GM Announces $1.3b Q2 Profit

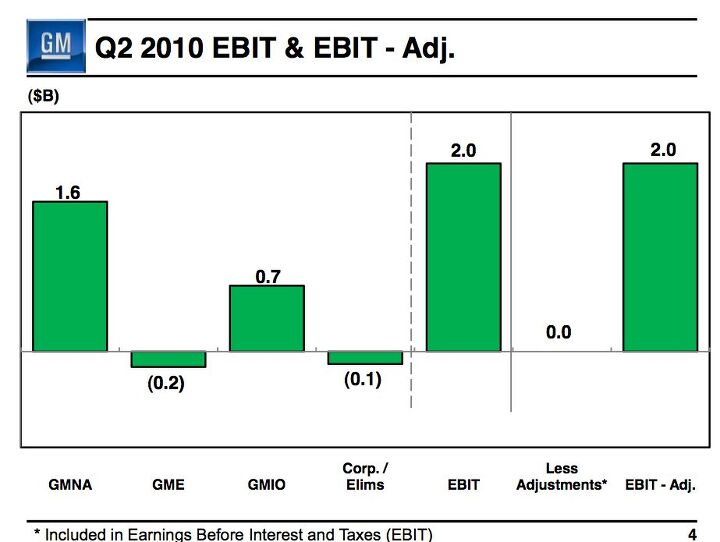

GM has released its Q2 earnings, and it’s pulled off a $1.3b net profit on improved North American revenue, and narrower losses on GM Europe. Revenues for GM International, however, were down to about half of their Q1 level. Despite over $1b in capital expenditures last quarter, GM managed to improve free cash flow from $970m in Q1 to $2.834b in Q2. Full chart packet available in .doc format here, presentation slides available in PDF format here.

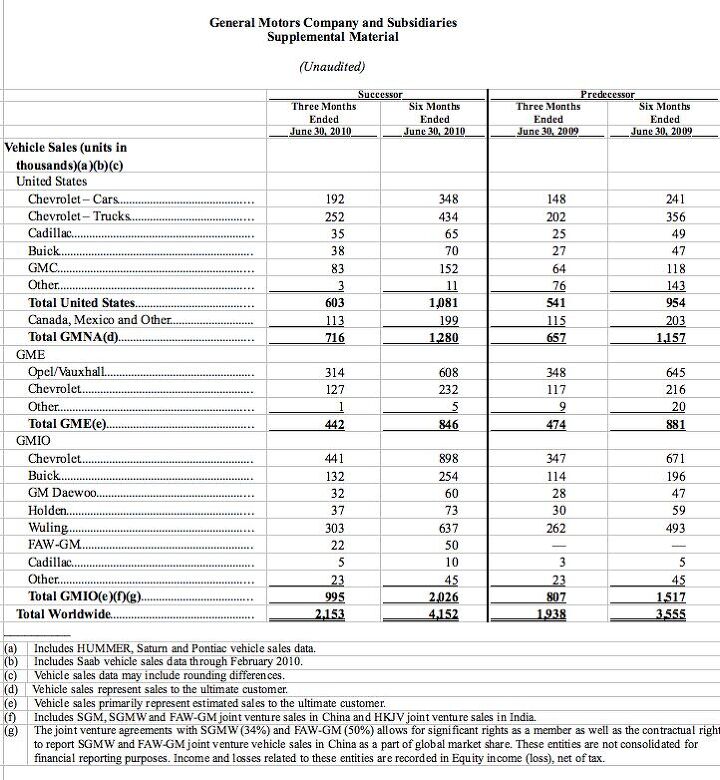

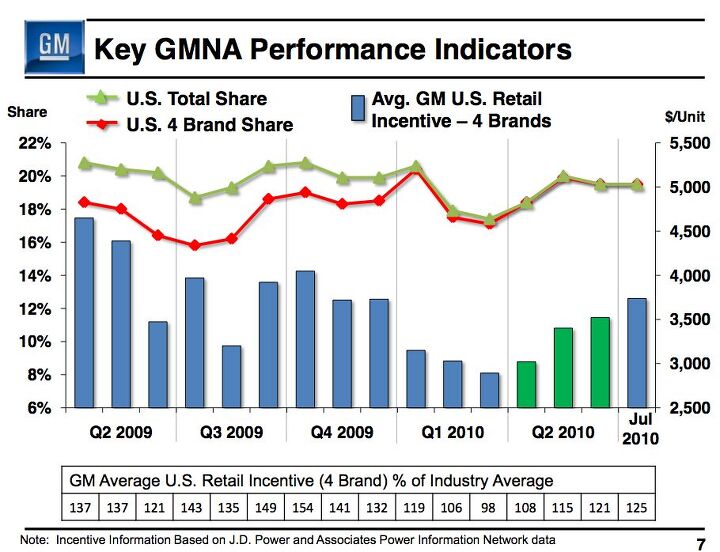

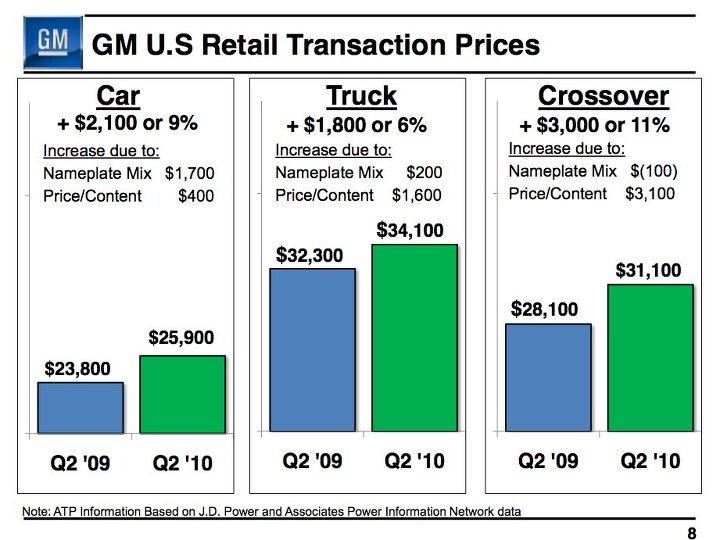

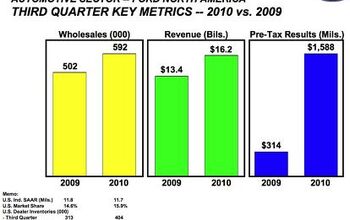

GM’s North American deliveries rose to 716,000 in Q2, and were composed almost entirely of “core brand” sales (old brands totaled 8k deliveries). Market share in NA rose to 18.7% (from 17.8% in Q1), wile US core brand share rose from 18.1 to 19.3%. As the slide above shows, volume increases were spurred on by incentive spending, but GM insists that incentives are mostly aimed at clearing out 2010 inventory. Moreover, GM insists that retail transaction prices are up considerably, although they are compared to Q2 2009 numbers, and there’s no indication that the Q2 jump in incentive spending has been accompanied by a rise in transaction prices over the same period.

And then there’s the fleet issue. Averaged over the first half of this year, GM says its fleet business runs at about 33 percent of deliveries, which is actually slightly higher than the number given recently by Automotive News [sub]. GM says the plan is to bring its fleet business down to 25-27 percent for the full year. But perhaps more damning than sheer fleet volume alone is the kind of fleet volume GM delivered. Two thirds of its fleet business went to daily rental fleets, which are largely considered to have the worst effects on resale and brand equity. GM says compact and midsized cars make up the bulk of that business.

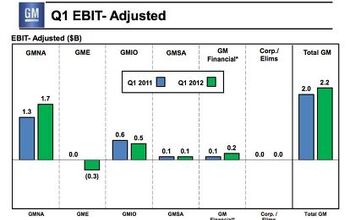

Overseas, GM still faces some serious challenges. GM Europe continues to log consistent losses, and though GM insists that GME is approaching break-even at current industry volumes, it says that restructuring costs will keep GME in the red on a quarterly basis for the rest of the year. Expect $200m-$300m in quarterly losses, which are considerably lower than previous GME losses. But the European woes were expected… slowdowns at the previously white-hot GM International are more surprising.

With the Chinese market down five percent, and GM’s market share there down two percent, The General reckons inventories and price pressure are building in China. Nobody’s freaking out about a bursting bubble, but Chinese-market news had a strangely sober tone. Same with Brazil, where GM admits that competitors beat it with new products and unexpected deals, dropping GM’s market share by over one point. Indian market share fell from 4.2 percent to 4 percent. Still, GM expects healthy growth from its International division and the markets it serves.

Overall, GM expects its financial performance to moderate over the second half of the year. Strong inventory builds in Q1, and strong lease return adjustments in Q2 were singled out as contributing to GM’s strong H1 performance, and CFO Chris Liddell warned that these factors should not be expected to play a role in the second half. Capital Expenditures increased from $800m in Q1 to $1.1b in Q2, and GM expects to shell out $5b-$5.5b in CapEx over the course of 2010. GM did say that it can expand capacity by 30-40 percent without major fixed-cost increases, which puts it on a steady course for growth.

All told, GM appears to be on a solid footing, although major issues remain. With the announcement of Ed Whitacre’s retreat from power, the question is whether GM’s new Chairman/CEO will enjoy solid North American performance, and can wean GM off its daily rental fleet sales and still-high incentives. Meanwhile, Europe remains an open wound with little sign of improvement in the short-to-medium-term, and GMIO is showing the first signs of weakness in years. The temptation at this point is to minimize the impacts of these challenges and keep GM cruising along at a solidly profitable rate, but sustainable success requires a clear vision of problems looming on the horizon and proactive solutions to them. Whether Dan Akerson can provide this still remains very much to be seen.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Jor65756038 As owner of an Opel Ampera/Chevrolet Volt and a 1979 Chevy Malibu, I will certainly not buy trash like the Bolt or any SUV or crossover. If GM doesn´t offer a sedan, then I will buy german, sweedish, italian, asian, Tesla or whoever offers me a sedan. Not everybody like SUV´s or crossovers or is willing to buy one no matter what.

- Bd2 While Hyundai has enough models that offer a hybrid variant, problem has been inadequate supply, so this should help address that.In particular, US production of PHEVs will make them eligible for the tax credit.

- Zipper69 "At least Lincoln finally learned to do a better job of not appearing to have raided the Ford parts bin"But they differentiate by being bland and unadventurous and lacking a clear brand image.

- Zipper69 "The worry is that vehicles could collect and share Americans' data with the Chinese government"Presumably, via your cellphone connection? Does the average Joe in the gig economy really have "data" that will change the balance of power?

- Zipper69 Honda seem to have a comprehensive range of sedans that sell well.

Comments

Join the conversation

Yes, a tough pill to swallow for the TTAC crowd. Don't worry as you can use the standard rationale- "must be all fleet sales" or "they cooked the books" etc.

Great news (I'll assume the books are cool). Now pay me back, and then the debate can be on product alone.