Ford Reports $1.7b Profit For Q3

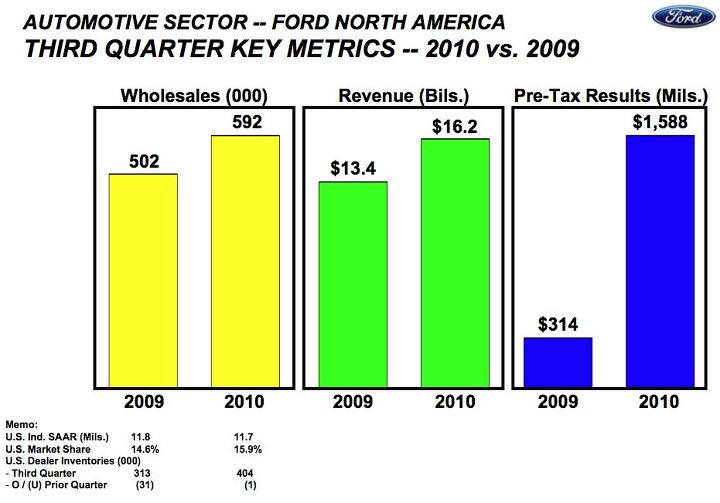

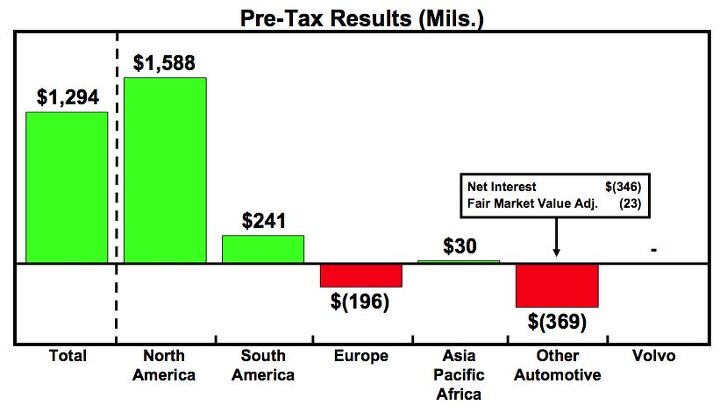

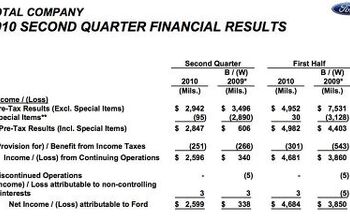

Ford’s profitability outstripped even yesterday‘s $1.37b estimate, coming in at a whopping $1.68b, as Ford made mad money in the North American market in the 3rd Quarter of this year, for a fifth consecutive profitable quarter. Global revenue was down by about $1b, but excluding Volvo from Q33 2009 results, revenue was actually up $1.7b. $1.6b of Ford’s profitability came from North America, as its most crucial market carried the company over weak overseas results. And with $900m in positive cash flow, Ford says its “automotive cash” will equal its debt by the year’s end, sooner than it had previously forecast. Ford paid of $2b of its revolving credit line last quarter, and plans to pay off the final $3.6b it owes the UAW VEBA trust in Q4. By the end of the year, Ford estimates it will have reduced its overall debt by $10.8b over the course of 2010. Hit the jump for a few key slides from Ford’s Q3 financial presentation.

Ford’s complete slide set can be found here in PDF format, but we’ve assembled a few of the most telling slides here.

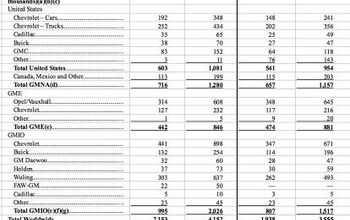

Clearly North America is where it’s happening for Ford.

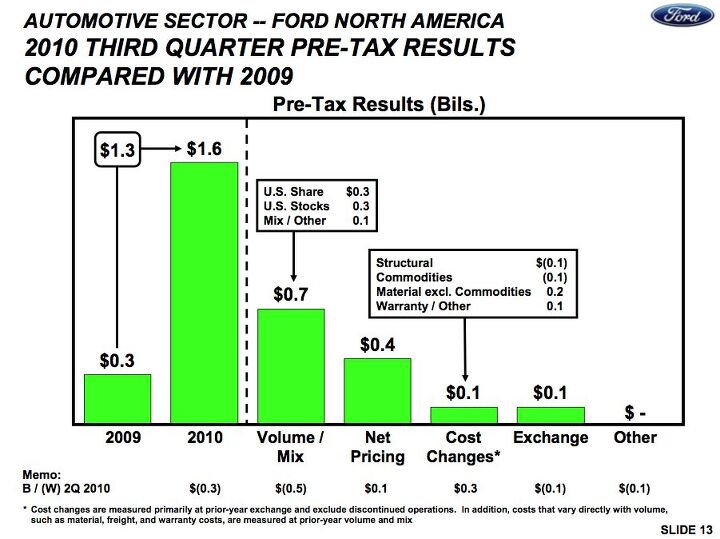

But where is Ford pulling those profits from? Volume and market share are up, and as identified yesterday, Net Pricing is a major contributor. Selling Fiestas for more than the cost of a Corolla is a great way to inflate already-healthy profits. But mix is important as well. Much of Ford’s volume gains have been in profitable trucks, as the F-Series is having one of its better years in some time.

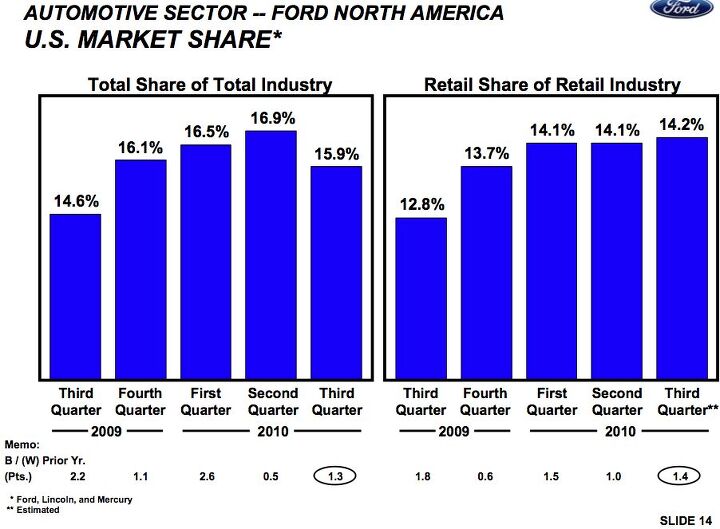

After all, Ford’s North American market share actually declined significantly in the third quarter… but its retail share actually increased. This seems to prove that Ford is getting off the fleet-sales jag that has brought overall sales levels up, and has particularly buoyed the Detroit firms. And why not? Ford is making enough money due to consumers choosing its more profitable products, and by securing better transaction prices for its vehicles. Though Ford ran at 30 percent fleet for most of the year, it hasn’t seemed to hurt demand, and Ford’s proving that it can lay off the “empty calorie” volume and focus on making money.

And making money it is. If Ford can end the year with more cash than debt and keep its sales and pricing momentum up into next year, when key products like the 2012 Focus launch, it will cement the Blue Oval’s status as the Detroit automaker to beat.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Kjhkjlhkjhkljh kljhjkhjklhkjh A prelude is a bad idea. There is already Acura with all the weird sport trims. This will not make back it's R&D money.

- Analoggrotto I don't see a red car here, how blazing stupid are you people?

- Redapple2 Love the wheels

- Redapple2 Good luck to them. They used to make great cars. 510. 240Z, Sentra SE-R. Maxima. Frontier.

- Joe65688619 Under Ghosn they went through the same short-term bottom-line thinking that GM did in the 80s/90s, and they have not recovered say, to their heyday in the 50s and 60s in terms of market share and innovation. Poor design decisions (a CVT in their front-wheel drive "4-Door Sports Car", model overlap in a poorly performing segment (they never needed the Altima AND the Maxima...what they needed was one vehicle with different drivetrain, including hybrid, to compete with the Accord/Camry, and decontenting their vehicles: My 2012 QX56 (I know, not a Nissan, but the same holds for the Armada) had power rear windows in the cargo area that could vent, a glass hatch on the back door that could be opened separate from the whole liftgate (in such a tall vehicle, kinda essential if you have it in a garage and want to load the trunk without having to open the garage door to make room for the lift gate), a nice driver's side folding armrest, and a few other quality-of-life details absent from my 2018 QX80. In a competitive market this attention to detai is can be the differentiator that sell cars. Now they are caught in the middle of the market, competing more with Hyundai and Kia and selling discounted vehicles near the same price points, but losing money on them. They invested also invested a lot in niche platforms. The Leaf was one of the first full EVs, but never really evolved. They misjudged the market - luxury EVs are selling, small budget models not so much. Variable compression engines offering little in terms of real-world power or tech, let a lot of complexity that is leading to higher failure rates. Aside from the Z and GT-R (low volume models), not much forced induction (whether your a fan or not, look at what Honda did with the CR-V and Acura RDX - same chassis, slap a turbo on it, make it nicer inside, and now you can sell it as a semi-premium brand with higher markup). That said, I do believe they retain the technical and engineering capability to do far better. About time management realized they need to make smarter investments and understand their markets better.

Comments

Join the conversation

Used part of my profits from Ford stock to buy a new Mustang Convertible. Win-win. :-)

It seems that the CNN/Money/Fortune Businessperson of the Year voting is coming down to a final round of Alan Mulally vs Steven Jobs. Mulally is crushing Warren Buffett in the semi-final round (95% to 5%). In the previous round Buffett defeated Ratan Tata.