The Other March 2012 Sales Numbers

(We’re big fans of Timothy Cain here at TTAC, and now the independent sales analyst par excellence is on board with us. Welcome!)

It’s one thing to point out that Fiat 500 sales jumped 642% in March in an attempt to display knowledge. It’s another thing to recognize, with great wisdom and awareness, that such a year-over-year comparison is all but invalid given the fact that Fiat only began selling the 500 in March of last year.

Surely a business growth consultant would advise against an automotive sales statistician from acknowledging the fact that statistics are deceitful. But they are, not unlike unknown Triple A call-ups who manage to shine in the absence of a star first baseman but fade in late August. Statistics create expectations, lead you on, and then obliterate initial findings upon deeper analysis.

One way of avoiding the pain is to avoid history lessons, but by doing so, statistics simply become numbers. Another option requires throwing caution to the wind by contrasting sales figures willy-nilly. Example: “Toyota sold 2223 CT hybrids in March but only 891 Prius Plug-Ins.”

Or, you can simply get your fingernails dirty by digging around for some truth, or at the very least, truthiness.

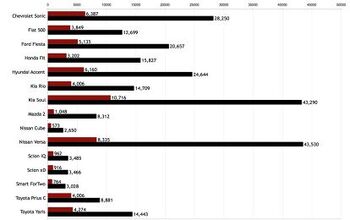

There’s more to the March 2012 sales report than GM saying, “Chevrolet and GMC Drive GM’s March Sales Up 12 Percent”, “CR-V Sets All-Time Monthly Record”, “Kia Motors America Announced All-Time Sales Record For March”, or “Ford Motor Company Posts Strongest U.S. March Sales In Five Years”. This isn’t a call for automakers to release negative PR headlines. Nevertheless, a cursory glance at the promo material is as unrevealing in the automotive sales world as it is in politics, Syrian conflicts, and the aftermath of Texas tornadoes.

The headlines restrict you from hearing that Buick and Cadillac were down 16% and 13%, respectively. The headlines don’t mention that the CR-V was booming while Honda’s traditional number one seller, the Accord, dropped 18% and ranked eighth in car volume.

Kia sold enough Optimas to make it the 23rd-best-selling vehicle in America in March, but last March’s top-selling Kia and 2011’s 24th-best-selling vehicle, the Sorento, became the third-best-selling Kia as sales dropped 7%.

Nearly a quarter of the extra Fords sold in March were F-Series pickups, but the Fiesta was down 34%. Overall Ford sales, up 5% in March, increased at a far slower pace than the overall market. And wasn’t this reliance on trucks instead of small cars considered a bad strategy when gas prices in Chicago weren’t $4.20/gallon?

Lightly-veiled information doesn’t have to shade negative storylines, of course. Not since December 2010 had Lexus sold more than 500 LX SUVs, but 666 were sold in March. (Doesn’t the number 666 turn it back into a negative storyline?)

Mercedes-Benz SLK sales climbed 179% to 567 in March, nine better than what Suzuki managed with its midsize Kizashi sedan. A 2-seat German roadster out-selling a Japanese midsize sedan means something, though it may speak more to Suzuki’s failures than the SLK’s successes.

It accounted for just 1.3% of all Chevrolet sales and 1% of all GM sales, but March was the Chevrolet Volt’s best month yet, 50% better than next-best December 2011. And Chevrolet could also teach a lesson on fleet success, as Equinox resale value is protected by the fleet-oriented Captiva Sport. The Captiva Sport sold in greater numbers than the Volkswagen Tiguan in March, though quite clearly to a different type of buyer.

The Infiniti JX’s first month on sale was marred by a disappointing month elsewhere in the Infiniti range. After sales rose 1% in February, every Infiniti model reported declining sales in March.

The truck-based jumbo SUV category – Armada, Expedition, Sequoia, Suburban, Tahoe, Yukon, Yukon XL – was down 11% in March even as the trucks from which they originate combined for an 11% increase. Besides which, more than 5000 extra copies of the third-best-selling Ram pickup were sold this March.

At the lower-priced end of the market, Nissan sold more Jukes than at any other point in its 18-month history, and this after four consecutive months of year-over-year drops.

One would say Mini’s improving numbers were skewed by the addition of the Coupe and Roadster, but Mini’s numbers didn’t improve in March. Sales of the regular Cooper and Cooper S fell 7%, the Convertible slid 8%, the Clubman plunged 36%, and Countryman sales were down 9% . Mini sold 336 Coupes and 144 Roadsters, not nearly enough to cover the gaps left by the core models.

Back at Fiat, 500 sales were strong, right? Better than ever. But it’s no wonder Fiat is keen to bring a couple other Fiats to Canada and perhaps not to the U.S. In this best-ever month for the 500, sales were only three times stronger than in Canada where the market is 1/9th the size.

Finally, a thought for wagon aficionados who want more import estates but blind their eyes to the fact that their E39 540i is the only one they’ve ever seen. The Acura TSX Wagon accounted for just 9.5% of all TSX sales in March and just 3.1% of all Acura sales. It was off last year’s pace with a 13% decline. TSX Wagon sales are down 7% this year even as sales of the TSX sedan are up 23%.

Sorry, but the numbers, though sometimes deceitful, don’t outright lie. And truths like this prevent North Americans from seeing the Audi A6 Avant, the Mercedes-Benz C-Class wagon, and even the Volvo V70.

Independent analyst Timothy Cain is the founder and editor of GoodCarBadCar.net

Independent analyst Timothy Cain is the founder and editor of GoodCarBadCar.net

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Theflyersfan Amazon Music HD through Android Auto. It builds a bunch of playlists and I pick one and drive. Found a bunch of new music that way. I can't listen to terrestrial radio any longer. Ever since (mainly) ClearChannel/iHeartMedia gobbled up thousands of stations, it all sounds the same. And there's a Sirius/XM subscription that I pay $18/month for but barely use because actually being successful in canceling it is an accomplishment that deserves a medal.

- MRF 95 T-Bird Whenever I travel and I’m in my rental car I first peruse the FM radio to look for interesting programming. It used to be before the past few decades of media consolidation that if you traveled to an area the local radio stations had a distinct sound and flavor. Now it’s the homogenized stuff from the corporate behemoths. Classic rock, modern “bro dude” country, pop hits of today, oldies etc. Much of it tolerable but pedestrian. The college radio stations and NPR affiliates are comfortable standbys. But what struck me recently is how much more religious programming there was on the FM stations, stuff that used to be relegated to the AM band. You have the fire and brimstone preachers, obviously with a far right political bend. Others geared towards the Latin community. Then there is the happy talk “family radio” “Jesus loves you” as well as the ones featuring the insipid contemporary Christian music. Artists such as Michael W. Smith who is one of the most influential artists in the genre. I find myself yelling at the dashboard “Where’s the freakin Staple singers? The Edwin Hawkins singers? Gospel Aretha? Gospel Elvis? Early Sam Cooke? Jesus era Dylan?” When I’m in my own vehicle I stick with the local college radio station that plays a diverse mix of music from Americana to rock and folk. I’ll also listen to Sirius/XM: Deep tracks, Little Steven’s underground as well as Willie’s Roadhouse and Outlaw country.

- The Comedian I owned an assembled-in-Brazil ‘03 Golf GTI from new until ‘09 (traded in on a C30 R-Design).First few years were relatively trouble free, but the last few years are what drove me to buy a scan tool (back when they were expensive) and carry tools and spare parts at all times.Constant electrical problems (sensors & coil packs), ugly shedding “soft” plastic trim, glovebox door fell off, fuel filters oddly lasted only about a year at a time, one-then-the-other window detached from the lift mechanism and crashed inside the door, and the final reason I traded it was the transmission went south.20 years on? This thing should only be owned by someone with good shoes, lots of tools, a lift and a masochistic streak.

- Terry I like the bigger size and hefty weight of the CX90 and I almost never use even the backseat. The average family is less than 4 people.The vehicle crash safety couldn't be better. The only complaints are the clumsy clutch transmission and the turbocharger.

- MaintenanceCosts Plug in iPhone with 200 GB of music, choose the desired genre playlist, and hit shuffle.

Comments

Join the conversation

"The Acura TSX Wagon accounted for just 9.5% of all TSX sales in March and just 3.1% of all Acura sales. It was off last year’s pace with a 13% decline. TSX Wagon sales are down 7% this year even as sales of the TSX sedan are up 23%." Talk about lies, damn lies, and statistics... The logic in this paragraph is just a fail. Sales volumes are meaningless without information about how many they even tried to sell... days supply and all that. The sales decline could have been due to a change in the mix available to dealers, production issues in the wagon, the fact that the same variety of engines and transmissions aren't offered in the wagon than in the sedan, etc. I don't know if any of these apply, just pointing out the logic miss. Where I live, the VW dealers complain that they can't keep Jetta wagons in stock, especially the Diesels and that they have waiting lists for them while the sedans are readily available. Subaru wagons are very common as well. BMW and Mercedes wagons are also very common given their prices and availability. Manufacturers have traditionally offered fewer wagons and in fewer combinations of options... dealers have also been more reluctant to order them... so are the poor sales due to low demand or is low demand caused by lower availability?

This should explain the rise at Government Motors. Take away 46k or so vehicles and GM sales actually declined, for another month. http://www.zerohedge.com/sites/default/files/images/user5/imageroot/2012/03/GM%20Channel%20Stuffing_0.jpg http://www.zerohedge.com/news/latest-parabolic-chart-gm-channel-stuffing