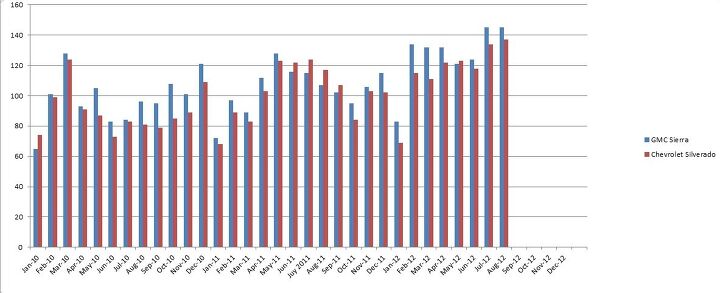

Chart Of The Day: GM Full-Size Truck Inventory, 1/2010 – 8/2012

Only one more day until we get August sales data, and September 4th will bring us the latest inventory numbers. Here at TTAC, we’re keeping an eye on GM’s full-size truck inventory, which is as high as 145 days for the GMC Sierra – well above the 100 day supply that’s considered safe for full-size trucks.

GM has long maintained that they are ramping up truck production to help keep inventories high in advance of the weeks long plant re-tooling to build the next-generation of full-size trucks. The story always truck us as odd; the claimed 21-week idle struck us as awfully long, and the wisdom of stacking ’em high would almost certainly lead to having to selling cheap, right? We’ve heard the call for incentives before, and now we’re hearing them again.

“My concern would be thatif inventory levels don’t improve, GM will need toraise the incentive level tomove the vehicles,” said Joseph Spak, an auto analyst with RBC Capital Markets LLC. A report in The Detroit News offers a less than flattering assessment.

As the chart above shows (click on it to see a full-size version), inventory levels are not only high now, but they were high at this time last year. Not quite as high as 145 days, but well above the 100 day threshold on a consistent basis that lasted from April to December, with a brief reprive in October. GM is apparently banking on strong sales in Q3 and Q4 2012 to clear up some of the excess truck inventory, with the News stating

Company executives have said they expect to sell down the stockpile of trucks throughout the second half of the year — traditionally a stronger period for truck sales — and have no plans to change production strategy.

Unfortunately for GM, the inventory data paints a different picture. This same time period in 2011 showed consistent inventory levels of 100 days or more, save for a brief downturn in October. 2010 levels were somewhat different. Sierra inventory hovered right around 100 days in August and September, then rose through the year end, while the supply of Silverados was relatively low.

The truck inventory story isn’t new – Ed examined it last year, when it was making headlines even without a plant changeover. Bertel has delved a bit deeper into “channel stuffing” and how the unsold inventory pushed onto dealers can actually count as a “sale” for financial reporting purposes.

The best we can do for now is to keep an eye on inventory and sales levels to see how it all pans out. Or tell me I’m an idiot in the comments.

More by Derek Kreindler

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Amy I owned this exact car from 16 until 19 (1990 to 1993) I miss this car immensely and am on the search to own it again, although it looks like my search may be in vane. It was affectionatly dubbed, " The Dragon Wagon," and hauled many a teenager around the city of Charlotte, NC. For me, it was dependable and trustworthy. I was able to do much of the maintenance myself until I was struck by lightning and a month later the battery exploded. My parents did have the entire electrical system redone and he was back to new. I hope to find one in the near future and make it my every day driver. I'm a dreamer.

- Jeff Overall I prefer the 59 GM cars to the 58s because of less chrome but I have a new appreciation of the 58 Cadillac Eldorados after reading this series. I use to not like the 58 Eldorados but I now don't mind them. Overall I prefer the 55-57s GMs over most of the 58-60s GMs. For the most part I like the 61 GMs. Chryslers I like the 57 and 58s. Fords I liked the 55 thru 57s but the 58s and 59s not as much with the exception of Mercury which I for the most part like all those. As the 60s progressed the tail fins started to go away and the amount of chrome was reduced. More understated.

- Theflyersfan Nissan could have the best auto lineup of any carmaker (they don't), but until they improve one major issue, the best cars out there won't matter. That is the dealership experience. Year after year in multiple customer service surveys from groups like JD Power and CR, Nissan frequency scrapes the bottom. Personally, I really like the never seen new Z, but after having several truly awful Nissan dealer experiences, my shadow will never darken a Nissan showroom. I'm painting with broad strokes here, but maybe it is so ingrained in their culture to try to take advantage of people who might not be savvy enough in the buying experience that they by default treat everyone like idiots and saps. All of this has to be frustrating to Nissan HQ as they are improving their lineup but their dealers drag them down.

- SPPPP I am actually a pretty big Alfa fan ... and that is why I hate this car.

- SCE to AUX They're spending billions on this venture, so I hope so.Investing during a lull in the EV market seems like a smart move - "buy low, sell high" and all that.Key for Honda will be achieving high efficiency in its EVs, something not everybody can do.

Comments

Join the conversation

There are 4 firms controlling the economic and social fate of this world. 1. Blackrock Institutional Trust Company N.A. 2. Statestreet Capital 3. Vanguard Group 4. FMR LLC (Fidelity) These 4 firms control the economic/social fate of the globe. They control either directly or indirectly through interlocking corporate holdings almost every major corporation in the world. This is a fact. Go to Yahoo finace, and start looking. It is all right before our eyes. Who are the individual shareholders of these 4 firms????? How has the past 4 years affected the balance sheets of the individuals behind these firms... This is the most important question of our generation.

What are they going to do when the sales stall as the new & improved models get hyped and current models look like stiffs? Very strange. Are they going to stop building in Jan.?