Carried By New Grand Cherokee, Chrysler Loses $84m In Q3

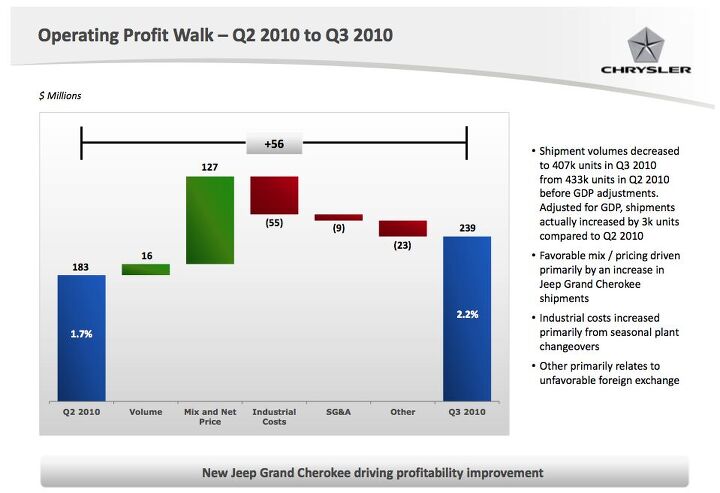

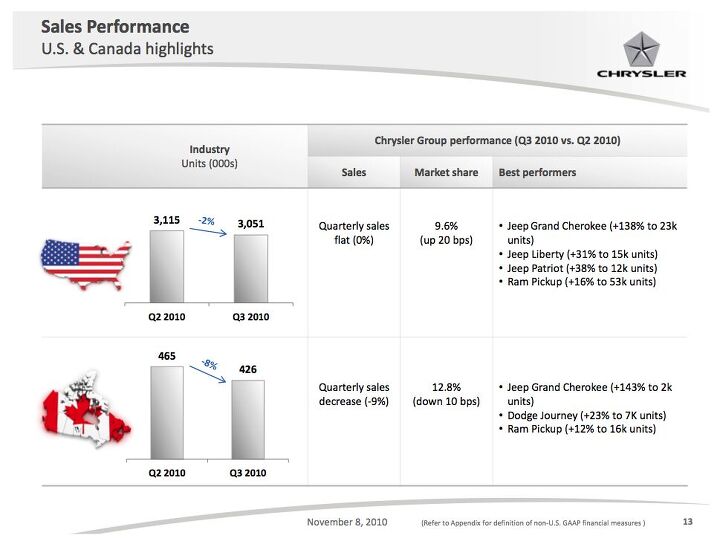

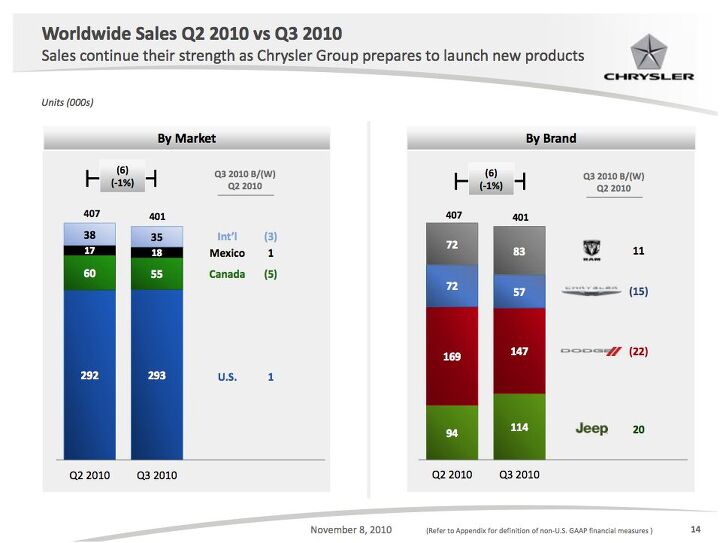

Chrysler lost $84m last quarter on an operating profit of $239m, showing slow but consistent progress from last quarter’s $172m loss [Press release here, slides here, both in PDF]. Chrysler has lost $453m since the beginning of this year. Overall deliveries and sales were down slightly compared to Q2 2010, but thanks to a strong launch for the profit-generating Grand Cherokee, revenues were up just over 5 percent to $11b. As the slide above proves, “Mix and Net Price” accounts for one of the biggest contributions to operating profit, and that’s largely thanks to the new Grand Cherokee which (at 12,721 units last month) is the second-best selling vehicle in Chrysler’s lineup after Ram pickups. That’s a good sign for the future of a company that needed a hero, but there are some troubling signs under the surface.

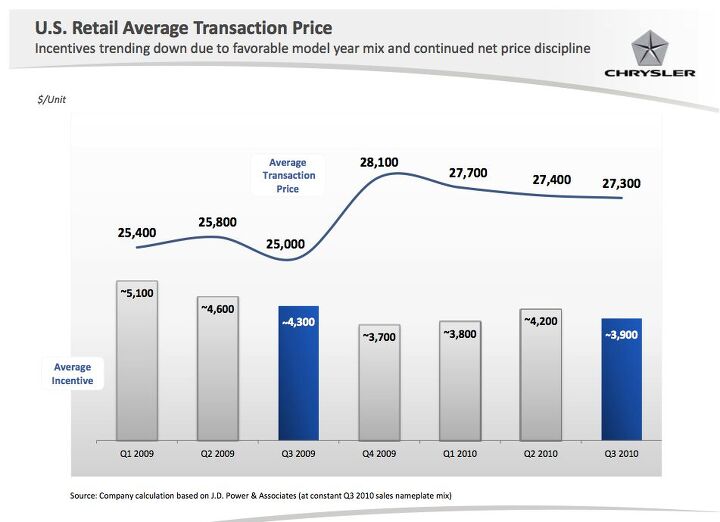

But before we get to the negatives, it’s important to put Chrysler’s mix and pricing trends in context. Yes, it’s improved compared to 2009, but it’s actually declined since 2009 even as sales have remained largely flat. And with remaining launch vehicles largely falling into the category of refreshes and are occurring in less-profitable segments, it’s not clear that Chrysler can expect more strong growth in transaction price.

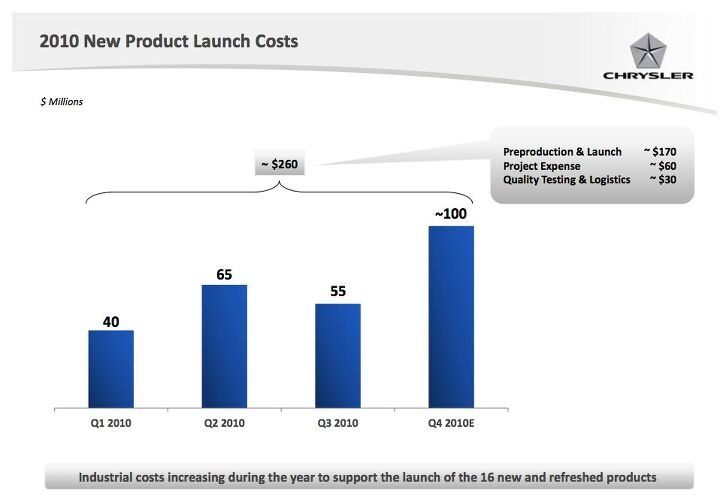

For one thing, launching new products costs money. Launch costs were reduced from Q2, adding to the Q3 bottom line, but they’re expected to zoom up to about one hundred million in the final quarter of the year. In support of those launches, Chrysler will spend a billion dollars in the final three months of the year on capital expenditures, up from $1.7b over the first three quarters. If the products launched with that money have the same effect as the Grand Cherokee,it will be money well spent. But will refreshed Sebrings and Journeys have the same result as an all-new, well-executed product in a profitable segment like the JGC? Only the future will tell.

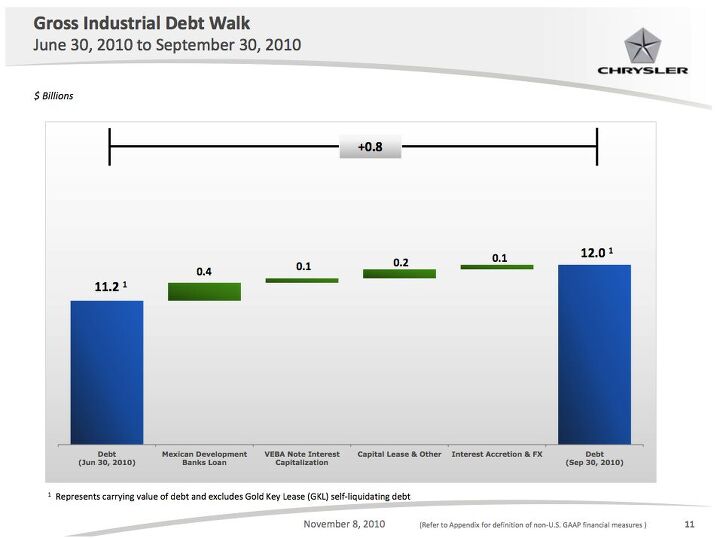

Cash improved by $419m, but gross debt climbed upwards for Chrysler by about $800m, and net debt increased by $400m to $3.8b. That debt cost Chrysler $308m in the third quarter, and net interest expense has amounted to $899m year-to-date.

But the real question is what happens to sales. Through the first three quarters of this year, 82 percent of Chrysler’s sales were 2010 models and 18 percent were the new 2011 models. As a result, sales have been flat and Chrysler has struggled to turn small operating profits into real net profit. Improvement, as it comes, has been based on mix, specifically an ever-growing dependence on Ram and Grand Cherokee profits. The market has been kind to trucks and SUVs in 2010, but this posture leaves Chrysler especially vulnerable to short-term fuel price volatility. More fuel-efficient offerings are on the way, but their profitability will not make up for any eventual decrease in Ram and Grand Cherokee volume.

And even Ram is underperforming. As Marchionne put it, the truck market is recovering, but Ram isn’t capturing the share of that recovery that it should “We got our nose bloodied going into the recession,” he said, “and we’re not getting enough back on the way out.” But Marchionne also noted that the competition enjoys “historical advantages,” likely referring to Ford’s immense success this year with its F-Series line. Marchionne seemed unclear about how to upset the truck order without killing profitability, and seemed to accept that Ram would remain the third player in the truck market.

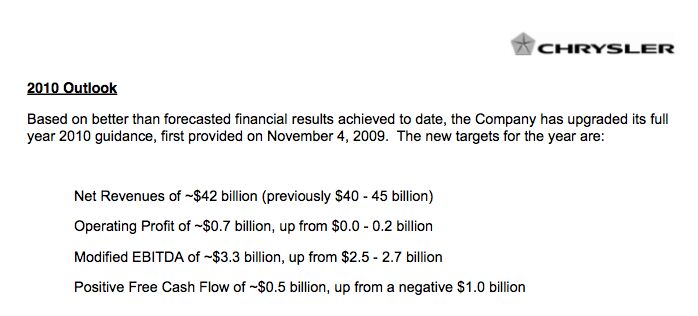

Despite modest results, Chrysler increased its guidance for full-year results. Chrysler did note that net debt could increase to $5.3b and even as much as $6.3b by year-end, and combined with increased expenditures, this could cause even modest improvements in Modified EBITDA and operating profit to result in losses. In the end though, Chrysler is surviving, which we’ve always said was its major goal for this year. But it’s been close: had the market not been accepting of less fuel-efficient offerings like Ram and Grand Cherokee, Chrysler would be in a world of hurt. The major question for this final quarter is whether the refreshed products create the kind of financial benefits that Grand Cherokee has, and whether fuel price volatility attacks this profit center (not to mention Chrysler’s forthcoming less-efficient models like Durango, Charger, and 300). Chrysler’s walked three quarters on a high-wire, and it hasn’t tumbled yet… but sooner or later, momentum will have to be built.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- ToolGuy TG likes price reductions.

- ToolGuy I could go for a Mustang with a Subaru powertrain. (Maybe some additional ground clearance.)

- ToolGuy Does Tim Healey care about TTAC? 😉

- ToolGuy I am slashing my food budget by 1%.

- ToolGuy TG grows skeptical about his government protecting him from bad decisions.

Comments

Join the conversation

The refreshed minivans should earn their keep for 2011. The last couple of years, these vehicles have sold on price, but Honda and Toyota have been chipping prices too because of their aged offerings. Now that the Honda and Toyota are brand new and the Chrysler vans will be new-ish, there should not be as much competitive pressure on prices, and transaction prices should improve. I think that an improved Journey could do very well. Theoretically, it is aimed at a much broader market than the JGC. The combination of the Journey and Durango should do well. And I would not count the 300/Charger out.

So what happens if this is still going on in five years? Someone save Jeep!