#HighFinance

Desperately Seeking Subprime: White House Admits GM's IPO Dash Hurting Ally's TARP Payback

The WSJ [sub] reports that GM is officially looking outside of its former captive finance arm Ally Financial (formerly GMAC) as it seeks more subprime loan deals to drive sales volume ahead of its IPO. GM execs tell the WSJ that The General could do even better with an in-house finance arm, but that these deals will help. And, according to Experian Automotive’s Melinda Zabritski, GM needs the help because

By not financing [subprime] consumers, they are locking out about 40% of the U.S. population

GM’s restructuring consultants AlixPartners add that loyalty improves for customers who buy using a captive lender. The downsides? Higher default risks, the temptation to overload on incentives, and then there’s one more biggy…

GM Filing IPO Paperwork As Soon As Next Week

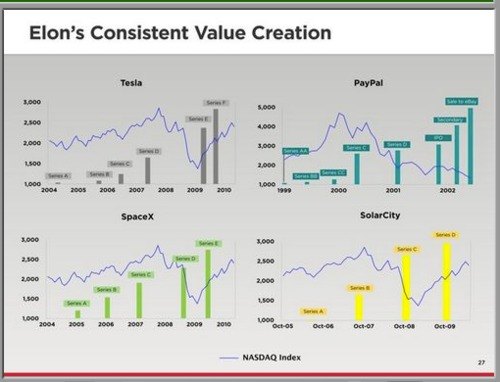

Chart Of The Day: Musk Versus The Market Edition

Tesla Revises IPO To $178m-$185m

Toll Road Giant Makes A Move On Red Light Camera Company

Toll road giant Macquarie Bank this week announced its intention to acquire the leading operator of red light cameras and speed cameras in the US. Macquarie, known for its skill in harnessing government guarantees to make itself a “millionaire’s factory,” made an offer to purchase Redflex Traffic Systems of Australia at the bargain price of A$2.50 a share.

Canada Won't Sell GM Stake In IPO… What About The US?

Quote Of The Day: Wall Street's Burden Edition

Handling [GM’s] IPO assignment is something of a vanity project for the Wall Street banks, given the relatively small fees the banks will earn through the process. One person familiar with the offering said that the banks may earn less than 1% of the overall deal. At a valuation of $10 billion, that would equal a total fee pool of $100 million.

The Wall Street Journal [sub]’s take on the forthcoming GM IPO. Persons anonymous tell The Journal that Morgan Stanley and JPMorganChase are the frontrunners in the vanity project sweepstakes. But as charitable as the one-percent arrangement seems, the Wall Street mavens have their work cut out for them…

SEC Seeks Three-Year Securities Work Ban On Rattner

Somewhere under a “Mission Accomplished” banner on an aircraft carrier, former car czar Steve Rattner is starting to get a bit lonely. Reuters reports that the Securities and Exchange Commission is seeking a three year ban on Rattner that would prevent him from working in the securities field. The ban stems from a recently-settled investigation into kickback allegations at Rattner’s former investment firm Quadrangle Group (involving a distribution deal for his brother’s low-budget movie “Chooch,” no less).

Treasury Hires Lazard As GM Moves Towards IPO

The Detroit News reports that the Treasury Department has hired Lazard Frères & Co. as an advisor to GM’s forthcoming IPO sale. And with news of the hiring comes confirmation that GM’s IPO really is coming soon: the investment bank will receive half a million dollars, according to the DetN, but that amount will drop to $250,000 if the IPO isn’t completed within one year. If you’re one of the GM boosters who believes that an IPO will repay all or most of the government’s investment in GM, it’s time to start saving those pennies. You have less than a year now to put your money where your mouth has been.

EV Startup Coda Snags $58m Investment

On the strength of Coda Automotive’s plan to launch a $45,000 EV conversion of a Chinese Hafei sedan, our coverage of the EV startup (formed from the ashes of Miles Electric Vehicles) has pretty much been limited to the conclusion that it “make the Volt look good.” And as the competition has moved forward, the venture isn’t looking any better by comparison. With news that Nissan will be able to manufacture its Leaf batteries for the low, low price of under $400 per kWh ( if all goes to plan, anyway) rocking the EV community, Coda’s proposition of asking $45,000 for a 33.8 kWh lithium-ion battery with a Chinese compact sedan attached to it has not aged well (conservatively assuming the Hafei costs $15k, that still breaks out to nearly $900 per battery kWh, as crude as the comparison may be). But don’t let a little common sense worry you about Coda’s future: according to a company press release [via PRNewswire] the firm just scored a cool $58m in an oversubscribed fundraising round that leaves it with over $125 in total investments.

Chrysler Beats GM To Non-Prime Loan Deal

As non-executive vice-chairman of the Swiss bank UBS, Chrysler CEO Sergio Marchionne has deep connections with the European banking community. Now, under threat of losing its primary lender Ally Financial to GM’s dreams of a return to in-house, subprime lending, Marchionne has leveraged that experience into a non-prime lending deal with a US division of Spain’s Banco Santander. Automotive News [sub] reports that Santander and Chrysler have reached a deal to provide loans to Chrysler customers with sub-650 credit scores that ChryCo reckons could result in an additional 2,000 sales each month.

Chrysler Repays Federal Loan

What, you want more context from a headline? It’s not like we’ve lied to you or anything. Technically, every word of it is true. OK, OK, here’s the fine print: CGI Holding, owners of “Old Chrysler” and Chrysler Financial paid $1.9b of a $4b pre-bankruptcy TARP loan, according to Automotive News [sub]. Though far less than face value, that payback “is significantly more” than what Treasury was expecting in return. In other words, this is great news if you thought the bailout would be a complete loss. Otherwise, it means that the various remains of Chrysler have repaid $3.9b of the $14.3 invested by taxpayers into the company pre-bankruptcy… and unless Chrysler’s IPO brings in about $100b, Treasury will still take a bath on the rescue.

GM Captive Finance Push Explained: The General Wants More Subprime Business

When we first heard that GM was eying a return to in-house financing, our first reaction was to worry that

the potential for falling back into old bad habits can’t be ignored.

Clearly our concern wasn’t wasted, as the AP [via Google] reports that The General’s major motivation for considering re-creating a captive lender is to chase subprime business its current major lender won’t touch. And considering that that lender is GM’s bailed-out former captive finance lender GMAC (now Ally Financial), which was badly burned by subprime mortgages, it’s not surprising that GM is frustrated by GMAC’s tentative approach. But should The General charge into the low-standard lending sectors where Ally fears to tread?

GM Q1 Profit: $865m After Dividends

Daimler Dumps New York Stock Exchange

One of the last vestiges of the Daimler-Chrysler union is being swept away, as Daimler has announced that it will delist from the NYSE. Daimler initially listed itself on Wall Street in 1993, as it began its “marriage made in heaven” with Chrysler. Since then, Daimler says advances in electronic trading make it easier for traders to buy and sell its Frankfurt listings, and that the low volume of NYSE trading isn’t worth all the financial regulation that comes with a Wall Street listing. According to the company, less than five percent of its trading volume comes through its US listing. This means no more SEC filings from the German firm, although it insists that the US market remains important to its business and that it wants to maintain open communication with American investors who own 17 percent of Daimler’s shares. And it definitely has nothing to do with the company’s recent settlement of a bribery investigation by the DOJ. Or the fact that Chrysler could find itself back on the exchange within another year.

Recent Comments