#HighFinance

What's Wrong With Tesla? How Much Time Do You Have?

I’ve been warned before by the B&B not to read too much into the forward-looking statements in SEC filings, especially the ones where companies ruminate over all the things that could still go wrong with their struggling firms. These legal disclosures of worst-case-scenarios often reflect unlikely scenarios and can be downright misleading, so we held off from diving too deep into Tesla’s IPO S-1 filing [complete document here]. Others around the web have jumped in without compunction, and this week has yielded a steady drip of troubling revelations. It’s a wild and woolly collection of issues, but given that people are going to be asked to invest in this nightmare of a company, it’s only fair that we give the grievances an airing.

Toyota: Recall To Cost $2b This Quarter, Dent Improved Financial Outlook

Agressive cost-cutting and improved sales yielded $1.68b in net profit for Toyota in the three months ending December 31, reports a press release in the WSJ. Sales revenue climbed 10 percent to $58.2b in the October-December quarter, boosting operating profit to about $2b. This quarter alone though, Toyota reckons the recall could cost the company $2b in repair costs and lost sales. For the fiscal year, ending on March 31, Toyota says the final impact should be limited to about $900m in losses on an operating basis, and has revised its fiscal year net profit projection to about $900m (compared to a $2.2b loss projected in November).

Tesla's Profit Claims Are Lies

S&P Sticks With "Buy" Rating For Toyota Stock

Toyota Sienna boy band, Boyota from Jennifer Vuong on Vimeo.

Standard & Poors Equity Research [via BNET] says you shouldn’t dump that Toyota stock just yet.

Will the aggressive action of cutting production and recalling so many vehicles scare away potential Toyota buyers, or will consumers think the abundantly cautious response shows a commitment to customer care and quality? We think it is too early to tell, but we believe resilience and global growth of vehicle demand will help TM (Toyota Motors)

You know, until mechanics actually start finding malignant hellspawn demons within Toyota electronic throttle control units. In which case you should invest heavily in law firms. Meanwhile, Toyota is apparently hiring shamans to cleanse their new product of metaphysical infestation by way of bizarre voodoo ceremonies like the one shown above [Hat Tip: Vanity Fair Gay Cars blog].

Hyundai Quadruples Fourth Quarter Profit

Ford, Ford Credit Record 2009 Profit

The Ford Motor Company [full results in PDF format here] earned net income of $2.7b last year, on pre-tax operating profits of $454m. The company enjoyed a strong fourth quarter with $868m in net income and an after-tax operating profit of $1.6b (excluding special items). Ford Motor Credit [full release in PDF format here] earned $1.3b in net income and $2b in pre-tax operating profit last year. Ford Credit’s receivables were down at the end of 2009 compared to 2008, with $93b receivable compared to $116b at the end of 2008, and leverage of 7.3 to 1.

Spyker Stocks Soar, But Sergio Isn't Buying

Here’s a situation in a hypothetical tense for you. If you were the CEO of a car company which never made a profit in 11 years and you offered to pay $74 million for a car company which hasn’t made a profit since 2001 and had a badly damaged brand, how would you expect your share price to go? Trust me, you’re not even close. MarketWatch.com reports that Spyker shares soared as much as 74% when they announced they had reached an agreement to buy Saab from General Motors. Spyker’s market capitalisation is now €107 million, four times more than when GM first put Saab up for sale.

Better Place Birthwatch: New $350m Investment Brings Deeper Pockets, But Not Broader Appeal

It goes without saying that it’s always good news for a business to be able to raise hundreds of millions of dollars on the financial markets. Just as important as the financial boost, such capital-raising also raises the profile of the company, presenting it as a viable investment and implicitly endorsing its underlying business plan. In the case of Project Better Place’s recent $350m funding boost however, the benefits might be largely limited to the firm’s balance book. Heavy participation by HSBC, Lazard and Morgan Stanley do help raise Better Place’s profile, but HSBC and Lazard are the only new investors in this most recent round of financing: Morgan Stanley, IsraelCorp, VantagePoint and other previous investors make up the rest of the round. This speaks to a fundamental challenge underlining Project Better Place: broadening, rather than deepening its appeal and support.

Old GM Stock Rallies Again. Good News For GM IPO?

Fisker Lines Up $115.3 In Funding, Still Needs To Spend $169m On Karma Engineering

With the economy desperately looking for signs that a bottom has been reached, news that Fisker has raised $115m in new funding might indicate that (if nothing else) the money markets are back to their good old speculative selves. At least it might if there weren’t so many darn extenuating circumstances. On the one hand, Fisker seems like the kind of business that has little business attracting much, well, business. Its $90k+ Karma brings little more to the table than some competition for Tesla in the EV-glamor-bauble segment, and like Tesla it’s trying to leverage its first model into ever cheaper, higher-volume vehicles. So why are VC firms giving Fisker the time of day?

GM-Daewoo Stayin' Alive. Barely.

An interview with Forbes the boss of the Korean Development Bank, which GM-Daewoo still owes several billion dollars, reveals that GM’s South Korean unit had a debt-to-equity ratio of 912 percent as recently as last June. GM “rescued” its crucial small-car development center by buying up all $413m of GM-Daewoo’s recent share offering, keeping the the KDB from imposing its will on the automaker. That was enough to keep the wolf from Daewoo’s door in the short term, but if Daewoo is ever going to develop a new generation of GM small cars and global products, it will have to address its $2b KDB debt and raise additional funds. For now though, GM-Daewoo is just hoping to keep a little momentum going.

Congressional Oversight Panel: Why Did We Bail Out GMAC Again?

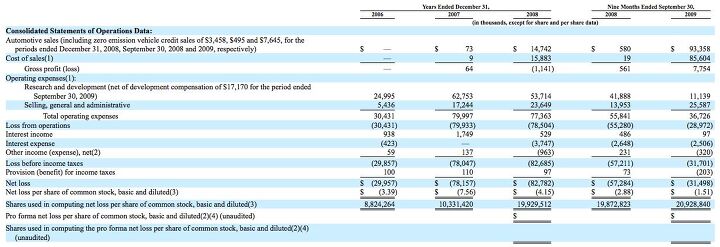

The TARP bailout of GM finance partner GMAC is being criticized by a congressional oversight panel [full report in PDF format here], reports the Detroit Free Press. The panel alleges that the Treasury

has not yet articulated a specific and convincing reason to support the company… It has never stated that a GMAC failure would result in substantial negative consequences for the national economy. If Treasury has made such a determination, then it should say so publicly.

Toyota Stumbles Towards Another North America Loss

With the Japanese Yen hovering around the 91 to 1 U.S Dollar exchange rate, a bullish VW focusing on boosting their market share in North America and Ford rising up, Toyota are probably a bit depressed. Business Week reports that, for the second year in a row, Toyota have resigned themselves to the notion that their North American division will post a loss this fiscal year. This will, almost certainly, have a knock-on effect in Toyota’s ability to turn a profit in the North American market, even after more cost cutting. “The finance company is having a solid year, so if you include that it will be so much easier to say positive things,” Yoshimi Inaba, Toyota’s North American chief executive, told reporters in Detroit. “We are still trying hard to improve (sales and manufacturing operations).”

Recent Comments