#MidsizeTrucks

Truck Buyers Made a Choice in October (and Chose the Bigger One)

So diverse are the trim levels available in a modern pickup truck, it wouldn’t be shocking to see automakers begin offering a “Scotsman” edition, complete with three-on-the-tree shifter, for buyers accustomed to eating beans out of a can. On the other end of the ladder, surely “Limited,” “Platinum,” and “Tungsten” fall short in the luxury trappings offered within their leather-trimmed cabins. Buyers clearly need a wood-panelled humidor for their stogies.

Suffice it to say that automakers are making the purchase of a pickup truck more appealing than ever, and in October, buyers did their duty. October 2017 was a boffo month for light truck sales, with every full-size truck line recording rising year-over-year sales in the United States. Unfortunately, but not all that unfortunately (according to accountants, anyway), buyers offered a raised middle finger to mid-size pickups sold by those same automakers.

Despite Sharp Midsize Truck Decline, U.S. Pickup Truck Sales Rose 4 Percent in August 2017

Noteworthy year-over-year sales declines were reported in August 2017 by the three lowest-volume members of America’s five-strong midsize pickup truck category. As a result, U.S. sales of midsize pickups tumbled 8 percent last month, driving their share of the overall pickup truck category down from 18 percent in August 2016 to 16 percent in August 2017.

The Honda Ridgeline, America’s lowest-volume pickup truck in each of the last two months, reported a 24-percent drop to 2,610 units. For the 2018 model year, Honda will make the all-wheel-drive Ridgeline distinctly less affordable. The GMC Canyon, which persistently and predictably generates far less showroom traffic than its Chevrolet Colorado twin, tumbled by a fifth to 2,698 sales. And the Nissan Frontier, which last year reported its best calendar year results in 15 years, continued its 2017 tumble with a 51-percent plunge to only 4,637 units, its lowest-volume month since January.

But those are low-volume midsize trucks, scarcely relevant in the overall pickup truck scheme. Total pickup truck volume rose 4 percent in August because full-size trucks jumped 6 percent, thanks mainly to the best-selling vehicle line in America: Ford’s F-Series.

U.S. Pickup Truck Sales Dipped in July 2017 - Blame General Motors

America’s auto industry is expected to report today its seventh consecutive month of decline, a drop of at least 5 percent based on forecasts and some sharp declines from three of the largest manufacturers: GM, Ford, and FCA.

Incidentally, GM, Ford, and FCA are America’s three biggest sellers of pickup trucks, and for the most part, pickup trucks are allowing a degree of buoyancy at the Detroit Three despite plunging passenger car sales. But after pickup truck sales rose 4 percent through the first-half of 2017, pickup truck sales declined in July 2017. Slightly. Somewhat.

And it was mostly General Motors’ fault.

Mercedes-Benz Is on the X-Class Defensive - Is It Really More Than Just Badge Engineering?

Australia’s pickup truck markets wants to know: is the Mercedes-Benz X-Class more than just a badge-engineered Nissan Navara?

“This is hardly a double badge,” Mercedes-Benz Vans’ global boss Volker Mornhinweg told Motoring.

But there’s a tendency to see matters another way. The production X-Class, not yet bound for North America’s nonexistent premium midsize pickup truck market, isn’t exactly a carbon copy of the X-Class Concept shown in late 2016.

Moreover, that X-Class gear lever looks downright familiar to Navara drivers.

Like GM's Current Midsize Trucks? Good, Because Colorado and Canyon Are Hanging Around Until 2022

General Motors evidently hopes you like the Chevrolet Colorado and GMC Canyon the way they are.

The midsize truck twins, which arrived in second-generation form nearly three years ago, won’t be replaced for another five years.

America's Midsize Pickup Truck Sales Growth Is Suddenly Slowing - Oh, Ranger, Where Art Thou?

Nearly two and a half years since General Motors increased the number of offerings in the midsize pickup truck sector by two-thirds, and nine months since Honda revitalized its unique Ridgeline offering, we’re once again in need of new midsize pickup truck nameplates.

America’s pickup truck category began 2017 with a bang, growing by more than 7 percent and easily outpacing an industry that declined by more than 1 percent in the first one-sixth of 2017.

Yet virtually all of that growth — fully 90 percent — was fuelled not by midsize pickups but by the stalwarts: full-size trucks.

More and More Consumers Paying Big Bucks For Smaller Trucks

U.S. sales of midsize pickup trucks jumped 54 percent in September 2016 to nearly 40,000 units.

While massive year-over-year increases in pickup truck sales can often be attributed to commensurate increases in incentives, as seen with the Ram P/U’s victory over the Chevrolet Silverado in September, midsize pickup truck buyers are willing to pay big bucks.

Average transaction prices in the Toyota Tacoma-controlled midsize pickup truck segment last month, according to Kelley Blue Book, rose 6 percent compared with September 2015. That was by far the biggest increase for any segment in average transaction prices.

These are hardly the sub-$20,000 antiquated Ford Rangers of 2010.

On average, consumers were buying $32,350 midsize pickup trucks in September 2016.

Toyota to Boost Tacoma Production as Midsize Sales Lead Slips

The Toyota Tacoma entered the year in an enviable position. Soaking up nearly half of all sales in the growing midsize pickup segment, the venerable nameplate’s spot on top of podium seemed unshakable.

Eight months later, Toyota seems spooked. The Tacoma’s market share is eroding, down to 38 percent of the midsize segment in August as its competitors surge. To stay ahead, the automaker plans to send a bundle of cash south of the border to boost production, Automotive News reports.

Toyota Tacoma Production Is Maxed Out As The Midsize Pickup Truck Category Rapidly Expands

America’s midsize pickup truck segment grew 19 percent in the first seven months of 2016. But as demand for midsize pickups expands throughout the remainder of 2016, it’s increasingly unlikely that the Toyota Tacoma will be able to make the most of the heightened interest.

Tacoma inventory has been tight for months, requiring Toyota to take full advantage of very specific modifications put in place at the San Antonio, Texas, and Baja California, Mexico, production lines a number of years ago.

No longer does a Tacoma roll off the San Antonio line every 65 seconds — it now takes only 60 seconds. There’s even a Saturday shift that drives the San Antonio plant up to 123-percent capacity.

Midsize Pickup Trucks Jump 29% In July 2016 As Full-Size Pickup Sales Level Off

Midsize pickup truck sales shot up 29 percent in the United States in July 2016, enough to drive the sub-sector’s share of the overall pickup category up three points to 17 percent.

Indeed, without the gains produced by the midsize truck sector, overall U.S. pickup truck volume would have flatlined in July on declining sales of the two top-selling truck lines, Ford’s F-Series and the Chevrolet Silverado. Moreover, without the midsize truck sector’s additional 8,973 July sales, total U.S. new vehicle sales volume would have risen by less than one-tenth of one percent.

Instead, because of a dramatic increase in sales of the second-generation Honda Ridgeline in its first month of availability, another huge uptick in Nissan Frontier sales, and continued growth from GM’s Colorado/Canyon duo, pickup truck sales grew four percent and the American auto industry reported nearly 10,000 extra sales in July 2016, year-over-year.

It's Still The Same Truck, But Nissan Is Selling Frontiers Like It's 2006

The recent introduction of a thoroughly re-engineered Toyota Tacoma is propelling sales of the segment’s top seller to all-time highs. After an elongated hiatus, there are new options from General Motors, and they’re selling more frequently than GM anticipated. Just last month, Honda began selling an all new, second-generation Ridgeline, a pickup at the opposite end of the spectrum from the rough and tumble Frontier. That Ridgeline, we told you yesterday, is selling like it’s 2008.

Moreover, demand for small/midsize pickup trucks is roughly 30-percent smaller than it was a decade ago.

At Nissan, there are plenty of factors, internal and external, working against the Frontier. The current-generation pickup is more than a decade old. Yet Nissan USA is on track to sell more Frontiers in 2016 than at any point since the current truck debuted on the Titan’s F-Alpha platform in January 2004 at Detroit’s North American International Auto Show.

Nearly Half of All Midsize Trucks Sold in America Are Toyota Tacomas

Competition improves the breed?

In order to tighten its grasp on the American midsize truck market, the Toyota Tacoma was thoroughly refreshed for model year 2016, a necessary development following the arrival – finally – of all-new competition at the end of 2014.

Evidently, Toyota did not need to debut an all-new pickup truck in order to fend off new General Motors challengers and keep its hold on a segment Toyota has led since 2005.

Want proof? Nearly half the non-full-size pickup trucks sold in the United States in the first two months of 2016 were Toyotas.

Can Ford Return To The Days Of Selling Hundreds Of Thousands Of Rangers Per Year?

What if an automobile manufacturer could develop a new product, bring it to market, never substantially update the product, and continue to sell that product at a similar pace year after year? That would be impressive. But Ford could not manage to execute that four-pronged action with the Ranger.

Yes, Ford originally developed a Ranger, brought the Ranger to the North American market, and didn’t bother to truly update the Ranger. The consistent sales pace aspect? Nope, didn’t happen.

U.S. Ranger sales declined in 11 consecutive years at the end of its tenure, from 2000 to 2010. The 28-percent year-over-year increase to 70,832 units in 2011 occurred as Ford cleared out the final Rangers at ridiculously low prices and buyers of small trucks who wanted a genuinely small truck picked up the Rangers that remained.

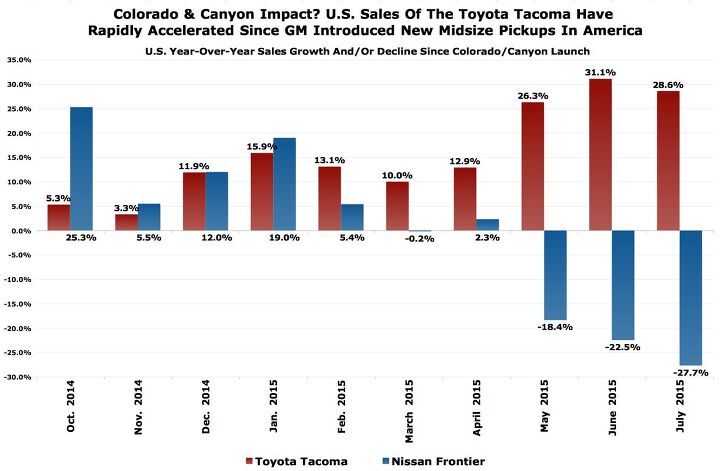

Chart Of The Day: Toyota Tacoma U.S. Sales Growth Is A Thing To Behold

In each of the last 28 months, the Toyota Tacoma has been America’s fifth-best-selling pickup truck nameplate.

One might imagine, however, that its ability to succeed in its own sub-category of small/midsize trucks would have weakened over the last ten months. With the introduction of new midsize pickup trucks from General Motors, the best-selling manufacturer of pickup trucks in America, the number of Tacoma competitors increased from one, the Nissan Frontier, to three.

U.S. Midsize Truck Sales Jumped 48% In April 2015 – Colorado/Canyon At 30% Market Share

Midsize pickup truck sales jumped 48% to just under 31,000 units in April 2015, a gain of 10,000 units.

In April, the overall U.S. auto industry grew by approximately 64,000 sales. Overall pickup truck sales increased by 15,000 units. In other words, much of the growth in the pickup truck market last month was generated by the smaller quintet.

Year-to-date, the Toyota Tacoma-led small/midsize category has grown by more than 38,000 sales, slightly more than the 36,000 sales added by full-size pickup trucks.

Recent Comments