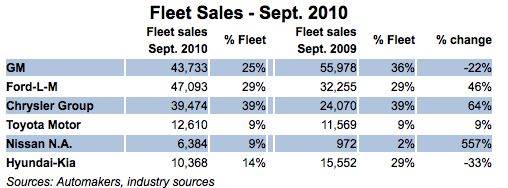

Chrysler Breaks Its Fleet Sales Promise, Tops Industry at 39%

According to Automotive News [sub], both General Motors and Hyundai-Kia have reduced their fleet sales percentages in the last year, as the two firms seek retail-level pricing for their recently-improved products. Ford and Chrysler? Not so much. As the top-selling brand in the US, Ford is simply using fleet sales to boost itself to the top of the pile. Winning the annual sales volume race is good for morale, but The Blue Oval should be careful not to delude itself into unrealistic expectations. For Chrysler, on the other hand, the continued practice of sending 40 percent of sales to fleets is big, big trouble.

Not only has Chrysler been barely making its minimum “survival volume” numbers (and some months, not), it also had a “come to Jesus” moment on the fleet issue back in April. At the time, Chrysler swore it would limit fleet sales to 25 percent of overall volume, but since that announcement, its fleet percentage has held steady at around 40 percent. For a company on the brink, the lost profits are just as important as the lost credibility. Meanwhile, each new Chrysler that ends up in a fleet cements the perception that Chryslers are the automotive purchase of last resort. And at this point, the perception probably isn’t too far from the truth.

More by Edward Niedermeyer

Comments

Join the conversation

I see a lot of Nissan Sentras in fleets lately. Altimas too, although the hybrids are pretty cool-looking as squad cars and taxis. I'd also bet that Titan pickups, now a 6y.o. design and dead at retail, goes to fleet buyers.

Good to see Ford's sales numbers finally put into perspective. There is a reason the Taurus sold so well last month (well...'sold well' for Taurus standards...it's sales are still dismal).

But wait! where are all the comments from Buickman and others on how all of GM's sales are fleet? Where are they?

Buickman's over at Automotive News' comments page bitching about the Verano and how all Buicks should be big with cushy rides and whitewalls. You should go bother him there and make him feel at home.