#profit

Musk Sees Tesla Profit In 2013, But Losses (And Issues) Are Still Piling Up

According to Tesla CEO Elon Musk, the EV luxury brand has pre-sold all 6,500 units of its new Model S to be built next year, and the company is on-track for a 2013 profit. Bt if you’re comparing Tesla to the erstwhile EV darling BYD in order for it to look good, you have to wonder how good things really are. If anything, Tesla should be compared to Audi, an established (and hot) luxury brand with the same EV technology and one of Tesla’s founders on board. Losses for this fiscal year are estimated at $437m, and Tesla’s crucial loans from the Department of Energy are attracting a distracting investigation in the wake of the Solyndra scandal (but hey, Musk is “personally guaranteeing” those loans, so no worries…). And, in a truly puzzling move, Tesla is ignoring the SAE J1772 protocol for rapid EV charging because it isn’t sexy looking enough. As EV guru Chelsea Sexton puts it to the New York Times

It’s hardly unusual for Tesla to zig where the rest of the industry zags. But it’s particularly counterintuitive not to use the J1772 standard, since Model S drivers will be more interested in public charging than Roadster owners. Tesla’s proprietary connector choice requires getting customers to care about form over function on one of the most utilitarian aspects of the car. How many people stare at a gas nozzle and think, ‘If only that were better looking’?

Selling out of a first-year production run is good news, but hardly surprising (all plug-in vehicles are currently capacity-constrained). Preventing buyers from using public charging infrastructure because it’s unsexy is the kind of surprising news that could seriously damage Tesla’s long-term efforts. Meanwhile, we still don’t know how this company will do with regards to manufacturing quality and reliability, especially as volumes ramp up to 20k units per year. After all, Tesla’s hype and niche marketing efforts are well-proven… it’s all the other aspects of building and selling cars that we’re still unsure about.

"Brave New World": AlixPartners Predicts Auto Market Headwinds, "Competitive Convergence," And Other Challenges

AlixPartners, the consulting firm that led GM’s reorganization efforts, has put the perennial optimism of auto industry analysts on notice, introducing its 2011 Automotive Outlook by arguing

The AlixPartners 2011 Automotive Outlook finds that while automakers and suppliers have seen profits bounce back handsomely – North American original equipment manufacturers (OEMs) posted $12.5 billion in 2010 profit on a net margin of 4.6% and North American suppliers reaped $8.2 billion on a net margin of 4.3% – no one should be tempted into thinking that things are now back to “normal,” or at least the normal defined by the consumer-incentive-induced sales levels of the past. In sync with its past annual auto studies, AlixPartners continues to predict that U.S. auto sales will climb slower, and to a lower peak, than many others are predicting. Specifically, the firm estimates U.S. auto sales will reach just 12.7 million units this year and only 13.6 million in 2012.

This is a tough moment for us: on the one hand, pessimistic economic forecasts don’t make anybody happy… on the other hand, the AlixPartner outlook is a significant validation of TTAC’s longtime bearishness. So rather than either moping or self-congratulating, let’s just take a look at why AlixPartners is so gloomy about the near-term outlook.

Chew On That: Ford Announces $8.3 Billion Profit

Ford did not disappoint and today announced its biggest annual profit in a decade. According to a Ford release, the company booked $8.3 billion in pre-tax profits for 2010. That is a $3.8 billion increase from a year ago.

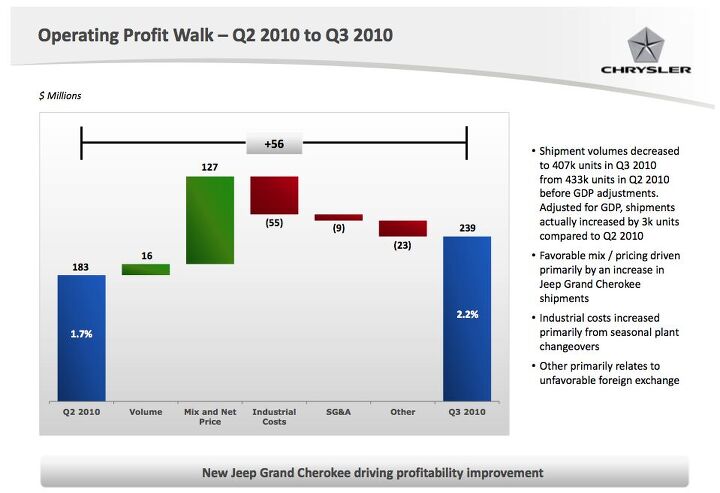

Carried By New Grand Cherokee, Chrysler Loses $84m In Q3

Chrysler lost $84m last quarter on an operating profit of $239m, showing slow but consistent progress from last quarter’s $172m loss [Press release here, slides here, both in PDF]. Chrysler has lost $453m since the beginning of this year. Overall deliveries and sales were down slightly compared to Q2 2010, but thanks to a strong launch for the profit-generating Grand Cherokee, revenues were up just over 5 percent to $11b. As the slide above proves, “Mix and Net Price” accounts for one of the biggest contributions to operating profit, and that’s largely thanks to the new Grand Cherokee which (at 12,721 units last month) is the second-best selling vehicle in Chrysler’s lineup after Ram pickups. That’s a good sign for the future of a company that needed a hero, but there are some troubling signs under the surface.

GM Releases Preliminary Q3 Results, Estimates $2b Net Income

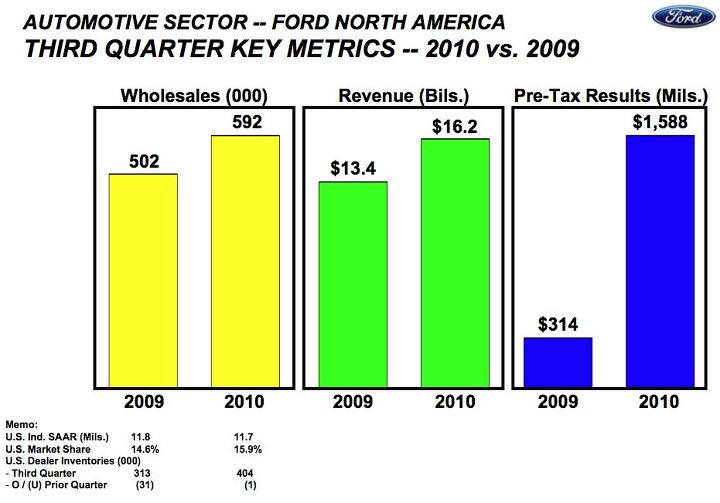

Ford Reports $1.7b Profit For Q3

Ford’s profitability outstripped even yesterday‘s $1.37b estimate, coming in at a whopping $1.68b, as Ford made mad money in the North American market in the 3rd Quarter of this year, for a fifth consecutive profitable quarter. Global revenue was down by about $1b, but excluding Volvo from Q33 2009 results, revenue was actually up $1.7b. $1.6b of Ford’s profitability came from North America, as its most crucial market carried the company over weak overseas results. And with $900m in positive cash flow, Ford says its “automotive cash” will equal its debt by the year’s end, sooner than it had previously forecast. Ford paid of $2b of its revolving credit line last quarter, and plans to pay off the final $3.6b it owes the UAW VEBA trust in Q4. By the end of the year, Ford estimates it will have reduced its overall debt by $10.8b over the course of 2010. Hit the jump for a few key slides from Ford’s Q3 financial presentation.

Marchionne Blames Bailout For Profit-Free 2010

We’re hardly shocked by the idea that Chrysler won’t turn profit this year. After all, Auburn Hills has barely made its minimum monthly sales volumes (at best, and with rampant incentives and fleet mix) this year, and lost $50m+ in “industrial inefficiencies” on the Jeep Grand Cherokee launch alone [ Q2 results analysis here]. With plans to close out the year with a non-stop barrage of product launches and attendant media spending, it would take a minor miracle for Chrysler to break even. But we’ve essentially known this all for some time… what’s truly shocking is that Chrysler’s CEO Sergio Marchionne actually admitted to the media that Chrysler won’t turn a profit.

Quote Of The Day: Professional Jealousy Edition

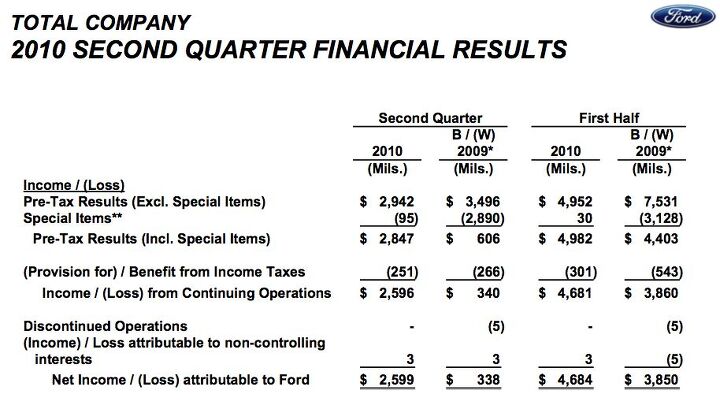

When Chrysler’s CEO Sergio Marchionne took the stage over the weekend to honor Lee Iacocca with an induction into the Walter P. Chrysler Legacy circle, he admitted to feeling unworthy of honoring Chrysler’s most famous executive in recent memory, and called Ford’s Alan Mulally and the UAW’s Bob King to help share the honor. And being the business-obsessed type he is, Marchionne wasn’t about to let Mulally get on stage without at least a mention of Ford’s just-announced $2.6b profit. And though the recognition and ensuing awkward “moment” helped add to the usual Detroit gala hometown booster vibe, it also highlighted the fact that Chrysler still has yet to announce its Q2 results.

Ford Reports $2.6b Q2 Profit

GM Q1 Profit: $865m After Dividends

Ford Shareholders Meeting: Profit This Year, But No Dividend

After four straight profitable quarters, Alan Mulally’s forecast today of a “solidly profitable” 2010 shouldn’t come as a huge surprise. But, as Executive Chairman Bill Ford put it to Ford shareholders at the company’s annual meeting [via AP],

It is the very early days in our recovery. We still have a lot of debt

And he’s not kidding. As of the end of Q1 2010, Ford was carrying $34b in debt. And though Ford faces a higher cost of borrowing because of its staggering debts, Bill Ford was clear that he wouldn’t trade places with Ford’s Detroit competitors, which cleaned out their balance books, at the expense of government bailouts and accompanying PR problems. After all, while GM and Chrysler were rebuilding, Ford managed to outperform both of them last year by gaining sales and market share. And Ford’s leadership sees that momentum carrying forward into next year.

Nissan Leaf "On Track" To Make Money In First Year On The Market

With over 8,000 pre-orders already logged, Reuters reports that Nissan is well on its way to selling out its capacity-constrained, 25,000-unit first-year production run of Leaf EVs. Better yet, Nissan’s North America director of product planning and strategy Mark Perry says that, with those sales volumes, the Leaf will actually turn a profit for Nissan. He tells Reuters:

We are making money at the price that we announced. We priced the car to be affordable. We priced it for mass adoption

Ford Pulls In $2.08 Billion Q1 Profit

The Ford Motor Company released its first quarter earnings today [Full report here, Slide presentation here (both PDF)], revealing that it gained over $2b in net profit on rising revenue and improved operating margins. Sales receipts rose to over $28b, and with each of Ford’s regional units posted operating profits, Ford’s gross automotive cash rose by $400m to $25.3b (although operating cash flow was $100m in the red). North American operations earned $1.2b in pre-tax operating profit, South America earned $203m, Europe recorded $107m and Asia-Pacific-Africa brought in $23m. Ford Credit racked up $828 in pre-tax profits, as lower depreciation levels improved results. Despite these fine results, Ford finished the quarter with $34.3b in automotive debt, a $700m increase from the beginning of the year. Ford paid $492m in interest on that debt in the first quarter.

Hyundai Nets Over $1b, Breaks Quarterly Profit Record Again

Did GM Lose Money Again In Q1?

Don’t ask Chairman/CEO Ed Whitacre. His only comments so far on GM’s Q1 2010 performance comes from a memo leaked to Reuters, in which he says:

In January, I said we could earn a profit in 2010, if everything falls into place. Our first quarter financial results will show us an important milestone, and I’m pleased to say that I anticipate solid operating results when we report our first quarter financials in May

“Important milestones”? “Solid operating results?” What the hell is Whitacre trying to say?

Recent Comments