#HighFinance

GM Withdraws $14.4b Government Loan Request

GM And GMAC: Together Again?

One of the more dangerous conflicts embedded in the US auto bailout that was identified in the recent Congressional Oversight Panel report has been a TTAC hobbyhorse for some time, namely the tradeoff between GM’s success and that of its former captive finance arm GMAC (now known as Ally Financial). As we wrote back in May,

if government-owned Ally isn’t interested in underwriting GM’s volume gains with risky loans but also isn’t interested in seeing its auto lending business bought by GM, there’s trouble brewing. After all, that would leave GM with only two options: partnering with another bank, or starting a new captive lender. Either way, a new GM captive lender would likely force Ally into offering more subprime business anyway, or face losing its huge percentage of GM business.

Fast forward the better part of a year, and GM has indeed bought its own in-house subprime lender, leaving the COP to term The General’s lack of interest in taking care of “the Ally Tradeoff” as “disconcerting.” After all, with over 20 percent of GM’s equity and over 70 percent of Ally’s stick, the Government should have been able to work out some kind of deal that gets GM and Ally back on the same page… right? Not so fast, reports the WSJ. Ally turned down a $5b GM offer for its wholesale lending business earlier this year, and now it seems another deal may be in the works. But it has nothing to do with maximizing taxpayer payback, and everything to do with shoring up GM’s floorplanning credit. And it’s not coming from the government, but from GM’s newly-ubiquitous CEO Dan Akerson.

Fiat And Chrysler: Alone At Last

Fiat split its auto business from the rest of its industrial operations today, creating two new companies: Fiat and Fiat Industrial. Fiat CEO Sergio Marchionne announced the move as a way for Fiat to unlock its share value and concentrate on its core business, telling the AP [via Newser]

This is a very important moment for Fiat, because it represents at the same time a point of arrival and a point of departure. Faced with the great transformations in place in the market, we could no longer continue to hold together sectors that had no economic or industrial characteristic in common.

But with Fiat Industrial taking care of the truck-and-tractor side of the business independently, Fiat SpA is focusing on the task at hand: Chrysler. With a 35 percent stake in the bailed-out American automaker in the bag, Fiat is aiming for a controlling stake when Chrysler’s IPO hits the markets later this year. And though the spin-off of FIat’s non-automotive business opens the door for a full merger of Fiat and Chrysler, Marchionne denies that a full merger will take place, saying only that

I don’t know whether it is likely, but it is possible that we’ll go over the 50 percent mark if Chrysler decides to go to the markets in 2011. It will be advantageous if that happens.

But don’t mind Sergio’s equivocation. Fiat will almost certainly snap up the remainder of a controlling stake by the end of this year. Here’s why…

GM Buys $2.1b Of Government's Equity

GM Seeks Pay Leeway From Treasury

Subprime Auto Sales Heat Up

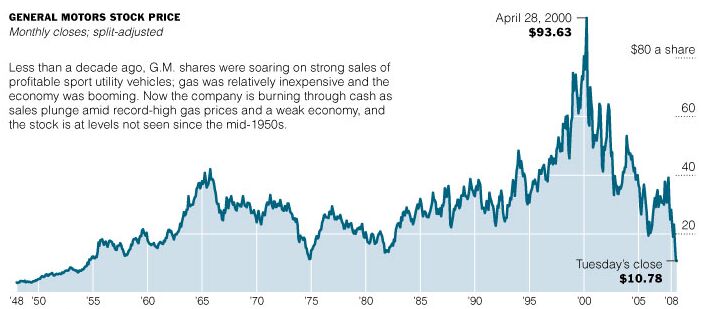

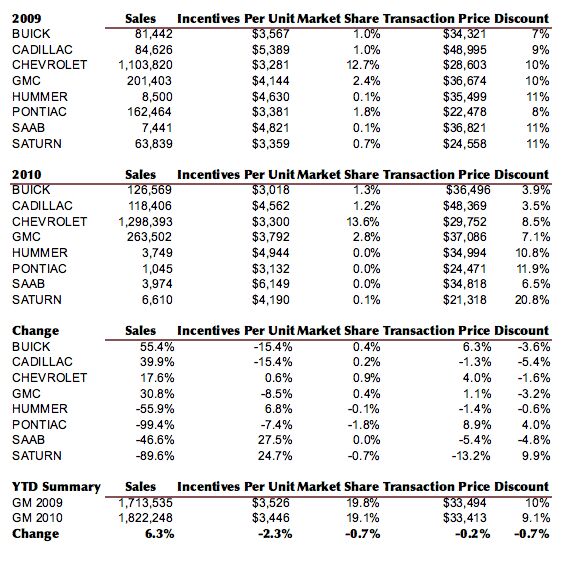

The debate over Detroit’s bailout was dominated by a narrative that portrayed the automakers as victims of Wall Street excess, and placed blame for their collapse on the frozen credit market. And though the credit crunch certainly hurt GM and Chrysler as well as their customers, Detroit was a victim of the credit crunch in the same way an addict is a victim of his dealer. By l everaging easy credit to fuel the SUV boom which covered for unprofitability in passenger cars (or didn’t, as the case may be), Detroit binged on zero-percent financing as the market road confidently to 16m annual sales. And then, finally, the music stopped and the Domestics crumpled, victims of their own greed, but with a convenient scapegoat in the hated Wall Street bankers. But if the bailout was intended to not only get GM and Chrysler back on their feet but also to prevent future collapses, there’s some troubling news in the offing: subprime auto lending is starting to roar back, and if it goes unchecked, it could reach pre-recession levels in short order…

GM Drops $4b On Underfunded Pensions

GM-Daewoo Finally Pays Down Its Debt

The Korean Development Bank, which owns 17 percent of GM’s GM-Daewoo Korean subsidiary, has been rolling about a billion dollars in Daewoo’s debt over on a monthly basis for most of this year. The debt, a legacy of a $2b+ loss on currency speculation. Now, The Korea Times reports that GM-Daewoo has paid back about a billion of that mature KDB debt, as GM-Daewoo boss Mike Arcamone explains

this action reflects GM Daewoo’s strong financial performance this year enabling us to make full payment on the outstanding facility … Full repayment of the credit facility will decrease the company’s future borrowing costs

Flush From GM's IPO, UAW Targeting New VW Plant

GM’s stock may be hovering near its IPO price of $3/share, but the UAW doesn’t need much more growth to cash out with every penny it wanted from GM. The UAW’s VEBA account has banked $3.4b in stock sales so far, and Forbes reports

The VEBA will break even on its investment if it can sell the remaining 206 million shares at an average price of $36.96.

Taxpayers, meanwhile, need GM’s stock to top at least $52/share in order to break even on the bailout that it funded. Because it’s just not a bailout unless the least deserving benefit the most. Meanwhile, with its accounts once again flush with cash, the UAW is turning South in hopes of accomplishing what it has never accomplished before: unionizing at ransplant auto factory in a right-to-work, Southern state.

Redflex Approves Executive Raises, Expects Profit

Redflex shareholders on Friday approved big pay hikes for the photo enforcement firm’s top management at the annual meeting in Victoria, Australia. Redflex has cornered 44 percent of the red light camera and speed camera market in the US, although Arizona-based rival American Traffic Solutions (ATS) is catching up to its down under competitor with a 41 percent market share.

General Motors, Public Company

GM IPO: Go Ask Opel (Or Daewoo)

With news that GM’s IPO price could be headed as high as $33/share (only $10.67 more per share to taxpayer payback!), boosting the offering to some $12b, some might think that the decks have been cleared of skeptics. Not so. Though GM has emphasized its international flavor during its IPO pitch, it’s stayed away from the fact that its overseas operations haven’t been immune to trouble. Take Opel (please). Though invaluable as a development center for GM’s upscale global products, Opel is miles of bad road away from actual profitability. Just ask the guy who tried to buy Opel back when the General was trying to fire-sale its European operations.There is a lot of euphoria about the IPO, but if you dig into the numbers, they still have a problem in Europe. They are doing worse than when we looked at them two years ago, and it’s going to take a lot of cash to fix Opel. That’s my concern on the IPO.

GM Releases Non-GAAP Q3 Results

Tesla Lost $34.9m In Q3, Dropped $103m Year-To-Date

California EV maker Tesla has reported its Q3 results, and they’re a sizable helping of not great. But before we dive into the messy reality, let’s check in with CEO Elon Musk for an unreasonably rosy take on the loss:

We are very pleased to report steady top-line growth and significant growth in gross margin, driven by the continued improvement in Roadster orders and our growing powertrain business. Roadster orders in this quarter hit a new high since the third quarter of 2008, having increased over 15% from last quarter. While some of this is due to seasonal effects associated with selling a convertible during the summer months, we are pleased with the global expansion of the Roadster business and the continued validation of Tesla’s technology leadership position evidenced by our new and expanding strategic relationships

Translation: Toyota is investing in us… now get out of here with your awkward questions. Unfortunately for Mr Musk, it isn’t quite that simple…

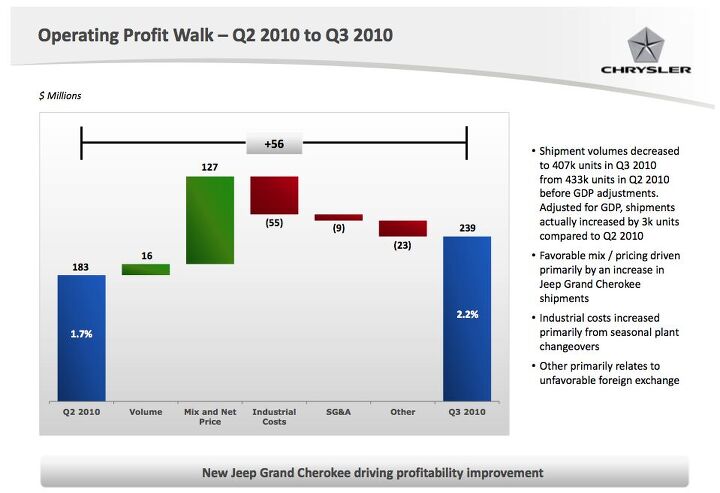

Carried By New Grand Cherokee, Chrysler Loses $84m In Q3

Chrysler lost $84m last quarter on an operating profit of $239m, showing slow but consistent progress from last quarter’s $172m loss [Press release here, slides here, both in PDF]. Chrysler has lost $453m since the beginning of this year. Overall deliveries and sales were down slightly compared to Q2 2010, but thanks to a strong launch for the profit-generating Grand Cherokee, revenues were up just over 5 percent to $11b. As the slide above proves, “Mix and Net Price” accounts for one of the biggest contributions to operating profit, and that’s largely thanks to the new Grand Cherokee which (at 12,721 units last month) is the second-best selling vehicle in Chrysler’s lineup after Ram pickups. That’s a good sign for the future of a company that needed a hero, but there are some troubling signs under the surface.

Recent Comments