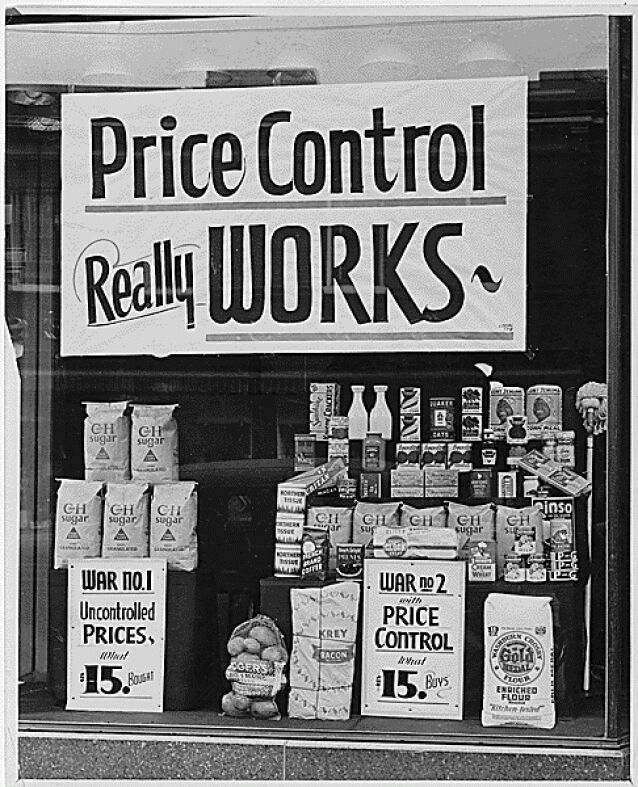

Price wars are just a race to the bottom. If I recall, Chrysler started it all with their "tent sales" in 1974, during a recession, and once it got out that if the OEM's were still making money with the price cuts, consumers rightly assume that's really what the products are worth, and when you start that sort of thing, all the "rich, Corinthian leather" in the world won't ever let you go back. So, here we are almost 37 years later and nothing's changed. By the way, I can't take my eyes off the photo used in this article, the main reason I haven't commented 'til now - the hand-lettered signs - that industry certainly did change - computer-manufactured and dumbed-down. I used to hand-letter signs all the time as part of my job back then and later, on the side for extra money.

So let me get this straight. The U.S. government illegally (certainly unconstitutionally) bailed out two major auto companies - GM and Chrysler - which had failed. They also shafted the bond holders. Then took over the bankruptcy and handed partial ownership to their cronies and friends in UAW places, as well as (in the case of Chrysler) handing partial ownership to FIAT of ITALY. All of this, instead of allowing the bankruptcy courts to actually do things in an orderly fashion AS WRITTEN BY LAW. So with all of this in mind, we can obviously see that making sure that the worst run companies can now cry for help because they are too big to fail, and receive it at the expense of the well run companies and taxpayers. Then the same government makes sure to try to "diss" a major competitor by making up sh!t about unintended acceleration to try to increase "their guy's" sales - and this is pretty well proven by the fact that another branch of the same government essentially came out a few days ago and said there were electronic gremlins in Toyotas. So now that we STILL have massive production capacity overages available for the market in the US (because Chrysler survived and GM didnt' get properly shrunk down due to interference with the free market and legal bankruptcy laws by a fascist government in Washington DC).... we now have DECENTLY RUN companies which have been PUTTING JOBS INTO THE UNITED STATES held at a massive disadvantage because GM especially desires more market share and are planning to buy it with "incentives" which are no doubt paid for by we taxpayers, ultimately. Wake me up when I no longer live in the Twilight Zone, 'mkay?