#HighFinance

Ford Shareholders Meeting: Profit This Year, But No Dividend

After four straight profitable quarters, Alan Mulally’s forecast today of a “solidly profitable” 2010 shouldn’t come as a huge surprise. But, as Executive Chairman Bill Ford put it to Ford shareholders at the company’s annual meeting [via AP],

It is the very early days in our recovery. We still have a lot of debt

And he’s not kidding. As of the end of Q1 2010, Ford was carrying $34b in debt. And though Ford faces a higher cost of borrowing because of its staggering debts, Bill Ford was clear that he wouldn’t trade places with Ford’s Detroit competitors, which cleaned out their balance books, at the expense of government bailouts and accompanying PR problems. After all, while GM and Chrysler were rebuilding, Ford managed to outperform both of them last year by gaining sales and market share. And Ford’s leadership sees that momentum carrying forward into next year.

GM And Chrysler Racing Towards Captive Finance?

News that GM is considering a number of options for a return to captive finance, has lit a fire under Chrysler CEO Sergio Marchionne, who tells the Detroit News that

One of the things that we do not wish under any circumstance is to have an uncompetitive relationship vis-À-vis GM

That would certainly be the case if GM bought up its recently-bailed-out former captive finance arm, GMAC (now known as Ally Financial). Chrysler relies on GMAC for leasing and loans just as much as GM does at the moment, so an Ally buyout would create major long-term problems. But even if GM created a new finance arm, Chrysler doesn’t seem to think that it will be able to survive without forming its own in-house finance department. Which would then compete with GM and Ally, to say nothing of the industry’s other finance competitors. But is the rush to captive finance going to be good for anyone?Obama: Dealer Finance Must Be Regulated

President Obama has weighed in on a crucial matter facing legislators attempting to overhaul America’s financial system: whether or not auto dealer finance should be subject to regulation by the new Consumer Protection Agency. Unsurprisingly, he has come down on the side of regulation, specifically echoing concerns voiced earlier by the Pentagon. The National Automobile Dealers Association has vowed to fight attempts to regulate dealer finance.

Statement by President Obama on Financial Reform

Throughout the debate on Wall Street reform, I have urged members of the Senate to fight the efforts of special interests and their lobbyists to weaken consumer protections. An amendment that the Senate will soon consider would do exactly that, undermining strong consumer protections with a special loophole for auto dealer-lenders. This amendment would carve out a special exemption for these lenders that would allow them to inflate rates, insert hidden fees into the fine print of paperwork, and include expensive add-ons that catch purchasers by surprise. This amendment guts provisions that empower consumers with clear information that allows them to make the financial decisions that work best for them and simply encourages misleading sales tactics that hurt American consumers. Unfortunately, countless families – particularly military families – have been the target of these deceptive practices.

GM Eying Return To Captive Finance?

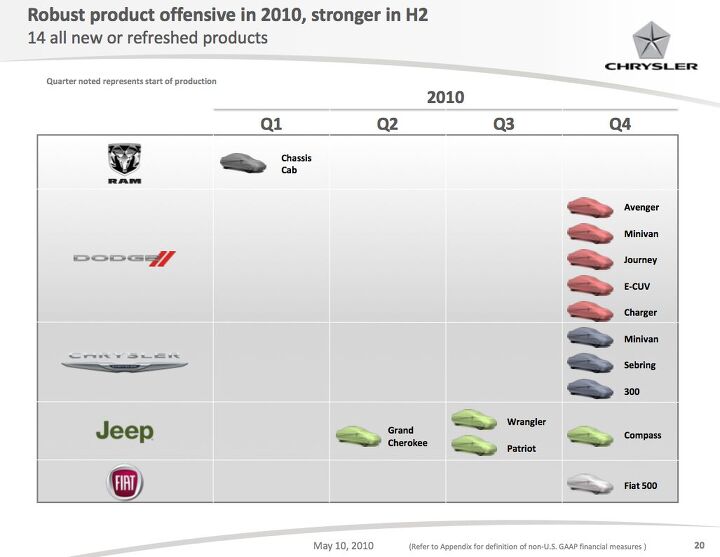

2010 GM And Chrysler IPOs Looking More Likely

Chrysler crowed over its 9.1 percent market share in its Q1 results conference call yesterday, and though CEO Sergio Marchionne refused to be pinned down on an exact time frame, an IPO this year looks more likely than ever. Similarly, BusinessWeek reports that GM’s Ed Whitacre has hinted that a Q1 profit is likely, as is an IPO in Q4 of this year or early next year. This improvement in both bailed-out automakers was underlined by former Presidential Auto Task Force head Steve Rattner, who said the two firms were “meeting expectations,” at a Detroit-area conference. But Rattner also put his expectations into some context by saying

When we did this restructuring we never expected a full recovery of our investment. If it ends up costing us $10 billion we should consider it a success. For about $10 billion we avoided economic and human calamities… I would suggest that that’s a pretty effective cost of government stimulus

That assessment is down considerably from Rattner’s last prediction, which expected a taxpayer profit on the auto bailout.

What's Wrong With This Picture: Here Comes The (Chrysler) Avalanche

GMAC Renames Itself Ally Financial

Perhaps the most fundamental challenge facing bailed-out financial and auto firms is convincing consumers to leave aside their anti-bailout prejudices and start buying their products. For GM, the first step in this process was as simple as repaying a loan and airing a “Mission Accomplished” advertisement that did everything but show Ed Whitacre landing on an aircraft carrier. For GM’s former captive finance arm, GMAC, escaping the stain of the bailout is a more prosaic matter. Having already launched an online consumer-oriented banking arm by the name of “Ally Bank,” the finance company is adopting the innocuous Ally moniker for its entire business, reports the Detroit News.

Senate Moves On Auto Safety, NHTSA "Revolving Door" Legislation, Stands Firm On Dealer Finance Oversight

The Treasury may be standing by GM’s “payback” claims, but the Congress hasn’t exactly been looking for ways to do the auto industry any favors. In fact, a toxic brew of political fallout from the financial crisis, auto bailout, and Toyota recall scandal has seems to have inspired a backlash against the industry that came to a head this week in the US Senate. Legislation has been introduced that would prevent NHTSA officials from taking jobs with automakers for up to three years after they leave the agency, and yet more is being drafted which could require a vast array of standard safety equipment on all cars sold in the US and could even add a federal fee to new car sales. Adding insult to injury, a much-hoped for exception to dealer financing oversight in the new financial reform bill appears to have fallen victim to Senate negotiations. Did nobody tell the old guys that they’re investors in the auto industry?

Ford Pulls In $2.08 Billion Q1 Profit

The Ford Motor Company released its first quarter earnings today [Full report here, Slide presentation here (both PDF)], revealing that it gained over $2b in net profit on rising revenue and improved operating margins. Sales receipts rose to over $28b, and with each of Ford’s regional units posted operating profits, Ford’s gross automotive cash rose by $400m to $25.3b (although operating cash flow was $100m in the red). North American operations earned $1.2b in pre-tax operating profit, South America earned $203m, Europe recorded $107m and Asia-Pacific-Africa brought in $23m. Ford Credit racked up $828 in pre-tax profits, as lower depreciation levels improved results. Despite these fine results, Ford finished the quarter with $34.3b in automotive debt, a $700m increase from the beginning of the year. Ford paid $492m in interest on that debt in the first quarter.

Hyundai Nets Over $1b, Breaks Quarterly Profit Record Again

Fiat Five Year Plan: Cars Stay, Trucks and Tractors Go

Much of the speculation in the leadup to Fiat’s five year plan announcement centered on a long-rumored spin-off of Fiat’s auto business from the rest of the industrial conglomerate. Speculators even drove up Fiat’s share price considerably yesterday on hopes that the long-awaited spin-off would be announced today. And sure enough, Fiat did announce today that it would be spinning off part of its business. The only problem, according to Automotive News [sub], is that the newly-formed unit isn’t made up of Fiat, Alfa and Lancia, but Iveco and New Case Holland. Instead of its car operations, Fiat is bundling off its heavy commercial truck and tractor business into a new entity known as Fiat Industrial S.p.A. (Fiat-branded light commercial vehicles and Fiat Powertrain will remain behind).

Fiat Five Year Plan: More Profit From Ferrari, Cheaper Maseratis

Given Ferrari’s pricing politics, it seems safe to assume that Ferrari/Maserati is a fairly profitable enterprise for its 85 percent owner, Fiat. Indeed, with over $2.5b in combined revenues last year and an 11.5 percent operating margin, the Italian sportscar brands aren’t exactly dying of economic downturn-related causes. But at today’s presentation of Fiat’s five year plan, CEO Sergio Marchionne revealed that his firm has big plans for Ferrari/Maserati, and gave unprecedented planning details as proof of the brands’ path towards even greater profitability.

Montezemolo Out As Fiat Moves Towards Auto Spin-Off

Fiat Chairman Luca Cordero Di Montezemolo will be leaving the firm to pursue a career in Italian politics, according to Automotive News [sub]. Montezemolo will remain on Fiat’s board, and will continue to serve as chairman of Ferrari, but he will be replaced atop the Fiat empire by vice-chairman and Agnelli family heir John Elkann. Fiat’s shares rallied considerably this morning, according to Bloomberg Businessweek, but not because Montezemolo is on the way out. Rather, Fiat has finally announced the news that speculators have been waiting patiently for: the firm now confirms that it plans to spin off its auto business.

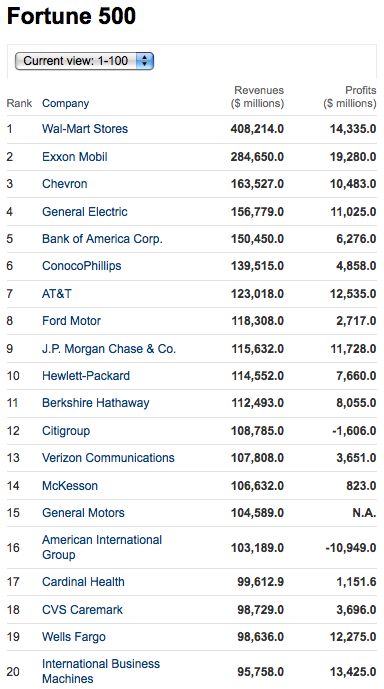

Is GM Worth More Than Ford?

Since GM has only recently come out with GAAP-approved financials, determining the company’s value isn’t easy. Still, The Detroit Free Press‘s Tom Walsh reckons The General is worth more than Ford, despite the fact that GM recently fell out of the Fortune 500’s top ten (and below Ford) for the first time in its 100+ years of history. What gives?

Chrysler Zombie Watch 10: Might As Well Jump

Chrysler has always held a special place in TTAC’s chronicling of Detroit’s decline, enjoying a bespoke “Suicide Watch” in contrast to our Ford and GM “Deathwatches.” In the first entry in that series Frank Williams wrote of a gutted firm, dependent on incentives and flagging truck sales, seemingly doomed to drag its foreign partner into bankruptcy. Four years and countless opportunities for death with (some) dignity later, Chrysler presents much the same picture. Sure, it’s been rinsed of debts and excess capacity in bankruptcy court, but the Pentastar’s brands are still fundamentally damaged from years of self-abuse and the firm is struggling (and failing) to improve on last year’s sales numbers, which were recorded en route to said bankruptcy. Inventory may be under control, but Frank’s four-year-old assessment of an investor warning by JP Morgan could have been written yesterday [with “DCX” replaced by “Fiat”]:

JP Morgan remains convinced that management patience towards Chrysler has “worn thin and increases the likelihood that DCX will reduce exposure to Chrysler.” It’s the investment community’s equivalent of yelling “jump!” to someone standing on a ledge.

In fact, analysts from London’s Bernstein Research wrote nearly the exact same line yesterday. Chrysler has officially shuffled back onto the ledge, and once again the analysts are shouting “Jump!”

Recent Comments