#October2014

America's 10 Fastest Growing Vehicles: October 2014 YTD Sales

The Chevrolet Corvette is the fastest growing auto nameplate in America through the first ten months of 2014.

Four of the other members of this list of America’s fastest growing vehicles are also General Motors products.

Corvette volume is up 146% this year, an improvement of 17,150 units. Two other nameplates, the Lexus GX and Mercedes-Benz S-Class, have both doubled their October 2013 year-to-date volume.

Chart Of The Day: How Many Subcompact SUVs Are Automakers Selling?

The Chevrolet Trax, Fiat 500X, Honda HR-V, Jeep Renegade, and Mazda CX-3 are coming. The Buick Encore, a pair of taller Minis, and the Nissan Juke are already here.

It’s a burgeoning segment, silly in the eyes of many, but useful for automakers who want to cash in on consumers’ desire for fuel efficiency and slightly higher driving positions, consumers who are forever interested in a little wheelarch cladding.

However, these vehicles don’t even combine to sell as often as the Honda CR-V, America’s top-selling SUV/crossover. That’s not to say they won’t. Nor are we suggesting that buyers of these vehicles would consider something as mainstream as a CR-V, Escape, or RAV4, America’s top-selling utilities.

Subaru's WRX/STi Is Outselling The BRZ and FR-S Twins Combined

Through the first ten months of 2014, Subaru has sold 19,969 copies of their Impreza-based WRX and STi, 996 more than the number of Toyobaru sports cars sold in America this year.

WRX/STi sales are up 35% through the end of October 2014, a 140% increase compared with the full 2010 calendar year, 45% compared with all of 2011, 47% compared with 2012, and 11% compared with all of 2013.

2014, as you know, is not over yet. Subaru USA has been selling just under 2000 WRXs and STis per month.

Year-over-year volume has increased in 24 consecutive months. Nearly three out of every ten Imprezas sold is either a WRX or an STi.

All The Minis Are Down Except The One That Counts

They’ve been certified, although not with the fuel economy figures we first heard. They’re available, although many Mini buyers will want their cars individually tailored. And as a result, U.S. sales of Mini’s core model – the one they call the Hardtop – jumped 64% in October 2014.

All other Mini variants posted fewer sales in October 2014 than in October 2013. In some cases, the declines represented significant losses.

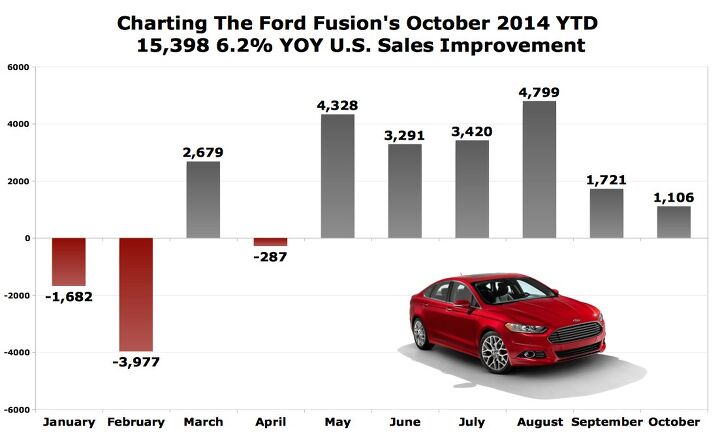

Midsize Aston Fusion Is Ford's Bright Car Light

Ford division car sales in the United States are down 4% in 2014. The automaker’s eight-nameplate passenger car lineup, including two Lincolns, is down 3.8% over the last ten months.

Imagine how much worse it would be without the Fusion, sales of which have risen 6.2% to 263,431 units this year. After the Fusion broke its 2011 sales record last year, 2014 is bound to be an improved year again, as the midsize Ford is on track to break through the 300K barrier for the first time ever. The last time a Ford car generated more than 300,000 U.S. sales in a single year was with the Taurus in 2005, the year the Fusion went on sale.

Exclude the Fusion from Ford’s passenger car sales equation and year-to-date car volume at the Ford brand would be down 9.9% in 2014.

Small/Midsize Truck Sales Up 19% In October 2014

U.S. sales of small/midsize/non-full-size pickup trucks jumped 19.4% in October 2014, a gain of 3672 units compared with October 2013.

Sales of the Toyota Tacoma were up 5%. Nissan Frontier sales shot up 25%. Not surprisingly, the slowly disappearing Honda Ridgeline was down 35%. GM’s new pickup trucks contributed an extra 2158 sales. Even without those additional Colorados and Canyons, the category would have risen 8% despite the Ridgeline’s sharp but relatively inconsequential decline.

Audi USA Sold More A3s Than A4s In October 2014

Are times changing, or was October nothing more than an optimal arranging of circumstances in favour of Audi’s smallest sedan?

Audi USA sold more A3s than A4 sedans in October 2014, a serious shift from a year ago when the old A3 hatchback was dead and Audi sold 3040 A4s.

Versa Still Rules Roost As Fit Sales Reach 42-Month High In October

American Honda reported the Fit’s best October ever last month. At 6851 U.S. sales, Fit volume was up 83% year-over-year to the highest total since April 2011, when Fit sales shot up 73% to 8116.

The new Fit, the third version of Honda’s sub-Civic car for North America has certainly been well-received early on in its tenure. With Honda sales rising to the highest October level ever and a new Mexican-built version of the brand’s least costly car finally readily available, seeing the Fit rise to new heights was not an unexpected occurrence.

It’s no E-Type on the outside, but the Fit’s purposeful design pays dividends inside for owners and even passengers. It is in some ways a mini-MPV with a very monobox shape. It’s not conventional, but its flexibility makes it strangely desirable as a result. Honda’s share of the subcompact category grew to 17.8% in October 2014, up from 10.8% a year ago and 10.6% in calendar year 2013 as a whole. It’s worth noting, as well, that the Fit is available only as a hatchback, while the four other members of the subcompact category’s October top five are sold as hatchbacks and sedans.

It’s also worth noting that the category continues to be controlled in large part by the cheap-and-roomy Nissan Versa, sales of which improved 29% in October 2014 to 11,097 units, 28.8% of the segment’s total.

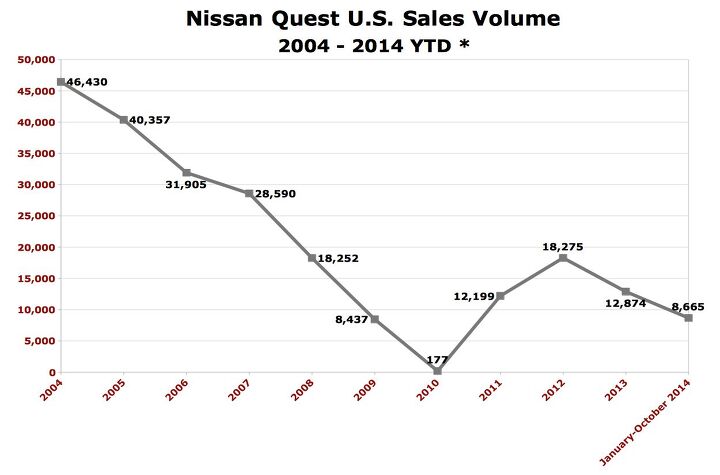

Nissan Quest U.S. Sales Reach 45-Month Low In October 2014

October 2014 was the lowest-volume U.S. sales month for the latest, fourth-generation Nissan Quest since the van debuted nearly four years ago in January 2011.

Minivan sales in America slid 2% in October 2014 but have risen 5% this year. Quest volume plunged 54% in October. Quest sales are down 23% this year. No minivan sold less often than the Quest in October, not even the cancelled Mazda 5.

Canada Auto Sales Recap: October 2014

In October 2014, for the first time since March of this year, the Chrysler Group outsold all other automobile manufacturers in Canada.

The margins were slim: only 259 units separated Chrysler Group’s five brands from the Ford Motor Compan y; only 301 stood between the Chrysler Group and General Motors. But these are celebratory moments for an automaker which owns 15.6% of the Canadian market. Chrysler Group’s market share in its “home” U.S. market stands at 12.6% through the first ten months of 2014.

Chronicling The Captiva Sport's Brief U.S. Sales History

The esteemable Jack Baruth backed one up toward an odd-looking statue back in March. Sales then boomed in April and May.

Post hoc ergo propter hoc.

In truth, Jack was no fan of the Chevrolet Captiva Sport he rented earlier this year, saying, “It won’t strike the desirability chord in anyone’s heart,” and, “This is a car to avoid at all costs.”

Fleet buyers, including most especially the rental car companies in the United States, did not avoid the Captiva Sport. They flocked to the reclothed Saturn Vue in large numbers.

Chart Of The Day: The Pickup Truck Portion

Pickup truck sales increased 10% in the United States in October, an 18,590-unit jump in a market which grew 6%. Besides drawing attention to the, “The people buy trucks because the fuel is cheap,” argument, which is not at all completely false nor entirely true, the 10% increase drew our attention to the massive figures generated by the biggest nameplates and their expansive product ranges.

We’ve covered truck sales already this month, so rather than taking another deep dive into October’s specifics, consider instead the percentage of America’s growing auto market that belonged to the pickup truck category last month: 15.8%.

That’s not a small number. Indeed, it’s a significantly larger number than the one achieved by the category through the first ten months of 2014: 13.8%. For perspective, however, think back one decade. In 2004, 19% of the new vehicles sold in America were pickup trucks.

Nissan Defies Trends, Keeps Selling More Cars In America

In the steadily growing U.S. new vehicle market, car sales have increased just 1% through the first ten months of 2014.

Nissan, however, says their car sales have grown 15.5% in 2014, surging forward by more than 90,000 units to 669,538.

In calendar year 2013, total new vehicle sales were up nearly 8%, but car sales grew just 4% during a year in which, for example, pickup trucks were up 12%.

2014 hasn’t been so kind to cars, with the Chrysler Group’s passenger cars collectively falling 15%, Ford Motor Company car sales sliding 4%, GM cars up less than 2%, American Honda car sales up less than 1%, Hyundai car sales down 3%, total Toyota/Lexus/Scion cars up just 1%, and the Volkswagen brand’s cars down 12%.

Now Is The Acura TLX A Hit?

In September we asked if the TLX could restore Acura’s car business. In October, we realized that by Acura standards, the TLX could quickly end up as a hit. And now in November, with October 2014 U.S. sales results in hand, the Acura TLX is a hit.

We could apply all manner of qualifying statements: it’s early; other cars are transitioning to a new model year as Acura ramps up the TLX; year-over-year comparisons only highlight the dire straits which were afflicting the TLX’s predecessors; the TLX is relatively inexpensive and thus obviously a more justifiable proposition for buyers moving up to “luxury” cars.

Or, the TLX is exactly what potential Acura customers had been desirous of for years. Not too big, not too small. A choice between an efficient four-cylinder or a similarly efficient but far more powerful V6. Front or all-wheel-drive. Transmissions which, at least in terms of ratios, leapfrog the competition. Somewhat subdued but not unattractive styling. And an advertised base price below $31,000.

The result? Only four premium brand cars – 3-Series/4-Series, C-Class, ES, 5-Series – and only six premium brand vehicles – RX and MDX included – outsold the TLX in October 2014.

Best-Selling Midsize Car: Chrysler 200, In Canada, In October

Canada’s best-selling midsize car? The Chrysler 200.

At least, that was the case in October 2014, a month in which sales of the 200 jumped 120% to 1800 units. Even with the near-disappearance of the Dodge Avenger, the fraternal twin of the new 200’s predecessor, Chrysler Canada midsize car sales grew 64% last month.

Odd as this may sound for U.S. observers, it’s not completely out of the blue in Canada. Nor did we arrive at this point without an explanation.

Recent Comments