Canada Auto Sales Recap: September 2014

Without an unexpected drastic downward turn in the final quarter of 2014, Canadian auto sales will reach record levels this year, a strong follow-up to best-ever sales in calendar year 2013.

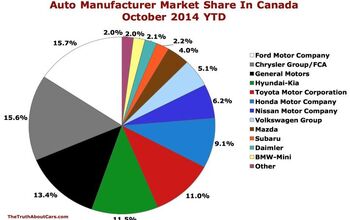

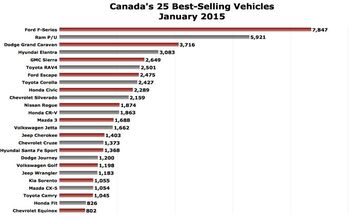

September 2014 was marked by a collective 13% sales improvement from the overall industry, a gain of nearly 19,000 units compared with September 2013. September also marked Ford Motor Company’s return to the top of the overall sales leaderboard in Canada. Chrysler Group’s five brands haven’t actually led the monthly results since March, but their lead was strong enough to support year-to-date number one status through the end of August.

Both Ford/Lincoln and General Motors outsold the Chrysler Group in September, however, despite a combined 20% year-over-year improvement from Chrysler, Dodge, Jeep, Ram, and Fiat.

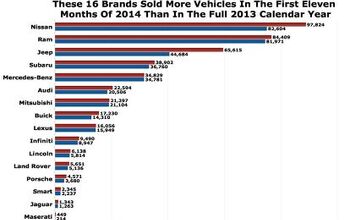

Jeep’s 140% year-over-year sales increase was at the top of September’s growth chart, surpassing Maserati’s 123% leap and Buick’s 111% improvement. Jeep volume has risen above 6000 units in each of the last six months. Jeep set an all-time monthly record for new vehicle sales in May of this year, when 7531 Wranglers, Cherokees, Grand Cherokees, Patriots, and Compasses were sold. Buick’s rise beyond 2000 units was the first such 2K+ month since April of last year, when precisely 2000 Buicks were sold in Canada.

Canada’s next-fastest-growing auto brand last month was Audi, sales of which shot up 42% to 2490 units. 29% of Audi Canada’s September volume was generated by the brand’s two new entry-level models, the A3 sedan (393 September sales) and Q3 crossover (328 September sales).

The Q3 was joined in Canada by its newest rival, the Mercedes-Benz GLA-Class, 184 of which were sold last month, a figure which is expected to steadily rise. 46% of Mercedes-Benz’s non-Sprinter volume was generated by five SUV and crossover nameplates last month. Through nine months, the Mercedes-Benz brand (excluding Sprinter vans) leads BMW, the second-ranked premium automaker, by a scant 50 units.

Midsize cars are an increasingly lackluster force in Canada’s auto market. Even in Canada’s declining passenger car market, the midsize segment’s decline is particularly egregious, falling 15% this year and 6% in September. Hyundai’s Sonata has bucked the trend of late, surging 140% in September to lead the category for the third consecutive month. But this Ford Fusion-led midsize segment was, Sonata excluded, down 15% last month, a loss of 1522 units.

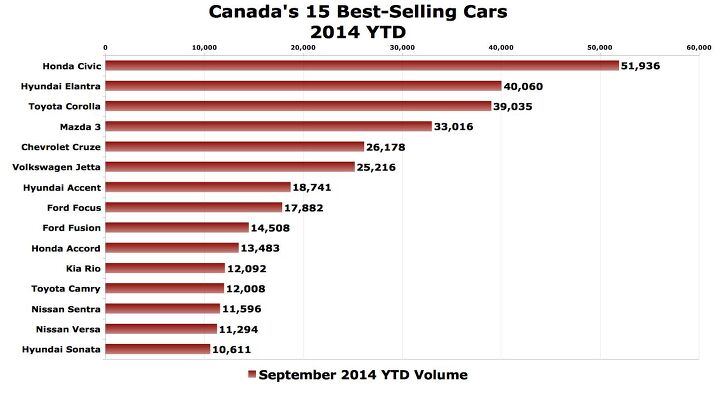

Canadians, of course, respond much more favourably to slightly more efficient, not quite as roomy, and much more affordable compact cars. 2014 will mark the Honda Civic’s 17th consecutive year as the compact leader and as Canada’s best-selling passenger car overall. September Civic sales jumped 10% as compact volume grew just 4%.

The Civic was joined on the positive side of the ledger by the Buick Verano (up 121%), Chevrolet Cruze (up 22%), Nissan Sentra (up 57%) and Volkswagen Golf (up 101%), among other.

Golf sales, at 2073 units, are notable for the difference achieved by the nameplate on two sides of one border. In the United States, where Volkswagen’s struggles have been thoroughly chronicled, the Golf family accounted for just 13% of VW volume in September. The Golf is VW Canada’s second-best-selling model, producing 32% of the brand’s September sales.

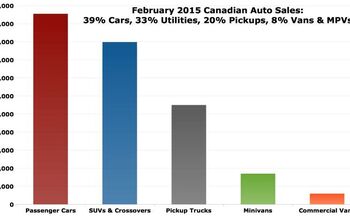

Volkswagen’s model range is thin, of course, with just two utility vehicles, and five continuing passenger car lines. Volkswagen is done with the Routan minivan, having sold their last in May 2013. Canadian minivan volume was up 12% in September; mini-MPV sales were down 43%. Pickup truck volume, jacked up by the best-selling Ford F-Series, rose 11% to 31,050 units. Commercial van sales were up 23%. Passenger car sales rose 2%, accounting for 41% of total new vehicle volume last month. And Canada’s growth sector, SUVs and crossovers, grew 30%, forming 35% of the Canadian auto industry’s volume, up from 30% a year ago.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Zerofoo No, I won't miss this Chevrolet Malibu. It's a completely forgettable car. Who in their right mind would choose this over a V8 powered charger at the rental counter? Even the V6 charger is a far better drive.

- Offbeat Oddity Nope, I won't miss it. I loved the 2008-2012 Malibu, but the subsequent generations couldn't hold a candle to it. I think the Impala was much more compelling at the end.

- Zerofoo An almost 5000 pound hot hatch that fell out of the ugly tree and hit every branch on the way down? No thanks.

- Tassos Jong-iL This would still be a very nice car in North Korea.

- Jeff One less option will be available for an affordable midsize sedan. Not much can be done about GM discontinuing the Malibu. GM, Ford, and Stellantis have been discontinuing cars for the most part to focus on pickups, crossovers, and suvs. Many buyers that don't want trucks or truck like vehicles have moved onto Japanese and South Korean brands. Meanwhile large pickups and suvs continue to pile up on dealer lots with some dealers still adding market adjustments to the stickers. Even Toyota dealers have growing inventories of Tundras and Tacomas.

Comments

Join the conversation

So few posts, nobody cares about Canada eh?

Canadians' preference for compact cars is even more pronounced in Quebec. I recently read an analysis on the Quebec market. In a nutshell, compacts make up over 60% of car sales in QC compared to about 45% in the Rest of Canada. Another interesting tidbit: when Fiat introduced the 500, Quebec accounted for nearly half of the 500's Canadian sales. There are few reasons to explain the Quebec market's predilection for compacts. First, gas is relatively expensive -- until recently it was over $1.40 per liter ($5.30 + per gallon). Second, driving and parking in Montreal and Quebec City, where most of the population is concentrated, can be rather trying in mid- and fullsizers. Third -- and this is a personal observation -- Quebeckers, both French and English, have a pronounced prejudice against American cars. People here remain blindly devoted to unreliable VWs plagued with all manner of gremlins and rusted-out Hyundais (I think the Elantra might be the best-selling vehicle in the province). I've no doubt any of the French automakers could sell staggering numbers of their most lamentable models in Quebec. Finally, my sense (and I think the analysis I read also touched upon this) is Quebeckers will buy the least amount of car their finances will allow; if a bare-bones $13K Accent will do the trick, that's what they'll buy. (Despite the fact Hyundais do not fare well at all in Quebec's winters.)