Morgan Stanley: Sendai Tsunami Will Wipe Out May SAAR. And Then Some

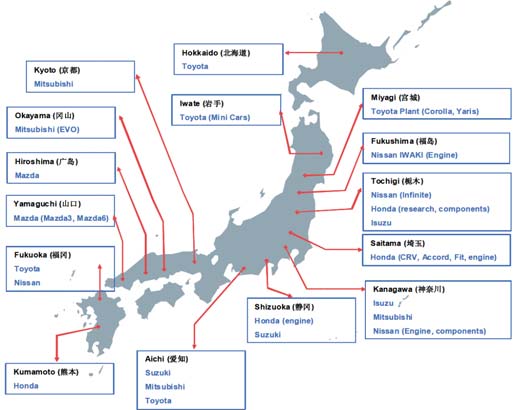

Japan is, after China, the world’s second largest car producer. In the first ten days after the March 11th earthquake and tsunami, the Japanese auto industry lost approximately 65 percent of its capacity. That is 338,000 units. Toyota alone has lost production of about 140,000 vehicles since March 14, says AP [ via MSNBC]. What will happen next? Will it affect us, and how?

Amongst banks and brokers, staid Morgan Stanley is one of the respected ones. Morgan Stanley always had a presence in Asia and manages many Asian funds. Japan’s Mitsubishi bank owns 21 percent. Morgan Stanley has no interest in talking Japan down. However, in a 34 page research note, sent out today, titled “Japanese Earthquake: Global Supply Chain Implications”, Morgan Stanley paints a dark picture: “A prolonged disruption of Japanese component supply could have a significant impact on 2011 auto production and profitability.” Not just in Japan, the world over. It is likely to depress sales: “ The impact on US SAAR could be severe in May.”

Instead of editorializing, let’s just give you the salient parts. You may want to have a stiff drink first. And your broker’s phone number nearby.

Globally, Morgan Stanley expects

“A disruption to all auto manufacturers: It may take several weeks for companies to quantify the impact. A prolonged disruption of Japanese component supply could have a significant impact on 2011 auto production and profitability.”

Morgan Stanley sees prices going up across the board, but especially for Japanese models:

“Even the threat of supply shortages can be positive for industry pricing throughout the chain. OEMs and dealers would be hesitant to exacerbate the dwindling of finished inventory. Consumers interested in scarce Japanese product may rush to buy desirable product ahead of a shortage.”

When there will be no car carriers from Japan, and when transplants sit idle due to missing engines and transmissions, the Detroit 3 will see increased market share. Then, or maybe even earlier, the D3 will be hit by the same problems. Morgan Stanley calls it zero sum-game:

“There is little doubt that the supply disruptions in Japan will result in at least a near-term market share increase for the D3 at the expense of Japanese manufacturers. However, lengthy supply disruptions could have an impact even on US domestic players. GM management has told us that finding the affected suppliers and alternative sources is a top priority.”

Believe it or not, the Sendai tsunami could whack the recovering U.S. car market:

“Impact on US SAAR could be noticeable in April and potentially severe starting in May. Production slowdowns would not have a material impact on March SAAR, which we expect to come in around 13 million units.”

Good for manufacturers, bad for bargain hunters, the looming price war will be averted:

“Pricing is likely supportive as the industry manages even the potential for disruption in the supply chain. The events in Japan would push out market concerns about a price war that have been building in recent weeks. Strong pricing could also have a negative impact on the US SAAR number, while supporting the value of the market.”

In Europe, Morgan Stanley sees little cause for worry, except for Renault. Japanese brands have a smallish market share in Europe, European makers have an even smaller share of the Japanese market.

“Amongst OEMs, we highlight Renault as most vulnerable to disruptions in the sales and production network of its partner Nissan which accounts for ~70% of Renault’s PBT and 80% of its EPS.”

In China, Morgan Stanley expects more bad news for Japanese makers:

“Japanese brands accounted for 24% of total China car sales in 2010, with over 95% of sales from local production and over 80% local content (the rest imported from Japan suppliers). Recovery and resumption of the Japanese supply chain is more important than the OEM side. We may see further share shift to European and US brands and stronger pricing, especially in the middle-to-high end segment, where Japanese brands dominate (Accord, Camry, CRV, RAV4).”

Lastly, Morgan Stanley points out two critical uncertainties:

“What part of the supply chain is affected, for how long, and can the parts be re-sourced?

How long will inventory of finished vehicles and safety stocks up the chain last?”

Those are exactly the questions carmakers around the world are grappling with. Nobody seems to have the answer.

(If you have a Morgan Stanley account, hit up your broker for “March 22, 2011 Japan Earthquake: Global Supply Chain Implications.” It covers all the big industries from steel to cell phones, from uranium to Gucci bags.)

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Redapple2 Love the wheels

- Redapple2 Good luck to them. They used to make great cars. 510. 240Z, Sentra SE-R. Maxima. Frontier.

- Joe65688619 Under Ghosn they went through the same short-term bottom-line thinking that GM did in the 80s/90s, and they have not recovered say, to their heyday in the 50s and 60s in terms of market share and innovation. Poor design decisions (a CVT in their front-wheel drive "4-Door Sports Car", model overlap in a poorly performing segment (they never needed the Altima AND the Maxima...what they needed was one vehicle with different drivetrain, including hybrid, to compete with the Accord/Camry, and decontenting their vehicles: My 2012 QX56 (I know, not a Nissan, but the same holds for the Armada) had power rear windows in the cargo area that could vent, a glass hatch on the back door that could be opened separate from the whole liftgate (in such a tall vehicle, kinda essential if you have it in a garage and want to load the trunk without having to open the garage door to make room for the lift gate), a nice driver's side folding armrest, and a few other quality-of-life details absent from my 2018 QX80. In a competitive market this attention to detai is can be the differentiator that sell cars. Now they are caught in the middle of the market, competing more with Hyundai and Kia and selling discounted vehicles near the same price points, but losing money on them. They invested also invested a lot in niche platforms. The Leaf was one of the first full EVs, but never really evolved. They misjudged the market - luxury EVs are selling, small budget models not so much. Variable compression engines offering little in terms of real-world power or tech, let a lot of complexity that is leading to higher failure rates. Aside from the Z and GT-R (low volume models), not much forced induction (whether your a fan or not, look at what Honda did with the CR-V and Acura RDX - same chassis, slap a turbo on it, make it nicer inside, and now you can sell it as a semi-premium brand with higher markup). That said, I do believe they retain the technical and engineering capability to do far better. About time management realized they need to make smarter investments and understand their markets better.

- Kwik_Shift_Pro4X Off-road fluff on vehicles that should not be off road needs to die.

- Kwik_Shift_Pro4X Saw this posted on social media; “Just bought a 2023 Tundra with the 14" screen. Let my son borrow it for the afternoon, he connected his phone to listen to his iTunes.The next day my insurance company raised my rates and added my son to my policy. The email said that a private company showed that my son drove the vehicle. He already had his own vehicle that he was insuring.My insurance company demanded he give all his insurance info and some private info for proof. He declined for privacy reasons and my insurance cancelled my policy.These new vehicles with their tech are on condition that we give up our privacy to enter their world. It's not worth it people.”

Comments

Join the conversation

So, I'm to assume SAAR is Seasonally Adjusted Annual Rate? http://www.investopedia.com/terms/s/saar.asp If you had used it in any other context I would have thought you meant the river valley that runs through France and Germany.

It seems like only weeks ago the great concern of automotive analysts was the chronically oversupplied global auto manufacturing market. Now some capacity is offline for a while and people are freaked about that????

It may take a few months, but other manufacturers will step in to fill whatever voids exist in certain parts of the supply chain. Meanwhile, net pricing of the finished product will go up if there is less supply chasing the available demand. Nothing makes cash on the hood go away like a tighter supply situation. Some makers who are struggling to grow in the US might make some real gains. VW and Chrysler/Fiat, for example, are probably less dependent on Japanese components than are some other companies and they both have capacity to spare.