GM China Copies Old Detroit Tactic: Sacrifice Profits For Volume

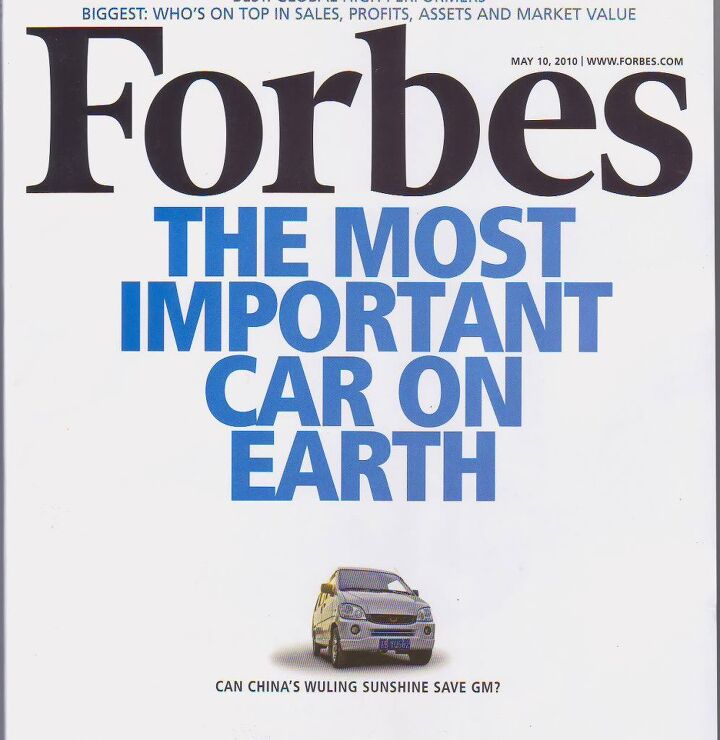

GM China always had a comfortable lead over Volkswagen in China – at least on paper. More than half of GM China’s volume comes from small delivery vans, made by a three-way joint venture with SAIC and Wuling, in which GM held 34 percent. This share had been recently raised to 44 percent. The joint venture agreement allows GM to claim 100 percent of the small cars as theirs. “Whatever turns them on” (or Chinese word to that effect) say the other JV partners who happily count the cars again in their annual reports. There is one big problem with that. The “breadvan segment” (so called because the cars looks like loafs on wheels) has been shrinking and is ruining GM’s otherwise good Chinese numbers. Now, GM can’t take it anymore, and is using a familiar tactic: “GM is sacrificing profit margins to maintain market share in China, cutting prices of low-cost minivans by as much as 15 percent to offset slowing sales in the world’s largest vehicle market,” Bloomberg reports.

“GM does not rely on the minibus for profit,” said Jenny Gu of J.D. Power China. “They only contribute volume.” At 15 percent off, the already razor-thin margin could evaporate. Now remember when we were young and swore we would stop when we need glasses? Same here.

“We made some short-term focused promotions to help the overall market situation,” Matthew Tsien, VP at SAIC-GM-Wuling, told Bloomberg. “We don’t expect it to be a long-term issue.” Same here.

June ’11June ’10ChangeYTDChangeShanghai GM101,52471,78241.4%600,00225.00%Chevrolet51,31238,30434.0%297,84114.50%Buick54,14036,48648.4%324,91928.20%Cadillac2,7221,81250.2%14,07888.30%Wuling88,02799,115-11.2%641,324-5.40%FAW-GM4,3275,220-17.1%30,332-38.80%All GM JV193,878176,4869.9%1,273,5025.30%The best-selling Wuling Sunshine minivan has been reduced to 28,000 yuan ($4,384) from 33,000 yuan earlier this year, according to GM.

Before the price reduction, SAIC-GM-Wuling made about 2,000 yuan ($313) on average for every minivan, says J.D. Power. GM’s 44 percent stake would translate to $138 per car.

In the meantime, Volkswagen is breathing down GM’s neck. GM sold 1.27 million vehicles in China in the first six months, 641,000 of those Wulings (see table.) Volkswagen sold 1.1 million cars in the same time in China, none of them cheap minivans.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Kjhkjlhkjhkljh kljhjkhjklhkjh A prelude is a bad idea. There is already Acura with all the weird sport trims. This will not make back it's R&D money.

- Analoggrotto I don't see a red car here, how blazing stupid are you people?

- Redapple2 Love the wheels

- Redapple2 Good luck to them. They used to make great cars. 510. 240Z, Sentra SE-R. Maxima. Frontier.

- Joe65688619 Under Ghosn they went through the same short-term bottom-line thinking that GM did in the 80s/90s, and they have not recovered say, to their heyday in the 50s and 60s in terms of market share and innovation. Poor design decisions (a CVT in their front-wheel drive "4-Door Sports Car", model overlap in a poorly performing segment (they never needed the Altima AND the Maxima...what they needed was one vehicle with different drivetrain, including hybrid, to compete with the Accord/Camry, and decontenting their vehicles: My 2012 QX56 (I know, not a Nissan, but the same holds for the Armada) had power rear windows in the cargo area that could vent, a glass hatch on the back door that could be opened separate from the whole liftgate (in such a tall vehicle, kinda essential if you have it in a garage and want to load the trunk without having to open the garage door to make room for the lift gate), a nice driver's side folding armrest, and a few other quality-of-life details absent from my 2018 QX80. In a competitive market this attention to detai is can be the differentiator that sell cars. Now they are caught in the middle of the market, competing more with Hyundai and Kia and selling discounted vehicles near the same price points, but losing money on them. They invested also invested a lot in niche platforms. The Leaf was one of the first full EVs, but never really evolved. They misjudged the market - luxury EVs are selling, small budget models not so much. Variable compression engines offering little in terms of real-world power or tech, let a lot of complexity that is leading to higher failure rates. Aside from the Z and GT-R (low volume models), not much forced induction (whether your a fan or not, look at what Honda did with the CR-V and Acura RDX - same chassis, slap a turbo on it, make it nicer inside, and now you can sell it as a semi-premium brand with higher markup). That said, I do believe they retain the technical and engineering capability to do far better. About time management realized they need to make smarter investments and understand their markets better.

Comments

Join the conversation

What's the revenue difference between selling a car there and NA? I put my $ on their market! Sell, sell, sell!

It's like I've said before: All the people who needed to learn from the bankruptcy learned nothing because of the government bailout. GM had good volume before they bankrupted too. Why not just have the best car for the job?