#MarketShare

Love for Luxury Cars in California and Florida Is Skewing National Luxury SUV Market Share

Depending where you live, it’s possible the shift away from luxury cars to luxury SUVs is dramatically more apparent than America’s nationwide figures suggest.

In 48 of 50 states, luxury utility vehicles outsell luxury cars. In seven states, premium brand utility vehicles form more than 65 percent of the premium market.

But according to Edmunds, the two states in which luxury cars still outperform luxury utility vehicles account for 31 percent of America’s luxury SUV market.

Toyota Sees All Upside for 2018 Camry If Rivals Decide to Focus Purely on SUVs

As Toyota watches its RAV4 quickly climb sales charts, the Japanese behemoth estimates it will sell fewer copies of its new-for-2018 eighth-generation Camry than it has in six years.

According to Reuters, Toyota is targeting 30,000 monthly Camry sales in the U.S. once the 2018 model fully takes over. That’s 360,000 Camry sales per year, well below the 412,000-unit average Toyota has managed over the last half-decade; 7-percent below last year’s output.

Toyota considers the thought of overall midsize sedan demise “inconceivable” but is by no means blind to the segment’s evolution. Recent deaths, such as the Chrysler 200 and Dodge Avenger, followed the disappearance of the Mitsubishi Galant, Suzuki Kizashi, and domestic nameplate removals, as well. Remember the Mercury Milan, Pontiac G6, and Saturn Aura?

But as the midsize segment struggles, Toyota looks down from its lofty perch and sees the odds increasingly turning in the Camry’s favor. “If other automakers left the sedan market to focus more on SUVs,” Camry chief engineer Masato Katsumata says, “that would be an opportunity to expand our market share of the segment.”

Stand By Your Crossover: Loyalty Skyrocketing Among Utility Owners, Study Finds

What’s big these days? You know the answer. Avocados. Leasing. Saying “it me” on Twitter. But above all else, crossovers and SUVs.

Not only have utility vehicles become the driving force in the North American automotive marketplace, ownership of these versatile vehicles is apparently becoming harder and harder to quit. More than ever, owners of crossovers and SUVs find themselves bolting from their old utility vehicle into a brand new one.

As for sedan buyers, never has love drained so quickly from a relationship.

In With the Good Sales, Out With the Bad: GM Plans to Further Shrink Fleet Sales

General Motors has decided to further shrink its outgoing fleet of rental vehicles to prioritize its in-house vehicle lending service, Maven, and focus on getting newer cars to customers. That does mean building fewer vehicles overall, but GM shouldn’t care if it can keep raking in the profits — something rental fleets aren’t particularly good at in lower volumes, unless you’re the one charging a daily rate.

Alan Batey, president of GM’s North American operations, claims sales to rental fleets should drop by about 50,000 units this year and an undisclosed amount in 2018. It follows the company’s trend to scale back fleet sales in general. Big businesses accounted for 16.1 percent of its total U.S. sales in 2014, but that was reduced to 11.7 percent in 2016.

What Happened To Ford's U.S. Market Share During The Mark Fields Era?

Prior to this morning’s announcement that outgoing Ford Motor Company CEO Mark Fields is “retiring,” Fields was in charge at the Blue Oval for nearly three years. Just a little more than ten quarters, to be more precise.

In eight of those quarters, Ford Motor Company U.S. market share declined, year-over-year.

Ford was not without excuse, of course. There was always market share to be taken if Ford wanted it. But an attempt to limit reliance on daily rental fleet sales, particularly with Ford’s passenger car division, did the automaker’s market share no favors. Ford’s transition from old F-150 to the new aluminum-bodied model was a major switch, too, and sales growth during the transition phase wasn’t easy to come by.

Nevertheless, Ford’s U.S. market share didn’t nosedive during the Mark Fields era. The burden on incoming CEO Jim Hackett’s shoulders won’t be the elevation of Ford Motor Company market share in the automaker’s home market.

No, it’s the price of a Ford share that matters right now.

Mazda Wants 2 Percent U.S. Market Share, But Not Just Any Ol' 2 Percent Market Share

“I am not comfortable with 2 percent. I’m comfortable with a good 2 percent.”

– Masahiro Moro, President and CEO, Mazda North American Operations

Mazda’s U.S. market share fell to a 10-year low in 2016 and hasn’t noticeably recovered in the first four months of 2017. A small lineup with no presence in key segments limits Mazda’s chances of becoming a major automaker.

But Mazda doesn’t want to be a major automaker. Mazda wants to be a small but profitable automaker with profitable dealers and loyal buyers.

Mazda also wants to carry greater sway in the U.S. market than it does at the moment. Only slightly. Fractionally more. Marginally, almost imperceptibly more. Only 1.7 percent of the new vehicles sold in the United States are Mazdas. Mazda wants 2 percent, surely a reasonable and easily attainable goal.

But Mazda’s North American boss, Masahiro Moro, has no intention of jumping up to that 2-percent marker rashly or hastily.

Pickup Trucks Tanked In April 2017, Titan Quadruples

After improving in 11 consecutive months, U.S. sales of pickup trucks declined 4 percent in April 2017.

8 of the 11 truck nameplates on offer in America sold less often in April 2017 than in April 2016, causing declines in both the dominant full-size pickup truck sector and in the until-this-year burgeoning midsize category.

One month does not a trend make, but April’s downturn didn’t represent the first batch of evidence suggesting a forthcoming pickup truck sales slowdown.

Granted, not all trucks are heading in the same direction.

Nissan Titan sales quadrupled in April 2017.

QOTD: Which Car Models Need to Die Immediately?

Today’s marketplace is a crowded affair. Each manufacturer seems to sit down at the table every new model year with more. More variants, more things with all-wheel drive, more CUVs, and more vehicles which split the pieces of the sales pie down to ever smaller fragments. This fragmentation leads to the eye splinter above, whatever the hell Toyota thinks it is, which will clog up parking lots everywhere starting next year.

To cure this portion issue, I think some models need to die, and I want you to help me choose which ones.

Toyota to Boost Tacoma Production as Midsize Sales Lead Slips

The Toyota Tacoma entered the year in an enviable position. Soaking up nearly half of all sales in the growing midsize pickup segment, the venerable nameplate’s spot on top of podium seemed unshakable.

Eight months later, Toyota seems spooked. The Tacoma’s market share is eroding, down to 38 percent of the midsize segment in August as its competitors surge. To stay ahead, the automaker plans to send a bundle of cash south of the border to boost production, Automotive News reports.

GM Is Losing All Kinds Of Market Share, And It's OK With That

“Has GM lost market share? Yes.”

Alan Batey, President, GM North America,

Wall Street Journal, July 6, 2016

From 17.7 percent in the first-half of 2015, General Motors’ U.S. market share tumbled by more than a point to 16.6 percent in the first-half of 2016.

But, GM’s North American president points out in a Wall Street Journal opinion piece, profitability is on the rise.

TrueCar estimates that, as a percentage of the average transaction price, GM’s incentive spend in June 2016 fell by half-a-percentage point to 10.9 percent, year-over-year. As for the average transaction price, TrueCar says GM’s rose 6.5 percent in June 2016 to $36,489. That is 9.4-percent higher than Fiat Chrysler Automobile’s June 2016 ATP, which also required greater incentives to achieve according to TrueCar. Meanwhile, Batey wrote in The Journal that GM has “reduced low-margin sales to daily rental companies in the U.S. by 88,500 units.”

This explains the marriage of two conflicting subjects: GM’s decreased volume in a growing market and GM’s corresponding increase in profitability.

Chart Of The Day: U.S. SUV/Crossover Market Share Surges In July 2015

U.S. sales of SUVs and crossovers jumped 14 percent in July 2015, a year-over-year improvement equal to more than 67,000 extra sales compared with July 2014.

As a result, just under 36 percent of the U.S. auto industry’s volume was produced by utility vehicles in July 2015, a three-percentage-point increase over the same period one year ago.

Passenger car volume, meanwhile, slid 3 percent last month, a drop of around 18,000 sales as the overall market grew by more than 5 percent, or 75,000 units.

Chart Of The Day: Automaker Market Share In America – July 2015

As the U.S. auto industry’s sales volume grew by more than 5 percent to 1.5 million units in July 2015, General Motors increased its July market share from 17.8 percent in 2014 to 18.0 percent in July 2015. GM says their retail sales jumped 14% last month. Total GM sales were up 6%.

Toyota Motor Sales saw their share of the U.S. market fall from 15 percent in July 2014 to 14.4 percent in July 2015 even as their premium Lexus division ended the month with more sales than BMW or Mercedes-Benz.

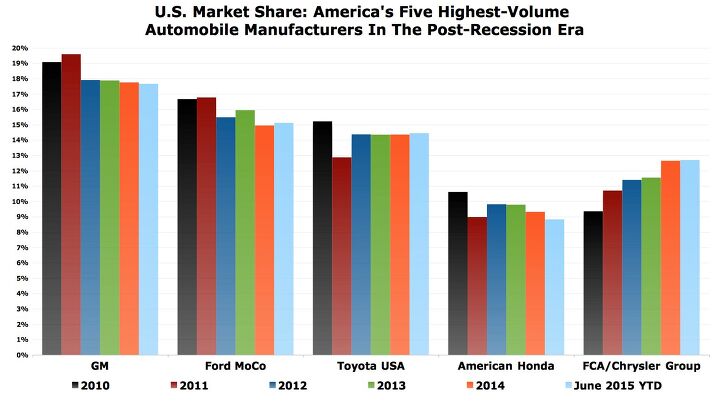

Chart Of The Day: Post-Recession Automaker Market Share In America

Since 2010 — when America’s auto industry was in tatters but also in recovery — General Motors, Ford Motor Company, Toyota USA, and American Honda have lost 5.5 percentage points of market share.

Through the first half of 2015, those four automobile manufacturers produced 56.1 percent of all new vehicle sales in the United States, down from 61.6 percent in calendar year 2010.

Chart Of The Day: U.S. Automaker Market Share In America – June 2015 YTD

General Motors generated 17.7% of the U.S. auto industry’s new vehicle sales in the first-half of 2015, a slight decline from the 17.8% market share earned by GM in the same period one year ago.

GM, the top-selling automobile manufacturer in the United States, posted a 3.4% year-over-year sales improvement through the first six months of 2015, but that was a full percentage point off the pace set by the industry as a whole.

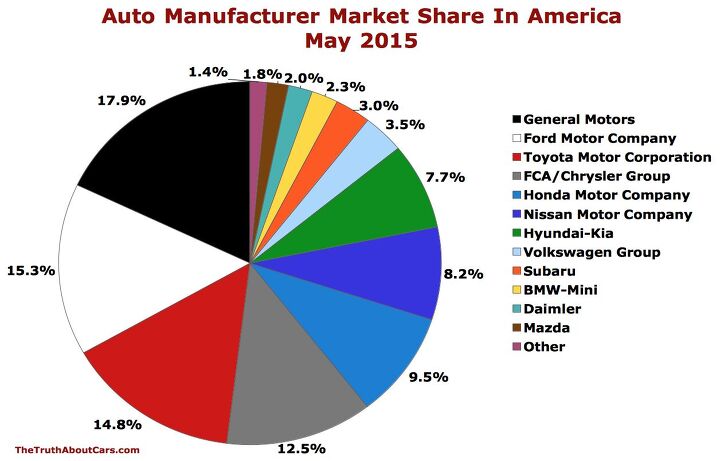

Chart Of The Day: Auto Brand Market Share In America In May 2015

General Motors earned 17.9% of the U.S. auto industry’s sales volume in May 2015, a drop from 18.5% one month ago but a slight improvement compared with May 2014, when GM’s market share stood at 17.7%.

In May 2015, GM’s U.S. sales grew at a 3% clip, twice the rate of improvement posted by the overall auto industry. GM’s gains came mainly as a result of improved pickup truck volume and a strong month for Lambda crossovers.

Recent Comments