There's Enough Buick LaCrosse Inventory in America to Last Until the 2018 July 4th Holiday

As General Motors seeks to get the company’s U.S. inventory down to the industry average of 70 days’ supply by the end of 2017, once-prominent passenger cars are inhibiting the company from achieving its vital goal.

At Cadillac, where even the company’s three utility vehicles have far more than 70 days of stock, the brand’s four car nameplates have 137 days’ supply. At Chevrolet, where the brand’s somewhat excessive light truck inventory is largely due to an intentional increase in Silverado stock, there’s a 128-day supply of passenger cars. Granted, that figure is worsened by a stop-sale on Chevrolet Sparks that limited the city car to only 1,132 U.S. sales in the last three months and by a necessary Corvette stockpile in advance of a Bowling Green shutdown.

But it’s at Buick, where new and old designs alike are suffering from dramatically lower-than-anticipated demand, that GM’s inventory reduction methodology doesn’t seem to be taking hold. According to Automotive News, Buick dealers have enough LaCrosses in stock to last until the July 4th holiday next summer.

How did Buick develop such a LaCrosse glut, and is there a silver lining to this black inventory cloud?

To be fair to the LaCrosse, it’s hardly the only Buick causing U.S. dealers to pave new overflow lots. There’s nearly half a year’s worth of Buick Envision inventory, roughly seven months’ supply of the departing fifth-gen Buick Regal, five months’ supply of the Buick Cascada convertible even as prime convertible season comes to a close, and even 111 days’ supply of Buick’s top-selling Encore.

But the LaCrosse takes inventory to a whole ‘nuther level.

GM’s not unaware of the issue. The company cut shifts and laid off workers at the Hamtramck, Michigan, assembly plant where the LaCrosse is built alongside the Cadillac CT6, Chevrolet Impala, and Chevolet Volt. Through the end of July, total Hamtramck production was 31-percent lower than in the first seven months of 2016, Automotive News Data Center figures show. LaCrosse production in July, specifically, was down 64 percent, year-over-year.

But prior to the slowing of LaCrosse production, General Motors was building the LaCrosse in the kinds of quantities that suggested GM anticipated full-size sedan success. And the LaCrosse, even early in the third-generation’s tenure, was not enjoying the predicted level of success.

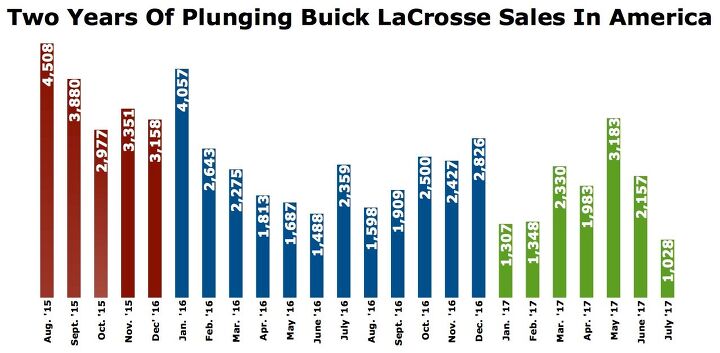

Last year (2016) ended as the LaCrosse nameplate’s worst calendar year ever. From nearly 93,000 sales in 2005 (its first full year) to 61,178 sales in 2010 (the second-gen’s first year), General Motors reported only 27,582 LaCrosse sales in 2016.

GM is technically on pace to sell fewer than 23,000 in 2017, but it appears increasingly unlikely that the LaCrosse can climb even that high. Its rate of decline recently increased, with July volume plunging 56 percent, year-over-year, to only 1,028 units, less than half of the total Buick sold in June and less than one-third of the total the LaCrosse produced in May. The LaCrosse nameplate averaged 4,300 monthly sales just three years ago but has sold fewer than 2,000 copies in six times in the last 12 months.

While selling far fewer LaCrosses in July 2017 than July 2016, GM did, however, sell LaCrosses at a far higher price point this year. Last month, the average transaction price for the LaCrosse grew by $4,788, Buick tells TTAC. Year-to-date, the LaCrosse’s ATP is up $3,431. In fact, while LaCrosse sales dive lower and lower each month, the customers who are still paying for the LaCrosse — and such customers do exist — are paying significantly more. The average transaction price for a LaCrosse in July was $1,957 higher than it was in June and $545 higher than it was in May.

If this offers some solace to General Motors’ corporate HQ, it does little to decrease the massive quantity of LaCrosses available across America. GM doesn’t want to sacrifice the long-term residual value of a near-premium car such as the LaCrosse by reverting to a fleet-first philosophy or by chasing customers with aggressive discounts.

But by what other method is this massive LaCrosse glut ever going to be cleared?

Not surprisingly, the LaCrosse was listed in a recent rumor of cars GM plans to cut by 2020.

[Images: Buick; Chart: © The Truth About Cars]

Timothy Cain is a contributing analyst at The Truth About Cars and Autofocus.ca and the founder and former editor of GoodCarBadCar.net. Follow on Twitter @timcaincars.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- SPPPP I am actually a pretty big Alfa fan ... and that is why I hate this car.

- SCE to AUX They're spending billions on this venture, so I hope so.Investing during a lull in the EV market seems like a smart move - "buy low, sell high" and all that.Key for Honda will be achieving high efficiency in its EVs, something not everybody can do.

- ChristianWimmer It might be overpriced for most, but probably not for the affluent city-dwellers who these are targeted at - we have tons of them in Munich where I live so I “get it”. I just think these look so terribly cheap and weird from a design POV.

- NotMyCircusNotMyMonkeys so many people here fellating musks fat sack, or hodling the baggies for TSLA. which are you?

- Kwik_Shift_Pro4X Canadians are able to win?

Comments

Join the conversation

I am getting use to the Buick LaCross! It is a car that I maybe getting in the future. Still kind of pricey for a fulloaded model at around $56K. I going wait till their is a big discount maybe in Winter time! I don't like the steering wheel nor the look of the interior. Otherwise, it okay!

I'm in SF, I never see these cars. Someone moved here recently and there is one of these just like the picture for sale for $17k in the window. They just look like junk to me, not the style for around here.