Question Of The Day: Are Small Crossovers Stealing Midsize Sales Because Of Fuel Prices?

After climbing above $3.50/gallon for much of the spring, the average U.S. retail price for regular gasoline began to decline in mid-July before rapidly plunging throughout the fall of 2014, sliding to around $2.70/gallon by the beginning of December.

Have consumer tendencies been altered as a result?

We’re not on a mission to suggest they have, nor is our aim to support the belief that they haven’t. Any change would be both slight and gradual, and not without other possible causes. (Indeed, if it is slight, it means the vast majority of buyers aren’t changing their ways at all.) But if there is a band of consumers which makes new vehicle purchase decisions based on a brief period of less costly fuel, how many consumers are in such a band, and how different is the new track they follow?

One-month snapshots don’t tell a full story. An examination of long forgotten history won’t answer the immediate question, either: is the current price decline changing consumer behaviour?

Sure, consumers aren’t buying full-size SUVs like they used to, but showcasing that trend in a chart that’s full of other moving parts ignores a multitude of other social, economic, and technological changes which will interfere with our ability to spot recent changes. We want to reduce, not increase, the number of variables.

If our goal is to determine what, if any, changes are made by the buying public as a result of this recent fuel price dive, one surefire way to reduce variables is to examine consumer behaviour only during this recent fuel price dive. This way, our figures will not be skewed as severely by automaker bankruptcies, government-infused purchase incentives, variances in the number of offerings, or major changes to specific high-volume vehicle lines.

Do buyers reconsider the type of vehicle they’ll pay for over the next three or six or eight years based on the price of fuel over the span of four or five months? We’ll attempt to find the collective consumer response to that question by looking at the overall share of the U.S. auto industry gleaned by different vehicle types, but we’ll remember that this is only one factor: out-the-door pricing, recalls, our culture’s constantly revamped palate, and significant product introductions play vital roles, as well.

One chart won’t sufficiently display all the information we wish to make manifest – this will be an ongoing process. The mission TTAC’s Managing Editor set out for these charts is to track. Not to reach a conclusion. Not to build a case. But to track. Together, we’ll discover that which is worth examining on a deeper level, or if anything at all warrants such an examination.

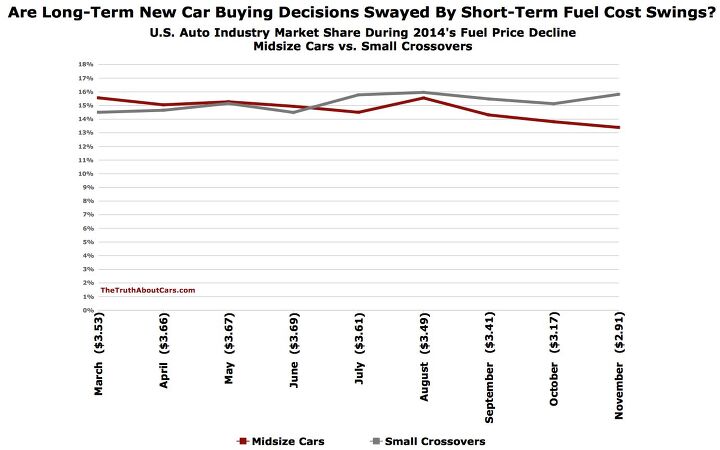

First up, the Honda CR-V-led small crossover segment and the Toyota Camry-controlled midsize car class. With the CR-V having just outsold every passenger car nameplate on its way to ending November as America’s fourth-best-selling vehicle, this seemed like a fair place to start our journey. Yet the extent to which fuel prices play a role in this discussion at all is up for debate, as one key reason leading to increased small crossover popularity is believed to be fuel efficiency, which doesn’t go hand in hand with a reckless disregard for the price of fuel.

The fact that today’s chart shows small crossovers outselling midsize cars is all but a moot point. After all, by reorganizing vehicle classifications to suit your preferences – we did the math with the 15 core midsize car nameplates and 19 core small crossovers and did not include subcompact utilities like the Buick Encore – you could rejig the numbers slightly. This isn’t about the totals, however, but the trend, where one grey line has steadily risen by claiming more and more U.S. market share. And while the cause of the shift is debatable, the trend itself is not.

Could midsize buyers be heading elsewhere? Of course. We’re not implying that a few thousand potential midsize buyers, without exception, all opted to buy a small utility vehicle instead. Nevertheless, it’s worth pointing out that the share of the market owned by compact cars has decreased from 14.5% in March to 13.7% in November, while larger and more costly volume brand cars have seen their share of the overall industry fall to 3.2% in November from 3.6% in March.

Timothy Cain is the founder of GoodCarBadCar.net, which obsesses over the free and frequent publication of U.S. and Canadian auto sales figures.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- MaintenanceCosts Land is never going to be a bad thing to own. I'm indifferent to the house - no desire to live in SoCal - but I'd love to own the land underneath it.

- Mike978 Fisker needs to sell his house and give the money to stockholders and others swindled by him.

- JoeCamaro I lost interest in Nissan vehicles years ago after they killed off the 300Z the first time. Good luck!

- Kwik_Shift_Pro4X Neither. However, in the grand scheme of things, one appreciates in value, the other does not.

- JoeCamaro Not really a wagon, but a "sportback", i.e., hatchback

Comments

Join the conversation

I believe the theory that the motion of gas prices, not their absolute value, is more important to US auto buying habits. I expect knee-jerk reactions with rapid gas price changes, but once they stabilize, trends revert. That being said, the time of extended higher gas prices and the feeling of finances being pinched has changed people's views of efficiency, and more smaller vehicles are sold as a result.

Probably the simplest near real time way to analyze this problem is to get and then study price trends for narrow categories in used vehicles and compare with pump prices. You could roughly correct for vehicle type, age and condition. Then examine to see if there has been a change in relative sales prices between groups as gas prices fell.