#HighFinance

What's Wrong With This Picture: Just What Tesla Needed More Of Edition

HYPE! Yes, according to a pimptastic Morgan Stanley report [via BusinessInsider], Tesla is about to become “the 4th American Automaker,” despite the fact that it hasn’t actually built a car in any kind of volume. The report enthuses

The confluence of structural industry change, disruptive technology, changing consumer tastes and heightened national security creates an opportunity for significant new entrants in the global auto industry. California dreaming? We don’t think so. In our view, the conditions are ripe for a shake-up of a complacent, century-old industry heavily invested in the status quo of internal combustion. The risks are high. So is the opportunity. Enter Tesla.

Did you just throw up in your mouth a little? Don’t worry, there are highly convincing charts to help you learn to stop worrying and love the auto industry’s answer to Apple. After all, when it comes to Tesla, charts always tell the whole story.

GM Dumps Ally Shares, Announces Dividend

Automotive News [sub] reports that GM has sold $1b worth of preferred stock in Ally Financial, the bank holding company that emerged from the wreckage of GM’s former in-house lender GMAC. GM will book $300m on the deal, which will take its ownership stake in the lender to 9.9 percent. GM will likely continue to reduce its exposure to Ally, which is 74% owned by the US Treasury, as its new CFO seeks to rebuild its in-house lending capabilities. GM’s move away from Ally has intensified competition between the financial firm and GM’s new financing arm, which has been built on the acquisition of subprime lender AmeriCredit. This mounting competition has been criticized by the TARP Congressional Oversight Panel, which rapped GM for failing to find a win-win solution for its own financing needs and the viability of the taxpayer-owned Ally. Amman’s strategy for avoiding further conflict: sticking with subprime and floorplan lending, leaving prime auto lending to Ally. But, argues analyst Maryann Keller

Floor-plan lending is about building an individual relationship with a lender. To get them to switch, you need to get people on the ground and get out and talk to dealers and build those relationships.

Meanwhile, with its stock struggling to achieve the value projected for it by several analysts, GM has approved a second quarterly dividend of $0.594 per share on its Series B mandatory convertible junior preferred stock. More cash and a new dividend seem likely to pump up GM’s stock price a little, but it is unlikely to reach the $55-ish price needed to pay back the government’s equity investment in the short term.

GM's CFO Departs

General Motors has announced that Chief Financial Officer Chris Liddell will be leaving the company on April 1, “having completed the largest public offering in history and stabilizing the company’s financial operations.” CEO Dan Akerson has denied that Liddell’s departure has anything to do with GM’s first-quarter financial performance or his relationship with the departing CFO, saying “we could finish each others sentences.” The former Microsoft man was brought into GM in January of last year, and helped guide the automaker through its IPO and eliminated its material weaknesses in internal financial controls, apparently the two tasks he needed to complete before riding off into the sunset.

Chrysler Turns $14b Into $4.8b

According to Steve Rattner, Chrysler was such a sick puppy in the immediate pre-bailout period that it would have only generated about $1b had it been liquidated in bankruptcy. Thanks to around $14b in government assistance, however, Chrysler is now worth a whopping $4.8b according to a Reuters analysis of its filings. But wait, you say, how does Chrysler have a valuation if it hasn’t yet launched an IPO?

Chrysler arrived at the valuation to set pay for its top executives, including Marchionne. Senior executives are paid partly through so-called deferred phantom shares, which will convert to shares in the company at a later date.

In June 2009, each share was worth $1.66, according to the filing. By the end of 2010, the value of each share was $7.95.

Renault-Nissan Rethinking Their Relationship

In an extended interview with Reuters, Nissan-Renault CEO Carlos Ghosn talks about the balancing act of leading two global automakers while maintaining their unique identities, a balance Ghosn says he wants to try to preserve even as the alliance looks to restructure its capital. Renault’s 44.3% stake in Nissan has caused some trouble with financial analysts because, as Ghosn puts it,

we are challenged (by financial markets) over how much capital we have imprisoned into the structure of the alliance. It’s a fair challenge. We are going to be studying and analyzing this with outsiders also, what are the ways to respond to these expectations from the financial markets without challenging the operating model which consists of keeping the two companies vibrant, motivated, engaged and keeping their identities

Does that mean a full merger? A new corporate structure? Where is Ghosn looking for answers as he attempts to give the markets what they want while maintaining the delicate balance between the needs of his two firms?

Quote Of The Day: Abandoning The Bailout Edition

The Detroit News reports that top White House economic adviser Austan Goolsby indicated today that the government would be exiting its equity position in GM in the short term. The DetN’s David Shepardson quotes Goolsby as saying

The writing is clearly on the wall that the government is getting out of the GM position. The government never wanted to be in the business of being majority shareholder of GM. It was only to prevent a wider spillover, negative event on the economy. So we’re trying to get out of that. We’re not trying to be Warren Buffet and figure out what the market is doing

And he’s not kidding: GM’s stock just closed at its lowest level since the IPO, after GM’s Q4 results came in below analyst expectations and the overall market experienced turmoil due to Middle East unrest.

With IPO Looming, Ally Financial Goes To War With GM

One of the strongest criticisms issued in the Congressional TARP Oversight Panel’s most recent report on the auto bailout concerned GM’s lack of effort to bring its former captive lender GMAC (now called Ally Financial) back to the fold, an omission the Panel termed “disconcerting.” After all, Ally’s business is still closely intertwined with GM’s, as the financial firm provides 82% of GM’s dealer floorplanning and 38.2% of GM’s consumer loans. And, as bailed-out businesses (Ally is now 73.8% owned by the US Treasury), any competition between GM and Ally will result in a lose-lose scenario for taxpayers. In recent months it seemed that the two firms were moving towards a deal at the initiative of GM CEO Dan Akerson (and likely motivated to some extent by the COP’s criticisms), but now Bloomberg reports that there are no negotiations between GM and Treasury about a reconciliation of the two firms… in fact, with an Ally IPO planned for this year, it seems the two firms are going to war.

GM Earned $4.7b, Beat "Financial Control" Issues In 2010

GM has announced its full-year results for 2010 [Highlights here, Chart set here, in PDF], and has achieved its first full-year profit since 2004 by pulling in $4.7b. Perhaps more significant than the numbers alone, however, is GM’s claim that it has whipped its “material weakness” in terms of financial reporting and internal controls, an issue that had haunted The General since being disclosed in the runup to its IPO. Still, GM’s earnings were well below the $5b+ full-year profit expected by analysts, and its half-billion Q4 profit was considerably more “pinched” than the $1b that Wall Street expected. More importantly, GM burned $1.7b in automotive operating cash (including a $4b pension contribution) and another $1.1b in CapEx in the fourth quarter, resulting in a $2.8b automotive free cash burn for the quarter. Over the course of 2010, GM’s cash pile has gone from $36.2b to $27.6b, although GM has access to over $5b in new credit facilities while cutting debt from $15.8b to $4.6b. Still, a weakly-profitable Q4 is better than last year’s $3.4b Q4 loss.

GM Profit Projections: Over $5b On The Year, But "Pinched" Q4

Analysts are reporting that GM could announce full-year 2010 profits of over $5b tomorrow, although Q4 profits may have dipped to $1.06b. That would make its full-year results the best since a $6b profit in 1999, but Q4 results could be the second-worst since emerging from bankruptcy. Why the slowdown? Analysts give Bloomberg a number of possible explanations, including

- GM’s spending on cars including the Chevrolet Volt plug-in hybrid and future products may lead to higher costs similar to those that restrained profits at Ford and Daimler AG.

- Automakers are paying more for materials such as steel and are struggling to pass the costs to consumers amid a “somewhat weak” economy

- Restructuring unprofitable European operations

Of all these dynamics, however, CEO Dan Akerson’s rush to revamp GM’s lineup and expand the applications of the Volt’s drivetrain could end up driving the most cost. Though GM is making a healthy profit again (and not paying taxes on it), an overly-ambitious speed-up in product cadence could combine with rising costs to slow The General back down (as they have already done to some extent at Ford). In any case, we will certainly have a better picture of GM’s financial performance tomorrow, when the firm’s results are announced.

Tesla Loses $154m In 2010

Despite launching a frothy IPO, EV maker Tesla’s net loss nearly tripled last year, losing more than $154m compared to a $55.7m loss in 2009. Total revenues were up nearly $5m, but only due to a nearly $20m bump in “development services” income. Revenue from “automotive sales” was down by around $15m. R&D costs skyrocketed from $19.3m to nearly $93m, while “selling, general and administrative” costs doubled to $84m. Still, CEO Elon Musk is all optimism in the firm’s press release, crowing

We are very pleased to report continued revenue growth, improving margins and a steady progression in our Roadster and powertrain activities,. Our powertrain team delivered solid results, with an increase in orders and record deliveries of battery packs and chargers for the Daimler Smart fortwo electric drive, the completion of our development program for the Daimler A-Class, and the commencement of the phase 1 development program for the Toyota RAV4 EV.

Musk noted that the firm is on-track to start delivery of its forthcoming Model S sports sedan in mid-2012. It had better be, because Tesla’s clearly not going to sustain itself on Roadsters.

GM Chinese Partner Suspends Shares, Says "Major News" Coming

Chart Of The Day: The Expectations Game Edition

Chrysler Posts $652m Net Loss For 2010

How did Chrysler do last year? It all depends on how you slice the numbers, isn’t it? As warned, Chrysler’s Q4 was a bit of a letdown, as net revenues dropped from $11.018b in Q3 to $10.763b, resulting in a $199m Q4 net loss. Interest expenses continue to be a major drag on Chrysler’s performance, costing $329m in Q3 and a whopping $1.228b over the course of the year. Cash dropped by nearly a billion dollars from Q3 to Q4, ending the year at $7.347b (not counting $2.3b in undrawn government facilities). Chrysler nearly hit the 1.6m worldwide sales number touted in its Five Year restructuring plan, as well as the 1.1m US-market target (although fleet mixes appear to have been higher than anticipated). Chrysler also hit its goal of $40b+ in net revenues and exceeded Operating Profit and EBITDA projections, but as the slide from Chrysler’s Q4 financial presentation [ PDF here] shows, Both debt (which will likely be restructured this year to reduce costs) and depreciation/amortization have killed Chrysler this year… which is why EBITDA and Modified Operating Profit take the top billing in Chrysler’s financial reporting.

Inside Ford's Best Year In A Decade

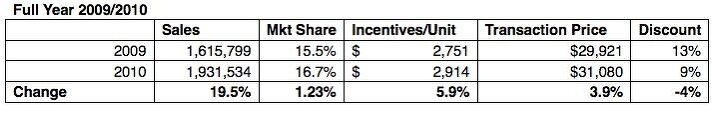

Regular TTAC readers know that there’s more to a successful performance from an automaker than pure volume alone. Average transaction prices, market share, and incentives all play a role in translating production numbers into profits. Luckily, our pals at TrueCar have broken all that lovely data down, and they’ve sent over the numbers behind Ford’s recently-announced $8.3b profit, the Blue Oval’s best performance in over a decade. And, as you can imagine, a performance like that requires not only a hefty increase in volume (up nearly 20% on the year) but also improvements in market share (up 1.23%), and transaction price. Yes, incentives stayed stronger than they perhaps needed to be, but they now make up a lower percentage of the average transaction price. And that, ladies and gents, is how you make a $5.4b pre-tax operating profit in the US market alone [Q4 and historical data after the jump].

Recent Comments