European New Car Sales Reach New Lows

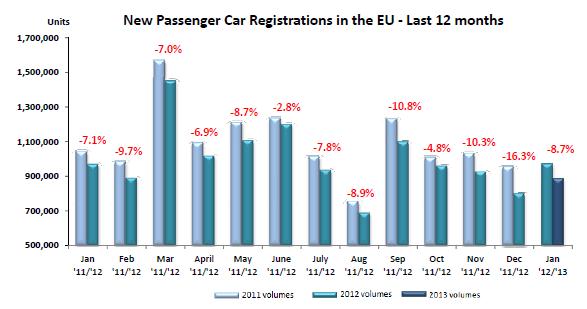

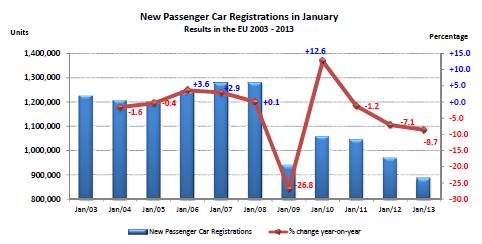

European new car sales had their worst January in recorded history. The European manufacturers organization ACEA started recording in 1990, and it had never seen a January as bad. New car registrations were down 8.7 percent to 885,159 units in the EU.

TTAC readers were pre-warned. As reported earlier in the month, volume markets such as Germany (-8.6%), Spain (-9.6%), France (-15.1%) and Italy (-17.6%) were down by the double digits. Only the UK (+11.5%) posted growth.

Ford, down 25.5 percent, is hard hit. GM is down only 5.5 percent, with Chevrolet down a whopping 40.2 percent, Opel is up 4.5 percent. PSA, down 16.3 percent, continues its swirl down the drain. Renault is down a benign 5.6 percent, Fiat lost 12.3 percent. Volkswagen, down 5.2 percent, keeps gaining market share. (Volkswagen’s odd “others” number is mostly Porsche, which became a Volkswagen brand in August 2012.)

New Car Sales EU January 2013January %ShareUnitsUnits% Chg’13’12’13’1213/12ALL BRANDS**885,159969,219-8.7VW Group24.423.5215,861227,728-5.2VOLKSWAGEN12.312.8108,744123,660-12.1AUDI5.45.148,11549,033-1.9SEAT2.21.919,77618,655+6.0SKODA4.03.735,75336,182-1.2Others (1)0.40.03,473198+1654.0PSA Group11.512.5101,680121,475-16.3PEUGEOT6.26.854,84565,762-16.6CITROEN5.35.746,83555,713-15.9RENAULT Group8.68.376,20680,751-5.6RENAULT6.36.455,92162,115-10.0DACIA2.31.920,28518,636+8.8GM Group7.77.468,17972,114-5.5OPEL/VAUXHALL6.65.858,63756,130+4.5CHEVROLET1.11.69,52115,930-40.2GM (US)0.00.02154-61.1FORD6.88.360,03680,635-25.5FIAT Group6.77.059,70468,090-12.3FIAT5.25.046,09448,014-4.0LANCIA/CHRYSLER0.70.96,1208,929-31.5ALFA ROMEO0.60.95,4128,616-37.2JEEP0.20.21,7912,128-15.8Others (2)0.00.0287403-28.8BMW Group6.25.354,65151,272+6.6BMW5.24.345,80941,737+9.8MINI1.01.08,8429,535-7.3DAIMLER5.64.949,22447,469+3.7MERCEDES5.04.343,91141,947+4.7SMART0.60.65,3135,522-3.8TOYOTA Group4.34.737,71545,337-16.8TOYOTA4.14.436,07442,219-14.6LEXUS0.20.31,6413,118-47.4NISSAN3.73.632,95735,057-6.0HYUNDAI3.63.331,72232,379-2.0KIA2.62.223,17421,609+7.2VOLVO CAR CORP.1.71.915,25318,559-17.8JAGUAR LAND ROVER Group1.31.011,4779,641+19.0LAND ROVER1.10.89,4467,970+18.5JAGUAR0.20.22,0311,671+21.5SUZUKI1.21.310,29912,695-18.9HONDA1.10.99,4148,535+10.3MAZDA1.00.99,2418,294+11.4MITSUBISHI0.50.74,5187,214-37.4OTHER**1.62.113,84820,365-32.0Data can be downloaded as PDF and as Excel sheet.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Yuda I'd love to see what Hennessy does with this one GAWD

- Lorenzo I just noticed the 1954 Ford Customline V8 has the same exterior dimensions, but better legroom, shoulder room, hip room, a V8 engine, and a trunk lid. It sold, with Fordomatic, for $21,500, inflation adjusted.

- Lorenzo They won't be sold just in Beverly Hills - there's a Nieman-Marcus in nearly every big city. When they're finally junked, the transfer case will be first to be salvaged, since it'll be unused.

- Ltcmgm78 Just what we need to do: add more EVs that require a charging station! We own a Volt. We charge at home. We bought the Volt off-lease. We're retired and can do all our daily errands without burning any gasoline. For us this works, but we no longer have a work commute.

- Michael S6 Given the choice between the Hornet R/T and the Alfa, I'd pick an Uber.

Comments

Join the conversation

Thanks for the historical data going back to 2003. Looks like there's been a 7% YOY drop over the last 5 years. Sergio is right about overcapacity. Moreover, this slump is sure to affect the US market soon.

Go Dacia !!! What has been said over and over is coming true - only premium and low cost brands will have growth in Europe. Look at the table, BMW, Mercedes and JLR group are up, Dacia too. Honda and Mazda are up due to their very good reliability right now, what little is left of the middle class buyers is migrating to them from VW, Ford, etc.