Canada Sales Recap: June 2013

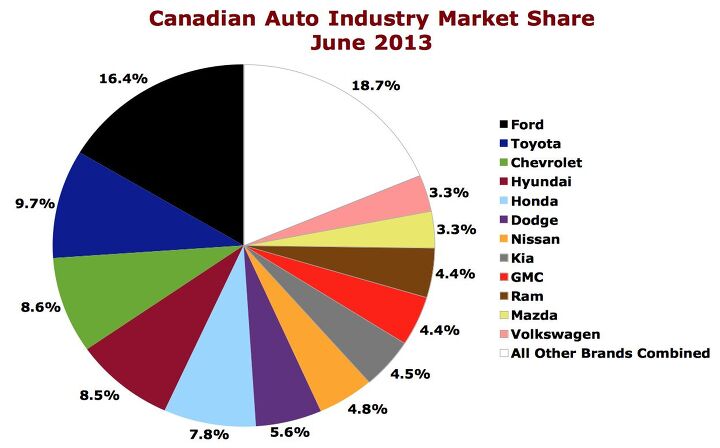

Canada’s auto industry grew 1.3% in June 2013, an increase of a couple thousand vehicles. No brand sold more often than Ford. No manufacturer sold more vehicles than Ford Motor Company. No June in history saw Canadians buy more vehicles than they did last month.

Ford MoCo, the Chrysler Group, and General Motors combined to to own 46.4% of the market, up from 45.5% in June 2012. Their market share in the United States in June was 46.8%, up from 46.7% a year ago.

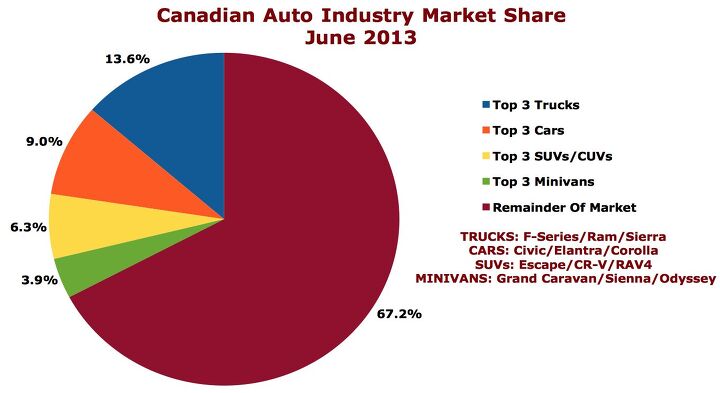

Although it’s becoming more and more difficult to perfectly determine (and agree on) what makes a passenger car qualify as passenger car, by the definitions of Canada’s Desrosiers Automotive Reports, car sales fell 4.9% in June, accounting for just 43.7% of the industry’s total volume, down from 46.6% a year ago.

This trend in the overall Canadian market is supported by the developments of Canada’s class-defining best sellers.

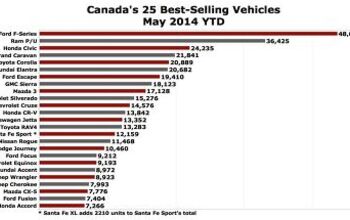

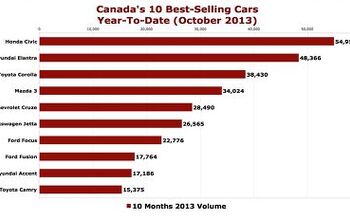

Canada’s perennial top-selling car, the Honda Civic, isn’t Canada’s most popular car in 2013. Although it held on for a narrow margin of victory in the month of June, outselling the Hyundai Elantra by 27 units, the Civic has managed to end the first half of 2013 as the second-best seller. Because of the Elantra’s growth? Well, yes, Elantra volume is up 12.8% this year. But the Civic, like the overarching passenger car category, is down this year. Its 11.2% drop equals 3599 fewer sales for Honda.

Moreover, the Civic hadn’t been selling as well last year as it had at the heights of 2006, 2007, and 2008, when more than 70,000 were sold annually. Honda Canada will have to work hard to sell more than 60,000 Civics this year.

Meanwhile, Canada’s consistently dominant utility vehicle, the Ford Escape – which didn’t sell more than 26,000 copies annually between 2004 and 2006, not more than 40,000 until 2010, and nearly equalled 2011’s total of 44,248 with 44,099 sales last year – has risen 12.7% in the first half of 2013. All brands haven’t reported their model-specific June numbers, but through May, Canada’s utility vehicle market was up 5.6%, a growth rate that was more than twice as healthy as that of the overall market.

And yes, even after a record 2012, Ford Canada is on pace to blow its own F-Series pickup truck sales record out of the water. Last month, Ford produced a record number of F-Series sales: 11,051, which accounts for 6.4% of the industry’s volume. Twelve trucks combined for a 9.5% increase in truck sales in June, ever so slightly better than the year-to-date improvement of 9.3%.

Nevertheless, although 175 out of every 1000 Canadian new vehicle buyers in Canada chooses a pickup truck, that still leaves plenty of room for far-flung corners of the market to create news, both good and bad.

Down 25.8% this year, Volvo reported its 14th consecutive year-over-year decrease in June. Porsche reported its 18th consecutive year-over-year increase. Jeep sold more Wranglers in June than any month in history. Subaru also set a June and first-half record – the Forester accounts for just under one-third of the brand’s Canadian sales.

Since we’re unable to eat at In-N-Out Burger and since we’ve only recently been offered a few Target locations, you would think Canadians would bask in the opportunity to buy cars Americans can’t have. (You wouldn’t actually think that, would you?) But the Chevrolet Orlando has plunged 48.9% in Canada this year, and fell 77.8% to 125 units in June, the Orlando’s lowest total since its first month on sale, September 2011.

Is this because of the arrival of the second iteration of another car Americans can’t buy? Kia Rondo sales jumped 117% to 945 units in June. For perspective, consider that Honda sold 1125 Odysseys, Toyota sold 1327 Siennas, Dodge sold 4278 Grand Caravans, and Mazda 5 sells fell 50% to 233. And what of the Chevrolet Trax, an inexpensive Buick Encore? June sales shot up to 982 units, the Trax’s best month yet. 3711 have been sold since January. Buick has sold 1344 Encores; 237 in June.

Clearly the growth in auto sales in Canada has slowed, but it’s important to keep in mind that the market hadn’t declined as drastically as the U.S. market did, post-recession. Watchful eyes will be trained to look out for worse decreases among cars or, perhaps, a slowing of the Ford F-Series and Ram P/U when the new GM truck twins hit full stride. Crew cab versions went on sale in late June.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Kjhkjlhkjhkljh kljhjkhjklhkjh A prelude is a bad idea. There is already Acura with all the weird sport trims. This will not make back it's R&D money.

- Analoggrotto I don't see a red car here, how blazing stupid are you people?

- Redapple2 Love the wheels

- Redapple2 Good luck to them. They used to make great cars. 510. 240Z, Sentra SE-R. Maxima. Frontier.

- Joe65688619 Under Ghosn they went through the same short-term bottom-line thinking that GM did in the 80s/90s, and they have not recovered say, to their heyday in the 50s and 60s in terms of market share and innovation. Poor design decisions (a CVT in their front-wheel drive "4-Door Sports Car", model overlap in a poorly performing segment (they never needed the Altima AND the Maxima...what they needed was one vehicle with different drivetrain, including hybrid, to compete with the Accord/Camry, and decontenting their vehicles: My 2012 QX56 (I know, not a Nissan, but the same holds for the Armada) had power rear windows in the cargo area that could vent, a glass hatch on the back door that could be opened separate from the whole liftgate (in such a tall vehicle, kinda essential if you have it in a garage and want to load the trunk without having to open the garage door to make room for the lift gate), a nice driver's side folding armrest, and a few other quality-of-life details absent from my 2018 QX80. In a competitive market this attention to detai is can be the differentiator that sell cars. Now they are caught in the middle of the market, competing more with Hyundai and Kia and selling discounted vehicles near the same price points, but losing money on them. They invested also invested a lot in niche platforms. The Leaf was one of the first full EVs, but never really evolved. They misjudged the market - luxury EVs are selling, small budget models not so much. Variable compression engines offering little in terms of real-world power or tech, let a lot of complexity that is leading to higher failure rates. Aside from the Z and GT-R (low volume models), not much forced induction (whether your a fan or not, look at what Honda did with the CR-V and Acura RDX - same chassis, slap a turbo on it, make it nicer inside, and now you can sell it as a semi-premium brand with higher markup). That said, I do believe they retain the technical and engineering capability to do far better. About time management realized they need to make smarter investments and understand their markets better.

Comments

Join the conversation

I do wonder how that untouchable Rondo would do in the US. The former version was nice and roomy.

Chrysler Canada Reports Growth of 11 Per Cent in June Best Calendar-year-to-date Sales Results Since 2000 43 consecutive months of year-over-year sales growth – longest growth streak in company’s history 26,222 vehicles sold; an increase of 11 per cent over June 2012 sales All-time sales record for Jeep® Wrangler June sales records set for Ram truck, Chrysler 200, Town & Country, Dodge Journey, Avenger and Jeep Grand Cherokee Jeep brand sales up 29 per cent Passenger car sales up 46 per cent over June 2012 sales Chrysler Canada has gained the most market share in Canada in 2013 July 3, 2013 , Windsor, Ontario - Chrysler Canada today announced its 43rd consecutive month of year-over-year sales growth, representing the longest sales streak in the company’s history. June 2013 sales were 26,222 compared with 23,705 vehicles sold in June 2012, which represents an 11 per cent increase. “2013 marks the best half-way point in the year for Chrysler Canada since 2000,” said Dave Buckingham, Chief Operating Officer, Chrysler Canada. ”With the record growth we are experiencing on the car side of our business, we’ve really rounded out our portfolio and established ourselves nicely in all vehicle segments.” Passenger car sales at Chrysler Canada are up an incredible 46 per cent, compared with sales results from the same period, one year ago. June was a massive sales month for our mid-size sedans with 1,468 Chrysler 200 and 1,000 Dodge Avenger sold, compared with 1,192 and 315 sold in June of 2012. This represents a June record for Chrysler 200, and triples Dodge Avenger sales results from where they were, just one year ago. Further, these results solidify Chrysler Canada as the number one seller of mid-size cars in Canada. http://media.chrysler.com/newsrelease.do;jsessionid=013F0A184A3F1F75580AB1EFE2E0A5D7?&id=14525&mid=2 Chrysler's also doing well in Canada. Just saying.