The Mercedes-Benz GLA's Arrival Isn't Slowing Down The Mercedes-Benz CLA: U.S. 2015 Q1 Sales

As Mercedes-Benz USA levels off with slightly less than 2000 GLA SUV/crossover/hatchback/whatever-it-is sales per month, U.S. sales of the GLA’s sedan donor vehicle, the CLA, haven’t slowed at all.

In other words, the GLA’s presence in Mercedes-Benz showrooms is not a deterrent to the CLA.

Yes, America, buyers continue to flock to the sedan even though there’s a crossover version of that sedan available. Believe it.

Granted, the CLA isn’t selling like it did during its launch period. Anticipated and hyped, the CLA generated 8518 U.S. sales in its first full two months, October and November 2013.

But over the last five months, a period in which the GLA became readily available, CLA sales increased 13%, year-over-year.

March volume jumped 81% after a 16% gain through the first two months of 2015. In the eight months immediately preceding the GLA’s launch, Mercedes-Benz USA was selling fewer than 2000 CLAs per month, although the belief was that dealers could have sold more if they had greater inventory of the Hungary-built sedan.

Mercedes-Benz needed to supply more CLAs to North America, and they have, but one might have expected that the increase in CLA inventory would be timed with decreased CLA demand as the GLA launch period began. Instead, Mercedes-Benz has proved capable of selling more than 2800 CLAs per month alongside the GLA, 45% more monthly sales than they were doing in pre-GLA 2014.

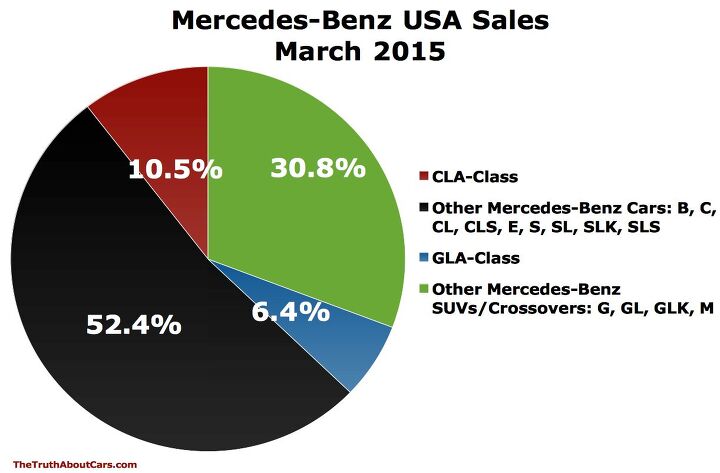

The impact on the brand? Excluding Sprinter, 18% of the Mercedes-Benzes sold in the U.S. in the first-quarter of 2015 were entry-level CLAs and GLAs – 11% for the CLA alone – up from 8% in the first-quarter of 2014, before the GLA. Non-CLA/GLA Benz sales are down 3% in the early stages of 2015.

With the entry-level pairing intact, Mercedes-Benz’s U.S. volume was up 9% in March; 8% in the first-quarter.

Even so, only twice in the last six months has Mercedes-Benz topped the premium leaderboard. BMW, the brand which outperformed Mercedes-Benz USA in December, February, and March, adopted a markedly different entry-level strategy compared with Mercedes-Benz and Audi, with their front and all-wheel-drive sedans. The 2-Series is a performance coupe with nothing more than low-volume potential: March was the best 1-Series/2-Series sales month since August 2010, but with only 1249 units, it wasn’t a common car.

No, BMW’s true entry-level car is the 320i, simply a lesser version of the nation’s top-selling premium brand car. BMW doesn’t release specific monthly figures for engine variants, but if we use Cars.com’s inventory results as a guide, BMW likely sold around 4600 copies of the 320i in 2015’s first-quarter.

Timothy Cain is the founder of GoodCarBadCar.net, which obsesses over the free and frequent publication of U.S. and Canadian auto sales figures.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Kjhkjlhkjhkljh kljhjkhjklhkjh A prelude is a bad idea. There is already Acura with all the weird sport trims. This will not make back it's R&D money.

- Analoggrotto I don't see a red car here, how blazing stupid are you people?

- Redapple2 Love the wheels

- Redapple2 Good luck to them. They used to make great cars. 510. 240Z, Sentra SE-R. Maxima. Frontier.

- Joe65688619 Under Ghosn they went through the same short-term bottom-line thinking that GM did in the 80s/90s, and they have not recovered say, to their heyday in the 50s and 60s in terms of market share and innovation. Poor design decisions (a CVT in their front-wheel drive "4-Door Sports Car", model overlap in a poorly performing segment (they never needed the Altima AND the Maxima...what they needed was one vehicle with different drivetrain, including hybrid, to compete with the Accord/Camry, and decontenting their vehicles: My 2012 QX56 (I know, not a Nissan, but the same holds for the Armada) had power rear windows in the cargo area that could vent, a glass hatch on the back door that could be opened separate from the whole liftgate (in such a tall vehicle, kinda essential if you have it in a garage and want to load the trunk without having to open the garage door to make room for the lift gate), a nice driver's side folding armrest, and a few other quality-of-life details absent from my 2018 QX80. In a competitive market this attention to detai is can be the differentiator that sell cars. Now they are caught in the middle of the market, competing more with Hyundai and Kia and selling discounted vehicles near the same price points, but losing money on them. They invested also invested a lot in niche platforms. The Leaf was one of the first full EVs, but never really evolved. They misjudged the market - luxury EVs are selling, small budget models not so much. Variable compression engines offering little in terms of real-world power or tech, let a lot of complexity that is leading to higher failure rates. Aside from the Z and GT-R (low volume models), not much forced induction (whether your a fan or not, look at what Honda did with the CR-V and Acura RDX - same chassis, slap a turbo on it, make it nicer inside, and now you can sell it as a semi-premium brand with higher markup). That said, I do believe they retain the technical and engineering capability to do far better. About time management realized they need to make smarter investments and understand their markets better.

Comments

Join the conversation

While out car shopping, I had a chance to sit in the CLA. It's truly bad. Then I looked at the sticker and laughed and laughed and laughed.

If I don't see the grille, I mistake the GLA for a Nissan.